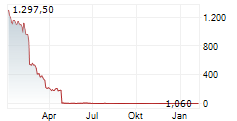

BOCA RATON, FL / ACCESS Newswire / June 24, 2025 / Greenlane Holdings, Inc. (NASDAQ:GNLN) ("Greenlane"), a global seller of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, today announced that it will effect a one-for-seven hundred fifty reverse stock split (the "Reverse Split") of its Class A common stock, par value $0.01 per share (the "Class A common stock"), that will become effective on June 26, 2025 at 5:00 P.M. Eastern Time, after the closing of trading on The Nasdaq Capital Market ("Nasdaq"). Greenlane has requested that Greenlane's Class A common stock begin trading on June 27, 2025, on a post-Reverse Split basis on the Nasdaq under the existing symbol "GNLN."

The Reverse Split is primarily intended to bring Greenlane into compliance with the minimum bid price requirement for maintaining its listing on the Nasdaq. The new CUSIP number for the Class A common stock following the Reverse Split will be 395330509.

At Greenlane's special meeting of stockholders on June 16, 2025 (the "Special Meeting"), Greenlane's stockholders approved the proposal to authorize Greenlane's board of directors (the "Board"), in its sole and absolute discretion, to file a certificate of amendment (the "Amendment") to Greenlane's amended and restated certificate of incorporation to effect the Reverse Split at a ratio to be determined by the Board, ranging from one-for-two hundred fifty to one-for-seven hundred fifty. On June 12, 2025, the Board approved the Reverse Split at a ratio of one-for-seven hundred fifty and the Amendment has been filed with the Secretary of State of the State of Delaware, which will become effective on June 26, 2025, at 5:00 P.M. Eastern Time, before the opening of trading on the Nasdaq.

The Reverse Split will affect all issued and outstanding shares of Class A common Stock. All outstanding options, restricted stock awards, warrants and other securities entitling their holders to purchase or otherwise receive shares of Class A common stock will be adjusted as a result of the Reverse Split, as required by the terms of each security. The number of shares available to be awarded under Greenlane's Third Amended and Restated 2019 Equity Incentive Plan, will also be appropriately adjusted. Following the Reverse Split, the par value of the Class A common stock will remain unchanged at $0.01 per share. The Reverse Split will not change the authorized number of shares of Class A common stock or preferred stock. No fractional shares of Class A Common Stock shall be issued as a result of the Reverse Split, and stockholders who otherwise would be entitled to receive fractional shares of New Class A Common Stock shall be entitled to receive the number of shares of New Class A Common Stock rounded up to the next whole number. The Reverse Split will affect all stockholders uniformly and will not alter any stockholder's percentage interest in Greenlane's equity (other than as a result of the rounding of fractional shares, as set forth above).

The Reverse Split will reduce the number of shares of Class A common stock issued and outstanding from approximately 1,039,735,642 million to approximately 1,386,314.

About Greenlane Holdings, Inc.

Founded in 2005, Greenlane is a premier global platform for the development and distribution of premium smoking accessories, vape devices, and lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers. We operate as a powerful family of brands, third-party brand accelerator, and an omnichannel distribution platform.

We proudly offer our own diverse brand portfolio including Higher Standards and Groove, and our exclusively licensed Marley Natural and K.Haring branded products. We also offer a carefully curated set of third-party products such as DaVinci Vaporizers, Storz & Bickel, Eyce, Pax, VIBES, and CCELL through our direct sales channels and our proprietary, owned and operated e-commerce platforms which include Vapor.com, PuffItUp.com, HigherStandards.com, and MarleyNaturalShop.com.

For additional information, please visit: https://investor.gnln.com.

Forward Looking Statements

Certain matters within this press release are discussed using forward-looking language as specified in the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and other factors that may cause the actual results or performance to differ from those projected in the forward-looking statements. These forward-looking statements include, among others, statements relating to: the current and future performance of the Company's business, the Company's ability to satisfy the various rules and requirements imposed by The Nasdaq Stock Market, unforeseen technical issues that could result in Greenlane's Class A common stock not trading on The Nasdaq Stock Market on a post-Reverse Stock split basis on June 27, 2025 as expected and the Company's financial outlook and expectations. For a description of factors that may cause the Company's actual results or performance to differ from its forward-looking statements, please review the information under the heading "Risk Factors" included in the Company's most recent Annual Report on Form 10-K for the year ended December 31, 2024, the Company's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, and the Company's other filings with the SEC, which are accessible on the SEC's website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to Greenlane on the date hereof. Greenlane undertakes no duty to update this information unless required by law.

Investor Contact:

IR@greenlane.com

or

TraDigital IR

Kevin McGrath

+1-646-418-7002

kevin@tradigitalir.com

SOURCE: Greenlane Holdings, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/agriculture/greenlane-announces-boards-approval-of-reverse-stock-split-ratio-1042696