Independent Healthcare Technology Research Firm Identifies Next-Generation Leaders in Revenue Cycle Management, Scoring Firms on Ten Strategic Performance Indicators for Exceptional Growth Potential

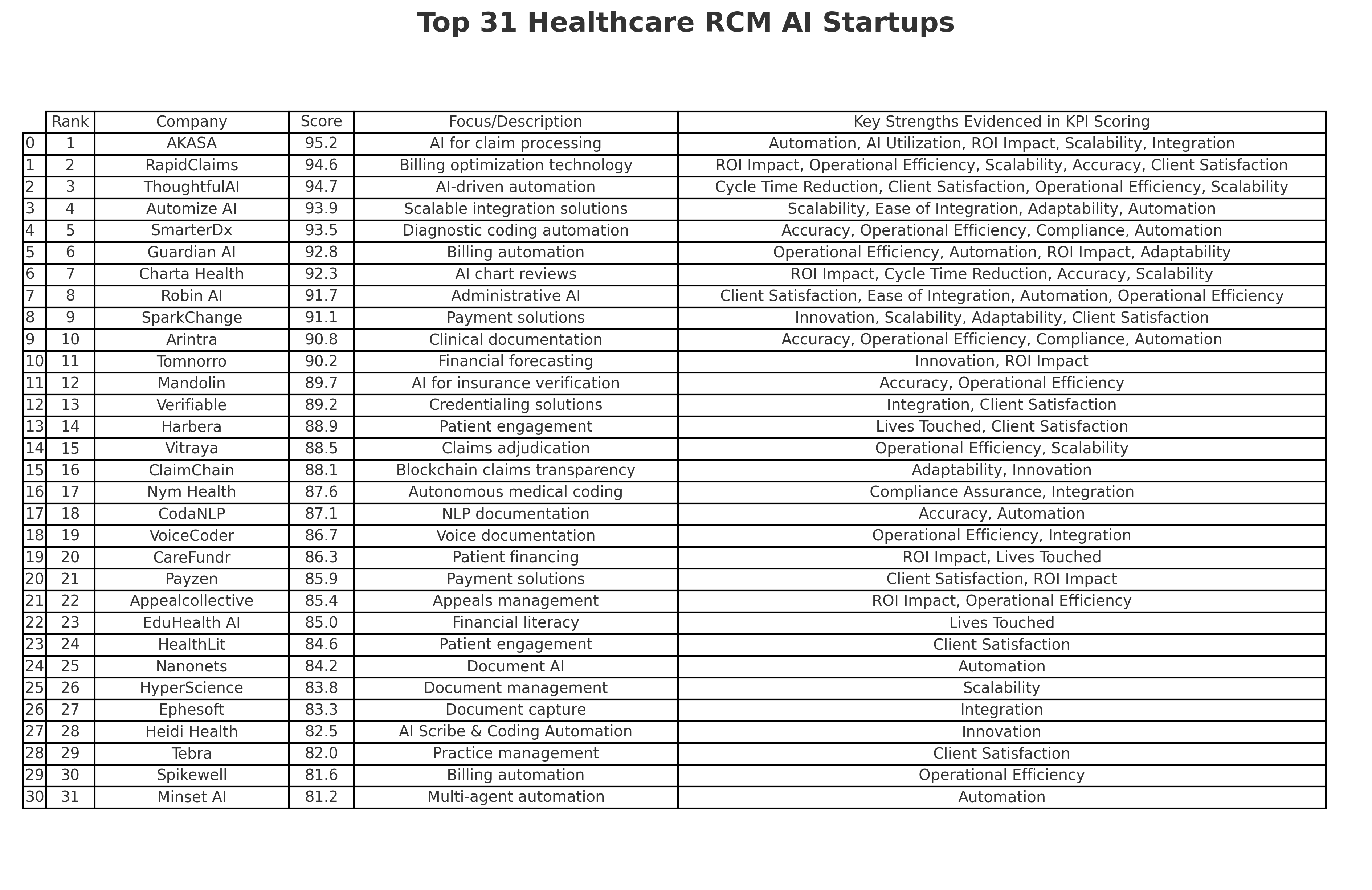

DENVER, CO / ACCESS Newswire / June 25, 2025 / Black Book, the market insights and healthcare technology research firm, today released its comprehensive ranking of the most promising startups and scale-ups transforming the Revenue Cycle Management (RCM) landscape. Applying a rigorous assessment through ten strategic qualitative Key Performance Indicators (KPIs), Black Book pinpointed 31 standout companies demonstrating extraordinary potential to achieve significant market impact and sustainable long-term growth.

Each firm was evaluated on a meticulous 100-point scale (scoring above 80 reflects outstanding capabilities and market readiness). Notably, these select companies have distinguished themselves amidst an otherwise challenging environment.

Market data indicates an alarming failure rate of between 88% and 94% for healthcare IT startups launched from 2019 to 2025, primarily driven by product-market mismatches, regulatory hurdles, inadequate financing, and operational inefficiencies. These rankings represent comprehensive market analysis and direct input from 314 venture capitalists, private equity investors, investment bankers, and industry analysts. Black Book provided a list of 270 RCM tech startups founded since 2019, 30% of which are funded for consideration.

"The companies featured share a powerful commonality: they leverage cutting-edge technology, especially artificial intelligence and automation, to revolutionize healthcare finance," said Doug Brown, Founder of Black Book Research. "Their strategic innovations produce measurable ROI, significant operational efficiencies, and enhanced compliance outcomes. Moreover, their proven adaptability to regulatory shifts, ease of integration, and rapid scalability underscore their immense potential for driving industry-wide transformation."

The ten strategic KPIs evaluated include:

ROI Impact - Tangible financial value delivered to clients

Scalability - Capacity for seamless growth and market expansion.

Innovation - Unique and differentiated technology or service offerings.

Ease of Integration - Compatibility with existing healthcare systems and infrastructure.

Accuracy and Compliance Assurance - Reducing errors and ensuring adherence to healthcare regulations.

Cycle Time Reduction - Efficiently speeding up revenue collection cycles.

Lives Touched - Demonstrable impact on healthcare populations.

Client Satisfaction and Retention - Proven reliability and effectiveness.

Automation and AI Utilization - Maximizing operational efficiency through advanced technologies.

Adaptability to Market Dynamics - Quick responsiveness to changing market and regulatory environments.

"The 31 firms identified are redefining the future of healthcare finance," said Doug Brown, Founder of Black Book Research. "Through cutting-edge technology, especially AI-driven automation, these companies are addressing longstanding challenges, significantly boosting financial performance, enhancing patient engagement, and ensuring regulatory compliance. Investors, competitors, and healthcare organizations alike should closely monitor these emerging leaders, as they represent critical shifts and immense opportunities within the RCM landscape."

Rank | Company | Score | Focus/Description | Key Strengths Evidenced in KPI Scoring |

|---|---|---|---|---|

1 | AKASA | 95.2 | AI for claim processing | Automation, AI Utilization, ROI Impact, Scalability, Integration |

2 | RapidClaims | 94.6 | Billing optimization technology | ROI Impact, Operational Efficiency, Scalability, Accuracy, Client Satisfaction |

3 | ThoughtfulAI | 94.7 | AI-driven automation | Cycle Time Reduction, Client Satisfaction, Operational Efficiency, Scalability |

4 | Automize AI | 93.9 | Scalable integration solutions | Scalability, Ease of Integration, Adaptability, Automation |

5 | SmarterDx | 93.5 | Diagnostic coding automation | Accuracy, Operational Efficiency, Compliance, Automation |

6 | Guardian AI | 92.8 | Billing automation | Operational Efficiency, Automation, ROI Impact, Adaptability |

7 | Charta Health | 92.3 | AI chart reviews | ROI Impact, Cycle Time Reduction, Accuracy, Scalability |

8 | Robin AI | 91.7 | Administrative AI | Client Satisfaction, Ease of Integration, Automation, Operational Efficiency |

9 | SparkChange | 91.1 | Payment solutions | Innovation, Scalability, Adaptability, Client Satisfaction |

10 | Arintra | 90.8 | Clinical documentation | Accuracy, Operational Efficiency, Compliance, Automation |

11 | Tomnorro | 90.2 | Financial forecasting | Innovation, ROI Impact |

12 | Mandolin | 89.7 | AI for insurance verification | Accuracy, Operational Efficiency |

13 | Verifiable | 89.2 | Credentialing solutions | Integration, Client Satisfaction |

14 | Harbera | 88.9 | Patient engagement | Lives Touched, Client Satisfaction |

15 | Vitraya | 88.5 | Claims adjudication | Operational Efficiency, Scalability |

16 | ClaimChain | 88.1 | Blockchain claims transparency | Adaptability, Innovation |

17 | Nym Health | 87.6 | Autonomous medical coding | Compliance Assurance, Integration |

18 | CodaNLP | 87.1 | NLP documentation | Accuracy, Automation |

19 | VoiceCoder | 86.7 | Voice documentation | Operational Efficiency, Integration |

20 | CareFundr | 86.3 | Patient financing | ROI Impact, Lives Touched |

21 | Payzen | 85.9 | Payment solutions | Client Satisfaction, ROI Impact |

22 | Appealcollective | 85.4 | Appeals management | ROI Impact, Operational Efficiency |

23 | EduHealth AI | 85.0 | Financial literacy | Lives Touched |

24 | HealthLit | 84.6 | Patient engagement | Client Satisfaction |

25 | Nanonets | 84.2 | Document AI | Automation |

26 | HyperScience | 83.8 | Document management | Scalability |

27 | Ephesoft | 83.3 | Document capture | Integration |

28 | Heidi Health | 82.5 | AI Scribe & Coding Automation | Innovation |

29 | Tebra | 82.0 | Practice management | Client Satisfaction |

30 | Spikewell | 81.6 | Billing automation | Operational Efficiency |

31 | Minset AI | 81.2 | Multi-agent automation | Automation |

"These 31 standout companies are united by their strategic focus on leveraging advanced AI and sophisticated automation technologies to drive substantial innovation in healthcare finance," said Brown. "Investors, venture capitalists, private equity firms, and corporate development teams should recognize the significant opportunities presented by this dynamic cohort, which addresses urgent needs in streamlining complex financial processes, improving regulatory compliance, and dramatically enhancing operational efficiency. "

Current market research underscores the urgency for such solutions, with over 90% of healthcare finance executives actively pursuing or considering AI-powered revenue management tools, recognizing AI's unparalleled potential to transform financial operations. Furthermore, automation continues its meteoric rise, as 85% of healthcare organizations plan substantial investments in automation technologies by the close of 2025. These firms exemplify the forefront of a fundamental shift in healthcare financial management, promising compelling returns and sustainable growth in the years ahead.

About Black Book Research

Black Book Research, founded in 2004, is a leading independent healthcare technology and market research firm providing unbiased insights and market intelligence. Specializing in comprehensive surveys of investor sentiment and market trends across healthcare IT software solutions and managed services, Black Book has built a trusted reputation for objectivity, transparency, and integrity. The firm maintains complete financial independence, ensuring that its research and rankings are impartial and free from any vendor sponsorship or influence. For more information, and gratis industry research report visit https://www.blackbookmarketresearch.com or contact research@blackbookmarketresearch.com

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

Related Images

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/the-31-most-promising-healthcare-rcm-startups-and-scale-ups-of-2025-b-1042743