Burlington, Ontario--(Newsfile Corp. - June 27, 2025) - Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) ('SBMI' or 'the Company') announces it has located the historical opening to the Subrosa Mineralized Zone in the Washington Mine, Idaho (the "Property"), in roughly the location as described in the Stoker Report. The field team has also located historical timbers and rails which would have supported the Property while in production. SBMI's data and observations continue to be consistent with the contents of the Stoker Report.

The Property first saw production in the late 1800's with an average gold grade of one ounce per ton. It again produced in the 1930's during which the then-owner lacked the process capability needed to produce silver, so a decision was then made to block out the silver mineralization with the intention of returning at a future date to process the silver. To the best of SBMI's knowledge, that never happened. The Stoker Report included an estimate for the Subrosa Mineralized Zone of 3 million ounces of silver with a grade of 30 to 90 ounces per ton and 15,000 ounces of gold at 0.3 ounces per ton. (Source, "Geological Evaluation", Roger G. Stoker, P.G. and Ryne C. Stoker, Student Geologist, Energy Services Inc., December, 1981.)

The references to data and observations derived from work not carried out by SBMI is of historical nature only and cannot be relied upon at this time. SBMI does not know the methods by which such work was carried out, or whether all or part of it was under the supervision of a Qualified Person, as that term is defined in NI43-101. SBMI refers to such data and observations to inform its knowledge of the area and to support its thesis for exploration.

Discovering the historical opening to the Subrosa Mineralized Zone advances SBMI's mining efforts, further proves up the Stoker Report, and brings a production date closer.

Next steps at the Property are to ensure the Subrosa Mineralized Zone is safe to access.

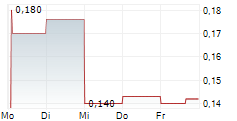

The Company also announces it has closed on a financing totaling $858,899, which represents 4,771,660 Units at a purchase price of 18 cents per Unit (a substantial premium to the current market). Each Unit consists of one common share and one non-transferable common share purchase warrant exercisable at 22 cents for a three year term. The Units will be subject to a four month hold period. Finders fees of 80,160 broker warrants priced at 22 cents and $15,779 in cash were paid.

Each participant in this financing is an existing shareholder in the Company and sees this as a key opportunity to accelerate SBMI's growth. The Company believes this type of investment provides stable long-term support for SBMI and its capital structure.

The use of proceeds from this financing will fund working capital, increase capacity in both Arizona and Idaho, and provide a buffer to offset some of the potential but unpredictable increased costs related to the current tariff situation.

Silver Bullet also advises that the holder of the convertible promissory note has elected to convert the balance of the note outstanding to equity, eliminating that debt from the Company's balance sheet. The note holder also elected to be paid related interest in common shares of the Company.

SBMI is still working on final agreements with numerous potential buyers of concentrate from mineralized material taken from the Super Champ Mine in Arizona. This material will be processed at SBMI's own mill in Globe, Arizona. After completing agreements with various buyers, SBMI will be able to prioritize processing of Super Champ material.

For further information:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1 (905) 302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that may constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management's current expectation of future events, and can be identified by words such as "believe", "expects", "will", "intends", "plans", "projects", "anticipates", "estimates", "continues" and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global virus; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the production and processing of mineralized material; the results of exploration and development activities; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI's properties; risks of future legal proceedings; income tax matters; fires, floods and other natural phenomena; the rate of inflation; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global pathogens create risks that at this time are immeasurable and impossible to define.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/257102

SOURCE: Silver Bullet Mines Corp.