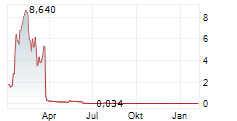

HONG KONG, June 30, 2025 (GLOBE NEWSWIRE) -- WANG & LEE GROUP, Inc. (NASDAQ: WLGS) ("Wang & Lee" or the "Company"), a Hong Kong-based construction prime and subcontractor engaging in the installation of Electrical & Mechanical Systems, today announced that as previously announced on May 7, 2025, the Company received a letter (the "Notification Letter") from the Listing Qualifications Staff (the "Staff") of The Nasdaq Stock Market, LLC ("Nasdaq") on May 6, 2025, notifying the Company that, based upon the closing bid price of the Company's ordinary shares for the last 30 consecutive business days, the Company is not currently in compliance with the requirement to maintain a minimum bid price of $1.00 per share for continued listing on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2) (the "Minimum Bid Requirement"), which matter serves as a basis for delisting the Company's securities from Nasdaq. Additionally, the Company's securities had a closing bid of $0.10 or less for the last ten consecutive trading days, and accordingly, is subject to the provisions under Listing Rule 5810(c)(3)(A)(iii). This serves as an additional basis for delisting.

On June 25, 2025, the Company received an additional Notification Letter notifying the Company that the Staff has determined to delist the Company's securities pursuant to their discretionary authority under Listing Rule 5101. The Staff's determination was based on public interest concerns primarily in relation to the Company's June 9, 2025 issuance of convertible notes.

The Company has filed a notice of appeal and requested a hearing before a Nasdaq Listing Qualifications Panel to review the Staff's determination. The appeal will stay delisting of the Company's securities pending the Panel's decision.

The Company will evaluate available options to regain compliance with the aforementioned Listing Rules. However, there are no assurances that the Company will be able to regain or maintain compliance or that any such appeal to the Panel will be successful, as applicable.

About WANG & LEE GROUP, Inc.

WANG & LEE GROUP, Inc. is a Hong Kong-based construction prime and subcontractor engaging in the installation of Electrical & Mechanical Systems, which includes low voltage (220v/phase 1 or 380v/phase 3) electrical system, mechanical ventilation and air-conditioning system, fire service system, water supply and sewage disposal system installation and fitting out for the public and private sectors. It is also able to provide design and contracting services to all trades in the construction industry. Their clients range from small startups to large companies.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding the Company's ability to grow its business and other statements that are not historical facts, including statements which may be accompanied by the words "intends," "may," "will," "plans," "expects," "anticipates," "projects," "predicts," "estimates," "aims," "believes," "hopes," "potential" or similar words. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including without limitation, the Company's ability to achieve profitable operations, customer acceptance of new products, and future measures taken by authorities in the countries wherein the Company has supply chain partners, the demand for the Company's products and the Company's customers' economic condition, the impact of competitive products and pricing, successfully managing and, general economic conditions and other risk factors detailed in the Company's filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake any responsibility to update the forward-looking statements in this release, except in accordance with applicable law.

For more information on the companies, please log on to

WANG & LEE GROUP, Inc.: https://www.wangnleegroup.com/

Email: ir@wangnlee.com.hk