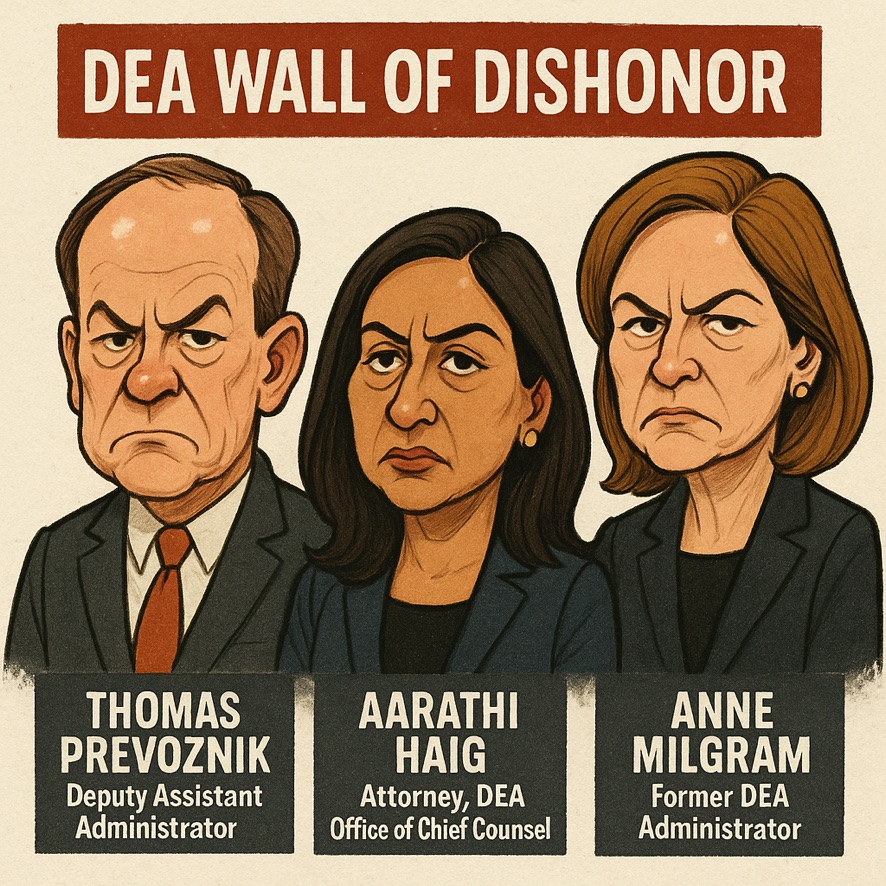

While Chinese cartels built a marijuana empire across at least six states, MMJ-a Rhode Island-based company with FDA orphan drug status-was left to rot in a bureaucratic black hole engineered by DEA Diversion officials Matthew Strait, Thomas Prevoznik, Anne Milgram and Aarathi Haig.

WASHINGTON, D.C. / ACCESS Newswire / July 1, 2025 / Just nine days after MMJ BioPharma Cultivation publicly exposed the DEA's failure to act on sprawling Chinese-backed illegal marijuana grows, the agency finally made headlines launching raids on massive criminal cannabis operations in Oklahoma tied to Chinese nationals. The bust involved over 40,000 plants, firearms, and cartel-style logistics.

But this long-overdue enforcement action raises a disturbing question:

Why has the DEA prioritized foreign crime syndicates only after years of silence and why is it still blocking a federally-compliant company like MMJ from advancing FDA authorized medical research?

DEA Ignored Foreign Criminal Networks Until Publicly Shamed

MMJ BioPharma Cultivation warned of DEA inaction over CCP linked marijuana grows on June 18, 2025. Just nine days later, the DEA moved in Oklahoma raiding what officials described as one of the largest criminal marijuana networks in U.S. history. The target: a Chinese syndicate with ties to the United Front Work Department (UFWD), the CCP's global influence arm.

"DEA had time to delay a law-abiding FDA-regulated company, but no time to shut down transnational farms tied to COMMUNIST CHINESE PARTY front groups. That's not just negligence; it's national security malpractice."

- Duane Boise, CEO, MMJ BioPharma Cultivation

While Chinese cartels built a marijuana empire across at least six states, MMJ, a Rhode Island-based company with FDA orphan drug status, was left to rot in a bureaucratic black hole engineered by DEA Diversion officials Matthew Strait, Thomas Prevoznik, Anne Milgram, and Aarathi Haig.

Science Stifled, Crime Rewarded

For over 2,390 days, MMJ has complied with every federal requirement to grow marijuana for clinical trials targeting Huntington's Disease and Multiple Sclerosis. But instead of supporting medical innovation, the DEA:

Ignored timelines under its own regulations

Forced MMJ into unconstitutional ALJ proceedings

Withheld a valid Order to Show Cause remedy

Allowed foreign criminal groups to operate unimpeded in the meantime

Worse, while MMJ was stalled, Strait and Prevoznik were sent to Dubai on taxpayer money to pose as drug policy "experts."

Supreme Court: DEA's Legal System Was Illegal

In a pair of landmark rulings, Axon v. FTC and Jarkesy v. SEC, the U.S. Supreme Court deemed the DEA's in-house judge system unconstitutional. These were the very proceedings used to sabotage MMJ's progress.

The Department of Justice has since abandoned the defense of these cases, leaving DEA Diversion leadership exposed for systemic abuse of power.

Florida Hemp Stats Show DEA Failure

A study by the Florida Department of Agriculture found:

64% of hemp-derived products were actually illegal marijuana

44% contained toxic pesticides

DEA enforcement? Zero.

Meanwhile, lab-made THC analogs like Delta-8, HHC, and THC-A are sold on every street corner without oversight, while MMJ's tightly controlled FDA pathway remains blocked.

DEA Must Now Face the Real Questions

With Matthew Strait quietly retiring under a cloud of scandal and Anne Milgram already gone, pressure mounts on Deputy Administrator Thomas Prevoznik, the architect of the cannabis blockade.

Incoming DEA Administrator Terrance Cole has a moment of reckoning:

Will he fix the agency or protect its worst actors?

MMJ and the Path Forward

If the DEA truly wants to reclaim its credibility, it must:

Immediately approve MMJ's registration

Audit Diversion Control Division corruption

End all ALJ hearings on cannabis licensing

Transfer cannabis oversight to FDA/NIH

Prosecute-not promote-DEA staff who obstructed medical research

Final Word

The DEA's sudden action on Chinese organized crime proves one thing: they can act when the pressure is real. MMJ's warnings, backed by years of compliance and legal action, helped trigger a long-overdue enforcement response.

But busting Chinese gangs isn't enough. It's time the DEA stops being the enemy of American science.

Until MMJ BioPharma Cultivation gets the registration it lawfully earned, and patients gain access to cannabinoid therapies they desperately need, the DEA's War on Medical Cannabis continues.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

mhisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/dea-busted-while-chinese-marijuana-cartels-spread-right-under-deas-no-1044296