The DEA's in-house administrative court system has been dealt a severe blow by recent U.S. Supreme Court rulings. Axon v. FTC (2023) and Jarkesy v. SEC (2024) have unequivocally declared this system unconstitutional, effectively rendering years of DEA imposed delays and administrative hearings illegitimate. In a significant move, the Department of Justice has formally refused to defend this unconstitutional system, potentially exposing current and former DEA leadership to civil rights litigation and heightened judicial oversight.

WASHINGTON, DC / ACCESS Newswire / July 2, 2025 / In a long overdue development, Matthew Strait, Deputy Assistant Administrator of Policy at the DEA's Diversion Control Division, has quietly retired, according to internal agency sources. Matthew Strait's departure marks a turning point in the unraveling scandal surrounding the DEA's obstruction of federally compliant medical cannabis research. But his exit raises a more pressing question:

Who will clean up the mess he left behind?

For over a decade, Strait was one of the central architects of the DEA's restrictive cannabis framework. From stonewalling licensing for legitimate pharmaceutical companies to defending unconstitutional administrative proceedings, his legacy is one of bureaucratic sabotage, regulatory failure, and deep public mistrust.

Strait's Legacy: Science Silenced

Strait oversaw the DEA's response to applications under the Controlled Substances Act from companies like MMJ BioPharma Cultivation, which spent over seven years trying to obtain a bulk manufacturing registration for FDA-approved clinical research into treatments for Multiple Sclerosis and Huntington's Disease. MMJ's application was fully compliant. Yet Strait's office buried it in delay tactics, forced the company into a now-defunct DEA administrative court system, and ultimately derailed progress on a lawful medical breakthrough.

And now, he walks away-no apology, no accountability.

The Fallout: Supreme Court Rejections, Department Of Justice Abandonment

Strait's departure comes amid a constitutional crisis that has upended the DEA's authority. The U.S. Supreme Court's decisions in Axon v. FTC (2023) and Jarkesy v. SEC (2024) declared the DEA's in house Administrative Law Judge (ALJ) system unconstitutional-the very system Strait forced companies like MMJ into. The Department of Justice has since refused to defend these proceedings, effectively validating claims that Strait's enforcement model violated due process, jury trial rights, and separation of powers.

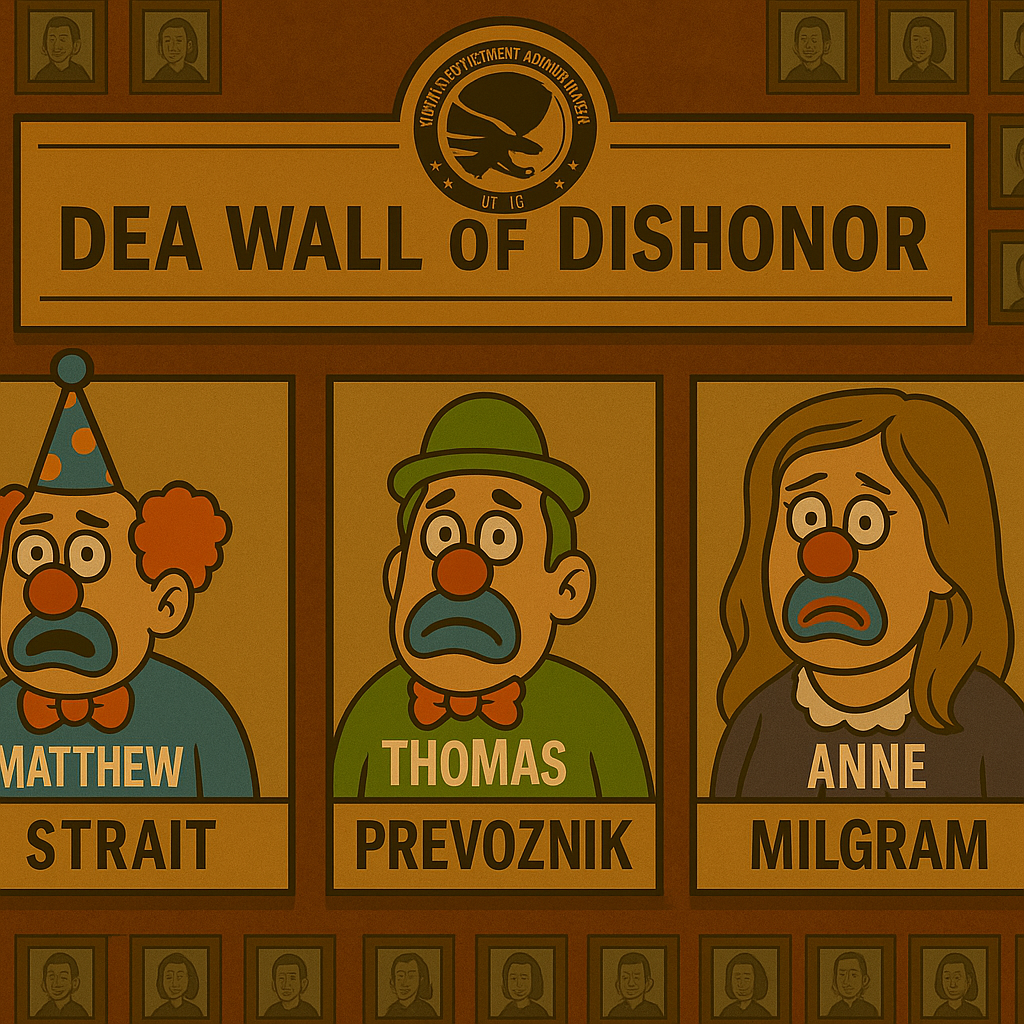

The "Wall of Dishonor" Still Stands

Strait's departure is only the beginning. Remaining atop the Wall of Dishonor is Thomas Prevoznik, DEA's Deputy Administrator for Diversion Control Affairs, who, by many accounts, was even more instrumental in structuring the agency's policy of obstruction. Known as the bureaucratic gatekeeper who legally fortified cannabis restrictions, Prevoznik has become the next likely target of scrutiny.

"Prevoznik was the intellectual muscle behind DEA's war on medical cannabis," said Duane Boise, MMJ's CEO. "Strait may have pulled the trigger, but Prevoznik loaded the gun."

Agency in Retreat, Public Pressure Mounting

With Anne Milgram already gone, Strait retired, and multiple resignations within the Diversion Control Division, the agency is in full damage control. Congress is demanding answers. Lawsuits are advancing. And MMJ BioPharma Cultivation's legal campaign has become the symbol of a broader reckoning.

Inside the DEA, morale is low and uncertainty is high.

What Comes Next?

Will the Office of the Inspector General launch a full-scale audit of past cannabis licensing delays?

Will Thomas Prevoznik face disciplinary action, early retirement, or worse?

Will new leadership under a potential Terrance Cole administration finally unwind the decades of sabotage?

And most importantly, when will patients finally get access to the medicine they were promised under federal law?

Final Word

Matthew Strait's retirement doesn't close the book-it opens it. His departure is an admission of failure, whether DEA acknowledges it or not. But until the damage is repaired, the truth exposed, and the policies reversed, justice remains unfinished.

The Wall of Dishonor still stands-and Thomas Prevoznik may be the next to fall.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/dea-architect-of-marijuana-obstruction-matthew-strait-retires-who-cle-1044171