A retail-first brokerage being built for transparency, freedom, and retail investors - launching a movement against Wall Street manipulation.

ROCKWALL, TX / ACCESS Newswire / July 3, 2025 / LitXchange, the fintech firm creating a new stock & crypto brokerage for retail investors, proudly announces the establishment of its corporate headquarters in Rockwall, Texas as it approaches a major milestone: $1 million raised through its active Regulation Crowdfunding (Reg CF) campaign. The company invites retail traders and everyday investors to become Founding Members and own equity in the platform they're helping to build.

"This isn't another Wall Street brokerage. This is for retail, by retail," said Marcel Kalinovic, Co-Founder of LitXchange. "We're coming to empower retail, expose market manipulation, and give investors the tools Wall Street never wanted them to have... While other brokerages are restricting what retail traders can buy, we're building our platform around freedom and transparency. No dark pools. No restrictions. No bullshit. "

Powered by OpenAI: Wall Street Tech for the Rest of Us

LitXchange has integrated OpenAI's cutting-edge language models into its platform to deliver:

Automated summaries of complex financial data based on your watchlist & preferences

AI insights into trending stocks, news, and market sentiment

24/7 investor education and swarm-intelligence capabilities

By building with OpenAI's GPT-4 API, LitXchange puts institutional-grade intelligence into the hands of everyday investors.

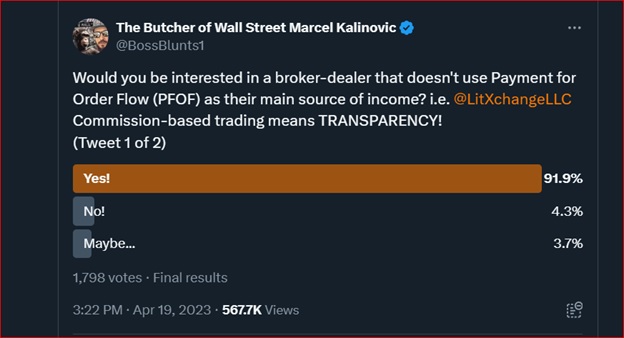

Viral Campaign Challenges Wall Street's Goliaths

LitXchange's latest ad campaign titled, "No Dark Pools. No Restrictions. No Bullshit." has resonated with frustrated traders across social media. The ad, which calls out the manipulation and centralized control across legacy brokerages, is gaining traction just as platforms like Robinhood, Fidelity (FNF), and others continue to limit trading access to popular retail stocks like GameStop (GME), AMC (AMC), FingerMotion (FNGR), and Genius Group (GNS).

" Retail investors are being silenced and robbed in broad-daylight ," Kalinovic said. "Their trades are constantly being restricted and front-run. We will NOT allow that to continue."

Lockdowns Spark Outrage: Retail Needs This New Platform

Retail trust in major platforms has eroded. Investors remember the 2021 legalized crime against GameStop, AMC, and Silver ETF investors. Over 50 securities were made "position-close only" by hundreds of brokers. Millions of retail investors lost out on billions of dollars.

In 2023, Robinhood forced users to sell key cryptocurrencies including Solana (SOL), Cardano (ADA), and Polygon (MATIC) following regulatory pressure. Users were blocked from transferring assets to external wallets, effectively forced to sell at market prices with some reporting significant losses. These forced liquidations echoed earlier issues from 2018-2022, when Robinhood prevented crypto withdrawals entirely, offering only sell-side exits.

Meanwhile, the collapse of crypto firms like Celsius, Voyager, BlockFi, Bittrex, and most notably, FTX - once considered a darling of crypto, further exposed the dangers of centralized control. As Marcel stated on X:

"FTX created BILLIONS of tokenized stocks backed by NOTHING, allowing short sellers to manipulate stock prices when there were no shares available to short, and Bittrex did the same. BlockFi and Celsius lied to retail and froze their withdrawals. Now Robinhood is pushing token-backed securities as if it's good for retail investors. Their #1 revenue source is Payment for Order Flow from the same institutions that benefit from tokenized stocks ."

Be a Founding Member. Help Build the Future of Finance.

LitXchange isn't just another brokerage app - it's a movement. A mission-driven fintech platform built from the ground up to eliminate market manipulation, restore trust, and elevate retail investors.

The company has applied for Nasdaq ticker reservation, and with less than $200,000 remaining in its Regulation CF crowdfunding goal of $1 million, the window is closing to:

Become a Founding Investor

Own equity and perks in a platform created by the people, for the people

Join the FIRST-EVER stock & crypto platform to give non-accredited investors the opportunity to own the company prior to planned launch & IPO.

Join The Movement & Invest now in our Reg C raise at: SEC Filings - Reg. CF Crowdfunding Campaign

Marcel Kalinovic - Co-Founder & CEO

contact@litxchange.app

www.litxchange.com

LITXCHANGE on X @LitXchangeApp

YouTube @The Butcher of Wall Street | X @BossBlunts1

For media inquiries, interviews, or investment opportunities contact: contact@litxchange.app

SOURCE: LITXCHANGE

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/litxchange-announces-hq-in-rockwall-texas-nears-1m-crowdfunding-goal-1045492