MONTREAL, July 07, 2025 (GLOBE NEWSWIRE) -- Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) ("Aya" or the "Corporation") is pleased to announce new high-grade drill exploration results from its 2025 program at Boumadine in the Kingdom of Morocco. Today's results also extend the Imariren mineralized trend to 1 kilometer ("km") and confirm high-grade continuity along the Boumadine Main Trend. In addition, Aya is pleased to announce that it has identified a new mineralized high-grade at-surface zone to the west.

Highlights1

- New prospective high-grade Asirem zone identified to the west of Boumadine Main Trend, with grab samples including 3.34 grams per tonne ("g/t") gold ("Au") and 4.0% copper ("Cu").

- High-grade intercepts on the Boumadine Main Trend (5.4km):

- BOU-MP25-038 intercepted 258 g/t silver equivalent ("AgEq") over 3.3 meter ("m") (2.85 g/t Au, 27 g/t silver ("Ag"), 0.1% zinc ("Zn"), 1.0% lead ("Pb") and 0.05% Cu, including 563 g/t AgEq over 1.3m (6.13 g/t Au, 65 g/t Ag, 0.3% Zn, 0.2% Pb and 0.1% Cu)

- BOU-MP25-028 intercepted 286 g/t AgEq over 4.3m (3.27 g/t Au, 19 g/t Ag, 0.3% Zn, 0.1% Pb and 0.1% Cu), including 460 g/t AgEq over 2.1m (5.46 g/t Au, 26 g/t Ag, 0.05% Zn, 0.1% Pb and 0.1% Cu)

- High-grade intercepts on the Tizi Zone (2km):

- BOU-DD25-547 intercepted 248 g/t AgEq over 9.0m (0.42 g/t Au, 80 g/t Ag, 3.6% Zn, 1.8% Pb and 0.04% Cu)

- BOU-DD24-540 intercepted 480 g/t AgEq over 2.0m (3.27 g/t Au, 53 g/t Ag, 1.1% Zn, 5.2% Pb and 0.2% Cu)

- Extension of Imariren strike length to 1km:

- BOU-DD25-503 intercepted 876 g/t AgEq over 1.0m (9.92 g/t Au, 49 g/t Ag, 1.6% Zn, 0.2% Pb and 0.1% Cu)

- BOU-DD25-529 intercepted 365 g/t AgEq over 2.0m (3.66 g/t Au, 52 g/t Ag, 0.5% Zn, 0.5% Pb and 0.1% Cu)

- Completed 79,732m of drilling at Boumadine year-to-date in 2025.

1. All intersections are in core lengths. Ag equivalent is based on a silver price of US$24/oz with a process recovery of 89%, a gold price of US$2,200/oz with a process recovery of 85%, a zinc price of US$1.20/lb with a process recovery of 72%, a lead price of US$1.00/lb with a process recovery of 85%, and a copper price of US$4.00/lb with a process recovery of 75% resulting in the following ratios: 1g/t Au: 77.9 g/t Ag; 1% Cu: 85.4 g/t Ag; 1% Pb: 24.2 g/t Ag; and 1% Zn: 24.6 g/t Ag.

"We are excited to have identified the new Asirem gold-copper zone at surface to the west of the Boumadine Main Trend - a new prospective target that highlights Boumadine's potential to become a large-scale, high-grade project," said Benoit La Salle, President & CEO. "We are well positioned to quickly drill test this new regional target, and the structure can now be traced to the west over 9km. In addition, high-grade holes BOU-MP25-038 and BOU-MP25-028 confirm strong continuity of the Boumadine Main Trend at depth, while hole BOU-DD25-529 extends the footprint south at Imariren. With over 8.4km of mineralized strike length, we continue to demonstrate Boumadine's significant resource growth potential."

Table 1 - Significant Intercepts from Boumadine Drill Exploration Program (Core Lengths)

| DDH No. | From | To | Au | Ag | Length* | Cu | Pb | Zn | Mo | Ag Eq** | ||||||||||

| (m) | (m) | (g/t) | (g/t) | (m) | (%) | (%) | (%) | (g/t) | (g/t) | |||||||||||

| BOU-DD25-503 | 224.2 | 225.2 | 9.92 | 49 | 1.0 | 0.1 | 0.2 | 1.6 | 6 | 876 | ||||||||||

| BOU-DD25-529 | 134.4 | 136.4 | 3.66 | 52 | 2.0 | 0.0 | 0.5 | 0.5 | 5 | 365 | ||||||||||

| BOU-DD25-533 | 204.3 | 207.7 | 1.18 | 61 | 3.4 | 0.2 | 0.1 | 3.7 | 13 | 266 | ||||||||||

| Including | 206.1 | 207.7 | 2.19 | 87 | 1.6 | 0.3 | 0.2 | 5.9 | 13 | 436 | ||||||||||

| BOU-DD25-537 | 119.9 | 124.3 | 1.46 | 30 | 4.4 | 0.0 | 0.2 | 0.8 | 119 | 174 | ||||||||||

| BOU-DD25-540 | 69.0 | 71.0 | 3.27 | 53 | 2.0 | 0.2 | 5.2 | 1.1 | 3 | 480 | ||||||||||

| BOU-DD25-547 | 117.0 | 126.0 | 0.42 | 80 | 9.0 | 0.0 | 1.8 | 3.6 | 5 | 248 | ||||||||||

| BOU-MP25-026 | 238.5 | 243.2 | 0.58 | 36 | 4.7 | 0.1 | 1.3 | 7.2 | 12 | 296 | ||||||||||

| BOU-MP25-028 | 392.1 | 396.4 | 3.27 | 19 | 4.3 | 0.1 | 0.1 | 0.3 | 8 | 286 | ||||||||||

| Including | 392.1 | 394.2 | 5.46 | 26 | 2.1 | 0.1 | 0.1 | 0.0 | 10 | 460 | ||||||||||

| BOU-MP25-031 | 279.1 | 282.0 | 2.47 | 21 | 2.9 | 0.1 | 0.2 | 0.7 | 7 | 242 | ||||||||||

| BOU-MP25-038 | 437.7 | 441.0 | 2.85 | 27 | 3.3 | 0.0 | 0.1 | 0.1 | 2 | 258 | ||||||||||

| Including | 437.7 | 439.0 | 6.13 | 65 | 1.3 | 0.1 | 0.2 | 0.3 | 2 | 563 | ||||||||||

| BOU-MP25-039 | 521.0 | 525.0 | 2.86 | 13 | 4.0 | 0.0 | 0.1 | 0.2 | 1 | 246 | ||||||||||

| Including | 521.0 | 523.0 | 3.91 | 19 | 2.0 | 0.1 | 0.1 | 0.4 | 1 | 339 | ||||||||||

| BOU-MP25-042 | 194.0 | 196.0 | 2.82 | 31 | 2.0 | 0.1 | 0.7 | 1.9 | 7 | 322 | ||||||||||

* True width remains undetermined at this stage; all values are uncut.

** Ag equivalent is based on a silver price of US$24/oz with a process recovery of 89%, a gold price of US$2,200/oz with a process recovery of 85%, a zinc price of US$1.20/lb with a process recovery of 72%, a lead price of US$1.00/lb with a process recovery of 85%, and a copper price of US$4.00/lb with a process recovery of 75% resulting in the following ratios: 1g/t Au: 77.9 g/t Ag; 1% Cu: 85.4 g/t Ag; 1% Pb: 24.2 g/t Ag; and 1% Zn: 24.6 g/t Ag

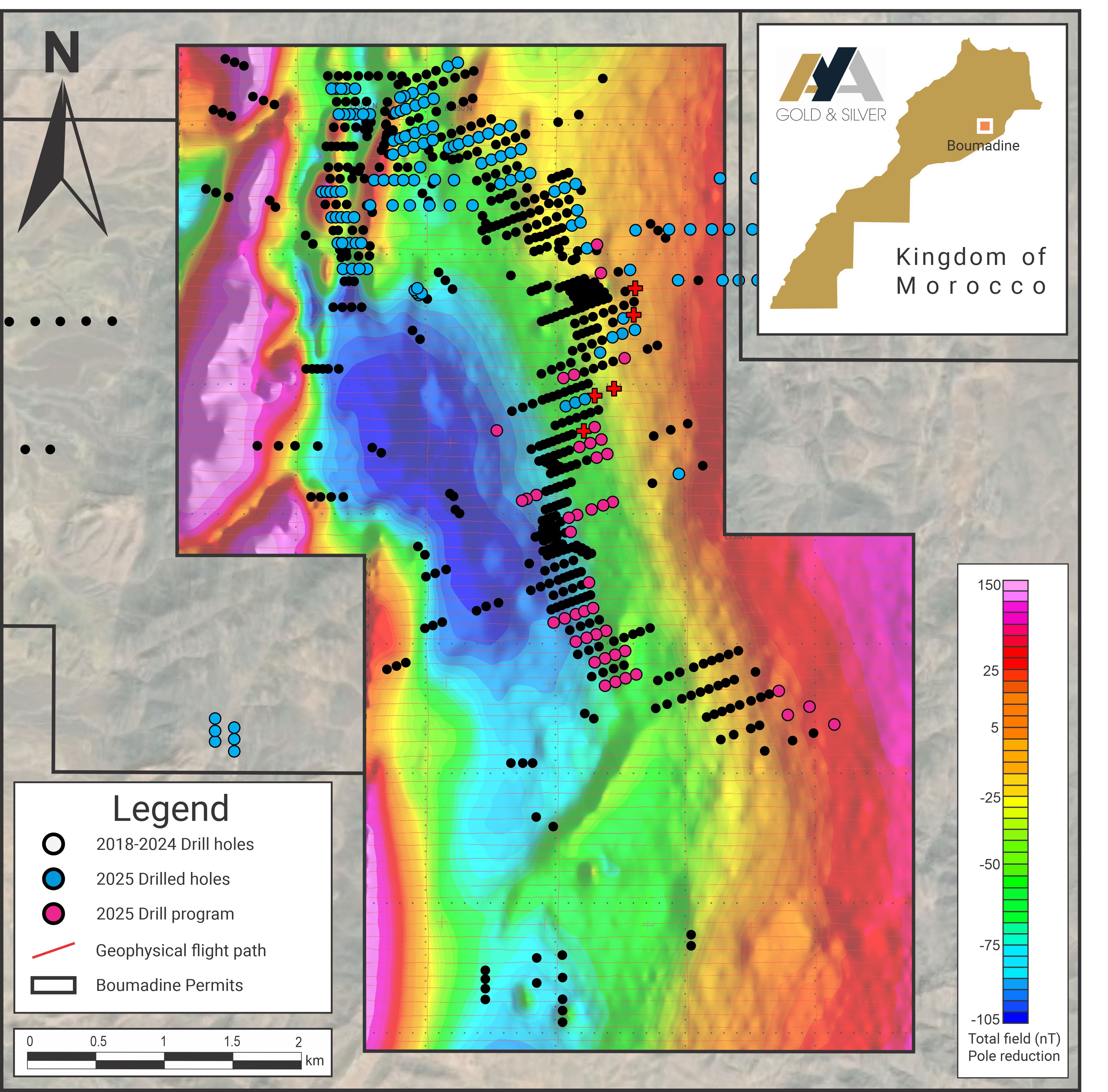

Figure 1 - Boumadine Mining Licence Surface Plan with Magnetic Data (Residual Total Field) and 2025 Drill Holes

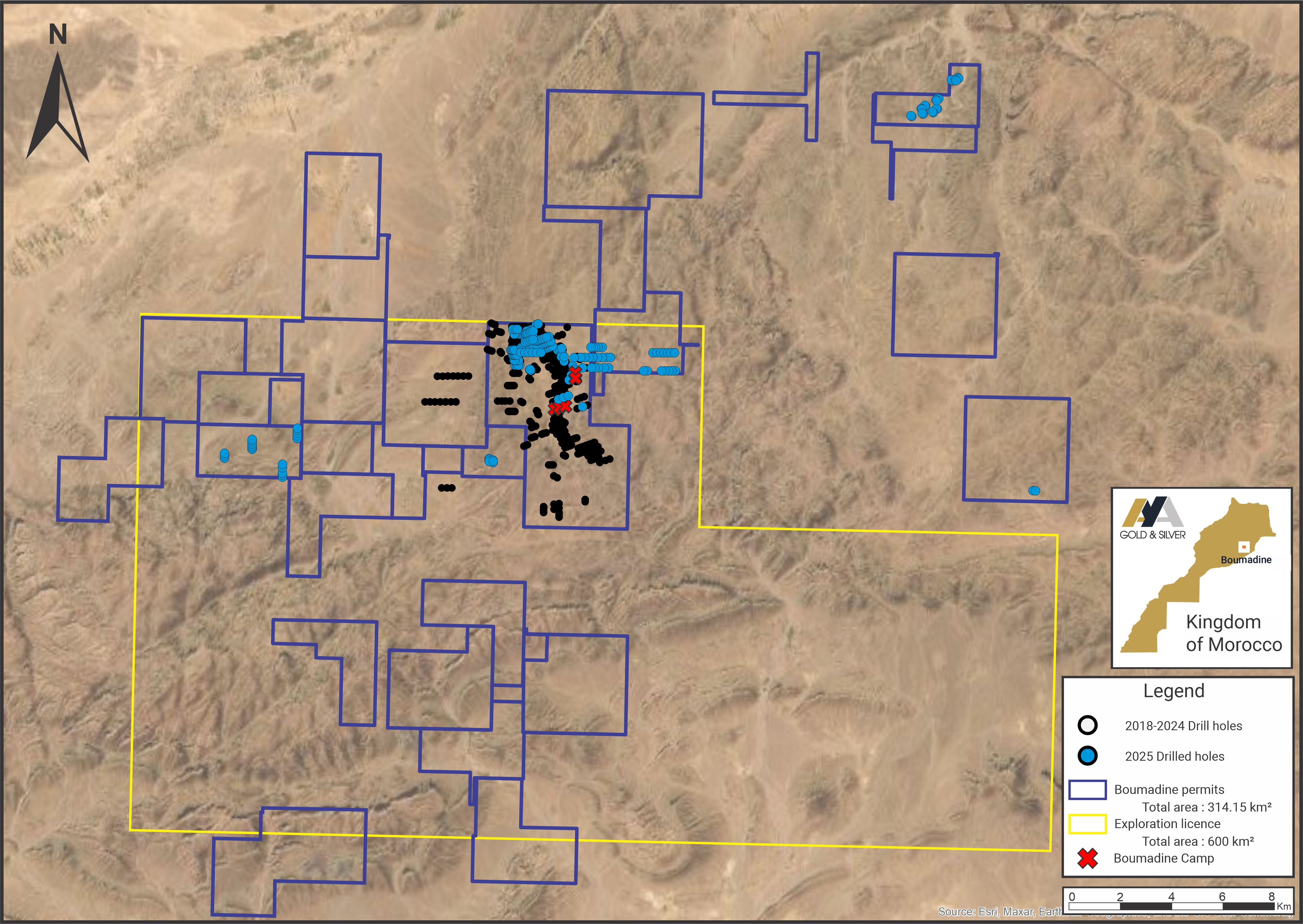

Figure 2 - Boumadine Property Surface Plan with 2025 Drill Holes

2025 Exploration Results

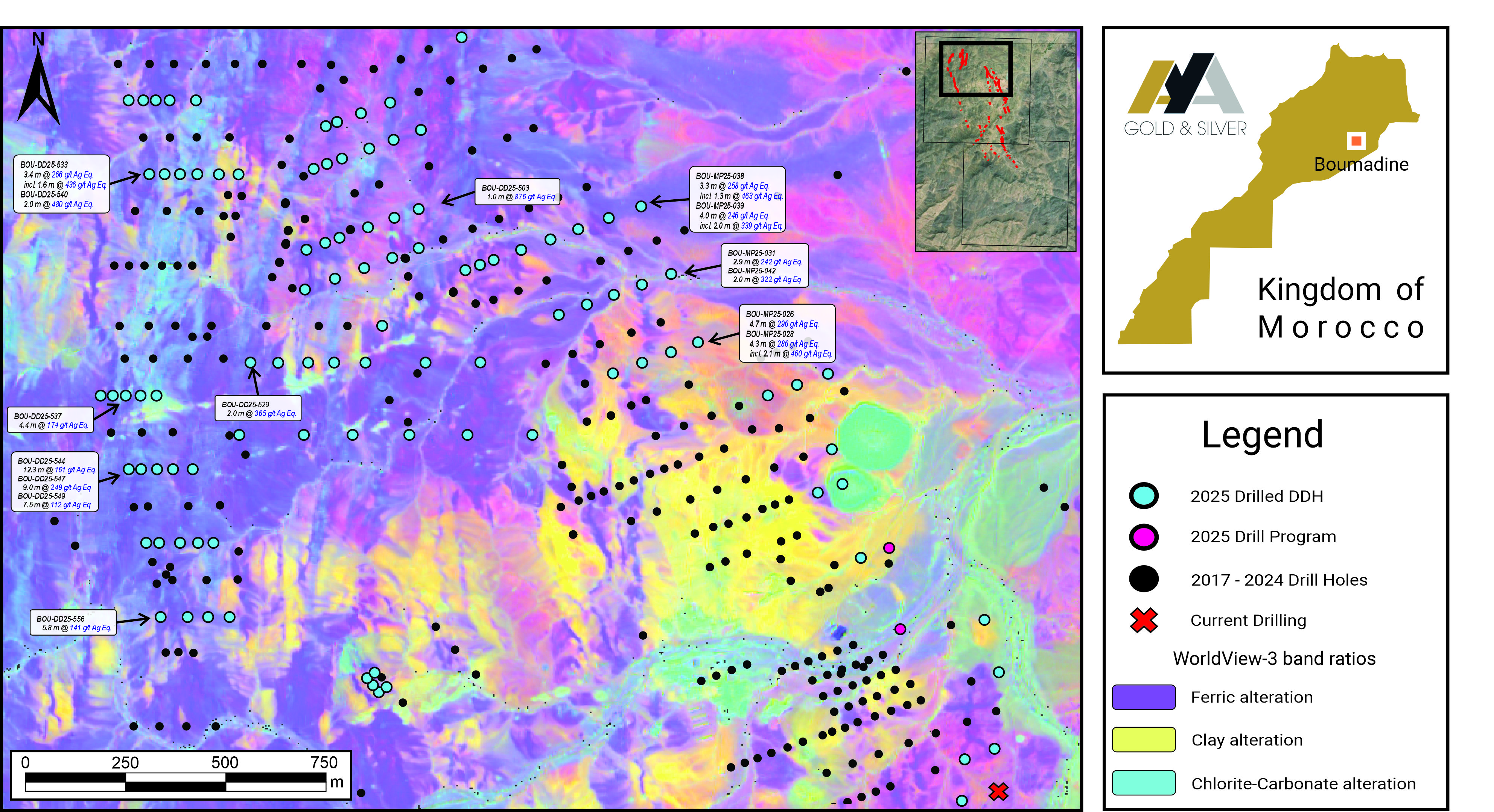

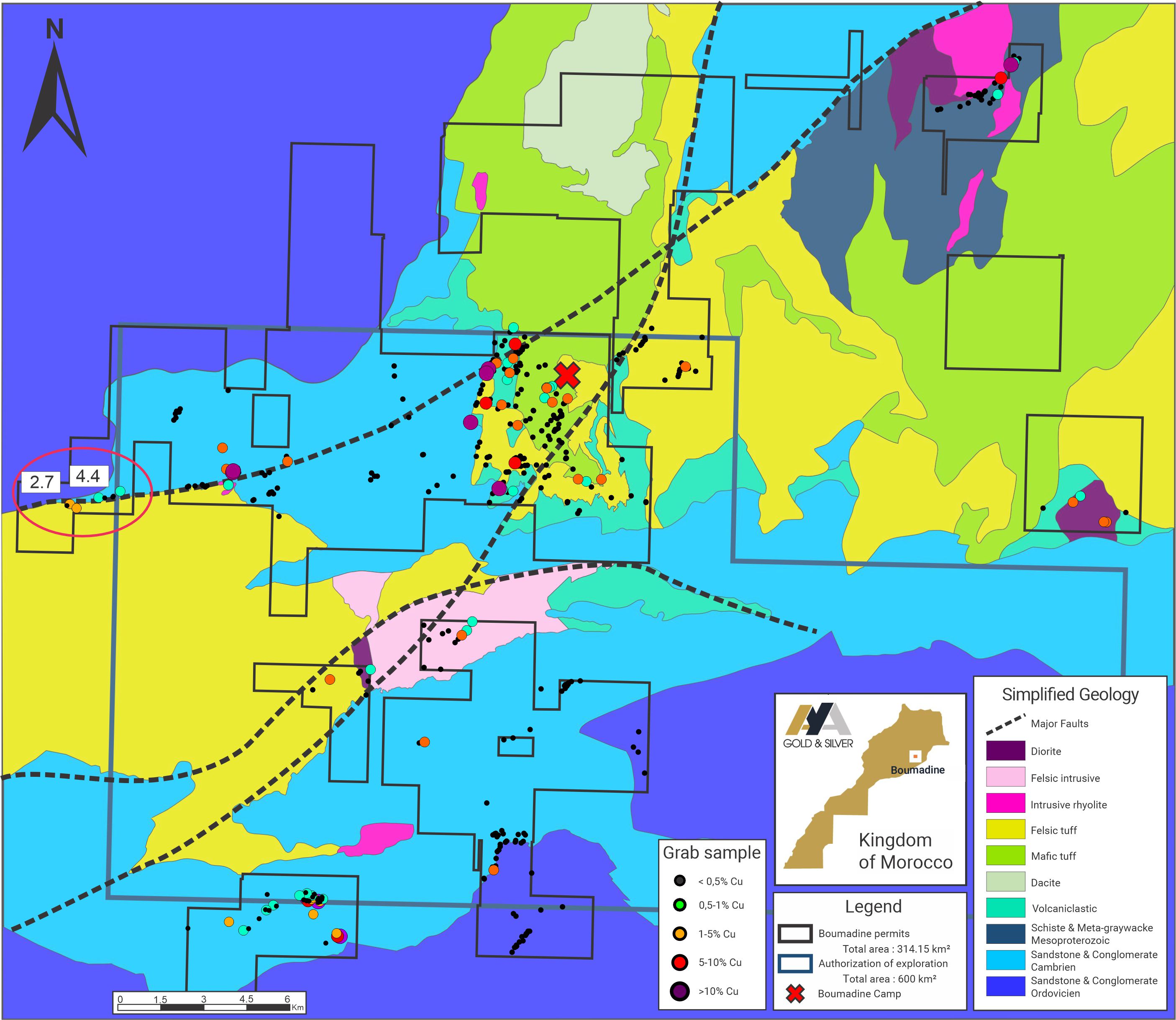

This year, 148 diamond drill holes ("DDH"), 31 reverse circulation holes ("RC") and 15 multi-purpose drill holes ("MP") totaling 79,732m have been completed at Boumadine (Figure 1, Figure 2 and Appendix 2). Drilling was conducted on strike along the Main Trend (North Zones), Tizi, Imariren as well as on some regional targets. The majority of results have been received for drill holes up to BOU-DD25-557 (Table 1, Figure 3, and Appendix 1).

Results received so far in 2025, including holes BOU-MP25-038 and BOU-MP25-028, confirm the high-grade continuity of the Main Trend, which remains open in all directions. Today's results, with BOU-DD25-529 and BOU-DD25-547, also confirm the continuity of the Tizi Zone and extend Imariren mineralization to 1.0km. The Imariren and Tizi zones also remain open in all directions.

The main mineralization generally measures 1m to 4m wide (locally reaching over a 10m width) N340-oriented massive sulphide lenses/veins sharply dipping eastward (> 70°). The massive sulphide veins (>80%) are mainly composed of pyrite, with variable proportions of sphalerite, galena, and chalcopyrite. Tizi and Imariren share the same characteristics except for their N000 orientation.

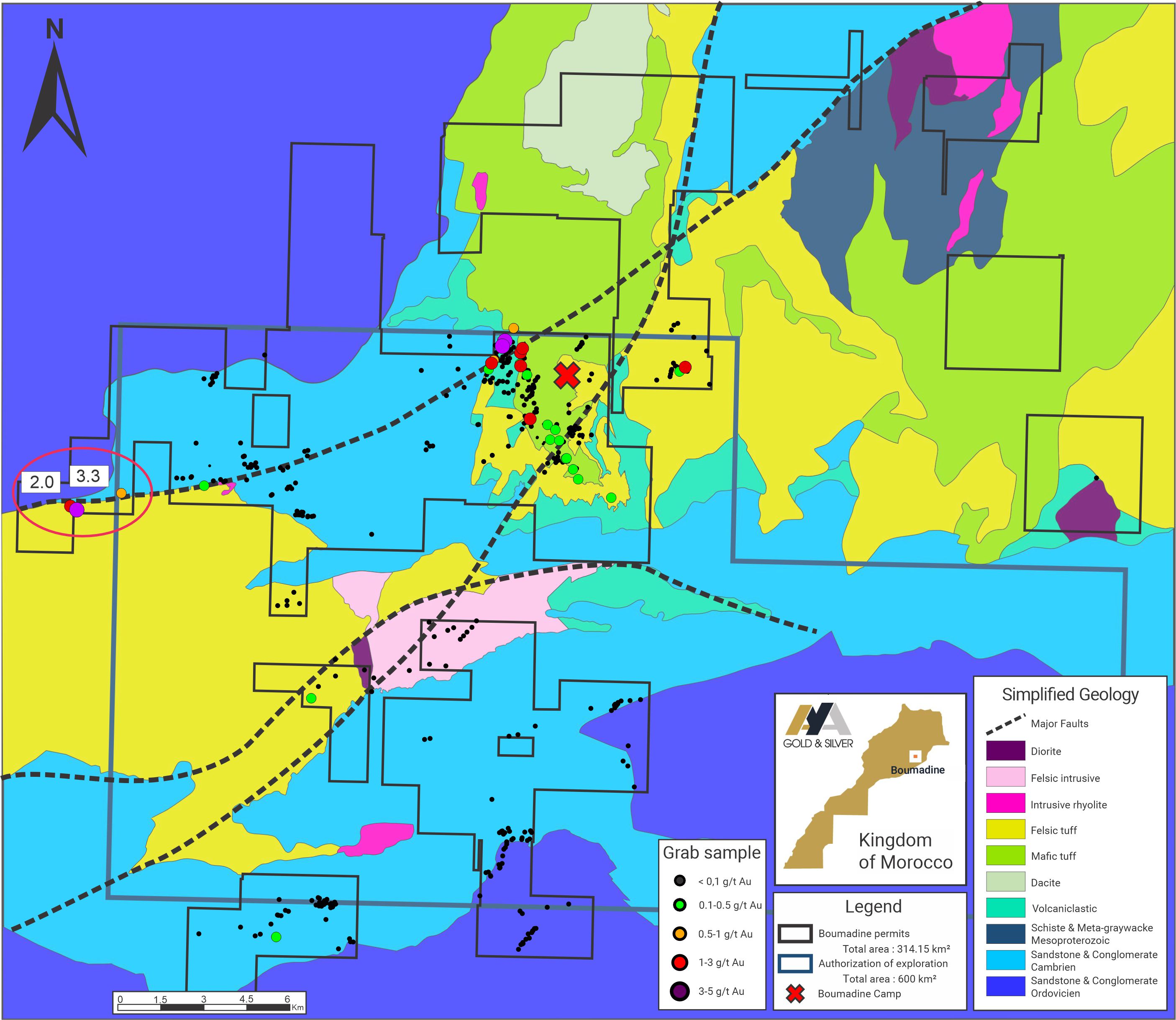

Figures 4 and 5 shows the newly receive grab results on the western most permit, recently acquired. Strong gold and copper results helped identify the new Asirem high-grade mineralization at-surface, which will be test drilled in the coming months. The Au-Cu anomalies coincide with a strong N080 geophysical feature and a regional fault. This major structure can be traced for over 9km within our new western exploration permits.

Figure 3 - Surface Plan of Boumadine North, Imariren and Tizi Zones with New DDH Results

Figure 4 - Surface Map of Boumadine Property with Simplified Geology and Au Grab Results

Figure 5 - Surface Map of Boumadine Property with Simplified Geology and Cu Grab Results

Next Steps

Significant upside potential exists to expand the Boumadine Main Trend, which currently extends 5.4km, the Tizi Zone, which currently extends 2.0km and the Imariren Zone, with a current extension of 1.0km; the three trends remain open in all directions. Currently, the Corporation has mobilized drill rigs to complete the 100,000m to 140,000m drilling program. Half of the drilling will focus along the Main Trend, Imariren and Tizi to continue extending the known mineralization trend along strike and at depth and to infill known areas advancing the project towards a preliminary economic assessment. The remaining 50% will focus on greenfield exploration designed to test geological hypotheses and drill targets generated from the past three years of work. The results from ongoing geology work will determine additional development work.

Technical Information

Aya has implemented a quality control program to comply with best practices in sampling and analysis of drill core and RC chips. For core drilling, all individual samples represent approximately one meter in length of core, which is halved. Half of the core is kept on site for reference, and its counterpart is sent for preparation and assaying to African Laboratory for Mining and Environment ("Afrilab") in Marrakech, Morocco. For drilling using RC, all individual samples represent 1.0m in length and a representative portion is kept for every meter in some chip trays stored on site. A split samples representing 1/16th, ranging from 2 to 4 kilogram is sent for preparation and assaying to Afrilab in Marrakech, Morocco.

All samples are analyzed for silver, copper, iron, lead, zinc, tin, and molybdenum using Aqua regia and finished by atomic absorption spectroscopy ("AAS"). Samples grading above 200 g/t Ag are reanalyzed using fire assaying. Gold is assayed by fire assaying. Standards of different grades and blanks were inserted every 20 samples in addition to the standards, blanks and pulp duplicate inserted by Afrilab.

Qualified Person

The scientific and technical information contained in this press release have been reviewed by David Lalonde, B. Sc, Vice-President Exploration, Qualified Person, for accuracy and compliance with National Instrument 43-101.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco.

The only TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is exploring its properties along the prospective South-Atlas Fault, several of which have hosted past-producing mines and historical resources.

Aya's management team maximizes shareholder value by anchoring sustainability at the heart of its production, resource, governance, and financial growth plans.

For additional information, please visit Aya's website at www.ayagoldsilver.com or contact:

| Benoit La Salle, FCPA, MBA President & CEO benoit.lasalle@ayagoldsilver.com | Alex Ball VP, Corporate Development & IR alex.ball@ayagoldsilver.com |

Forward-Looking Statements

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding Aya's future growth and business prospects (including the timing and development of new deposits and the success of exploration activities) and other opportunities. Wherever possible, words such as "expand", "Identify", "extend", "confirm", "prospective", "target", potential", "become", "position", "continue", "potential", "to complete", and similar expressions or statements that certain actions, events or results "may", "could", "would", "might", "will", or are "likely" to be taken, occur or be achieved, have been used to identify such forward-looking information. Specific forward-looking statements in this press release include, but are not limited to, statements and information with respect to the (1) confirmation of high-grade continuity along the Boumadine Main Trend and the extension of the Imariren mineralized trend to 1 kilometer; (2) identification of a new mineralized high-grade at-surface zone to the west for potential future exploration; (3) identification of the new prospective high-grade Asirem zone to the west of Boumadine Main Trend for potential future exploration; (4) identification of the Asirem gold-copper zone as a new prospective target; (5) potential of Boumadine to become a large-scale, high-grade project; (6) intention and readiness to quickly drill test the newly identified Asirem regional target; (7) mineralized structure at Boumadine to be traced over 9 kilometers, supporting future exploration potential; (8) continued demonstration of Boumadine's significant resource growth potential; (9) high-grade continuity within the Main Trend and its continued potential for extension, as it remains open in all directions; (10) continuity in the Tizi Zone and the extension of mineralization at Imariren to 1.0 km; (11) potential for continued extension and exploration at the Tizi and Imariren zones, which remain open in all directions; (12) identification of the new Asirem high-grade surface mineralization; (13) intention to drill test the new Asirem high-grade surface mineralization in the coming months; (14) major mineralized structure to be traced for over 9 kilometers within the newly acquired western exploration permits, supporting future exploration potential; (15) potential to expand the Boumadine Main Trend, Tizi Zone, and Imariren Zone, all of which remain open in all directions; (16) execution of the planned 100,000 to 140,000 meter drilling program at Boumadine; (17) continuation and success of the exploration program, including the extension of mineralization; (18) advancement of the project toward a preliminary economic assessment; (19) focus of future drilling on greenfield exploration and testing of geological hypotheses and targets generated over the past three years; (20) expectation that ongoing geological work will guide and determine further development activities. Although the forward-looking information contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, Aya cannot be certain that actual results will be consistent with such forward-looking information. Such forward-looking statements are based upon assumptions, opinions and analysis made by management in light of its experience, current conditions, and its expectations of future developments that management believe to be reasonable and relevant but that may prove to be incorrect. These assumptions include, among other things, the ability to obtain any requisite governmental approvals, obtaining regulatory permits for on-site work, importing goods and machinery and employment permits, the accuracy of Mineral Reserve and Mineral Resource Estimates (including, but not limited to, ore tonnage and ore grade estimates), silver price, exchange rates, fuel and energy costs, future economic conditions, anticipated future estimates of free cash flow, and courses of action. Aya cautions you not to place undue reliance upon any such forward-looking statements.

The risks and uncertainties that may affect forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including government approvals and permitting, changes in economic conditions, changes in the worldwide price of silver and other key inputs, changes in mine plans (including, but not limited to, throughput and recoveries being affected by metallurgical characteristics) and other factors, such as project execution delays, many of which are beyond the control of Aya, as well as other risks and uncertainties which are more fully described in Aya's 2024 Annual Information Form dated March 31, 2025, and in other filings of Aya with securities and regulatory authorities which are available on SEDAR+ at www.sedarplus.ca. Aya does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs, and opinions change. Nothing in this document should be construed as either an offer to sell or a solicitation to buy or sell Aya securities. All references to Aya include its subsidiaries unless the context requires otherwise.

Appendix 1 - Full Drill Results from Boumadine (core lengths)

| DDH No. | From | To | Au | Ag | Length* | Cu | Pb | Zn | Mo | Ag Eq** | |||||||||||

| (m) | (m) | (g/t) | (g/t) | (m) | (%) | (%) | (%) | (g/t) | (g/t) | ||||||||||||

| BOU-DD25-492 | 0.0 | 666.0 | 0.00 | 0 | 666.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-DD25-495 | 258.9 | 259.5 | 0.03 | 47 | 0.6 | 0.6 | 0.0 | 0.1 | 9 | 102 | |||||||||||

| BOU-DD25-499 | 0.0 | 705.0 | 0.00 | 0 | 705.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-DD25-503 | 224.2 | 225.2 | 9.92 | 49 | 1.0 | 0.1 | 0.2 | 1.6 | 6 | 876 | |||||||||||

| BOU-DD25-507 | 28.0 | 29.4 | 1.18 | 20 | 1.4 | 0.0 | 0.4 | 2.0 | 14 | 171 | |||||||||||

| BOU-DD25-523 | 0.0 | 183.0 | 0.00 | 0 | 183.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-DD25-527 | 129.4 | 131.3 | 0.73 | 26 | 1.9 | 0.1 | 0.2 | 0.3 | 2 | 99 | |||||||||||

| BOU-DD25-529 | 103.0 | 104.0 | 1.41 | 14 | 1.0 | 0.0 | 0.1 | 0.1 | 6 | 131 | |||||||||||

| BOU-DD25-529 | 105.9 | 108.2 | 1.42 | 6 | 2.3 | 0.0 | 0.3 | 0.5 | 4 | 142 | |||||||||||

| BOU-DD25-529 | 134.4 | 136.4 | 3.66 | 52 | 2.0 | 0.0 | 0.5 | 0.5 | 5 | 365 | |||||||||||

| BOU-DD25-532 | 43.6 | 44.4 | 3.32 | 32 | 0.8 | 0.0 | 0.1 | 0.2 | 16 | 299 | |||||||||||

| BOU-DD25-532 | 51.0 | 52.0 | 0.09 | 81 | 1.0 | 0.1 | 0.2 | 3.5 | 2 | 187 | |||||||||||

| BOU-DD25-532 | 165.3 | 165.8 | 1.22 | 11 | 0.5 | 0.2 | 0.1 | 0.4 | 2 | 135 | |||||||||||

| BOU-DD25-532 | 169.4 | 171.2 | 0.64 | 12 | 1.8 | 0.0 | 0.1 | 0.4 | 2 | 77 | |||||||||||

| BOU-DD25-532 | 189.0 | 190.0 | 0.89 | 6 | 1.0 | 0.0 | 0.3 | 1.3 | 3 | 114 | |||||||||||

| BOU-DD25-533 | 204.3 | 207.7 | 1.18 | 61 | 3.4 | 0.2 | 0.1 | 3.7 | 13 | 266 | |||||||||||

| Including | 206.1 | 207.7 | 2.19 | 87 | 1.6 | 0.3 | 0.2 | 5.9 | 13 | 436 | |||||||||||

| BOU-DD25-534 | 0.0 | 114.0 | 0.00 | 0 | 114.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-DD25-535 | 230.5 | 231.5 | 0.48 | 9 | 1.0 | 0.0 | 0.2 | 0.8 | 1 | 72 | |||||||||||

| BOU-DD25-537 | 65.6 | 70.0 | 0.92 | 29 | 4.4 | 0.1 | 0.1 | 0.4 | 6 | 118 | |||||||||||

| BOU-DD25-537 | 104.2 | 104.8 | 0.33 | 44 | 0.6 | 0.0 | 1.2 | 1.5 | 4 | 135 | |||||||||||

| BOU-DD25-537 | 108.5 | 109.0 | 0.24 | 42 | 0.5 | 0.0 | 0.5 | 1.0 | 8 | 102 | |||||||||||

| BOU-DD25-537 | 119.9 | 124.3 | 1.46 | 30 | 4.4 | 0.0 | 0.2 | 0.8 | 119 | 174 | |||||||||||

| BOU-DD25-538 | 203.5 | 204.3 | 0.23 | 74 | 0.8 | 0.1 | 0.2 | 1.7 | 2 | 147 | |||||||||||

| BOU-DD25-538 | 264.0 | 266.0 | 0.66 | 5 | 2.0 | 0.0 | 0.0 | 0.0 | 2 | 60 | |||||||||||

| BOU-DD25-539 | 80.2 | 81.0 | 0.90 | 1 | 0.8 | 0.0 | 1.1 | 1.1 | 7 | 128 | |||||||||||

| BOU-DD25-539 | 85.7 | 86.3 | 0.89 | 373 | 0.6 | 0.3 | 0.5 | 13.7 | 4 | 816 | |||||||||||

| BOU-DD25-539 | 113.0 | 113.9 | 0.46 | 11 | 0.9 | 0.0 | 0.4 | 1.1 | 2 | 86 | |||||||||||

| BOU-DD25-540 | 69.0 | 71.0 | 3.27 | 53 | 2.0 | 0.2 | 5.2 | 1.1 | 3 | 480 | |||||||||||

| BOU-DD25-540 | 164.2 | 165.1 | 0.90 | 11 | 0.9 | 0.1 | 0.0 | 0.1 | 8 | 93 | |||||||||||

| BOU-DD25-540 | 330.5 | 331.5 | 2.59 | 332 | 1.0 | 0.3 | 0.7 | 0.2 | 2 | 582 | |||||||||||

| BOU-DD25-541 | 111.8 | 112.9 | 0.78 | 52 | 1.1 | 0.0 | 0.2 | 1.5 | 9 | 159 | |||||||||||

| BOU-DD25-541 | 133.5 | 134.2 | 2.16 | 1 | 0.7 | 0.0 | 0.2 | 0.2 | 114 | 184 | |||||||||||

| BOU-DD25-541 | 165.7 | 166.3 | 1.02 | 3 | 0.6 | 0.1 | 0.1 | 0.1 | 1 | 93 | |||||||||||

| BOU-DD25-541 | 255.7 | 256.5 | 0.93 | 1 | 0.8 | 0.0 | 0.2 | 0.4 | 1 | 89 | |||||||||||

| BOU-DD25-542 | 22.4 | 23.0 | 0.84 | 13 | 0.6 | 0.0 | 0.3 | 0.3 | 20 | 96 | |||||||||||

| BOU-DD25-542 | 36.0 | 37.0 | 0.87 | 1 | 1.0 | 0.0 | 0.3 | 0.4 | 5 | 86 | |||||||||||

| BOU-DD25-542 | 177.3 | 179.0 | 0.80 | 1 | 1.7 | 0.0 | 0.3 | 0.5 | 14 | 86 | |||||||||||

| BOU-DD25-542 | 182.0 | 183.0 | 0.66 | 1 | 1.0 | 0.0 | 0.4 | 0.6 | 12 | 76 | |||||||||||

| BOU-DD25-543 | 200.0 | 201.0 | 0.68 | 6 | 1.0 | 0.0 | 1.0 | 1.6 | 4 | 124 | |||||||||||

| BOU-DD25-543 | 223.0 | 224.0 | 0.48 | 11 | 1.0 | 0.0 | 0.6 | 1.5 | 2 | 103 | |||||||||||

| BOU-DD25-544 | 31.9 | 44.2 | 0.31 | 60 | 12.3 | 0.0 | 1.1 | 1.9 | 4 | 161 | |||||||||||

| BOU-DD25-544 | 55.0 | 56.0 | 0.38 | 35 | 1.0 | 0.0 | 0.7 | 1.9 | 1 | 130 | |||||||||||

| BOU-DD25-545 | 130.8 | 131.8 | 0.60 | 32 | 1.0 | 0.2 | 1.2 | 3.2 | 14 | 205 | |||||||||||

| BOU-DD25-545 | 134.2 | 136.6 | 0.52 | 25 | 2.4 | 0.2 | 0.9 | 1.1 | 5 | 127 | |||||||||||

| BOU-DD25-545 | 177.8 | 178.5 | 0.46 | 23 | 0.7 | 0.1 | 1.3 | 2.9 | 6 | 170 | |||||||||||

| BOU-DD25-545 | 242.0 | 244.4 | 1.48 | 23 | 2.4 | 0.2 | 0.6 | 1.5 | 6 | 206 | |||||||||||

| BOU-DD25-545 | 368.4 | 369.3 | 0.50 | 16 | 0.9 | 0.0 | 0.1 | 1.2 | 1 | 88 | |||||||||||

| BOU-DD25-546 | 22.1 | 22.8 | 0.95 | 37 | 0.7 | 0.1 | 1.1 | 7.1 | 11 | 320 | |||||||||||

| BOU-DD25-546 | 41.7 | 42.6 | 0.38 | 21 | 0.9 | 0.0 | 0.5 | 1.2 | 4 | 91 | |||||||||||

| BOU-DD25-546 | 57.0 | 59.7 | 0.57 | 53 | 2.7 | 0.0 | 1.8 | 1.8 | 6 | 189 | |||||||||||

| BOU-DD25-546 | 62.4 | 63.3 | 0.45 | 26 | 0.9 | 0.0 | 1.2 | 1.8 | 9 | 137 | |||||||||||

| BOU-DD25-546 | 79.4 | 82.1 | 0.55 | 78 | 2.7 | 0.1 | 1.6 | 1.8 | 7 | 209 | |||||||||||

| BOU-DD25-547 | 69.3 | 73.0 | 0.72 | 22 | 3.7 | 0.0 | 0.3 | 0.7 | 4 | 106 | |||||||||||

| BOU-DD25-547 | 86.3 | 86.8 | 0.20 | 69 | 0.5 | 0.0 | 0.4 | 1.5 | 3 | 134 | |||||||||||

| BOU-DD25-547 | 97.8 | 98.6 | 0.74 | 26 | 0.8 | 0.0 | 0.5 | 1.0 | 2 | 123 | |||||||||||

| BOU-DD25-547 | 117.0 | 126.0 | 0.42 | 80 | 9.0 | 0.0 | 1.8 | 3.6 | 5 | 248 | |||||||||||

| BOU-DD25-548 | 0.0 | 294.0 | 0.00 | 0 | 294.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-DD25-549 | 176.5 | 184.0 | 0.40 | 38 | 7.5 | 0.0 | 0.8 | 0.9 | 4 | 112 | |||||||||||

| BOU-DD25-549 | 186.0 | 187.7 | 0.32 | 34 | 1.7 | 0.0 | 1.5 | 3.2 | 8 | 176 | |||||||||||

| BOU-DD25-550 | 40.2 | 40.8 | 0.44 | 82 | 0.6 | 0.0 | 0.7 | 1.6 | 13 | 173 | |||||||||||

| BOU-DD25-551 | 95.5 | 100.0 | 0.47 | 36 | 4.5 | 0.0 | 0.8 | 1.0 | 8 | 116 | |||||||||||

| BOU-DD25-552 | 54.6 | 55.9 | 1.19 | 21 | 1.3 | 0.0 | 0.2 | 0.2 | 3 | 128 | |||||||||||

| BOU-DD25-552 | 123.4 | 124.1 | 0.41 | 19 | 0.7 | 0.0 | 0.1 | 0.4 | 6 | 64 | |||||||||||

| BOU-DD25-552 | 161.5 | 163.0 | 1.01 | 13 | 1.5 | 0.0 | 0.2 | 0.5 | 14 | 110 | |||||||||||

| BOU-DD25-552 | 166.6 | 168.1 | 0.69 | 117 | 1.5 | 0.0 | 1.8 | 2.7 | 8 | 282 | |||||||||||

| BOU-DD25-553 | 102.1 | 102.9 | 0.28 | 30 | 0.8 | 0.0 | 0.2 | 0.7 | 4 | 75 | |||||||||||

| BOU-DD25-553 | 286.3 | 287.8 | 0.73 | 108 | 1.5 | 0.3 | 2.2 | 4.8 | 3 | 361 | |||||||||||

| BOU-DD25-554 | 222.0 | 223.9 | 0.58 | 58 | 1.9 | 0.1 | 1.4 | 2.6 | 6 | 207 | |||||||||||

| BOU-DD25-554 | 224.9 | 226.5 | 0.29 | 34 | 1.6 | 0.0 | 0.9 | 1.6 | 9 | 119 | |||||||||||

| BOU-DD25-555 | 171.8 | 172.8 | 0.54 | 9 | 1.0 | 0.0 | 0.0 | 0.1 | 10 | 55 | |||||||||||

| BOU-DD25-556 | 24.7 | 30.5 | 1.73 | 2 | 5.8 | 0.0 | 0.0 | 0.1 | 12 | 141 | |||||||||||

| BOU-DD25-556 | 45.1 | 46.1 | 0.06 | 122 | 1.0 | 0.0 | 0.1 | 0.3 | 32 | 136 | |||||||||||

| BOU-DD25-557 | 212.0 | 213.0 | 0.40 | 25 | 1.0 | 0.0 | 0.0 | 0.1 | 2 | 60 | |||||||||||

| BOU-DD25-557 | 214.7 | 215.2 | 6.38 | 126 | 0.5 | 0.1 | 1.8 | 0.7 | 3 | 697 | |||||||||||

| BOU-DD25-557 | 222.2 | 222.8 | 2.30 | 21 | 0.6 | 0.0 | 0.4 | 1.0 | 1 | 236 | |||||||||||

| BOU-DD25-557 | 234.3 | 235.0 | 1.35 | 27 | 0.7 | 0.1 | 0.6 | 1.8 | 3 | 196 | |||||||||||

| BOU-DD25-557 | 246.3 | 247.0 | 2.52 | 30 | 0.7 | 0.2 | 0.4 | 0.7 | 5 | 273 | |||||||||||

| BOU-DD25-557 | 258.7 | 259.9 | 1.99 | 20 | 1.2 | 0.0 | 0.5 | 0.9 | 17 | 210 | |||||||||||

| BOU-DD25-557 | 266.6 | 268.4 | 2.32 | 34 | 1.8 | 0.1 | 0.1 | 0.1 | 5 | 231 | |||||||||||

| BOU-DD25-557 | 270.5 | 271.0 | 1.71 | 29 | 0.5 | 0.1 | 0.1 | 0.2 | 6 | 181 | |||||||||||

| BOU-DD25-560 | 82.0 | 83.0 | 1.19 | 9 | 1.0 | 0.0 | 0.0 | 0.0 | 10 | 104 | |||||||||||

| BOU-DD25-560 | 90.3 | 91.0 | 1.19 | 9 | 0.7 | 0.0 | 0.0 | 0.0 | 9 | 103 | |||||||||||

| BOU-MP25-024 | 0.0 | 200.0 | 0.00 | 0 | 200.0 | 0.0 | 0.0 | 0.0 | 0 | 0 | |||||||||||

| BOU-MP25-025 | 151.0 | 152.0 | 0.06 | 57 | 1.0 | 0.0 | 0.6 | 2.5 | 16 | 138 | |||||||||||

| BOU-MP25-025 | 164.0 | 165.0 | 0.40 | 17 | 1.0 | 0.0 | 0.1 | 0.5 | 13 | 63 | |||||||||||

| BOU-MP25-026 | 13.0 | 14.0 | 0.80 | 5 | 1.0 | 0.0 | 0.6 | 0.1 | 14 | 86 | |||||||||||

| BOU-MP25-026 | 238.5 | 243.2 | 0.58 | 36 | 4.7 | 0.1 | 1.3 | 7.2 | 12 | 296 | |||||||||||

| BOU-MP25-026 | 252.0 | 254.0 | 0.47 | 16 | 2.0 | 0.0 | 1.1 | 1.2 | 15 | 115 | |||||||||||

| BOU-MP25-026 | 317.0 | 318.0 | 1.12 | 2 | 1.0 | 0.0 | 0.1 | 0.1 | 2 | 96 | |||||||||||

| BOU-MP25-026 | 326.0 | 327.0 | 1.53 | 4 | 1.0 | 0.0 | 0.1 | 0.4 | 2 | 137 | |||||||||||

| BOU-MP25-028 | 392.1 | 396.4 | 3.27 | 19 | 4.3 | 0.1 | 0.1 | 0.3 | 8 | 286 | |||||||||||

| Including | 392.1 | 394.2 | 5.46 | 26 | 2.1 | 0.1 | 0.1 | 0.0 | 10 | 460 | |||||||||||

| BOU-MP25-029 | 69.0 | 70.0 | 0.39 | 20 | 1.0 | 0.0 | 1.1 | 0.4 | 25 | 90 | |||||||||||

| BOU-MP25-031 | 275.0 | 276.3 | 0.47 | 31 | 1.3 | 0.0 | 0.4 | 0.9 | 6 | 100 | |||||||||||

| BOU-MP25-031 | 279.1 | 282.0 | 2.47 | 21 | 2.9 | 0.1 | 0.2 | 0.7 | 7 | 242 | |||||||||||

| BOU-MP25-034 | 191.0 | 192.0 | 0.53 | 12 | 1.0 | 0.0 | 0.4 | 0.7 | 6 | 83 | |||||||||||

| BOU-MP25-034 | 497.0 | 498.0 | 0.75 | 12 | 1.0 | 0.0 | 0.2 | 0.6 | 1 | 92 | |||||||||||

| BOU-MP25-036 | 312.3 | 313.0 | 0.87 | 19 | 0.7 | 0.0 | 0.7 | 1.3 | 3 | 137 | |||||||||||

| BOU-MP25-036 | 618.2 | 618.9 | 1.38 | 30 | 0.7 | 0.1 | 0.1 | 1.4 | 7 | 183 | |||||||||||

| BOU-MP25-036 | 646.8 | 647.5 | 1.34 | 11 | 0.7 | 0.1 | 0.1 | 1.4 | 8 | 161 | |||||||||||

| BOU-MP25-036 | 721.2 | 722.3 | 1.45 | 33 | 1.1 | 0.1 | 0.0 | 0.1 | 1 | 157 | |||||||||||

| BOU-MP25-037 | 733.6 | 734.4 | 3.52 | 10 | 0.8 | 0.0 | 0.1 | 0.2 | 1 | 293 | |||||||||||

| BOU-MP25-038 | 437.7 | 441.0 | 2.85 | 27 | 3.3 | 0.0 | 0.1 | 0.1 | 2 | 258 | |||||||||||

| Including | 437.7 | 439.0 | 6.13 | 65 | 1.3 | 0.1 | 0.2 | 0.3 | 2 | 563 | |||||||||||

| BOU-MP25-038 | 453.9 | 457.6 | 1.66 | 2 | 3.7 | 0.0 | 0.0 | 0.2 | 4 | 139 | |||||||||||

| BOU-MP25-038 | 907.6 | 908.3 | 3.29 | 84 | 0.7 | 0.2 | 0.6 | 1.4 | 5 | 408 | |||||||||||

| BOU-MP25-039 | 164.0 | 166.0 | 0.24 | 161 | 2.0 | 0.0 | 0.2 | 0.3 | 5 | 192 | |||||||||||

| BOU-MP25-039 | 419.4 | 420.1 | 0.52 | 16 | 0.7 | 0.0 | 0.1 | 1.5 | 7 | 101 | |||||||||||

| BOU-MP25-039 | 466.0 | 467.0 | 0.97 | 12 | 1.0 | 0.1 | 0.6 | 1.2 | 14 | 136 | |||||||||||

| BOU-MP25-039 | 521.0 | 525.0 | 2.86 | 13 | 4.0 | 0.0 | 0.1 | 0.2 | 1 | 246 | |||||||||||

| Including | 521.0 | 523.0 | 3.91 | 19 | 2.0 | 0.1 | 0.1 | 0.4 | 1 | 339 | |||||||||||

| BOU-MP25-039 | 565.0 | 565.6 | 0.61 | 26 | 0.6 | 0.1 | 0.7 | 2.4 | 2 | 154 | |||||||||||

| BOU-MP25-039 | 604.2 | 604.7 | 0.42 | 25 | 0.5 | 0.1 | 0.9 | 1.4 | 1 | 119 | |||||||||||

| BOU-MP25-040 | 413.5 | 415.4 | 0.89 | 25 | 1.9 | 0.0 | 0.3 | 0.8 | 14 | 126 | |||||||||||

| BOU-MP25-040 | 568.8 | 569.6 | 0.03 | 77 | 0.8 | 0.2 | 5.9 | 2.8 | 4 | 308 | |||||||||||

| BOU-MP25-040 | 571.6 | 572.5 | 0.03 | 77 | 0.9 | 0.0 | 0.2 | 0.4 | 6 | 95 | |||||||||||

| BOU-MP25-040 | 574.3 | 576.9 | 1.94 | 26 | 2.6 | 0.1 | 0.8 | 0.6 | 3 | 218 | |||||||||||

| BOU-MP25-041 | 70.0 | 71.0 | 0.39 | 20 | 1.0 | 0.0 | 1.4 | 1.4 | 27 | 120 | |||||||||||

| BOU-MP25-041 | 81.0 | 83.0 | 0.90 | 15 | 2.0 | 0.0 | 0.9 | 1.1 | 30 | 138 | |||||||||||

| BOU-MP25-041 | 114.0 | 115.0 | 0.47 | 16 | 1.0 | 0.1 | 0.4 | 2.6 | 9 | 130 | |||||||||||

| BOU-MP25-041 | 116.0 | 120.0 | 0.69 | 19 | 4.0 | 0.0 | 0.6 | 2.3 | 7 | 148 | |||||||||||

| BOU-MP25-041 | 121.0 | 122.0 | 0.52 | 10 | 1.0 | 0.0 | 0.1 | 0.1 | 7 | 56 | |||||||||||

| BOU-MP25-041 | 487.0 | 487.5 | 1.77 | 30 | 0.5 | 0.1 | 0.5 | 1.7 | 1 | 228 | |||||||||||

| BOU-MP25-041 | 621.5 | 622.4 | 0.72 | 33 | 0.9 | 0.3 | 0.3 | 0.3 | 18 | 128 | |||||||||||

| BOU-MP25-041 | 626.0 | 626.5 | 0.50 | 64 | 0.5 | 0.1 | 1.3 | 1.9 | 6 | 193 | |||||||||||

| BOU-MP25-041 | 644.6 | 645.1 | 2.50 | 45 | 0.5 | 0.1 | 0.5 | 3.4 | 1 | 347 | |||||||||||

| BOU-MP25-041 | 648.6 | 649.1 | 4.86 | 20 | 0.5 | 0.0 | 0.7 | 1.6 | 1 | 458 | |||||||||||

| BOU-MP25-042 | 189.0 | 190.0 | 0.51 | 8 | 1.0 | 0.0 | 0.9 | 1.0 | 9 | 96 | |||||||||||

| BOU-MP25-042 | 194.0 | 196.0 | 2.82 | 31 | 2.0 | 0.1 | 0.7 | 1.9 | 7 | 322 | |||||||||||

| BOU-MP25-042 | 776.4 | 776.9 | 0.80 | 6 | 0.5 | 0.1 | 0.5 | 0.4 | 20 | 100 | |||||||||||

* True width remains undetermined at this stage; all values are uncut.

** Ag equivalent is based on a silver price of US$24/oz with a process recovery of 89%, a gold price of US$2,200/oz with a process recovery of 85%, a zinc price of US$1.20/lb with a process recovery of 72%, a lead price of US$1.00/lb with a process recovery of 85%, and a copper price of US$4.00/lb with a process recovery of 75% resulting in the following ratios: 1g/t Au: 77.9 g/t Ag; 1% Cu: 85.4 g/t Ag; 1% Pb: 24.2 g/t Ag; and 1% Zn: 24.6 g/t Ag.

Appendix 2 - New Drillhole Coordinates of 2025 Boumadine Exploration Program (completed holes)

| DDH No. | Easting | Northing | Elevation | Azimuth | Dip | Length (m) | |

| BOU-DD25-596 | 305278 | 3473693 | 1245 | 180 | -50 | 156 | |

| BOU-DD25-597 | 305278 | 3473774 | 1240 | 180 | -50 | 168 | |

| BOU-DD25-598 | 305278 | 3473868 | 1252 | 180 | -50 | 216 | |

| BOU-DD25-599 | 317536 | 3476276 | 1212 | 250 | -50 | 820 | |

| BOU-DD25-600 | 305278 | 3473946 | 1249 | 180 | -50 | 237 | |

| BOU-DD25-601 | 304208 | 3473224 | 1349 | 180 | -50 | 153 | |

| BOU-DD25-602 | 317338 | 3476969 | 1201 | 250 | -50 | 846 | |

| BOU-DD25-603 | 304208 | 3473316 | 1320 | 180 | -50 | 330 | |

| BOU-DD25-606 | 317171 | 3475739 | 1250 | 250 | -50 | 543 | |

| BOU-MP25-070 | 317700 | 3476451 | 1208 | 250 | -55 | 102 | |

| BOU-MP25-071 | 317612 | 3476303 | 1209 | 250 | -55 | 126 | |

| BOU-MP25-072 | 317631 | 3476114 | 1231 | 250 | -55 | 200 | |

| BOU-MP25-073 | 317440 | 3476157 | 1213 | 245 | -55 | 36 | |

| BOU-MP25-074 | 317440 | 3476157 | 1213 | 245 | -55 | 36 | |

| BOU-MP25-075 | 317385 | 3474168 | 1286 | 65 | -50 | 12 | |

| BOU-MP25-076 | 317385 | 3474168 | 1286 | 65 | -55 | 84 | |

| BOU-MP25-077 | 317316 | 3474143 | 1273 | 65 | -55 | 102 | |

| BOU-MP25-078 | 317700 | 3476451 | 1208 | 250 | -50 | 12 | |

| BOU-RC25-028 | 317142 | 3476181 | 1218 | 250 | -55 | 192 | |

| BOU-RC25-029 | 317104 | 3476167 | 1219 | 250 | -55 | 156 | |

| BOU-RC25-030 | 317065 | 3476153 | 1223 | 250 | -55 | 200 | |

| BOU-RC25-031 | 332555 | 3487943 | 1033 | 315 | -50 | 192 | |

| BOU-RC25-032 | 332337 | 3487819 | 1039 | 135 | -50 | 200 | |

| BOU-RC25-033 | 331313 | 3486836 | 1069 | 135 | -55 | 200 | |

| BOU-RC25-034 | 331286 | 3486864 | 1066 | 135 | -50 | 200 | |

| BOU-RC25-035 | 335465 | 3471963 | 1183 | 180 | -50 | 150 | |

| BOU-RC25-036 | 335464 | 3471922 | 1182 | 180 | -50 | 144 | |

| BOU-RC25-037 | 335564 | 3471908 | 1190 | 180 | -50 | 200 | |

| BOU-RC25-038 | 335564 | 3471955 | 1194 | 180 | -50 | 12 | |

Photos accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d5680833-e2ce-4006-90ad-2a047964caac

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf8b09d8-ea49-4323-8b24-b598e6607485

https://www.globenewswire.com/NewsRoom/AttachmentNg/b884ad1f-f454-4204-8685-f6fea6c3be99

https://www.globenewswire.com/NewsRoom/AttachmentNg/59603825-a692-49b7-8f86-03a2d76ec51b

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba3dace5-398b-47da-a805-5b756fdd974f