JANUARY-JUNE 2025

- Rental income increased to SEK 466 m (454). For the like-for-like portfolio, rental income increased by 3.9 percent.

- Net operating income increased to SEK 260 m (229). For the like-for-like portfolio, net operating income increased by 12.3 percent due to both higher rental income and lower property management costs.

- Profit from property management increased by 49.5 percent to SEK 102 m (68) despite the absence of net operating income from seven properties that were divested during the preceding year.

- The property portfolio's value at the end of the period amounted to SEK 13,821 m (13,701) and change in value of the properties amounted to SEK 11 m (-220) for the period.

- Net profit for the period amounted to SEK -1 m (-110).

- The net asset value amounted to SEK 45.40 per share (44.68).

APRIL-JUNE 2025

- Rental income increased to SEK 236 m (227) as a result of rent increases.

- Net operating income increased to SEK 152 m (139) due to higher rental income and lower property management costs.

- Profit from property management for the second quarter increased to SEK 74 m (58) as a result of higher net operating income and reduced central administration costs.

SIGNIFICANT EVENTS DURING AND AFTER THE SECOND QUARTER

- Neobo's CEO Ylva Sarby Westman was elected to the European Public Real Estate Association (EPRA) Advisory Board at its annual general meeting on June 17.

- In July, a building right relating to part of the Träkolet 16 property in Sollentuna was divested at an underlying property value of SEK 19.5 m. The sales price slightly exceeded the most recent external valuation of the building right.

CEO comment

On the right track - profit from property management grows by 50%

Since Neobo was founded, we have worked purposefully to increase the return from our properties, and it is gratifying to see that our efforts have yielded results and that we are on the right path.

Profit from property management increased by 50 percent in the first six months of the year, despite seven properties being divested last year, and net operating income rose by 12 percent in the like-for-like portfolio. The surplus ratio improved to 65 percent (61) and the interest coverage ratio to a multiple of 2.2 (1.9) during the quarter. These are the highest figures noted for both key metrics since Neobo's formation.

Value-creating refinement

Since year-end, we have invested SEK 109 m in value-creating measures that have increased our net operating income and made our residential areas more attractive and secure. This includes our renovation of about 39 apartments and a number of sustainability investments that have moved us one step closer to achieving our long-term sustainability targets.

There is much talk of an increase in the number of vacant rental apartments in Sweden and for us, residential vacancies increased by 27 apartments during the quarter. However, currently, around 30 apartments are being renovated in areas with good occupancy rates, and we expect to lease them out immediately upon completion.

Ready to ramp up transaction pace

In July, we signed an agreement to divest a building right in Sollentuna, allowing for the development of approximately 80 student apartments, corresponding to just over?2?,500 square meters of habitable gross area. The sales price of SEK 19.5 m is just over the most recent external valuation of the building right and the divestment will unlock capital that can be reinvested in strategic properties.

As the transaction market is now starting to recover, we are ready to ramp up the pace of our optimization efforts to leverage opportunities in the market.

Stable balance sheet in a turbulent external environment

Considerable uncertainty continues to dominate the external environment. In June, the Swedish Central Bank cut the policy rate by 0.25 percentage points and several forecasters are now predicting further cuts in the autumn.

With a robust financial base comprising equity and secured bank financing, we are maintaining a stable financial position, which puts us in a good position to navigate the fluctuations in the market and to continue implementing our strategy for value creation.

For the first six months of the year, we are reporting positive unrealized changes in value in the property portfolio of SEK 11 m (-216) as a result of stabilized yield requirements and increased net operating income. The average yield requirement that has been used in the property valuations has remained unchanged at 5.0 percent over the last five quarters.

Continued focus on increased profitability

Our strategy has yielded results. By maintaining our focus on increased profitability and with the strong commitment of our employees, we are continuing the path we have embarked upon to develop attractive and sustainable living environments and to optimize our property portfolio. I am convinced that this is the right way to create value for our tenants and shareholders.

Stockholm, July 9, 2025

Ylva Sarby Westman, CEO

For more information, please contact:

Ylva Sarby Westman, CEO

mobile: +46 (0) 706 90 65 97 e-mail: ylva.sarby.westman@neobo.se

Maria Strandberg, CFO

mobile: +46 (0) 703 98 23 80 e-mail: maria.strandberg@neobo.se

About Us

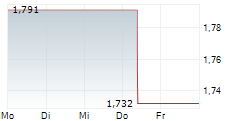

Neobo is a real estate company that manages and refines residential properties over the long term in municipalities with strong demand for rental apartments. Our vision is to create attractive and sustainable living environments where people can thrive and feel secure. Neobo's shares are listed on Nasdaq Stockholm under the ticker symbol NEOBO and ISIN code SE0005034550.

This information is information that Neobo Fastigheter AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-07-09 07:00 CEST.

Image Attachments

CEO Ylva Sarby Westman