2.08% Sb, 2.64 g/t Au over 17.0 m including 3.15% Sb, 10.92 g/t Au over 4.0 m

1.66% Sb, 0.42 g/t Au over 14.0 m including 2.31% Sb, 0.50 g/t Au over 10.0 m

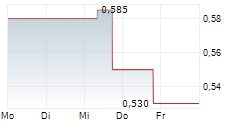

LONGUEUIL, Québec, July 09, 2025 (GLOBE NEWSWIRE) -- Azimut Exploration Inc. ("Azimut" or the "Company") (TSXV: AZM) (OTCQX: AZMTF) is pleased to announce that the Company has undertaken a systematic diamond drilling program to further delineate the Fortin antimony-gold Zone on its wholly owned Wabamisk Property (the "Property") in the Eeyou Istchee James Bay ("James Bay") region of Québec, Canada (see Figures 1 to 12).

This second drill program will accelerate the definition of the Fortin Zone, a multi-kilometre-long antimony-gold-bearing feldspar porphyry sill hosted in sheared metasediments. The program follows up on previously reported exciting results, which included 1.1% Sb over 51.5 m (press releases of October 29, 2024 and May 22, 2025).

A salient result of the pre-drilling stripping phase was the uncovering of high-grade gold (up to 36.5 g/t Au over 1 m in channel WS25-02) associated with antimony. The gold potential of the Fortin Zone may increase at depth, a pattern already observed in other antimony-gold deposits worldwide. Six (6) stripped areas along the zone confirmed the continuity of antimony mineralization, returning high-grade values over a strike length of at least 1.5 kilometres. To date, 42 drill holes have intersected the sill over a lateral distance of 2.65 kilometres, and it remains open to the west.

Summer Program Goals

- Delineate the Fortin Zone with systematic drilling over a 1.5-kilometre strike and down to 200 metres vertically. The minimum 5,000-metre drilling phase is scheduled to be completed in August. A second phase of 5,000 metres will take place later this year to infill and/or expand the mineralized zone.

- Search for high-grade gold at depth related to a possible vertical zonation. In several deposits around the world, gold-rich sections occur at deeper levels than antimony mineralization. Recent channel results support the potential of finding high-grade gold within the Fortin Zone.

- Commence a mineralogical and metallurgical characterization of the mineralized material, which will include comminution testing and flotation testwork.

Highlights from Stripping (Figures 10 to 12, Table 1)

Mechanical surface stripping and extensive channel sampling were carried out this summer along the Fortin Zone.

- Salient channel sampling results:

WR25-01: 3.24% Sb / 19.0 m incl. 4.02% Sb / 15.0 m. Peak value of 13.4% Sb / 1 m (see note below).

WR25-02: 2.08% Sb, 2.64 g/t Au / 17.0 m incl. 3.15% Sb, 10.92 g/t Au / 4.0 m. Peak value of 36.5 g/t Au / 1 m.

WR25-12: 1.66% Sb, 0.42 g/t Au / 14.0 m incl. 2.31% Sb, 0.50 g/t Au / 10.0 m. Peak value of 4.29% Sb / 1 m.

WR25-13: 0.97% Sb, 0.17 g/t Au / 16.0 m. Peak value of 2.36% Sb / 1 m.

WR25-08: 0.88% Sb / 17.0 m incl. 1.14% Sb / 11.0 m. Peak value of 5.9% Sb / 1 m.

WR25-21: 0.72% Sb, 0.31% Au / 20.0 m. Peak value of 2.28% Sb / 1 m.

WR25-03: 1.26% Sb, 0.88 g/t Au / 10.0 m incl. 0.74% Sb, 1.66 g/t Au / 5.0 m. Peak value of 4.69% Sb / 1 m.

WR25-11: 0.75% Sb / 12.0 m incl. 1.53% Sb / 4.0 m. Peak value of 2.51% Sb / 1 m.

WR25-16: 0.85% Sb, 0.21 g/t Au / 10.0 m incl. 1.36% Sb / 6.0 m. Peak value of 2.14% Sb / 1 m.

- All six (6) stripped areas, collectively covering 350 metres along a 1.5-kilometre east-west strike, exposed the feldspar porphyry sill and host metasediments, supporting the geometric continuity of the mineralized system. Mapping and sampling are still underway. Only preliminary results have been presented in this press release.

- Three hundred and eighty-eight (388) 1-metre-long channel samples were collected from 29 sawed channels. These channels have been cut perpendicularly to the geological strike and the main mineralized quartz vein system. 158 grab samples were also collected. Channel WR25-01 corresponds to Channel #1 in the press release of October 29, 2024 (3.92% Sb, 0.3 g/t Au / 14.0 m), which has now been extended 5 metres to the south.

Preliminary geometry of the Fortin Zone

- Strike-length: At least 1.5 kilometres, based on 31 mineralized holes, within a broader 2.4-kilometre-long prospective corridor, based on two (2) holes drilled on the eastern and western extensions (WS25-22 and WS25-34, respectively). Recent prospecting led to the discovery of a new antimony showing ("Bob West") located 200 metres west of hole WS25-34.

- Thickness: Intervals grading above 0.1% Sb range from 5 to 50 metres wide along the hole, roughly 25 metres on average.

- Dip: To the south at approximately 75 degrees.

- Vertical extent: Mostly tested from surface down to 50 metres; open at depth.

Mineralized system and geological context

- The antimony-gold mineralized system is hosted in an east-west striking, subvertical feldspar porphyry intrusive sill and its sheared contacts with metasedimentary rocks (mostly siltstones). To date, 42 holes have intersected the sill over a lateral distance of 2.65 kilometres, and it remains open to the west. Its thickness varies from several metres to over 90 metres, with a steep dip to the south. So far, the sill has been intercepted vertically down to 140 metres, and a deeper extent is anticipated. The multi-kilometre lateral continuity of the sill may suggest a kilometre-scale vertical extent.

- Antimony sulphides (mostly stibnite: Sb2S3; occasionally, possible gudmundite: FeSbS) are related to intense quartz veining within the sill and are commonly associated with other sulphides (arsenopyrite, pyrrhotite, pyrite). Sericite is the main alteration mineral, locally accompanied by chlorite, epidote and carbonate. The most abundant mineralization occurs along the southern contact where the sill is in contact with sheared and folded metasedimentary rocks. The northern contact is also mineralized, but drilling to date suggests it is less continuous than along the southern contact. The quartz vein network is mostly subparallel to the east-west schistosity. The rheologic contrast between the brittle porphyry sill and the more ductile metasedimentary rocks appears to be one of the key controls on mineralization at the scale of the Fortin Zone.

- Antimony-rich systems are unusual in Archean settings in Québec. The mineralized sill on the Wabamisk Property lies along the major tectono-metamorphic boundary separating the volcano-plutonic La Grande Subprovince and the metasedimentary Opinaca Subprovince. This geological environment has already been recognized as prospective for gold, exemplified by the Eleonore gold deposit. At Wabamisk, the antimony-rich zone may transition to a deeper gold-rich zone.

About the Antimony Supply Shortage

The price of antimony has risen sharply due to ongoing supply shortages exacerbated by trade disputes, recently reaching US$60,000 per tonne in markets outside China. Antimony is listed as a critical mineral by the Canadian and American governments and the European Commission. Three countries account for about 90% of the world's production, estimated to be 100,000 tonnes in 2024 (China 60%, Tajikistan 17% and Russia 13%). Antimony is not currently mined in Canada or the United States. In August 2024, China imposed restrictions on the export of antimony, resulting in a significant reduction in exports in October, which increased the risk of supply disruptions and potentially led to further price appreciation. Source: USGS, Antimony Commodity Summary, January 2025.

About the Wabamisk Property

Wabamisk is a wholly owned project (39.5 km by 9.2 km) comprising 662 claims covering 350.5 km2. It lies 13 kilometres east of the Clearwater Property (Fury Gold Mines), 42 kilometres northeast of the Whabouchi lithium deposit (Rio Tinto - Nemaska Lithium), and 70 kilometres south of the Eleonore gold mine (Dhilmar). Major powerlines pass through or close to the Property's eastern end, and the North Road highway passes 37 kilometres to the south. The nearest town is Nemaska, a Cree village municipality 55 kilometres to the southwest.

Drilling, Analytical Protocols and Project Management

Nouchimi-RJLL Drilling Inc. of Rouyn-Noranda, Québec, is conducting the drilling program using NQ core diameter.

Grab samples, sawed channel samples and sawed half-core drill core samples are sent to ALS Laboratories in Val-d'Or or Montreal, Québec, where gold is analyzed by fire assay, with atomic absorption and gravimetric finishes for grades above 3.0 g/t Au. Samples are also analyzed for a 48-element suite using ICP. Antimony is also analyzed using four-acid digestion and ICP-AES (Sb-ICP08). Azimut applies industry-standard QA/QC procedures to its drilling and prospecting programs. All batches sent for analysis included certified reference materials, blanks and field duplicates. Note that grab samples are selective by nature, unlikely to represent average grades, and may not represent true underlying mineralization.

The project is under the direction of Alain Cayer (P.Geo.), Azimut's Project Manager.

Qualified Person

Dr. Jean-Marc Lulin (P.Geo.), Azimut's President and CEO, prepared this press release and approved the scientific and technical information disclosed herein, including the previously reported results presented by Azimut in the figures supporting this press release. He is acting as the Company's qualified person within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Azimut

Azimut is a leading mineral exploration company with a solid reputation for target generation and partnership development. The Company holds the largest mineral exploration portfolio in Québec, controlling strategic land positions for gold, copper, nickel and lithium.

The Company's wholly owned flagship project, the Elmer Gold Project, is at the resource stage (311,200 oz Indicated and 513,900 oz Inferred using a gold price of US$1,800 per ounce*) and has a strong exploration upside. Azimut is also advancing the Galinée lithium discovery in collaboration with its joint venture partner, SOQUEM Inc. In addition, significant exploration progress was made in 2024 on the Wabamisk (antimony-gold, lithium), Kukamas (nickel-copper-PGE) and Pilipas (lithium) projects.

Azimut uses a pioneering approach to big data analytics (the proprietary AZtechMine expert system) enhanced by extensive exploration know-how. The Company's competitive edge is based on systematic regional-scale data analysis. Azimut maintains rigorous financial discipline and a strong balance sheet.

Contact and Information

Jean-Marc Lulin, President and CEO

Tel.: (450) 646-3015 - Fax: (450) 646-3045

Jonathan Rosset, Vice President Corporate Development

Tel.: (604) 202-7531

info@azimut-exploration.comwww.azimut-exploration.com

The results of Azimut's work on the Wabamisk Property since the acquisition of the project by the Company in 2005, including the work carried out by its former partner, have been presented in 24 press releases, including the results disclosed in this release. The press releases are available on the Company's website or through SEDAR (www.sedarplus.ca). The technical reports related to this work have been filed with Québec's Ministry of Natural Resources and Forests and are accessible via SIGÉOM.

* "Technical Report and Initial Mineral Resource Estimate for the Patwon Deposit, Elmer Property, Québec, Canada", prepared by: Martin Perron, P.Eng., Chafana Hamed Sako, P.Geo., Vincent Nadeau-Benoit, P.Geo. and Simon Boudreau, P.Eng. of InnovExplo Inc., dated January 4, 2024. The initial MRE comprises: Indicated resources: 311,200 ounces in 4.99 million tonnes grading 1.93 g/t Au; Inferred resources: 513,900 ounces in 8.22 million tonnes grading 1.94 g/t Au.

Cautionary note regarding forward-looking statements

This press release contains forward-looking statements, which reflect the Company's current expectations regarding future events related to the drilling results from the Wabamisk Property. To the extent that any statements in this press release contain information that is not historical, the statements are essentially forward-looking and are often identified by words such as "consider", "anticipate", "expect", "estimate", "intend", "project", "plan", "potential", "suggest" and "believe". The forward-looking statements involve risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Many factors could cause such differences, particularly volatility and sensitivity to market metal prices, the impact of changes in foreign currency exchange rates and interest rates, imprecision in reserve estimates, recoveries of gold and other metals, environmental risks including increased regulatory burdens, unexpected geological conditions, adverse mining conditions, community and non-governmental organization actions, changes in government regulations and policies, including laws and policies, global outbreaks of infectious diseases, including COVID-19, and failure to obtain necessary permits and approvals from government authorities, as well as other development and operating risks. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this document. The Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, other than as required to do so by applicable securities laws. The reader is directed to carefully review the detailed risk discussion in our most recent Annual Report filed on SEDAR+ for a fuller understanding of the risks and uncertainties that affect the Company's business.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.