Raanana, Israel, July 15, 2025 (GLOBE NEWSWIRE) -- Polyrizon Ltd. (Nasdaq: PLRZ) (the "Company" or "Polyrizon"), a development stage biotech company specializing in the development of innovative intranasal hydrogels, announced that it has received a notification letter from the Nasdaq Hearings Panel (the "Panel") granting the Company's request for the continued listing of its securities on the Nasdaq Capital Market.

As previously reported by the Company on May 23, 2025, the Listing Qualifications Department of The Nasdaq Stock Market LLC ("Nasdaq") issued a public interest determination under Listing Rule 5101, citing the Company's issuance of securities in a private placement (the "Private Placement") pursuant to the securities purchase agreement dated March 31, 2025, particularly the Series A warrants exercisable on an alternate cashless basis. In connection with the Private Placement, the Company issued an aggregate of 5,962,073 ordinary shares, which includes 5,829,389 ordinary shares issued upon the exercise of warrants on an alternate cashless basis. As of the date hereof, all of the warrants issued in the Private Placement have been exercised.

A hearing before the Panel was held on June 26, 2025. At the hearing, Polyrizon presented its plan to address Nasdaq's concerns, including a commitment to avoid the use of overly complex or inherently dilutive financing instruments in future capital-raising activities.

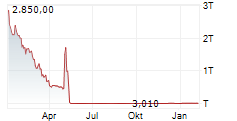

On July 9, 2025, the Panel issued its determination, granting the Company's request for continued listing on the Nasdaq Capital Market, subject to the Company regaining compliance with the Minimum Bid Price Rule by October 17, 2025.

"We appreciate Nasdaq's thoughtful consideration of this matter and are pleased to maintain our listing on Nasdaq," said Tomer Izraeli, CEO of Polyrizon Ltd. "Following the Private Placement, we have a cash balance of approximately $15.68 million. With the full exercise of the warrants issued in that transaction, we have meaningfully simplified our capital structure, eliminating a significant source of potential dilution and overhang. We believe this positions us well to enhance long-term shareholder value and better reflect the strength of our underlying business.

"In addition, we are implementing a formal internal control framework to govern future securities issuances and ensure ongoing compliance with Nasdaq listing standards," Mr. Izraeli added. "This includes enhanced oversight of financing activity, Nasdaq-related reporting, and quarterly internal compliance reviews, which will be reported to our Audit Committee."

About Polyrizon

Polyrizon is a development stage biotech company specializing in the development of innovative medical device hydrogels delivered in the form of nasal sprays, which form a thin hydrogel-based shield containment barrier in the nasal cavity that can provide a barrier against viruses and allergens from contacting the nasal epithelial tissue. Polyrizon's proprietary Capture and Contain TM, or C&C, hydrogel technology, comprised of a mixture of naturally occurring building blocks, is delivered in the form of nasal sprays, and potentially functions as a "biological mask" with a thin shield containment barrier in the nasal cavity. Polyrizon are further developing certain aspects of our C&C hydrogel technology such as the bioadhesion and prolonged retention at the nasal deposition site for intranasal delivery of drugs. Polyrizon refers to its additional technology, which is in an earlier stage of pre-clinical development, that is focused on nasal delivery of active pharmaceutical ingredients, or APIs, as Trap and Target, or T&T. For more information, please visit https://polyrizon-biotech.com.

Forward Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements when it discusses the Company's ability to continue to remain listed on Nasdaq. Forward-looking statements are not historical facts, and are based upon management's current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance that management's expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company, reference is made to the Company's reports filed from time to time with the Securities and Exchange Commission ("SEC"), including, but not limited to, the risks detailed in the Company's annual report filed with the SEC on March 11, 2025 and subsequent filings with the SEC.. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release. Polyrizon is not responsible for the contents of third-party websites.

* Share amounts herein reflect the 1-for-250 reverse share split effected on May 27, 2025, as the Company announced in its Report on Form 6-K filed with the Securities and Exchange Commission on May 22, 2025.

Contacts:

Michal Efraty

Investor Relations

IR@polyrizon-biotech.com