Vancouver, Kelowna, and Delta, British Columbia--(Newsfile Corp. - July 16, 2025) - Investorideas.com, a global investor news source covering mining and metals stocks issues a snapshot of fully permitted, pre-production gold and silver miner ESGold Corp. (CSE: ESAU) (OTCQB: ESAUF) (FSE: Z7D) and its strategy from its founding fifteen years ago, to minimize risk for its shareholders.

ESGold Gold-Silver Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6292/258907_bf4ae729a498ab0b_001full.jpg

The Management

From choosing a property that could fast-track to production, to attracting the right management, to a funding strategy that was less dilutive, founder and former CEO, Paul Mastantuono, embedded the philosophy of protecting the shareholders from inception into the Company.

Mastantuono now continues to serve as Chairman of the Board while also taking on the role of Chief Operating Officer.

Mastantuono told Investorideas.com in a recent Exploring Mining Podcast that, "In 2010 we put together a group of family/friends investors with an idea of building an asset that we could fast-track and get a mining project up and running into production; creating value for shareholders for a long time."

Taking his vision to a pivotal point nearing production, Mastantuono, thinking as a shareholder, felt it was the right time to bring a leader on board that could take the company to the next level.

New CEO, Gordon Robb, possesses more than ten years of expertise in investment banking, fixed income trading, and capital markets within the mining sector. Most recently, he held the position of Business Development and Investor Relations Manager at Scottie Resources (TSXV: SCOT.V), where he played a pivotal role in securing funding for the company and driving effective shareholder communication strategies.

Previously, Robb occupied senior positions at prominent global financial firms, including ICAP in Hong Kong, BGC Partners (once a division of Cantor Fitzgerald), and the TMX Group. In these roles, he managed complex fixed income instruments for major institutional clients worldwide. His career has taken him to key financial hubs, including Hong Kong, London, New York, and Dubai, placing him at the forefront of global capital markets and international investment activities.

Gordon Robb also shares the shareholder philosophy of Paul Mastantuono, a lesson deeply rooted in his years at Scottie Resources.

He recently shared with host Cali Van Zant on an Exploring Mining Podcast, "I was very fortunate to work with Scottie Resources and the CEO, Brad Rourke. Brad was an investor first and saw how money was being spent and ended up taking over the company. To see a company run by an investor, worried about dilution, making sure the shareholders were put first consistently, is a skill I plan on taking forward with ESGold."

ESGold also announced the addition of Mr. Peter Espig to the Board of Directors in May as part of its production strategy moving forward. Espig is an experienced capital markets and mining executive with a proven history of success in project financing, corporate restructuring, and guiding junior companies to become cash-flow positive producers.

The Property

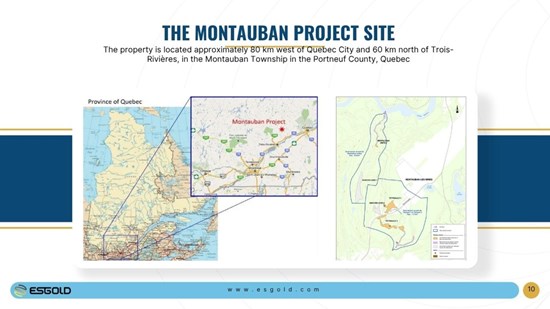

Montauban, situated 80 km west of Quebec City, serves as a model for redeveloping legacy sites into cash-flow-generating projects throughout North America.

Talking about its Gold-Silver Project and the risk strategy in choosing it, Mastantuono said, "We wanted to focus on a very different model. Finding a property like Montauban, where it had low hanging fruit, with a million metric tons of tailings made it very simple. It was above ground, no cost exploration; no risk.

"We could see it, we could touch it, and we could walk on it. We didn't have to spend millions of dollars to find out where it is and what we have.

"It was simple; just process the material and then we have cash flow and then from the cash flow model - take the money and invest it into the ground. We want to tap into what is potentially underground,"

CEO Gordon Robb said to Investorideas, "We're not just exploring first and going down the same path as most exploration companies do. It is move into production quickly and first generate cash flow and then use that money to go back and explore."

In June, the company announced a milestone towards its goal of production. ESGold reported a significant expansion of its Montauban Project mine building to support the Company's transition into gold and silver production. Originally planned at approximately 2,000 square feet, the building is now being expanded to 4,000 square feet to accommodate enhanced operational needs and support infrastructure.

More recently ESGold made a major announcement on the Montauban Project, making the potential even bigger than originally anticipated.

From the news:

The company announced the results of its recent Ambient Noise Tomography (ANT) survey operated by Caur Technologies at the Montauban Gold-Silver Project in Quebec. The preliminary interpretation of this advanced seismic imaging has revealed multiple deep-seated geological structures, suggesting that the Montauban system may extend far beyond its historically mined zones - opening the door to a potential district scale mineral system.

Originally scoped to map subsurface structures to 400 metres, the ANT survey exceeded expectations - imaging to depths of 1,200 metres and revealing a vertically extensive, laterally continuous geological system.

These findings suggest that Montauban may represent a district-scale Volcanogenic Massive Sulphide (VMS) environment, rather than a singular deposit, with structural and lithological features consistent with some of the most prolific mining camps globally.

Key Highlights:

Imaging Unveiled to Depths of 1,200 Meters: ANT survey has revealed deep-seated structural zones potentially hosting stacked mineralized lenses - a breakthrough for exploration at Montauban.

New Interpretation Supports District-Scale Opportunity: Montauban may represent a clustered VMS system with structural repetition and geological similarities to world-class deposits like Sweden's Skellefte district.

North-Central Feeder Zone Emerges: Strong contrast between high-velocity basement in the north and structurally complex southern domains presents multiple potential discovery targets; while the southern area shows more structural complexity - both priority areas for high-value targeting.

Historic Assays + VTEM + ANT = Advanced Model Underway: The ongoing 3D geological model will integrate over 950 historic drill holes results, 2015 VTEM survey data, and this new deep seismic imaging to identify next-generation discovery zones.

André Gauthier, P.Geo., Director of the Company, added: "We now believe Montauban may be far more than a single deposit - it is emerging as a deep, district-scale system with possible structural and geological continuity," said André Gauthier, as a director of exploration. "These results may place Montauban into a new category of exploration potential. Where previous generations saw a series of shallow pods, we now see the signature of a vertically integrated mineral system - potentially with stacked, repeating lenses akin to those in VMS system or Broken Hill-style districts. We're seeing signatures that resemble the structural architecture of globally significant systems, but we are still in the early stage of exploration."

"Montauban is no longer just a development story - it's a discovery story in the making," said Gordon Robb, CEO of ESGold. "This survey has fundamentally changed the way we understand this special deposit. The continuity, depth, and scale of the structures we're seeing suggest that the original mine was just the tip of the iceberg. As we build toward production from the tailings, we're simultaneously unlocking the blue-sky potential beneath. This data confirms Montauban may be just the first chapter in a much larger district-scale opportunity, and we're excited to share that story with the world."

Full news: https://esgold.com/esgold-unlocks-district-scale-discovery-potential-at-montauban-with-geological-structures-extending-to-1200m/

The ESG Factor

For mining companies one of the biggest risks and hurdles is the environmental challenges they face in taking a mine to production.

The Montauban Property offers a distinctive opportunity to convert legacy tailings into valuable resources through modern milling techniques, while promoting environmental restoration.

Chairman Paul Mastantuono explained to Exploring Mining, "Today you need to be socially responsible but it is beyond that with the Government's new mining acts checks and balances. It's a challenge, but it's not rocket science.

"The material left behind is an aggregate; a rock. If you have a rock processed at a quarry, different granulation sizes; there is a value to that. In this case the rock is considered waste because of the way it was treated.

"If we are able to reprocess it and neutralize it, then you have a material that is worth a lot of money in the industry. What we are able to do is create a byproduct that is 100% reusable, and that makes us full circle ESG.

"And more importantly we don't have to manage a tailings pond."

The Risk

Chief Executive Officer, Gordon Robb, said to Investorideas, "What investors are looking for is risk-off. That is why ESGold is so exciting to me. We are fully permitted, very close to production with a mill on-site and tailings piles ready to be processed.

"We just have a few more steps to get there; start producing, be cash flow positive and then funnel that money into exploration, where we don't need to go the market with our hand out.

"This is not the dilution model that so many other exploration companies have being doing over the past 30-40 years.

"It's risk-off in a risky industry."

Learn more about ESGold Corp. (CSE: ESAU) (OTCQB: ESAUF) (FSE: Z7D), https://esgold.com/investors/.

Research mining stocks at Investorideas.com with our free mining stocks directory at Investorideas.com.

About Investorideas.com - Big Investing Ideas

Investorideas.com is the go-to platform for big investing ideas. From breaking stock news to top-rated investing podcasts, we cover it all.

Disclaimer/Disclosure: This article featuring EsGold is paid for content as part of a monthly featured mining stock service (payment disclosure). Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This is not investment opinion. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. Contact management and IR of each company directly regarding specific questions. More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp. Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/. Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp.

Follow us on X @investorideas @Exploringmining

Follow us on Facebook https://www.facebook.com/Investorideas

Follow us on YouTube https://www.youtube.com/c/Investorideas

Contact Investorideas.com to be a guest or sponsor this podcast

800-665-0411

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/258907

SOURCE: Econ Corp Services DBA Investorideas.com