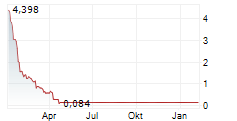

Revised Potential Distribution Range of $0.03 to $0.07 per share

based on current estimates and assumptions

Failure to approve Dissolution Proposal on a timely basis will result in continued operating

costs and further reduce or eliminate any potential distributions to stockholders

SAN MATEO, Calif., July 16, 2025 (GLOBE NEWSWIRE) -- Vincerx Pharma, Inc. (OTC Pink: VINC) today announced that the re-convened Special Meeting of Stockholders to consider a proposal to approve the liquidation and dissolution of Vincerx (the "Dissolution Proposal"), which was originally scheduled for earlier today, has again been adjourned, this time until 10:00 a.m., Pacific time, on August 27, 2025 via live audio webcast at www.virtualshareholdermeeting.com/VINC2025SM2. This additional adjournment will allow Vincerx more time to solicit the votes needed to approve the Dissolution Proposal

Vincerx currently estimates a revised range of between $0.03 to $0.07 per share of its outstanding common stock that could potentially be available for distribution following approval of the Dissolution Proposal to stockholders of record as of the record date for any such distribution. This range is subject to change and is based on Vincerx's current estimates and assumptions, including timely approval of the Dissolution Proposal. Additional delays in approving the Dissolution Proposal will result in continued operating costs and expenses and further reduce or eliminate any funds available for distribution to stockholders.

Vincerx is urging ALL stockholders to vote IMMEDIATELY FOR the Dissolution Proposal.

Vincerx's board of directors unanimously recommends that stockholders vote FOR the Dissolution Proposal and believes that approval of the Dissolution Proposal is extremely important to stockholders for a number of reasons, including the following:

- Preserve Possibility of Distributions. Vincerx currently estimates a revised range of between $0.03 to $0.07 per share of its outstanding common stock that could potentially be available for distribution. However, additional delays in approving the Dissolution Proposal will result in continued operating costs and expenses - further reducing or eliminating funds available for distribution to stockholders. Approving the Dissolution Proposal will allow Vincerx to move forward expeditiously and maximize the likelihood and amount of distributions to stockholders.

- Recognize Potential Tax Benefits. U.S. stockholders who receive less than their tax basis in their shares could be eligible to recognize a capital loss for U.S. federal income tax purposes. Timely approval of the Dissolution Proposal will facilitate this recognition.

Every vote matters. Stockholders must ACTIVELY VOTE for their vote to count. Further delay in approving the Dissolution Proposal will result in continued expenditures and reduce the likelihood and amounts available for distribution to stockholders.

Voting is quick and simple:

- BY PHONE: Please call Advantage Proxy, Vincerx's proxy solicitor, toll-free at 1-877-870-8565 between the hours of 9:00 a.m. and 9:00 p.m., Eastern Time, Monday through Friday. You can also contact Advantage Proxy if you have any questions about voting.

- BY INTERNET: Vote by going to www.proxyvote.com and entering the control number on your proxy card or by following the instructions provided by your broker, bank, or other nominee.

Your vote FOR the Dissolution Proposal is very important - please VOTE TODAY.

Additional Information

Information regarding the Dissolution Proposal, including the board of director's reasons for recommending approval of the Dissolution Proposal, is set forth in the company's proxy statement and supplements thereto, which have been filed with the Securities and Exchange Commission ("SEC") and are available at the SEC's website at www.sec.gov.

Forward-Looking Information

This press release contains forward-looking statements within the meaning of the federal securities laws including, but not limited to, statements about the reasons for approving, and the consequences of failing to approve, the Dissolution Proposal; the amounts potentially available for distribution to stockholders; and the potential tax benefits to stockholders of approving the Dissolution Proposal. Forward-looking statements involve risks and uncertainties that may cause actual results or performance to differ materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, risks involved in dissolving, liquidating, and winding down Vincerx's business and affairs; the timing and amount of distributions, if any, to Vincerx's stockholders, and the accuracy of, and changes to, the assumptions used in estimating such amounts; Vincerx's operating costs and expenses, including any unexpected costs, expenses, or claims; the ability to obtain stockholder approval of the Dissolution Proposal and the timeliness of such approval; the risk that Vincerx may need to seek alternatives to the Dissolution, including seeking protection of the bankruptcy court; and the other factors discussed in Vincerx's SEC reports, including its Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and subsequent reports filed with the SEC. All forward-looking statements are based on information available to Vincerx as of the date of this press release. Vincerx undertakes no duty or obligation to update these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Contact Information:

info@vincerx.com