Gold Equivalent Ounce ("GEO") Production of 11,437 GEO for the 2nd Quarter 2025

Underground Development has commenced and production set to ramp up in H2/2025

Expanded crushing and agglomeration capacity should expand tonnages to the leach pads and improve recoveries at the Heap Leach operation

2025 Production Guidance of 55,000 - 60,000 GEO remains in place, production weighted to H2 2025 as underground ramps up

20,000m Exploration Program underway at MDN targeting potential significant resource growth opportunities

Development activities continue to progress both the Lagoa Salgada and Mont Sorcier projects

TORONTO, ONTARIO / ACCESS Newswire / July 17, 2025 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the second quarter ended June 2025 ("Q2 2025") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full quarterly financial results are expected to be released prior to August 30, 2025.

Q2 Operating Highlights

Q2 Production of 11,437 GEO vs 11,163 in Q1

Heap leach production steadily ramping up to expanded capacity for H2/25

Underground development at Paloma commencing as planned with three access portals started

CIL plant starting to receive initial contribution from underground development, production expected to ramp up over H2/2025

Operational results for Q2 2025 showed a slight increase in production over the previous quarter, driven by modestly higher production from the heap leach operations. The heap leach operational performance remained steady over the quarter, however, recovery rates were impacted by a larger amount of primary ore placed on the pad during the quarter due to mine sequencing. This primary material has lower recovery rates and longer retention times as compared to oxide material. Heap leach production is expected to improve in H2/25 as more oxide ore is mined, the addition of an agglomerator to reduce fines and the ongoing upgrades to the crushing circuit are completed. In addition, during the quarter the crushing circuit was offline for approximately 15 days early in the quarter as upgrades were put in place to support higher throughput rates moving forward. Production from stockpiled material via the CIL plant declined somewhat due to lower grades, however, underground operations at Paloma are expected to begin to contribute meaningfully to production in Q3 2025 and beyond as development rates increase and more ore becomes available.

The second phase of the expansion of the heap leach crushing circuit is now operational, which will increase feed stability in order to deliver steady ore to the pad. While supporting higher production rates, additional crushing facilities are also expected to reduce the feed size to the pad and result in increased recoveries. The final updates to the crusher circuit, including final installation of the agglomerator and additional conveyors, are set to be completed in Q3/25

As previously announced, the company commenced underground mining in June, opening up three portals for underground mining beneath the Paloma pit. Ore production is expected to ramp up over the coming months and is set to make a material contribution to production rates as the year progresses. While initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at lower costs than drilling from surface. Underground exploration aims to materially expand resources at MDN, leveraging the underground development for a potential expansion in production and/or mine life.

On the exploration front, the Company commenced an approximate 20,000 metre drill program late in the quarter and is set to drill numerous targets in the coming months with the aim to potentially define new resources to provide mill feed to the CIL plant at MDN. Drilling commenced with a single DDH rig north of the Paloma pit, where several new veins have been intersected. Results are pending and further drilling will be required to confirm any new resources.

Mark Brennan, CEO and Chairman commented, "While Q2 results were modestly lower than our expectations as the heap leach continues to ramp up to its fully expanded capacity, we continue to be confident in our full year expectations as the underground operations ramp-up in H2/25. Cerrado also continued to progress both the Lagoa Salgada project and the Mont Sorcier projects towards completion of feasibility studies by Q3/2025 and Q1/2026 respectively, which we believe should demonstrate substantial value being unlocked by Cerrado's development projects."

Mont Sorcier Project Update

At the Mont Sorcier high-purity iron project, detailed metallurgical test work and flow sheet design continued during the quarter. All key workstreams are now engaged and the Company has commenced an infill drill program to update sufficient resources to the Proven and Probable categories as required to support the ongoing feasibility. Assay results remain pending at this time.

The Bankable Feasibility Study will look to provide greater detail of the potential for the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV8% of US$1.6 Billion based upon iron concentrates grading 65% iron. With the improved metallurgical results received to date the Company is confident it can deliver a high purity DRI grade Iron ore concentrate product of over 67% iron, enhancing the project value and delivering a highly desired product to support the Green Steel transition.

Lagoa Salgada Project Update

At the Lagoa Salgada polymetallic VMS project, detailed metallurgical test work is scheduled to be completed by the end of July, with results targeting improvements across recoveries and grades for the various concentrate products. An updated Mineral Resource and Reserve Estimate is planned to be completed in Q3/25 incorporating the results of the metallurgical test work as well as using updated long term commodity price expectations. This updated resource will be used as part of the Optimized Feasibility Study that is well underway and expected to be completed around the end of Q3/25.

Corporate Activities

In addition to funding development programs at Lagoa Salgada and Mont Sorcier Cerrado continued to pay down debt during the quarter. The Company anticipates its balance sheet to strengthen over the remainder of the year as cash flow increases from higher production rates and strong gold prices. In the medium term the Company is also set to receive future payments from the sale of the Brazilian Monte do Carmo asset sale totaling US$15 million (U$10 million due in July 2026 and US$5 million by March 2027) as well as a further US$10 million should the option granted over the Company's Michelle properties in Argentina be exercised.

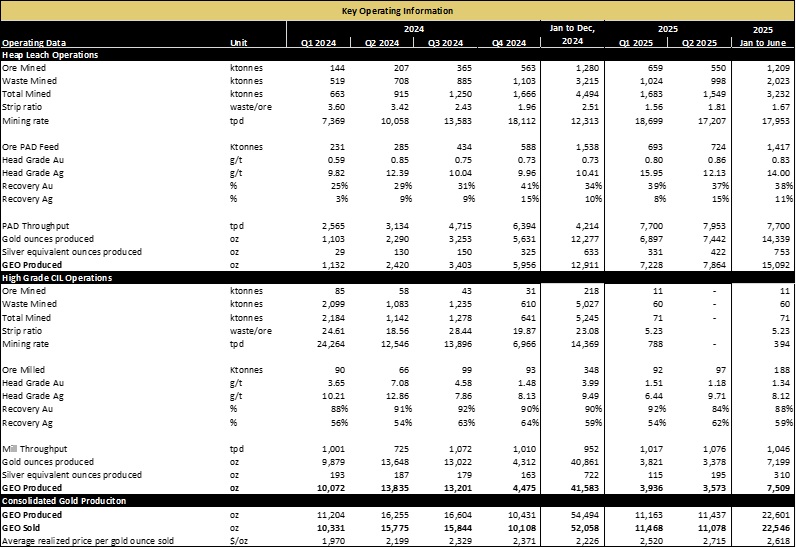

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Andrew Croal, P.Eng., Chief Technical Officer for Cerrado Gold, who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company. The Company is the 100% owner of the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Portugal, the Company holds an 80% interest in the highly prospective Lagoa Salgada VMS project through its position in Redcorp - Empreendimentos Mineiros, Lda. In Canada, Cerrado Gold is developing its 100% owned Mont Sorcier Iron project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas ("MDN") operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Portugal, Cerrado is focused on the development and exploration of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. The Lagoa Salgada project is a high-grade polymetallic project, demonstrating a typical mineralization endowment of zinc, copper, lead, tin, silver, and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 7,209-hectare property concession. Located just 80km from Lisbon and surrounded by exceptional infrastructure, Lagoa Salgada offers a low-cost entry to a significant development and exploration opportunity, already showing its mineable scale and cashflow generation potential.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier high purity high grade DRI Iron project, which has the potential to produce a premium iron concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of sustainable development goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, production forecasts and estimated AISC for 2025 and beyond, the potential for additional crushing capacity that may be added and the performance of the heap leach pad, the production potential of MDN' underground mining operations, the potential to produce iron concentrate grading in excess of 67% at Mont Sorcier and the potential to enhance project value, anticipated timing to complete metallurgical test work at Lagoa Salgada, the potential further deleveraging and/or the potential to enhance liquidity during 2025, receipt of the deferred closing payment of US$15 million in connection with the Monte do Carmo asset sale, the likelihood of the Michelle option being exercised by the optionor and the related option payment being received. In making the forward-looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/cerrado-gold-announces-q2-2025-production-results-at-its-minera-don-nicolas-mine-1049504