Improved margin in a tentative market

The second quarter was dominated by continued uncertainty due to the global geopolitical situation and future international trade terms. The unclear trade environment adversely impacted the investment climate, promoting a cautious sentiment among companies both locally and globally. However, with the exception of the automotive industry, a general increase in business activity was noted toward the end of the period. This gives us reason for cautious optimism as we enter the second half of 2025, where we believe there is potential for organic growth for the Group.

Net sales fell by 2 percent, with organic sales declining by 1 percent year-on-year. Acquisitions made a positive contribution of 6 percent, while exchange rate effects had a negative impact of 7 percent on sales. EBITA, excluding items affecting comparability, decreased 1 percent while the margin was 18.6 percent (18.4). The cash conversion ratio for the rolling 12-month period remained stable at 87 percent.

We maintained solid profitability and even strengthened our EBITA margin, both sequentially and year-on-year, despite challenging market conditions and lower production volumes. This was the result of strong operational execution, with an emphasis on flexible production and a well-balanced pricing strategy. Ongoing structural improvements have also increased resilience for the Group's earnings capacity.

For Trelleborg Industrial Solutions, organic sales increased slightly compared with the year-earlier period. Development within diversified industrials was mixed. Sales to certain sub-segments, including seals for the construction industry in both Europe and North America, remained weak. Meanwhile, other sub-segments such as marine solutions, LNG projects, aerospace, and seals for water infrastructure posted solid growth.

Trelleborg Medical Solutions noted slightly lower organic sales year-on-year, which was due in its entirety to the cautious purchasing behavior among North American medtech customers. In Europe, sales to medtech customers posted a positive trend, while deliveries to our smaller life sciences segment increased sharply.

Trelleborg Sealing Solutions also reported a decline in organic sales year-on-year. This was due entirely to a clear fall-off in deliveries to the automotive industry. We believe that this is related to inventory adjustments among certain major customers as a result of lower end-customer demand and increased uncertainty. Sales to the industrial segment were unchanged overall, with a strong performance in Asia offsetting somewhat lower volumes in Europe and North America. Sales to the aerospace industry continued to show solid global growth.

While we await clearer guidance on international trade conditions, we are continuing to focus on the factors we can influence. We are strengthening our organization and recently inaugurated an expansion of our facility in Malta. The purpose of this investment is to increase capacity and enhance our customer offering in the medtech and semiconductor industries. Facility inaugurations are planned in Vietnam and Costa Rica for the second half of the year, further strengthening our global presence and creating a basis for new business opportunities.

During the quarter, we completed three bolt-on acquisitions, strengthening our position in selected niche segments. In the Trelleborg Industrial Solutions business area, National Gummi was acquired - a manufacturer of rubber profiles and sealing solutions for specialized construction, industrial, and automotive applications. Sico Gesellschaft für Siliconverarbeitung, including the joint venture company Sico Silicone, was also acquired, adding expertise in silicone rubber products. In Trelleborg Sealing Solutions, the offering was broadened with the acquisition of US-based Aero-Plastics, active in high-performance components for the aerospace industry. After the end of the quarter, an agreement was also signed to acquire Masterseals, which specializes in sealing solutions for the energy and industrial sectors. These acquisitions add complementary technologies, deepen our customer relationships, and create attractive opportunities for continued profitable growth.

As we enter the second half of the year, we do so with cautious optimism. Order intake was up quarter-on-quarter, and June performed more strongly than the beginning of the quarter. Although uncertainty remains, our overall assessment is that demand in the third quarter will be somewhat higher than in the second quarter.

Peter Nilsson,

President and CEO

Second quarter 2025

- Net sales for the quarter declined 2 percent to sek 8,551 m (8,711). Organic sales decreased 1 percent compared with the preceding year, structural changes increased sales by 6 percent while translation of currency reduced sales by 7 percent compared with the preceding year.

- EBITA, excluding items affecting comparability, decreased 1 percent to sek 1,587 m (1,599). The exchange rate effect from the translation of foreign subsidiaries had a negative impact of sek 104 m. The EBITA margin was 18.6 percent (18.4).

- Items affecting comparability for the quarter totaled sek -80 m (-111) and pertained to restructuring costs.

- EBITA, including items affecting comparability, amounted to sek 1,507 m (1,488) for the quarter.

- Earnings per share, excluding items affecting comparability, amounted to sek 4.31 (4.49), down 4 percent.

- For the Group as a whole, earnings per share were sek 4.03 (4.14).

- Operating cash flow amounted to sek 1,000 m (1,193), down 16 percent.

- The cash conversion ratio for the most recent 12-month period was 87 percent (88).

- The key figures in this report relate to continuing operations, unless otherwise stated.

Market outlook for the third quarter of 2025

Demand is expected to be somewhat higher compared with the second quarter of 2025, adjusted for seasonal variations. Due to the geopolitical situation, the outlook is associated with continued uncertainty.

Market outlook from the interim report published on April 24, 2025, relating to the second quarter of 2025

Demand is expected to be on a par with the first quarter of 2025, adjusted for seasonal variations. Due to the geopolitical situation, the outlook is associated with unusually high uncertainty.

This is a translation of the company's Interim Report in Swedish.

Contacts

Media: Vice President Communications Tobias Rydergren, +46 (0)410 67015, +46 (0)733 747015, tobias.rydergren@trelleborg.com

Investors/analysts: Vice President IR Christofer Sjögren, +46 (0)410 67068, +46 (0)708 665140, christofer.sjogren@trelleborg.com

About Us

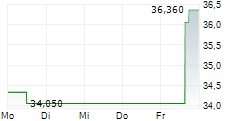

Trelleborg leverages in-depth materials and applications expertise with early market insights, making the Group a world leader in engineered polymer solutions. We offer a unique portfolio covering a broad range of applications - even the most complex ones. In 2024, Trelleborg Group reported annual sales of approximately SEK 34 billion, with operations in around 40 countries. The Group comprises three business areas: Trelleborg Industrial Solutions, Trelleborg Medical Solutions, and Trelleborg Sealing Solutions. The Trelleborg share has been listed on the Stock Exchange since 1964 and is traded on Nasdaq Stockholm, Large Cap. www.trelleborg.com

This information is information that Trelleborg is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-07-17 13:00 CEST.