Miami, FL, July 17, 2025 (GLOBE NEWSWIRE) -- Triple Bolt Technology LLC, the developer behind the innovative gold-backed crypto asset, today announced its high-level technical plan for the implementation of the Blue Gold Token (BGT) - a digital asset backed by legally binding, long-term futures contracts on physical gold.

The Blue Gold Token is designed to bring institutional-grade commodity exposure to blockchain-based capital markets. Each token represents a contractual right to a future delivery of gold, secured through verified reserves and structured through a compliant, smart contract-based framework.

Nathan Dionne CEO at TripleBolt comments.

"We are excited to be part of this project that will provide Nasdaq listed - Blue Gold Limited (BGL) with an innovative solution, bringing together the advantages of both digital and physical assets. The possibility of backing digital tokens with physical gold represents a new opportunity to access the precious metals sector. Gold plays a major role in the capital markets. With a market cap of over USD 11 trillion, it offers investors a reliable hedge against inflation and a store of value irrespective of economic turbulence."

Technical Implementation Overview:

? Token Architecture: BGT will be issued as an ERC-20 token on Ethereum or a leading Layer 2 network. The total supply will be fixed and directly correlated to verified gold futures contracts. Each token will represent a fractional claim on a deliverable futures contract for physical gold, initially structured around a 1-gram equivalent.

? Smart Contract Engineering: Token issuance, transfer, and redemption logic will be fully encoded into audited smart contracts. The contracts will include built-in time-lock mechanisms to enforce a minimum redemption window and secure early withdrawal logic if applicable.

? Proof-of-Resource/Reserves Integration:

Blue Gold already has implemented a robust proof of reserves and resource system validated by independent third party experts and auditors, which it has made public and which will be continually updated. This multi-layered proof system will also be visible via a public-facing dashboard by the time the BGT is launched, to provide full transparency.

? Redemption Framework: At maturity, token holders will be entitled to redeem each token for physical gold or a cash equivalent. The redemption protocol will be handled through a regulated entity or trustee, with full KYC/AML compliance as required.

? Security & Audit Protocols: All contracts will undergo third-party audits prior to deployment. Blue Gold is in discussions with leading firms to conduct technical reviews and provide continuous monitoring of deployed smart contracts.

? Liquidity Strategy: Upon launch, Blue Gold will deploy initial liquidity on decentralized exchanges (DEXs), forming a BGT/USDT or BGT/ETH pair. Liquidity pools will be seeded and locked to promote market stability and investor confidence.

About TripleBolt

TripleBolt Experts enable Global businesses to scale as needed with top-tier engineering and software talent based in USA. Delivered inland and nearshore, our tailored solutions are backed by a strong team of curated IT experts, a broad tech stack, and flexible engagement models.

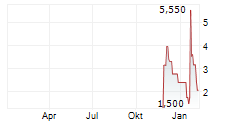

About Blue Gold Limited

Blue Gold Limited (Nasdaq: BGL) is a next-generation gold development company focused on acquiring and aggregating high-potential mining assets across strategic global jurisdictions. The Company's mission is to unlock untapped value in the gold sector by combining disciplined resource acquisition with innovative monetization models, including asset-backed digital instruments. Blue Gold is committed to responsible development, operational transparency, and leveraging modern financial technologies to redefine how gold is produced, accessed, and owned in the 21st century.

Blue Gold prioritizes growth, sustainable development, and transparency in all our business practices. We believe that our commitment to responsible mining will enable us to create value for our shareholders while minimizing our environmental footprint.??

For media inquiries, partnership opportunities, or additional technical documentation, please contact:?Nate@triplebolt.io