Gouverneur, N.Y., July 21, 2025 (GLOBE NEWSWIRE) -- Titan Mining Corporation (TSX: TI; OTCQB: TIMCF) ("Titan" or the "Company") is pleased to provide an update on the construction of its graphite processing facility for its Kilbourne Graphite Project at Empire State Mines LLC ("ESM"), its wholly owned subsidiary located in St. Lawrence County, New York.

Highlights:

- First Fully Integrated U.S. Graphite Producer in 70+ Years: Titan on track to deliver domestically sourced and processed natural graphite in Q4 2025.

- Major Construction Milestone Achieved: Over 50% of major equipment delivered; installation starting August 2025, commissioning targeted for Q4 2025.

- North American Supply Chain Focus: Over 90% of equipment sourced in North America, majority from the United States, supporting domestic manufacturing.

- Permitted and Ready for Operations: All key operating permits secured; sales qualification targeted for Q1 2026.

- Tariff-Free, Secure U.S. Supply: Titan offers a reliable, tariff-free graphite source amidst rising global trade restrictions and tariffs on imports.

- Strategic Advantage with Existing Infrastructure: Utilizes the Company's skilled 135+ person workforce, on-site power, and logistics network to fast-track readiness.

- Clear Pathway to Growth: The Kilbourne Graphite Project offers significant scalability, positioning Titan to be able to meet a majority of projected U.S. graphite demand in key sectors.

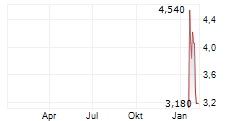

The recent arrival and placement of the ball mill-shown in the image below-marks another significant milestone in advancing toward operational readiness.

Don Taylor, CEO of Titan commented: "Graphite is a critical material, yet the U.S. has gone decades without domestic production. The current resource outlined at Kilbourne represents only 8,300 ft of strike length tested of a known total strike length of 25,000 ft. Kilbourne has significant resource expansion potential to meet the demands of U.S. natural flake graphite over a long-term period. Our facility is a major step toward restoring U.S. industrial graphite capability and delivering a fully Made in America natural graphite product in 2025."

Rita Adiani, President of Titan commented: "With escalating tariffs on imports and tightening trade restrictions globally, Titan is uniquely positioned to offer secure, tariff-free, U.S.-produced graphite to industrial markets. By investing in U.S.-sourced equipment, leveraging existing infrastructure, and maintaining a skilled domestic workforce, Titan provides customers with a reliable alternative amidst growing supply chain uncertainty."

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. Titan is also an emerging natural flake graphite producer and targeting to be the USA's first end to end producer of natural flake graphite in 70 years. Titan's goal is to deliver shareholder value through operational excellence, development and exploration. We have a strong commitment towards developing critical minerals assets which enhance the security of the domestic supply chain. For more information on the Company, please visit our website at www.titanminingcorp.com

Contact

For further information, please contact: Investor Relations: Email: info@titanminingcorp.com

Cautionary Note Regarding Forward-Looking Information

Certain statements and information contained in this new release constitute "forward-looking statements", and "forward-looking information" within the meaning of applicable securities laws (collectively, "forward-looking statements"). These statements appear in a number of places in this news release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including that Titan is on track to become the only fully integrated U.S. graphite producer by Q4 2025; equipment installation starting August 2025, commissioning targeted for Q4 2025; qualification sales targeted for Q1 2026; the Kilbourne Graphite Project offers significant scalability, positioning Titan to be able to meet a majority of projected U.S. graphite demand in key sectors. When used in this news release words such as "to be", "will", "planned", "expected", "potential", and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of zinc and graphite; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in New York State; risks due to legal proceedings; risks related to operation of mining projects generally and the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators. Such forward-looking statements are based on various assumptions, including assumptions made with regard to our forecasts and expected cash flows; our projected capital and operating costs; our expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mining activities will remain consistent; our approved business plans; our mineral resource estimates and results of the PEA; our experience with regulators; political and social support of the mining industry in New York State; our experience and knowledge of the New York State mining industry and our expectations of economic conditions and the price of zinc and graphite; demand for graphite; exploration results; the ability to secure adequate financing (as needed); the Company maintaining its current strategy and objectives; and the Company's ability to achieve its growth objectives. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3f09f80-1ddf-48e1-9b29-714818e224b3