BLUEFIELD, Va., July 21, 2025 (GLOBE NEWSWIRE) -- First Community Bankshares, Inc. ("First Community") (NASDAQ: FCBC), headquartered in Bluefield, VA, and Hometown Bancshares, Inc. ("Hometown"), headquartered in Middlebourne, WV, jointly announced today their entry into an Agreement and Plan of Merger (the "Agreement"). Pursuant to this Agreement, First Community will acquire Hometown, and First Community's banking subsidiary, First Community Bank, will acquire Hometown's banking subsidiary, Union Bank, Inc. As of June 30, 2025, Union Bank had total assets of approximately $402 million. Upon completion of the transaction, First Community is expected to have total consolidated assets of approximately $3.6 billion with 60 branch locations in four states.

This merger aligns with First Community's strategic focus on growing low-cost core deposits and positions the combined entity to expand its presence in the Parkersburg-Marietta-Vienna MSA. "First Community has a 150-year history of community banking excellence in West Virginia. Our partnership with Hometown and Union Bank is a natural expansion into West Virginia markets that are similar in size and makeup to the locations where we've had great success across our broader banking footprint. We look forward to bringing the two franchises together to better serve our customers and local communities" said Gary R. Mills, President and CEO of First Community Bank.

Tim Aiken, President, CEO and Director of Hometown and Union Bank, commented, "When considering a long-term partner, we sought a community-minded bank that shares our commitment to providing top-tier banking services with that personal touch. Also, First Community Bank will bring services to our communities that Union Bank currently does not provide, such as Trust and Wealth Management services. We are confident that our combined franchise will serve our communities well and continue to create value for our customers, shareholders, and employees."

"We are pleased to announce our partnership with Union Bank. This collaboration will further strengthen our robust banking franchise in West Virginia. We believe First Community will benefit from Union's strong deposit base, while Union's customers will enjoy the advantages of increased scale, higher lending limits, and enhanced product and technology offerings from First Community," said William (Will) P. Stafford, II, Chairman and Chief Executive Officer of First Community.

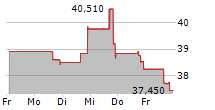

The Agreement provides for the merger of Hometown with and into First Community, with First Community as the surviving corporation. Under the terms of the Agreement, each outstanding share of Hometown common stock will be converted into the right to receive 11.706 shares of First Community common stock, which equates to $472.10 per share of Hometown common stock and an aggregate transaction value of approximately $41.5 million based on a closing price for First Community common stock of $40.33 as of July 18, 2025. First Community expects the transaction to be minimally dilutive to tangible book value per share (non-GAAP) and to provide high-single digit accretion to earnings per share.

The transaction, which received unanimous approval from both First Community's and Hometown's Boards of Directors, is subject to customary closing conditions, including the approval of Hometown's shareholders and the receipt of all required regulatory approvals. The transaction is expected to be consummated in the first quarter of 2026. At that time, First Community anticipates welcoming Union Bank's Chief Executive Officer, Tim Aiken, to the First Community team.

D.A. Davidson & Co. served as financial advisor to First Community, and Bowles Rice LLP served as legal counsel. Hovde Group, LLC served as financial advisor to Hometown, and Hunton Andrews Kurth LLP served as legal counsel.

About First Community Bankshares, Inc.

First Community is a financial holding company headquartered in Bluefield, Virginia that provides banking products and services through its wholly owned subsidiary First Community Bank. First Community Bank operates 52 branch banking locations in Virginia, West Virginia, North Carolina, and Tennessee. The company reported consolidated assets of $3.2 billion as of March 31, 2025. The company's common stock is listed on the NASDAQ Global Select Market under the trading symbol "FCBC." Additional investor information is available on the company's website at www.firstcommunitybank.com.

About Hometown Bancshares, Inc.

Hometown, located in Middlebourne, WV, offers banking products and services through its wholly owned subsidiary Union Bank. Union Bank operates eight locations in Northern West Virginia and has assets totaling $402 million as of June 30, 2025. Union Bank is committed to providing exceptional service to its customers while being an exemplary corporate citizen in the communities it serves.

Investor Contacts:

David D. Brown

Chief Financial Officer

First Community Bankshares, Inc.

Phone: (276) 326-9000

Important Information for Shareholders

This press release shall not constitute an offer to sell, the solicitation of an offer to sell, or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transaction, First Community Bankshares, Inc. ("First Community or FCBC") will file a registration statement on Form S-4 with the Securities and Exchange Commission (the "SEC"), which will contain the proxy statement of Hometown Bancshares, Inc. ("Hometown") and a prospectus of First Community. Shareholders of Hometown are encouraged to read the registration statement, including the proxy statement/prospectus that will be part of the registration statement, because it will contain important information about the proposed transaction, Hometown, and First Community. After the registration statement is filed with the SEC, the proxy statement/prospectus and other relevant documents will be mailed to Hometown shareholders and will be available for free on the SEC's website (www.sec.gov) and First Community's website at https://ir.fcbresource.com under the tab "SEC Filings". The proxy statement/prospectus will also be made available for free by contacting the Corporate Secretary of First Community at P.O. Box 989, Bluefield, Virginia 24605-0989; telephone (276) 326-9000. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Transactions

First Community, Hometown and their respective directors, executive officers and certain other members of management and employees may be deemed "participants" in the solicitation of proxies from Hometown's shareholders in favor of the merger with First Community. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Hometown shareholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC.

You can find information about the executive officers and directors of First Community in its Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on March 7, 2025, and in its definitive proxy statement filed with the SEC on March 10, 2025. You can find information about Hometown's executive officers and directors by accessing Hometown's website at www.hometownbanc.bank under the tab "About Union Bank" and then under the heading "About Us". You can obtain free copies of these documents from First Community using the contact information above.

Forward-Looking Statements

This joint press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements, including statements regarding the intent, belief, or current expectations of First Community's management regarding the company's strategic direction, prospects, or future results or the benefits of the proposed transaction, are subject to numerous risks and uncertainties. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of First Community and Hometown and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of First Community and Hometown. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the risk that the cost savings and revenue synergies anticipated in connection with the proposed transaction may not be realized or may take longer than anticipated to be realized, (2) disruption from the proposed transaction with customers, suppliers, or employee or other business relationships, (3) the occurrence of any event, change, or other circumstances that could give rise to the termination of the Agreement and plan of merger, (4) the risk of successful integration of the two organizations' businesses, (5) the failure of Hometown shareholders to approve the proposed transaction, (6) the amount of costs, fees, expenses, and charges related to the proposed transaction, (7) the ability to obtain required governmental and regulatory approvals for the proposed transaction, (8) reputational risk and the reaction of the parties' customers to the proposed transaction, (9) the failure of the conditions to closing of the proposed transaction to be satisfied, (10) the risk that the integration of Hometown's operations with those of First Community will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by First Community's issuance of additional shares of its common stock in the proposed transaction, (13) changes in management's plans for the future, (14) prevailing economic and political conditions, particularly in our market areas, (15) credit risk associated with our lending activities, (16) changes in interest rates, loan demand, real estate values, and competition, (17) changes in accounting principles, policies, or guidelines, (18) changes in applicable laws, rules, or regulations, and (19) other competitive, economic, political, and market factors affecting our business, operations, pricing, products, and services. Certain additional factors which could affect the forward-looking statements can be found in First Community's annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, in each case filed with or furnished to the SEC and available on the SEC's website at http://www.sec.gov. First Community and Hometown caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to First Community or Hometown or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. First Community and Hometown disclaim any obligation to update or revise any forward-looking statements contained in this press release, which speak only as of the date hereof, whether as a result of new information, future events, or otherwise.