KEY POINTS

Numerous significant drill-ready targets defined at Green Bay using extensive geophysical surveys

A total of 325 geophysical targets have so far been identified which are considered to be look-alikes to the major deposits at Green Bay, including Ming, Rambler Main and East Mine, with very similar geology and geophysical responses

The geophysics, which comprised airborne electromagnetic (EM) and magnetic surveys, was the first modern geophysical campaign completed over the project area

Ground-based EM follow-up of conductive anomalies provides further strong evidence of the potential for copper and gold discoveries

Part of the proceeds from the recent capital raising will be used to accelerate the surface drilling program. A second surface drill rig has mobilised to site

At Rambler Main Mine and East Mine, further assays are expected in coming weeks:

- Initial results received from the Rambler Main Mine extension include 10m @ 6.4% CuEq and 12.9m @ 4.3% CuEq (see ASX announcement dated 15 May 2025)

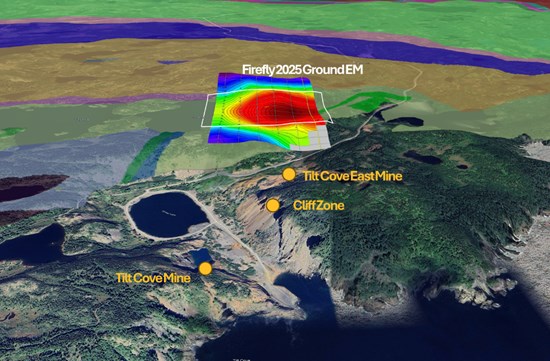

Exploration activities have commenced at the nearby Tilt Cove Project that was acquired by the Company in late 2024. Historical mining at the Tilt Cove Mine produced ~170,000t of copper and 50,000oz of gold from a large-scale Volcanogenic Massive Sulphide (VMS) system (see ASX announcement dated 4 November 2024)

Ground-based EM completed by FireFly at the Tilt Cove Project confirms an extensive untested conductive anomaly first identified by Newmont Exploration in the 1980s. Drill testing of the anomaly is planned for Q4 2025

In addition, multi rig underground drilling continues to infill and extend the existing Mineral Resources at the nearby underground Ming copper-gold Mine

The Company remains well funded, with anticipated cash and liquid investments of ~A$145M,1 having strengthened its balance sheet as a result of substantially completing a multi-tranche capital raising2(see ASX announcements dated 5, 10 and 16 June 2025) and share purchase plan (see ASX announcement dated 11 July 2025)

FireFly Managing Director, Steve Parsons, said: "The results of this geophysical campaign are extremely strong and support our view that there is huge potential for major discoveries at Green Bay.

"No modern geophysics has been used at Green Bay until now and the regional upside has barely been tested. But these results have uncovered compelling targets which share key similarities with the known deposits at the project.

"We will soon have a second surface rig operating and we look forward to testing these targets as part of our wider resource growth strategy."

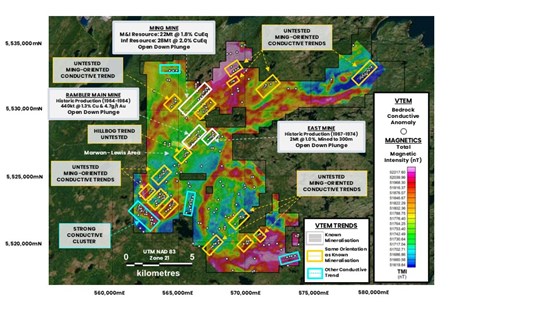

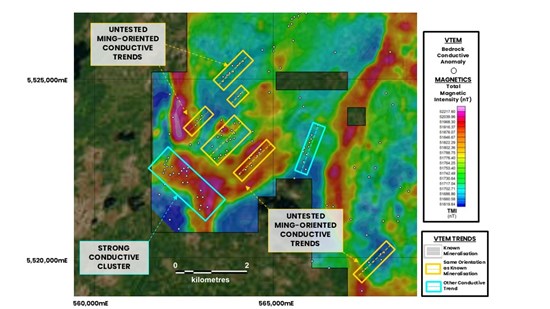

West Perth, Western Australia--(Newsfile Corp. - July 23, 2025) - FireFly Metals Ltd (ASX: FFM) (TSX: FFM) ("Company" or "FireFly") is pleased to announce that a recent geophysics campaign has identified numerous compelling regional targets at its Green Bay copper-gold project in Newfoundland, Canada. The Company conducted airborne electrical (VTEM) and magnetic surveys across the central Green Bay project claims in addition to localised detailed ground electromagnetic surveys. These recent geophysical surveys have so far confirmed a total of 325 significant conductive responses potentially caused by copper-gold bearing sulphide mineralisation.

Geophysics is a key exploration tool at Green Bay, with the mineralisation at Ming and other known deposits exhibiting strong responses to electromagnetic surveys due to the conductive nature of the chalcopyrite-rich sulphide mineralisation.

A significant number of anomalies have been identified that exhibit similar geological settings, orientation and electromagnetic responses to known mineralisation at historically mined deposits, such as the Ming, Rambler Main and East Mines. These targets will be systematically drill tested in upcoming exploration drilling campaigns throughout 2025 to confirm the cause of the anomalous response, which could include copper and gold bearing sulphides.

IMAGE: Multiple significant new targets from the recent airborne VTEM and magnetic geophysical surveys.The white dots represent bedrock conductive anomalies. There are numerous untested conductive trends in a similar orientation (yellow boxes) to the known mineralisation at the Ming, Rambler Main and East Mines (white boxes). So far, a total of 325 conductive responses have been identified which are significant and potentially caused by copper-gold bearing sulphide mineralisation.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11430/259886_4493abc98499189f_003full.jpg

INITIAL TARGETS:

TILT COVE COPPER MINE

FireFly has commenced exploration at the nearby Tilt Cove Project, located only ~30km east of the Ming Mine. The Tilt Cove deposit is a large-scale copper-gold VMS system. The Tilt Cove Mine historically produced ~170,000t of copper and 50,000oz of gold in various mining campaigns between 1864 and 1967. Limited modern base metals exploration has been completed at the property.

In 1983, Newmont Exploration conducted an electromagnetic survey in the Tilt Cove Project area and identified an extensive and unexplained conductive anomaly. FireFly has completed a detailed ground electromagnetic survey and confirmed the presence of the large-scale conductor - refer image below. Drill testing of the anomaly is planned for the latter part of 2025.

The Company plans to complete a lease-wide airborne VTEM and magnetic survey over the entire 115km2 Tilt Cove Project area in Q3 2025. This will be the first airborne geophysics conducted over the property.

ISOMETRIC IMAGE: Tilt Cove Copper-Gold Project area showing the large-scale conductor (red) identified by FireFly's ground-based EM survey. This conductor is significant and potentially caused by copper-gold bearing sulphide mineralisation. These results confirm an anomaly earlier identified in a 1983 EM survey completed by Newmont Exploration. The anomaly has yet to be drill tested and will be the subject of maiden drilling later in 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11430/259886_4493abc98499189f_004full.jpg

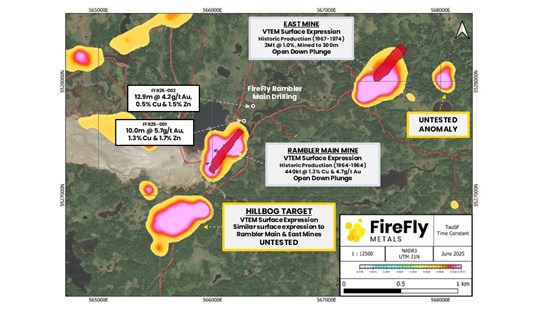

RAMBLER MAIN MINE AND EAST MINE AREA: HILLBOG TARGET

The airborne VTEM survey also identified strong electromagnetic anomalism around the Rambler Main and East Mine areas. In addition to identifying the surface expression of both historical mines, the survey identified a large previously unknown look-alike anomaly 300m to the south of Rambler Main Mine, known as Hillbog - refer image below.

Drilling of this target has commenced, with results expected in the coming weeks.

SOUTHWEST TARGET AREA

In the Southwest portion of the project, approximately 8 km SW of Ming Mine, a series of large untested EM anomalies have been defined in prospective volcanic rocks - Refer image below. The area is covered by glacial sediments and boulders with very little outcropping exposures.

The EM response is similar to known mineralisation within FireFly's past producing copper mines. Drill testing of this area will commence shortly.

IMAGE: Hillbog VTEM anomaly located less than 300m south of Rambler Main Mine and associated VTEM anomalies. The strong anomaly has many similarities to the nearby Rambler Main and East Mines. Drill testing of the anomaly is currently in progress.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11430/259886_4493abc98499189f_005full.jpg

IMAGE: Multiple significant new targets from the recent airborne VTEM and magnetic geophysical surveys to the South-West of the Ming Copper-Gold Mine.The white dots represent bedrock conductive anomalies. There are numerous untested conductive trends in a similar orientation (yellow boxes) to the known mineralisation at the Ming, Rambler Main and East Mines. These responses are significant and potentially caused by copper-gold bearing sulphide mineralisation.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11430/259886_4493abc98499189f_006full.jpg

About the Geophysical Survey Results

Based on the strength of the targets generated, the Company intends to fast-track the surface discovery program with part of the proceeds of the recent capital raising.

After processing of the VTEM data, 325 individual anomalies were identified that related to bedrock conductivity. Many of these anomalies occur as coherent trends that exhibit strong resemblance to known mineralisation in the district. These similarities include geological setting, orientation of the trends (North-East, similar to Ming) and magnitude of the conductive responses.

Due to the significant number of high priority new geophysical targets, a second surface diamond drill rig has been mobilised to Green Bay. A total of ~C$16M of funding, raised at a significant premium via the issue of Canadian flow-through shares3, will be spent on discovery, targeting and testing of greenfields areas at Green Bay over the period to December 2026.

Recently, the surface drill has been testing mineralisation proximal to historic deposits such as Rambler Main and East Mines. Results previously announced from drilling at Main Mine included 10m @ 6.4% CuEq and 12.9m @ 4.3% CuEq (see ASX announcement dated 15 May 2025). Further results are expected in coming weeks.

The recently arrived surface diamond drill rig is initially focusing on high priority EM targets south of the Ming Mine. This takes the total diamond drill rigs at Green Bay to eight, with six rigs currently working on the underground resource and exploration drilling at the Ming Mine.

The region is host to multiple Volcanogenic Massive Sulphide (VMS) deposits, including the Company's flagship Ming copper-gold Mine which has a current Mineral Resource of 24.4Mt at 1.9% CuEq Measured & Indicated and 34.5Mt at 2.0% CuEq in the Inferred category.

The landscape in the project area is a combination of regolith cover, localised outcrops and low-lying swamps. Geophysics is a key tool in identifying blind copper-gold mineralisation hidden beneath the surface. Electromagnetic geophysical methods are particularly useful in identifying the copper-gold VMS mineralisation due to the conductive nature of the chalcopyrite-rich sulphide minerals associated with the known deposits in the area.

The surveys completed by FireFly are the first modern regional geophysical campaigns over the project. These surveys leverage the significant technological advancements made in both data acquisition and computer processing to identify subsurface anomalies previously overlooked by the historical work, which was mostly completed in the 1990s and earlier.

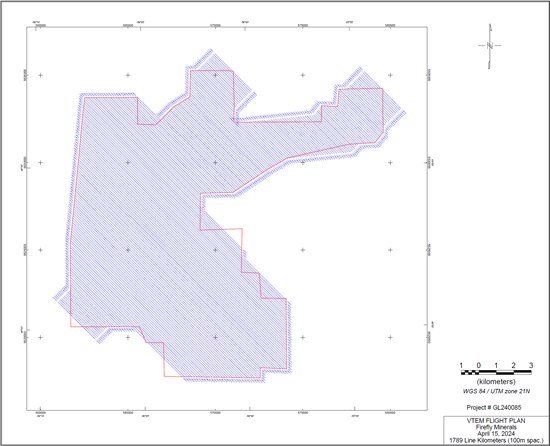

The Company has completed an extensive airborne Versatile Time Domain Electromagnetic (VTEM) and aeromagnetic survey over the central Green Bay project claims. A total of 1,820 line kilometres were flown using the deep penetrating helicopter system of local geophysical contractor, Geotech Ltd. Magnetic data was also collected during the survey. For further technical information on the VTEM Max survey, please refer to Appendix B of this announcement.

When overlaid on the regional geological interpretation, many of the conductive anomalies cross-cut the stratigraphy in orientations similar to the Ming Mine. Combined with other geological information, this suggests the potential of copper-bearing sulphide mineralisation at depth, rather than the anomalism being related to lithology.

Where an anomalous trend was identified in the airborne VTEM, a ground survey was conducted to better define the response using close-spaced Fixed Loop Transient Electromagnetic survey (FLEM (TDEM) Survey). For further detail of on the technical aspects of the FLEM (TDEM) Surveys, please refer to Appendix B of this announcement.

The targets will be systematically tested by diamond drilling as part of the two-rig exploration campaign currently underway.

Forward Work Plan

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Mineral Resource Growth, Upgrading the Mineral Resource (infill) and New Discoveries. The Company now has a total of eight diamond drill rigs at Green Bay with six underground at the Ming Mine and two surface exploration rigs focused on regional discovery.

Based on the quality of the targets identified, the Company plans to accelerate the regional discovery program at Green Bay, with C$16M to be invested in early-stage exploration over the period to December 2026.

Surface drilling during 2025 has to date focused on extensions of mineralisation at Rambler Main Mine. Further assay results from this program are expected in coming weeks. The second surface rig is testing priority targets beyond the known deposits. Key priority areas to be tested include the Hillbog prospect and Southwest target area.

Furthermore, exploration will ramp up at the Company's highly prospective Tilt Cove Project. The first airborne geophysical survey over the entire 115km2 project area is planned for August 2025. Follow-up drill testing of the historical Newmont conductive anomaly is scheduled before the end of 2025.

The Company is continuing with its six-rig underground Mineral Resource growth campaign at the Ming Mine. The rigs remain focused on a combination of step-out growth and upgrading the current Inferred Resource to the comparatively more valuable and higher confidence Measured and Indicated category. An updated Mineral Resource Estimate is planned in the December 2025 quarter.

Economic studies continue to progress, with detailed engineering design and analysis for a staged restart of operations well underway. Metallurgical test work is nearing completion with results expected in the coming weeks. The first economic studies are planned for completion and release in Q1 2026, soon after the updated Minerals Resource Estimate. The proposed timing of the updated Mineral Resource Estimate and the economic studies is indicative and may be subject to change.

The Company remains well funded to complete its growth and exploration strategy and has recently substantially completed a multi-tranche capital raising and Share Purchase Plan, resulting in anticipated cash and liquid investments of ~A$145M.4

| Steve Parsons Managing Director FireFly Metals Ltd +61 8 9220 9030 | Jessie Liu-Ernsting Corp Dev & IR FireFly Metals Ltd +1 709 800 1929 | Media Paul Armstrong Read Corporate +61 8 9388 1474 |

ABOUT FIREFLY METALS

FireFly Metals Ltd (ASX: FFM) (TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq.

The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX: FFM) or the Company's website www.fireflymetals.com.au or SEDAR+ at www.sedarplus.ca.

COMPLIANCE STATEMENTS

Mineral Resources Estimate - Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company's ASX announcement dated 29 October 2024, titled "Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq" and is also set out in the Technical Reports for the Ming Copper Gold Mine titled "National Instrument 43-101 Technical Report, FireFly Metals Ltd., Ming Copper-Gold Project, Newfoundland" with an effective date of 29 November 2024 and the Little Deer Copper Project, titled "Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada" with an effective date of 26 June 2024, each of which is available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate - Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company's ASX announcement dated 4 May 2023, titled "High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t" and is also set out in the Technical Report for the Pickle Crow Project, titled "NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada" with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company's operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for the Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in Appendix B of this announcement.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and the Company's operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

Previously reported Exploration Results at the Green Bay Project referred to in this announcement were first reported in accordance with ASX Listing Rule 5.7 in the Company's ASX announcements dated 31 August 2023, 11 December 2023, 16 January 2024, 4 March 2024, 21 March 2024, 29 April 2024, 19 June 2024, 3 September 2024, 16 September 2024, 3 October 2024, 10 December 2024 and 12 February 2025.

Original announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons' and Qualified Persons' findings are presented have not been materially modified from the original market announcements.

COMPETENT PERSON AND QUALIFIED PERSON STATEMENTS

The information in this announcement that relates to new Exploration Results is based on and fairly represents information compiled by Mr Darren Cooke, a Competent Person who is a member of the Australasian Institute of Geoscientists. Mr Cooke is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Cooke has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Cooke consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly's plans, forecasts and projections with respect to its mineral properties and programs. Forward-looking statements may be identified by the use of words such as "may", "might", "could", "would", "will", "expect", "intend", "believe", "forecast", "milestone", "objective", "predict", "plan", "scheduled", "estimate", "anticipate", "continue", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company's public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly's plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly's mineral properties. The performance of FireFly may be influenced by a number of factors which are outside of the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) | |

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) | |

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) | |

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

- Mineral Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101.

- Mineral Resources have been reported at a 1.0% copper cut-off grade.

- Metal equivalents for the Mineral Resource Estimate have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been set at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

- Totals may vary due to rounding.

APPENDIX B - JORC CODE, 2012 EDITION

Table 1

Section 1 - Sampling Techniques and Data for Regional Geophysical Survey (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC AND AEROMAGNETIC GEOPHYSICAL SURVEY The conductors reported are preliminary interpretations of preliminary data provided to the Company by the geophysical contractor. The data was acquired from an airborne electromagnetic and magnetic survey completed by Geotech Ltd., an independent geophysical contractor. The survey utilised the VTEM Plus (versatile time domain electromagnetic) system.

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

| Data spacing and distribution |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

| Orientation of data in relation to geological structure |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

| Sample security |

|

|

| Audits or reviews |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

Plan view of VTEM Flight Plan in this announcement

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11430/259886_4493abc98499189f_007full.jpg

Section 1 - Sampling Techniques and Data for Tilt Cove Project (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

| FLEM (TDEM) SURVEY

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

| FLEM (TDEM) SURVEY

|

| Data spacing and distribution |

| FLEM (TDEM) SURVEY

|

| Orientation of data in relation to geological structure |

| FLEM (TDEM) SURVEY

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary | ||||

| Mineral tenement and land tenure status |

|

| ||||

| Licences 013054M 013055M 014109M 014111M 019122M 019158M 020510M 022576M 022791M 022796M 024119M 024535M 025051M 025291M 025437M 025558M 025832M 025838M 025853M 026202M 026379M 026404M 026540M 026680M 026729M 026730M 026950M 026992M 027285M 027398M 031602M 031816M 032148M 032906M 034851M 034854M 035078M 035079M 035080M 035081M 037157M | Registered Company Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Firefly Metals Canada Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. | |||||

| ||||||

| Exploration done by other parties |

|

| ||||

| Geology |

|

| ||||

| Drill hole Information |

|

| ||||

| Data aggregation methods |

|

| ||||

| Relationship between mineralisation widths and intercept lengths |

|

| ||||

| Diagrams |

|

| ||||

| Balanced reporting |

|

| ||||

| Other substantive exploration data |

|

| ||||

| Further work |

|

| ||||

1 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the Share Purchase Plan which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement (T2 Placement) of ~A$26.6 million, which is subject to shareholder approval at a general meeting planned to be held on 28 August 2025, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

2 One final tranche of the capital raising (the T2 Placement) remains to be competed, as it is subject to receiving shareholder approval at a general meeting planned to be held on 28 August 2025.

3 Canadian "flow-through shares" provide tax incentives to the relevant investors relating to certain qualifying exploration expenditures under the Income Tax Act (Canada). (See ASX announcements dated 28 March 2024 and 5 June 2025).

4 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the Share Purchase Plan which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement (T2 Placement) of ~A$26.6 million, which is subject to shareholder approval at a general meeting planned to be held on 28 August 2025, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259886

SOURCE: FireFly Metals Ltd.