Press release

Brussels, 24 July 2025

Regulated information - Inside information

Orange Belgium announces a new Management Services Agreement with Orange SA

Orange Belgium's previous Strategic Partnership Agreement ("SPA") with Orange SA expired on December 31, 2024. Under such previous SPA, a fixed management fee of EUR 5 million was charged by Orange SA to Orange Belgium in return for (1) access to the Orange Group sourcing programme, (2) specific know-how available within Orange SA and (3) access to Orange Group roaming and interconnect programs.

It has been considered to replace the SPA as of 2025 with a new Management Services Agreement ("MSA"), covering more management services-oriented type of activities, thereby transitioning to a structure that includes a cross charge of management fees, determined as a ratio (based on Orange SA costs), multiplied by Orange Belgium's annual external turnover, excluding taxes. This approach is applied by Orange SA towards other members of the Orange SA group.

The board of directors has instructed a committee of independent directors in the framework of article 7:97 of the Companies and Associations Code, with the assistance of an independent expert, to assess the arm's length character of the new management fee structure. The independent expert has performed by proxy a transfer price analysis based on applicable guidelines. Such methodology was considered the best available proxy in view of the extensive and detailed regulations, guidelines and practices available to assess intragroup relationships. In addition, for a duration of three years, the total service fee charged by Orange SA to Orange Belgium would not exceed EUR 15.4 million per annum.

The conclusion of the committee of independent directors is as follows: The Committee of Independent Directors, after having considered the Independent Expert's Opinion and after due consideration, is of the opinion that the Contemplated Transaction can be considered at arm's length, and that hence it does not cause the Company any disadvantages within the meaning of Article 7:97 §3 of the Belgian Code of Companies and Associations and that hence no further analysis is required to assess whether such disadvantages are compensated by other elements of the Company's policy or whether such disadvantages are clearly abusive (kennelijk onrechtmatig / manifestement abusive).

Furthermore, the assessment carried out by the company's auditor regarding the proposed operation in accordance with Article 7:97 §4 of the Companies and Associations Code indicates that:

"Based on our assessment, we have not identified any facts leading us to believe that the financial and accounting data contained in the opinion of the Independent Directors Committee and the minutes of the Board of Directors dated July 23, 2025, justifying the proposed transaction, are not accurate and sufficient in all material respects in light of the information available to us in the context of our mission as statutory auditor of Orange Belgium SA."

Based on the above, in its meeting of July 23, 2025, the Board of Directors of Orange Belgium has approved this new Management Services Agreement with Orange SA.

About Orange Belgium

Orange Belgium is one of the major telecommunication operators on the Belgian market, with revenues of 1993.7 million euros, 3.5 million mobile customers and more than 1 million fixed broadband customers on 31 December 2024, and in Luxembourg, via its subsidiary Orange Communications Luxembourg. Thanks to its own fixed and mobile networks, Orange Belgium offers both residential and business customers fixed and mobile connectivity services and convergent offerings (internet, telephony, television, including original TV content: Be tv, VOOsport, etc.). As a responsible operator, Orange Belgium invests to reduce its ecological footprint and promote sustainable and inclusive digital practices. Orange Belgium is also a wholesale operator, offering its partners access to its infrastructure as well as a broad portfolio of connectivity and mobility services, including offerings based on Big Data and the Internet of Things (IoT).

Orange Belgium is a subsidiary of the Orange Group, present in 26 countries with a total customer base of 291 million customers worldwide on 31 December 2024. Orange is also a leading provider of global IT and telecommunication services to multinational companies under the brand Orange Business.

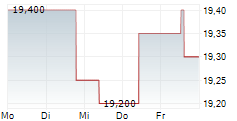

Orange Belgium is listed on the Brussels Stock Exchange (OBEL).

For more information, on the internet and on your mobile: corporate.orange.be, www.orange.be or follow us on X: @pressOrangeBe

Orange and any other Orange product or service names included in this material are trademarks of Orange or Orange Brand Services Limited.

Press contact

Sven Adams - sven.adams@orange.com+32

Attachment

- Press release management fee 2025 UK (https://ml-eu.globenewswire.com/Resource/Download/2d30a981-2e5a-449b-875c-73ac650ace47)