NextCell Pharma AB (publ) (NXTCL or NextCell) publishes its Interim Report 3 for the period March 1, 2025 - May 31, 2025. This English version of the Interim Report is a translation of the Swedish version. The Swedish version is the official version.

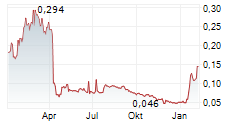

The report is available on the company's website: https://www.nextcellpharma.com/en/investorsfinancial-report. NextCells share is traded on Nasdaq First North Growth Market under the ticker "NXTCL". The amount in brackets refers to the corresponding period in the previous year.

Third Quarter (2025-03-01 to 2025-05-31)

- Operating income amounted to 2,262 (2,482) TSEK, of which Cellaviva contributed 2,261 (2,442) TSEK.

- Net sales amounted to 2,261 (2,442) TSEK.

- Profit/loss after financial items amounted to -10,271 (-8,822) TSEK.

- Earnings per share* were -0.14 (-0.26) SEK.

- Cash and cash equivalents amounted to 16,710 (20,797) TSEK.

- Equity ratio** amounted to 79 (77) percent.

First Nine Months (2024-09-01 to 2025-05-31)

- Operating income amounted to 8,542 (9,582) TSEK, of which Cellaviva contributed 8,338 (9,022) TSEK.

- Net sales amounted to 8,338 (9,022) TSEK.

- Profit/loss after financial items amounted to -26,511 (-28,710) TSEK.

- Earnings per share* were -0.36 (-0.84) SEK.

*Earnings per share: Net result for the period divided by the average number of shares. The average number of shares for the third quarter of 2024/2025: 73,091,327 (34,379,523) shares. The average number of shares for the first nine months of 2024/2025: 73,091,327 (34,379,523) shares. The number of shares in NextCell as of 31 May 2025: 73,091,327 (34,379,523) shares.

**Equity ratio: Shareholders' equity as a percentage of total assets.

Significant events and news during the third quarter

? At the end of March, NextCell Pharma announced that the company's Chief Scientific Officer (CSO), Dr. Lindsay Davies, has been elected to the Board of Directors of ATMP Sweden.

? At the beginning of April, NextCell published preliminary 1-year results from the older age group (12-21 years) in the ongoing ProTrans-Young clinical study. The study evaluates the safety and efficacy of the company's cell therapy ProTrans in preserving insulin production in young individuals with newly diagnosed type 1 diabetes, compared to placebo.

? NextCell announced in early April that Dr. Lindsay Davies, Chief Scientific Officer at NextCell Pharma AB, has been elected Vice President Elect for Europe within the international industry organization International Society for Cell and Gene Therapy (ISCT).

? At the beginning of May, the company announced that a recently published clinical study showed promising results for mesenchymal stromal cells (MSCs) in the treatment of mild Alzheimer's disease. The study is a phase 2a study and is published in Nature Medicine (Rash et al., 2025) The results strengthen the scientific basis for NextCell's drug candidate ProTrans, which is being developed for autoimmune and inflammatory diseases.

? NextCell announced in mid-May that Eric Strati PharmD, MBA, joins NextCell's Board of Advisors to support the commercial strategy for ProTrans

? In mid-May, NextCell announced that it had entered into a strategic partnership with Fujifilm Irvine Scientific Inc. to bring together their core competencies in mesenchymal stromal cells (MSCs) and life science raw materials. The goal of the collaboration is a comprehensive offering to researchers, biotech and pharmaceutical companies in the cell therapy field - standardized MSC products, optimized cell culture and solutions for cryopreservation.

? At the end of May, the company announced that it hadbeen granted a US patent for the MSC prediction algorithm. The patent protects NextCell's innovative method for predicting the effect of treatment with mesenchymal stromal cells (MSCs) in individual patients and for developing individualized treatment options based on this prediction.

? At the end of May, the company further announced that Angela Vollstedt, PhD, MBA, will join NextCell's Board of Advisors to strengthen the company's strategy for manufacturing and licensing.

Significant events and news after the reporting period

? At the beginning of June, the Company announced the outcome of the exercise of TO2 and resolved on directed share issues to guarantors, Through the exercise of the Warrants and the Directed Issue, the Company will receive a total of approximately SEK 36.6 million before deduction of issue costs. Furthermore, the Board of Directors has resolved on a set-off issue of 1,742,100 shares to the guarantors for payment of the guarantee fee.

? The Company announced in early June that all patients in the ongoing ProTrans-Young clinical study had been treated. A milestone that marks the completion of dosing in the company's largest clinical study to date. ProTrans-Young is evaluating the safety and efficacy of the company's lead cell therapy candidate, ProTrans, for the treatment of children and adolescents with newly diagnosed type 1 diabetes.Cell and Gene Therapy (ISCT).

? In Mid-July the company summoned to an Extra General Meeting on August 21st in order to change the company's fiscal year to be aligned with the calendar year.

This disclosure contains information that NextCell Pharma AB is obliged to make public pursuant to the EU Market Abuse Regulation (EU nr 596/2014) and the Swedish Securities Markets Act (2007:528). The information was submitted for publication, through the agency of the contact person, on 24-07-2025 07:00 CET.

For more information about NextCell Pharma, please contact

Mathias Svahn, CEO

Patrik Fagerholm, CFO

Tel: +46 8 735 55 95

E-mail: info@nextcellpharma.com

Website:www.nextcellpharma.com

Linkedin: https://www.linkedin.com/NextCell-Pharma

Twitter: https://twitter.com/NextCellPharma

For more information about Cellaviva, please contact

Sofie Falk Jansson, CEO Cellaviva AB

Tel: +46 8 735 20 10

E-mail: info@cellaviva.se

Website:www.cellaviva.se

Facebook: https://www.facebook.com/cellavivasverige

Instagram: https://www,instagram.com/cellaviva

Certified Adviser

The company's shares are listed on the Nasdaq First North Growth Market.

RedEye AB is assigned as Certified Adviser.

About NextCell Pharma AB

NextCell Pharma is a clinical-stage cell therapy company developing ProTrans, a patent-protected platform based on allogeneic mesenchymal stromal cells (MSCs) from umbilical cord tissue. Using a proprietary selection algorithm, ProTrans delivers optimised cell tailored to specific indications. In type 1 diabetes, a single infusion has been shown to preserve insulin production and delay disease progression for at least five years. A Phase III trial is planned to commence upon securing a commercial partner. ProTrans is also being evaluated for other autoimmune and inflammatory conditions. NextCell's subsidiaries include Cellaviva, Scandinavia's largest private stem cell bank, and QVance, the Nordic region's first dedicated provider of quality services for developers of advanced therapies.