Strategic Farm-in Agreement with PTTEP

Major Offshore Acreage Expansion Creates New Growth Platform in the Gulf of Thailand

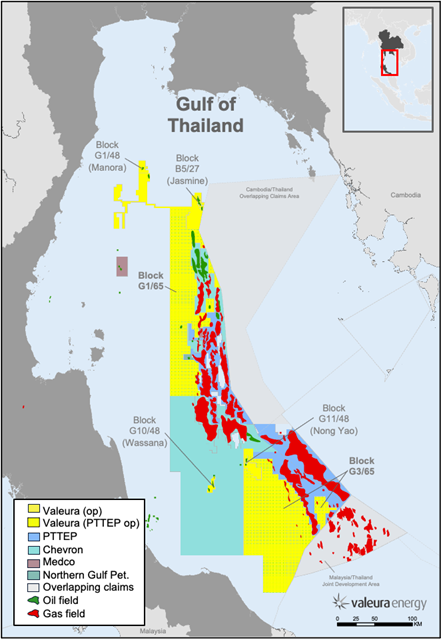

CALGARY, AB / ACCESS Newswire / July 25, 2025 / Valeura Energy Inc. (TSX:VLE)(OTCQX:VLERF) ("Valeura" or the "Company") is pleased to announce that it has entered into a Farm-in Agreement with PTT Exploration and Production Plc ("PTTEP"), through its subsidiary, PTTEP Energy Development Company Limited to earn a 40% interest in Blocks G1/65 and G3/65 (the "Blocks"), in the offshore Gulf of Thailand (the "Farm-in").

Key Highlights

· Strategic Partnership: Farm-in Agreement with PTTEP, the largest oil and gas explorer, producer, and operator in Thailand;

· Substantial Acreage Expansion: Increases Valeura's gross acreage position in Thailand from 2,623 km² to 22,757 km²;

· Prime Location Adjacent to Major Infrastructure: The Blocks are strategically positioned next to some of Thailand's largest producing gas fields and Valeura's oil fields;

· Discoveries: 15 oil and gas discoveries on the Blocks, supported by 27 wells which encountered oil and gas pay;

· Infrastructure-Led Growth: Existing discoveries and exploration prospects that the Company believes can be tied back quickly to existing oil and gas infrastructure; and

· Immediate Activity: Exploration and appraisal work already underway with 3D seismic acquisition planned to commence in the coming months.

Dr. Sean Guest, President and CEO commented:

"The spirit of collaboration between Valeura and PTTEP is strong, and we are excited to begin work on this vast swath of prospective acreage in the Gulf of Thailand with the potential for both near and long-term natural gas and oil developments. PTTEP has an unparalleled depth of knowledge in Thailand and a proven track record of exploration and development success both in Thailand and throughout the Southeast Asia region.

Acquiring an interest in these Blocks increases our acreage in the offshore Gulf of Thailand substantially, and provides us with existing discoveries and attractive exploration prospects immediately adjacent to several world class gas fields and our producing oil assets. Both Blocks already contain existing discoveries, and new exploration drilling has commenced in 2025, aimed at confirming sufficient gas and/or oil volumes for installation of new platforms that can be tied back to existing infrastructure. While our initial focus is on pursuing these near-term development opportunities, there are also higher-risk/higher-reward prospects which we plan to explore, with the objective of building out a pathway for longer-term growth.

Our intent is to both expand and diversify our business both organically and inorganically. This Farm-in furthers that goal by layering in low cost, infrastructure-led exploration, while also adding gas developments within a welcoming jurisdiction that has prioritised energy development to fuel its growing economy. We see this Farm-in and strategic partnership with PTTEP as an excellent opportunity to drive further value generation for our stakeholders."

Farm-in

Under the terms of the Farm-in, Valeura is entitled to earn a 40% working interest in the Blocks, with PTTEP holding the remaining 60% and continuing to operate. The parties have agreed to a work programme for 2025 that includes drilling four exploration wells (all recently completed) and acquiring just over 1,200 km2 of new 3D seismic data. To earn its interest, Valeura will pay 40% of actual back costs (US$14.7million to June 30, 2025). These costs include the recently completed four-well 2025 drilling programme, geological and geophysical studies, PSCs signature bonuses, and general and administrative costs incurred since the Blocks were awarded in March 2023. Valeura will also carry PTTEP on an additional seismic acquisition (requested by Valeura) of approximately 165 km2 on Block G3/65, located to the northeast of the Nong Yao field - capped at US$3.7 million (gross). For costs thereafter, each of PTTEP and Valeura will pay their respective pro rata share.

The Blocks are governed by the terms of Production Sharing Contracts ("PSCs") granted by the Thailand Government through the Ministry of Energy which set out fiscal terms including a royalty payable to the Thailand Government at 10% of gross revenue, provisions for cost recovery up to 50% of gross revenue, and profits thereafter shared 50% government / 50% contractor. The corporate income tax rate on contractor net profit is 20%.

The PSCs provide for a six-year exploration period, during which a total of eight wells must be drilled (five on G1/65 and three on G3/65), and 800 km2 of 3D seismic must be acquired (500 km2 in G1/65 and 300 km2 in G3/65) before the end of the exploration period in May 2029. A three-year extension to the exploration period may be provided thereafter. Fields developed under the PSC regime are given a 20-year production period, with a potential 10-year extension thereafter.

Closing of the Farm-in is subject to the approval of the Government of Thailand.

Block G1/65

Block G1/65 comprises a gross area of 8,487 km2 immediately south of Valeura's B5/27 block (Jasmine/Ban Yen fields, 100% Valeura interest) and west of PTTEP-operated large gas fields (Erawan, Platong, and Benchamas, currently producing 900 mmcf/d, 27 mbbls/d condensate, and 23 mbbls/d oil, respectively, based on May 2025 production data disclosed by Thailand's Department of Mineral Fuels). The block is approximately 240 km long covering the north-western flank of the Pattani basin, the most prolific basin in the Gulf of Thailand, and encircles the Rossukon oil field (2% Valeura gross royalty interest). The block includes eight oil and gas discoveries, supported by 12 wells which encountered oil and gas pay, as well as several undrilled prospective trends. PTTEP and Valeura have high-graded two focus areas on Block G1/65 which will guide their initial work programme.

The Jarmjuree South area:A liquids-rich gas and oil-bearing structural trend between the producing Benchamas and Platong fields. The Company believes that the area has been substantially de-risked by four wells which confirmed the accumulation of both oil and gas in multiple stacked reservoir intervals. PTTEP has just completed a three-well appraisal drilling campaign in the Jarmjuree South area to further delineate the opportunity, and to date, one well has been disclosed by the Department of Mineral Fuels to have encountered gas pay. Valeura anticipates that field development planning will follow in the near term, and after closing of the Farm-in, the Company intends to provide further detail on the next steps towards the commercialisation of this area.

The Maratee-Bussaba area: Located immediately south of the Rossukon oil field, contains a three-way closure structure as well as several combined structural/stratigraphic traps which have been identified as drilling candidates, based on existing 3D seismic data over the area. Based on nearby producing fields and discoveries in the vicinity, the Company expects the trend to be an oil-prone fairway. The planned 3D seismic acquisition on Block G1/65 will focus on the western portion of the Maratee-Bussuba area to better image the reservoir to support further exploration drilling in this area.

Block G3/65

Block G3/65 comprises a gross area of 11,647 km2, bounding Valeura's G11/48 block in the north (Nong Yao field, 90% Valeura working interest) and is immediately west of the large PTTEP-operated Bongkot gas field, which currently produces 850 mmcf/d gas and 24 mbbls/d condensate, based on May 2025 production data disclosed by Thailand's Department of Mineral Fuels. The block is approximately 200 km long covering the northwest flank of the North Malay basin, and has seven identified oil and gas discoveries, supported by 15 wells with oil and gas pay. Two key focus areas have been identified on Block G3/65 which will guide the initial work programme.

The Nong Yao North-East area: Believed by the Company to contain an oil-bearing fairway between the Company's Nong Yao field and the undeveloped Ubon oil field to the north. The area is expected to be covered with 3D seismic in 2025 to accurately define the prospects and thereafter Valeura anticipates the start of exploration and appraisal drilling. Given this new opportunity, the Company's objective is to determine whether this area, or the recent Nong Yao-D discovery by Valeura in 2024, are better placed as the next tie-back development to Valeura's operated processing infrastructure on the Nong Yao Field.

The Bussabong-Angun area:Located immediately west of PTTEP's Bongkot gas field, is thought to contain extensive gas accumulations, as substantiated by multiple existing gas discoveries. PTTEP recently drilled an exploration well to fully validate the Bussabong opportunity, which has been disclosed by the Department of Mineral Fuels to have encountered gas pay. The Bussabong discovery is a prime candidate for a fast-track gas development, potentially resulting in Company's first gas reserves in Thailand. Valeura is optimistic that development planning will progress at pace, and after completion of the Farm-in, the Company intends to provide further disclosure on next steps for the Bussabong gas accumulation.

Results Timing

Valeura intends to release its unaudited financial and operating results for the three and six-month periods ended June 30, 2025 on August 7, 2025 and will host a webinar the same day to discuss the results as well as today's announcement.

For further information, please contact:

Valeura Energy Inc. (General Corporate Enquiries)+65 6373 6940

Sean Guest, President and CEO

Yacine Ben-Meriem, CFO

Contact@valeuraenergy.com

Valeura Energy Inc. (Investor and Media Enquiries) +1 403 975 6752 / +44 7392 940495

Robin James Martin, Vice President, Communications and Investor Relations

IR@valeuraenergy.com

Contact details for the Company's advisors, covering research analysts and joint brokers, including Auctus Advisors LLP, Canaccord Genuity Ltd (UK), Cormark Securities Inc., Research Capital Corporation, and Stifel Nicolaus Europe Limited, are listed on the Company's website at www.valeuraenergy.com/investor-information/analysts/.

About the Company

Valeura Energy Inc. is a Canadian public company engaged in the exploration, development and production of petroleum and natural gas in Thailand and in Türkiye. The Company is pursuing a growth-oriented strategy and intends to re-invest into its producing asset portfolio and to deploy resources toward further organic and inorganic growth in Southeast Asia. Valeura aspires toward value accretive growth for stakeholders while adhering to high standards of environmental, social and governance responsibility.

Additional information relating to Valeura is also available on SEDAR+ at www.sedarplus.ca.

Advisory and Caution Regarding Forward-Looking Information

Certain information included in this news release constitutes forward-looking information under applicable securities legislation. Such forward-looking information is for the purpose of explaining management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project", "target" or similar words suggesting future outcomes or statements regarding an outlook.

Forward-looking information in this news release includes, but is not limited to, planned 3D seismic acquisition in respect of the Blocks commencing in the coming months; Valeura's plan to leverage higher-risk/higher-reward prospects to build out a pathway for longer-term growth; the Farm-in driving value generation for Valeura's stakeholders; the work programme in 2025, including the drilling of four exploration wells and the acquisition of just over 1,200 km2 of new 3D seismic data; Valeura paying 40% of the actual back costs relating to the award of the Blocks, and such costs being equal to (US$14.7 million to June 30 2025); Valeura paying only 40% of its share of drilling, seismic and studies costs, and carrying the cost of the seismic acquisition request from Valeura for approximately 165 km2 located to the northeast of the Nong Yao field; anticipated cost recovery of a portion of the Company's earning provisions; the Farm-in receiving approval of Thailand's minister of energy; Valeura's expectation that field development planning in the Jarmjuree South Area will follow in the near term, and Valeura's timing for providing further detail on the next steps towards the commercialisation of this area; Valeura's expectation that the Maratee-Bussaba area is an oil-prone fairway; the Company's expectation that part of the planned 3D seismic acquisition on Block G1/65 will focus on the Maratee-Bussaba area; the Company's belief that the Nong Yao North-East focus area contains an oil bearing fairway; the Company's expectation that the Nong Yao North-East focus area will be covered with 3D seismic in 2025 and the Company's anticipated exploration and appraisal drilling starting thereafter; the Company's expectation that the Bussabong area contains extensive gas accumulations; the possibility that the Bussabong area may become the Company's first gas reserves in Thailand; the Company's expectation that development planning in the Bussabong area will progress at expected pace, and the expected timing on which the Company will provide further disclosure on the next steps for the Bussabong gas accumulation; the Company's anticipated timing for releasing its unaudited financial and operating results for the three and six month periods ending June 30, 2025.

Although the Company believes the expectations and assumptions reflected in such forward-looking information are reasonable, they may prove to be incorrect.

Forward-looking information is based on management's current expectations and assumptions regarding, among other things: political stability of the areas in which the Company is operating; continued safety of operations and ability to proceed in a timely manner; continued operations of and approvals forthcoming from governments and regulators in a manner consistent with past conduct; ability to achieve extensions to licences in Thailand and Türkiye to support attractive development and resource recovery; future drilling activity on the required/expected timelines; the prospectivity of the Company's lands; the continued favourable pricing and operating netbacks across its business; future production rates and associated operating netbacks and cash flow; decline rates; future sources of funding; future economic conditions; the impact of inflation of future costs; future currency exchange rates; interest rates; the ability to meet drilling deadlines and fulfil commitments under licences and leases; future commodity prices; the impact of the Russian invasion of Ukraine; the impact of conflicts in the Middle East; royalty rates and taxes; management's estimate of cumulative tax losses being correct; future capital and other expenditures; the success obtained in drilling new wells and working over existing wellbores; the performance of wells and facilities; the availability of the required capital to funds its exploration, development and other operations, and the ability of the Company to meet its commitments and financial obligations; the ability of the Company to secure adequate processing, transportation, fractionation and storage capacity on acceptable terms; the capacity and reliability of facilities; the application of regulatory requirements respecting abandonment and reclamation; the recoverability of the Company's reserves and contingent resources; future growth; the sufficiency of budgeted capital expenditures in carrying out planned activities; the impact of increasing competition; the availability and identification of mergers and acquisition opportunities; the ability to successfully negotiate and complete any mergers and acquisition opportunities; the ability to efficiently integrate assets and employees acquired through acquisitions; global energy policies going forward; international trade policies; future debt levels; and the Company's continued ability to obtain and retain qualified staff and equipment in a timely and cost efficient manner. In addition, the Company's work programmes and budgets are in part based upon expected agreement among joint venture partners and associated exploration, development and marketing plans and anticipated costs and sales prices, which are subject to change based on, among other things, the actual results of drilling and related activity, availability of drilling, offshore storage and offloading facilities and other specialised oilfield equipment and service providers, changes in partners' plans and unexpected delays and changes in market conditions. Although the Company believes the expectations and assumptions reflected in such forward-looking information are reasonable, they may prove to be incorrect.

Forward-looking information involves significant known and unknown risks and uncertainties. Exploration, appraisal, and development of oil and natural gas reserves and resources are speculative activities and involve a degree of risk. A number of factors could cause actual results to differ materially from those anticipated by the Company including, but not limited to: the ability of management to execute its business plan or realise anticipated benefits from acquisitions; the risk of disruptions from public health emergencies and/or pandemics; competition for specialised equipment and human resources; the Company's ability to manage growth; the Company's ability to manage the costs related to inflation; disruption in supply chains; the risk of currency fluctuations; changes in interest rates, oil and gas prices and netbacks; the risk that the Company's tax advisors' and/or auditors' assessment of the Company's cumulative tax losses varies significantly from management's expectations of the same; potential changes in joint venture partner strategies and participation in work programmes; uncertainty regarding the contemplated timelines and costs for work programme execution; the risks of disruption to operations and access to worksites; potential changes in laws and regulations, including international treaties and trade policies; the uncertainty regarding government and other approvals; counterparty risk; the risk that financing may not be available; risks associated with weather delays and natural disasters; and the risk associated with international activity. See the most recent annual information form and management's discussion and analysis of the Company for a detailed discussion of the risk factors.

Certain forward-looking information in this news release may also constitute "financial outlook" within the meaning of applicable securities legislation. Financial outlook involves statements about Valeura's prospective financial performance or position and is based on and subject to the assumptions and risk factors described above in respect of forward-looking information generally as well as any other specific assumptions and risk factors in relation to such financial outlook noted in this news release. Such assumptions are based on management's assessment of the relevant information currently available, and any financial outlook included in this news release is made as of the date hereof and provided for the purpose of helping readers understand Valeura's current expectations and plans for the future. Readers are cautioned that reliance on any financial outlook may not be appropriate for other purposes or in other circumstances and that the risk factors described above or other factors may cause actual results to differ materially from any financial outlook.

The forward-looking information contained in this news release is made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Gulf of Thailand map

The Gulf of Thailand map featured in this press release has been compiled by Valeura based on various public and proprietary data sources. Polygons identified as oil fields and gas fields are not necessarily indicative of commercial viability, nor does the Company represent that aerial extent of such polygons correlates to ultimate potential recovery of oil and gas from such accumulations.

This news release does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction, including where such offer would be unlawful. This news release is not for distribution or release, directly or indirectly, in or into the United States, Ireland, the Republic of South Africa or Japan or any other jurisdiction in which its publication or distribution would be unlawful.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This information is provided by Reach, the non-regulatory press release distribution service of RNS, part of the London Stock Exchange. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Valeura Energy Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/oil-gas-and-energy/valeura-energy-inc.-announces-strategic-farm-in-agreement-with-pttep-1052874