TORONTO, ON / ACCESS Newswire / July 28, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) announces the mutual termination of the previously announced option and acquisition agreement (the "Agreement") with Altair Resources Inc. ("Altair"), the Company's intention to pursue strategic partnership opportunities on its Nevada silver assets, and the grant of 3,939,740 Deferred Share Units ("DSUs") to members of its Board of Directors.

Mutual Termination of Altair Agreement

The Company and Altair have mutually agreed to terminate the Agreement, originally announced on November 22, 2023, which contemplated Altair earning up to 100% interest in the Corcoran Canyon silver-gold project, the Belmont silver project and the Belmont North gold-silver project through the acquisition of EML subsidiary, North American Silver Corporation ("NAS"), by making payments to EML and its subsidiary of cash and common shares of Altair ("Altair Shares"), and the expenditure of funds on the Project.The termination took effect on July 25, 2025. No termination fees or penalties were incurred by either party.

Strategic Partnership Opportunities - Nevada Silver Assets

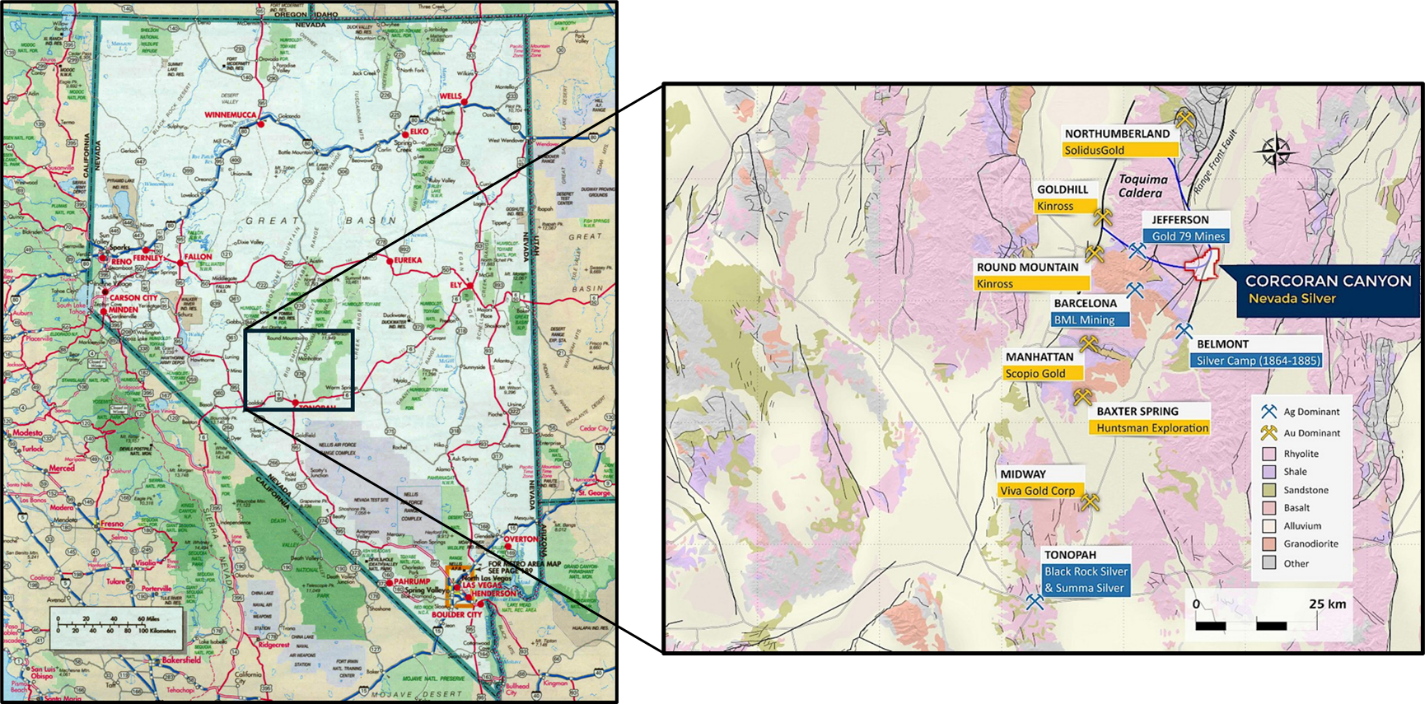

Following the termination of the Agreement, the Company is actively seeking partners to earn-in or acquire its Nevada-based precious metal assets: the Corcoran Canyon Silver - Gold Project, the Belmont Silver Project and the Belmont North Gold-Silver Project. These projects are located north of Tonopah and east of Round Mountain in Nye County, within the Toquima caldera complex-one of the most highly endowed Au-Ag districts in the U.S. This 30 km-wide zone of nested calderas includes five ore deposits hosting 24 Moz gold and 89+ Moz silver.

Corcoran Canyon and Belmont Silver Projects Location Map

Corcoran Canyon Silver-Gold Project

Corcoran hosts near-surface mineralization that remains open in all directions and carries an NI 43-101 Mineral Resource Estimate of 33.5 million silver-equivalent ounces (effective August 12, 2021), prepared by Mr. Gregory Z. Mosher, P.Geo., M.Sc. and Mr. David S. Smith, P.Geo., M.S. The estimate assumes an open-pit cut-off grade of 15 g/t Ag-Eq and underground cut-off of 100 g/t Ag-Eq, calculated with recoveries of 77% silver and 45% gold, based on test work commissioned by Centennial Mining (an Electric Metals subsidiary), and metal prices of US$21.09/oz silver and US$1,657/oz gold.

For context, as of July 25, 2025, the London PM Fix price for silver was US$38.18/oz (+81%) and the London PM Fix price for gold was US$3,343.50/oz (+101%) compared to the assumptions used in the 2021 resource estimate, highlighting the upside potential. Corcoran also features high-priority exploration targets and significant depth potential for high-grade silver-gold feeder zones.

Belmont Silver Project and Belmont North Gold-Silver Project

Located 15 km south of Corcoran, Belmont was among the earliest and richest silver mining camps in the Tonopah district, historically averaging 25 oz/t (775 g/t) Ag. Despite negligible exploration since the 1880s, USGS sampling has confirmed grades up to 0.5% Ag from remnant mine dumps. Its proximity to Corcoran allows for shared technical resources and strong development synergies.

"Both the Corcoran Canyon and Belmont Projects represent attractive targets for silver and gold discovery and expansion in an excellent location in central Nevada. We are actively evaluating opportunities to enhance work on these projects and monetize the Nevada assets for the benefit of our shareholders," said Brian Savage, CEO, EML. "At the same time, our primary focus remains on advancing our high-grade Emily Manganese Deposit in Minnesota, with the results of the Emily Manganese PEA to be announced soon."

Parties interested in partnership or acquisition discussions are invited to contact the Company for further information.

Grant of Deferred Share Units

The Company granted an aggregate of 3,939,740 Deferred Share Units (DSUs) to non-executive members of its Board of Directors on July 24, 2025, under the Company's Omnibus Equity Incentive Plan that Shareholders approved on June 26, 2024. The Board sets DSU vesting terms, subject to TSXV rules that require a one-year minimum vesting period while the Company is TSXV-listed, with limited exceptions (e.g., death or a Change of Control). DSUs are redeemable for common shares upon a director's departure, aligning interests with those of shareholders. The DSUs are being issued in lieu of cash-based Board fees.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV: EML) (OTCQB: EMUSF) is a US-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. The Company's principal asset is the Emily Manganese Project in Minnesota, the highest-grade manganese deposit in North America, which has been the subject of considerable technical studies, including National Instrument 43-101 Technical Reports - Resource Estimates. The Company's mission in Minnesota is to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets. With manganese playing a critical and prominent role in lithium-ion battery formulations, and with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, the State of Minnesota and for the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts","projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the ability of the Company to complete the Offering; the size, terms and timing of the Offering; participation in the Offering by insiders of the Company; the timing and receipt of TSXV and other approvals required in connection with the Offering; the intended use of proceeds of the Offering; the Company's mission to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical and prominent role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

These statements address future events and conditions and so involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, the failure to obtain all necessary stock exchange and regulatory approvals; investor interest in participating in the Offering; and risks related to the exploration and other plans of the Company. Forward-looking information is based on the reasonable assumptions,estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments,except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE:

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/electric-metals-announces-mutual-termination-of-altair-resources-option-and-acqui-1053401