Regulatory News:

Celyad Oncology (Euronext: CYAD) (the "Company" or "Celyad") today announced that it has entered into a subscription agreement for a private placement financing.

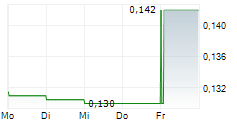

Under the terms of the agreement, CFIP CLYD (UK) Limited ("Fortress") will subscribe to a capital increase for an aggregate amount of €1 million in exchange for 3,333,333 newly issued ordinary shares of Celyad. The shares will be issued at a subscription price of EUR 0.30 per share, which represents a 15% discount to the volume-weighted average price (VWAP) of Celyad's shares on Euronext Brussels over the ten (10) trading days preceding the date of signing. Fortress's subscription commitment is subject to customary conditions precedent. The closing is expected to take place on or around August 5, 2025. CFIP CLYD (UK) Limited is an affiliate of Fortress Investment Group.

The private placement is being conducted within the limits of the Company's authorized capital as approved by the Extraordinary Shareholders' Meeting of 14 November 2023, with cancellation of the preferential subscription rights of the existing shareholders in favor of Fortress. Following and subject to the issue of the shares to Fortress, Fortress is expected to hold approximately 58.51% of the Company's shares.

The net proceeds of the placement will be used to support the working capital of the Company for general corporate purposes. The Company believes that following the close of the private placement, its cash runway will be extended from mid Q3 2025 to mid Q4 2025 which will give additional time for the Company to evaluate its strategic options to strengthen its balance sheet.

As Fortress qualifies as a related party of the Company, the board of directors applied Article 7:97 of the Belgian Code of Companies and Associations (the "BCCA"), which requires, among other things, the intervention of a committee of independent directors to give an opinion to the board of directors. The conclusions of the committee's opinion is as follows: "The Committee has assessed the envisaged Transaction in light of the criteria included in article 7:97 of the BCCA and concluded, in view of the Company's financial situation and cash flow requirements, after considering and examining alternative funding options and taking into account the interest of all stakeholders, that the expected advantages of the Transaction outweigh the expected disadvantages thereof, which leads to the conclusion that the Transaction is to the advantage and in the interest of the Company. The Transaction is in line with the Company's strategic policy and is not manifestly unreasonable and the Committee affirms its positive advice in relation to the Transaction". The directors previously appointed by Fortress did not participate in the deliberations or votes.

In light of the Company's limited cash runway, the board of directors believes that the envisaged capital increase is in the best interests of the Company and its stakeholders because, if completed, the capital increase will give additional time for the Company to evaluate its strategic options to strengthen its balance sheet. In accordance with article 7:97 of the BCCA, the Company's auditor has issued a report on the accounting and financial information contained in the committee's opinion and the board minutes approving the related party transaction. The auditor's conclusion in this respect is as follows: "Based on our assessment, nothing has come to our attention that causes us to believe that the accounting and financial information included in the advice of the committee of independent directors dated July 23, 2025 and in the minutes of the Board of Directors dated July 23, 2025, justifying the proposed transaction, is not fair and sufficient, in all material respects, with regard to the information available to us within the scope of our mission."

About Celyad Oncology

Celyad Oncology is a cutting-edge biotechnology company focused primarily on unlocking the potential of its proprietary CAR-T technology platforms and intellectual property. The Company is headquartered in Mont-Saint-Guibert, Belgium. For more information, visit www.celyad.com.

About Fortress Investment Group

Fortress Investment Group LLC is a leading, highly diversified global investment manager. Founded in 1998, Fortress manages $51 billion of assets under management as of March 31, 2025, on behalf of approximately 2,000 institutional clients and private investors worldwide across a range of credit and real estate, private equity and permanent capital investment strategies. AUM refers to assets Fortress manages, including capital that Fortress has the right to call from investors, or investors are otherwise required to contribute, pursuant to their capital commitments to various funds or managed accounts. For more information, please visit www.fortress.com.

Celyad Oncology Forward-Looking Statement

This release may contain forward-looking statements, including, without limitation, statements regarding beliefs about and expectations for the Company's updated strategic business model, including associated potential benefits, transactions and partnerships, statements regarding the potential value of the Company's IP, statements regarding the Company's financial statements and cash runway, statements regarding the Company's future fundraising plans, statements regarding the Company's hiring plans, and statements regarding the continuation of the Company's existence. The words "will," "potential," "continue," "target," "project," "should" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this release are based on management's current expectations and beliefs and are subject to a number of known and unknown risks, uncertainties and important factors which might cause actual events, results, financial condition, performance or achievements of Celyad Oncology to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks related to the material uncertainty about the Company's ability to continue as a going concern; the Company's ability to realize the expected benefits of its updated strategic business model; the Company's ability to develop its IP assets and enter into partnerships with outside parties; the Company's ability to enforce its patents and other IP rights; the possibility that the Company may infringe on the patents or IP rights of others and be required to defend against patent or other IP rights suits; the possibility that the Company may not successfully defend itself against claims of patent infringement or other IP rights suits, which could result in substantial claims for damages against the Company; the possibility that the Company may become involved in lawsuits to protect or enforce its patents, which could be expensive, time-consuming, and unsuccessful; the Company's ability to protect its IP rights throughout the world; the potential for patents held by the Company to be found invalid or unenforceable; and other risks identified in the latest Annual Report of Celyad Oncology. These forward-looking statements speak only as of the date of publication of this document and Celyad Oncology's actual results may differ materially from those expressed or implied by these forward-looking statements. Celyad Oncology expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, unless required by law or regulation.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250728845166/en/

Contacts:

Investors Media:

David Georges, VP Finance and Administration

investors@celyad.com