DEA Counsel's Conduct: Is It Fraud on the Tribunal?

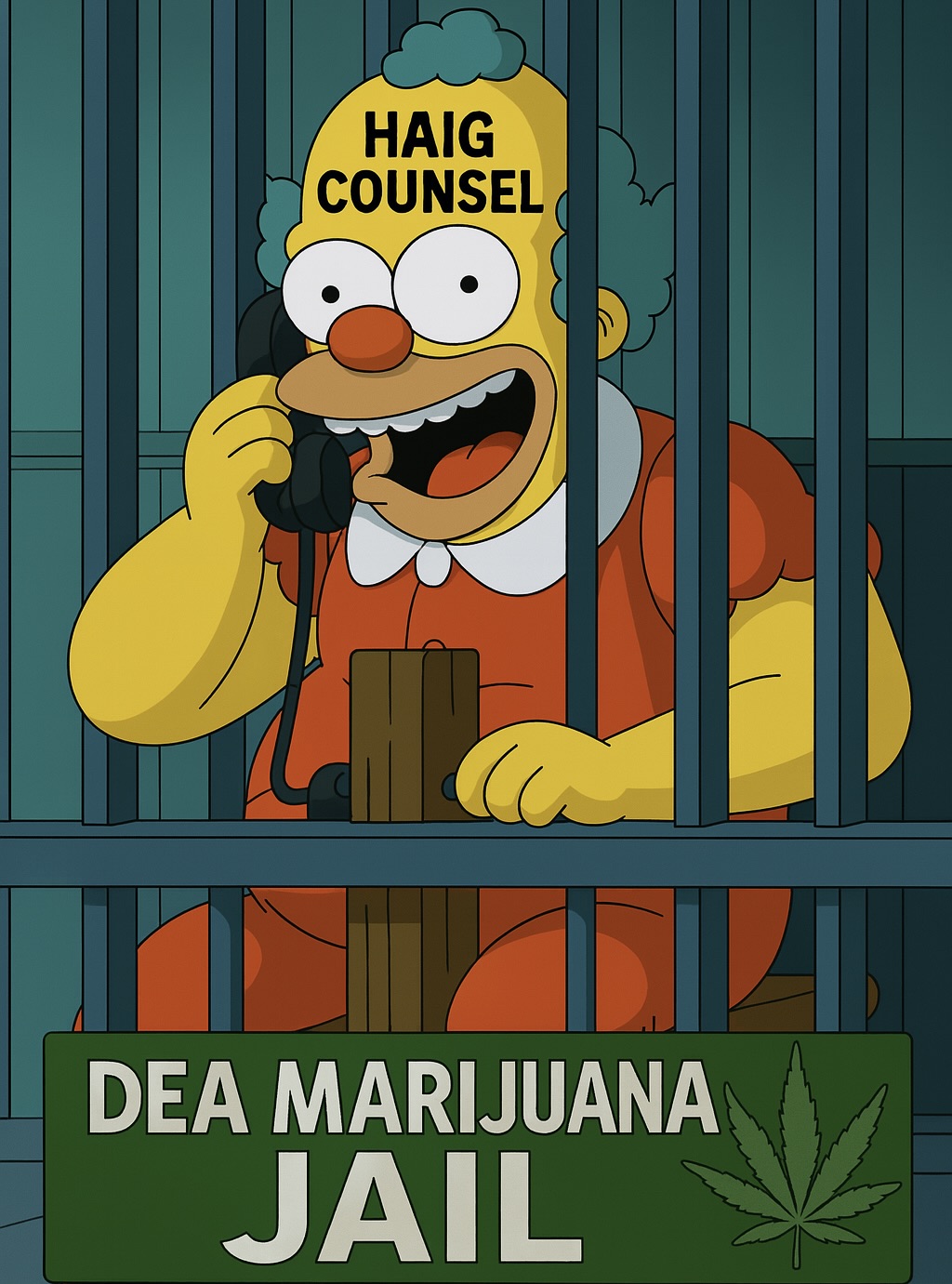

DEA attorney Aarathi D. Haig submitted a formal legal response on July 25, 2025 to DEA Administrator Terry Cole, asserting that MMJ BioPharma Cultivation lacked a bona fide supply agreement (BFSA) - the critical requirement for Schedule I bulk manufacturing registration.

But this is provably false. That misrepresentation - made knowingly and in writing to the DEA Administrator and under the guise of the law - raises serious civil and criminal red flags.

WASHINGTON, DC / ACCESS Newswire / July 29, 2025 / The Drug Enforcement Administration just perjured itself in the matter of MMJ BioPharma Cultivation. In a July 25 filing signed by attorney Aarathi D. Haig, the DEA outrageously claimed that MMJ "had no bona fide supply agreement (BFSA)" with a Schedule I registrant. That statement is not only false; it's demonstrably, documentably false.

We have the signed, sealed BFSA between MMJ BioPharma and a DEA-registered Schedule I manufacturer. The agreement meticulously satisfies every clause of DEA's own regulatory requirement under 21 C.F.R. § 1318.05(b)(3)(i).

This wasn't a technicality. It was a coordinated lie meant to bury seven years of federally compliant work, destroy a Huntington's Disease treatment before it reaches patients, and protect DEA insiders who have weaponized bureaucracy against medical marijuana science.

The Receipts DEA Pretends Don't Exist

Let's be crystal clear: MMJ's supply agreement with a schedule 1 registrant contains every single requirement DEA demanded in its own rules:

Schedule I registrant?

Specific strains and cannabis delivery quantities? Detailed in Article I.

Harvest notifications, packaging, DEA Form 222, and ownership transfer protocols? Articles II & III.

Secure vault storage, anti-diversion controls, payment terms, IRB-reviewed clinical trial data, IND approval from FDA?

Yet the DEA continues to write in federal filings, as though we're all too stupid to read the documents, that MMJ "failed" to provide a Bona Fide Supply Agreement.

This is not a misunderstanding. This is deception and fraudulent misrepresentation at the highest level.

Mulrooney's Kangaroo Court and Aarathi Haig's Legal Fiction

Chief Administrative Law Judge John J. Mulrooney II, now conveniently retired, rubber-stamped this lie and refused to even admit the supply agreement into evidence. He helped orchestrate a procedural sham that made it impossible for MMJ to present the truth.

And now DEA Counsel Aarathi Haig doubles down with a legal sleight of hand that should be called what it is: fraud on the tribunal.

Haig knows that MMJ's agreement complies with DEA's rule: she just chose to ignore it and assert to the Administrator that it never existed.

Who Will Hold DEA Accountable?

This isn't just about MMJ BioPharma anymore.

It's about whether facts still matter in federal law.

It's about whether a rogue federal agency can retroactively invent rules, then pretend applicants didn't comply, and get away with it while patients with deadly diseases like Huntington's continue to suffer.

This case exposes DEA's Diversion Control Division as a cartel of obstructionists who have abandoned science, betrayed public trust, and refused to follow the law.

DEA Terrance Cole's First Test as Administrator

New DEA Administrator Terrance Cole inherited a mess. But now he has a chance to do something Mulrooney and Haig never would: Tell the truth. Follow the law. And approve MMJ's long-blocked registration so clinical trials can finally begin.

If Cole doesn't act, he won't just be complicit; he'll become the latest face of a federal agency that has turned cannabis research into a rigged game; a game where the rules change, the facts don't matter, and the fix is always in.

This Is What Scientific Sabotage Looks Like

At stake here is not just one registration; it's the future of FDA compliant, patient focused cannabis research in the United States.

MMJ BioPharma Cultivation has done everything by the book. The DEA burned the book-and then accused MMJ of not reading it.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/is-dea-marijuana-lies-civil-misconduct-or-criminal-fraud-dea-administ-1054154