MEDELLÍN, CO / ACCESS Newswire / July 29, 2025 / Grupo Nutresa S.A. (BVC:NUTRESA):

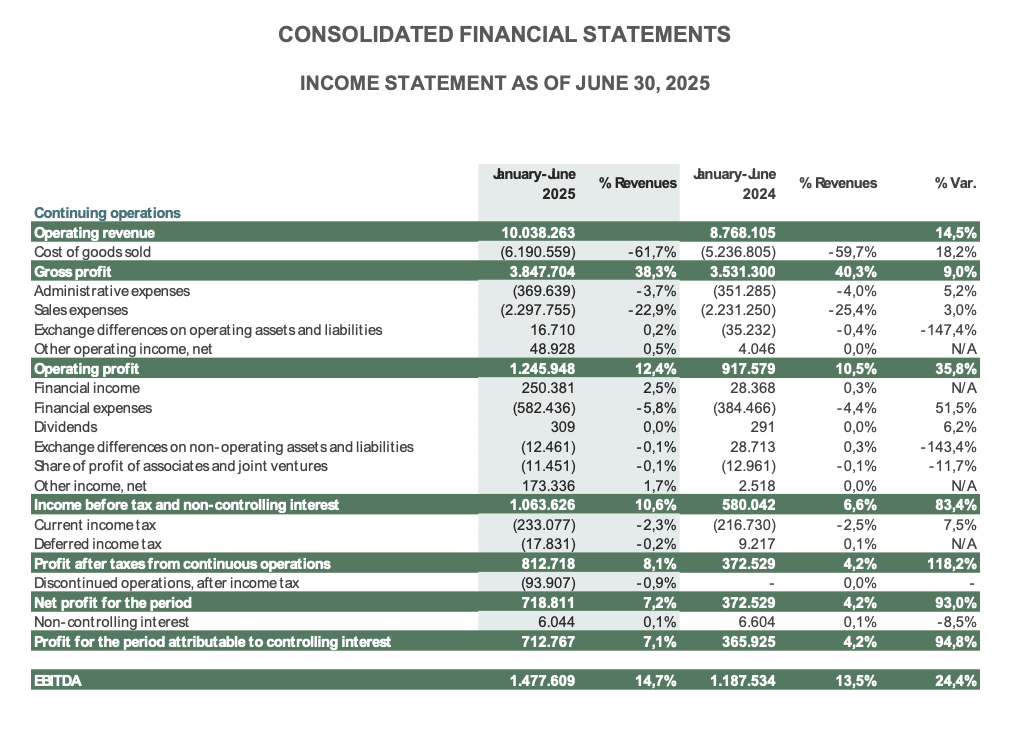

INCOME STATEMENT AS OF JUNE 30, 2025

Grupo Nutresa's sales are showing dynamic growth in both Colombia and the rest of the region. During the period, revenues reached COP 10.0 trillion, representing a 14.5% increase.

In Colombia, sales show a growth of 9.6% to COP 5.8 trillion. Significant growth is seen in the Chocolate, Biscuits, Coffee and Others business units.

International revenue amounted to COP 4.2 trillion, representing a 22.1% increase. In U.S. dollars, these revenues reached USD 1,001.0 million, representing a 14.3% increase compared to the same period last year.

Organizational transformation initiatives focused on efficiency, agility, and profitability expansion continue to advance. Consequently, the Group's EBITDA grew 24.4%, a higher rate than its sales, and reached COP 1.48 trillion. The margin on sales stood at 14.7%.

Finally, the Company's net income reached COP 712,767 billion, representing a 94.8% increase.

Grupo Nutresa S.A. (BVC:NUTRESA) announces progress on several issues relevant to the Organization and reports its consolidated financial results as of June 30, 2025.

Grupo Nutresa is moving forward with determination in its organizational transformation project, promoting initiatives focused on efficiency, agility, and profitability. Integrating these actions seeks to enhance and accelerate the development of capabilities that serve as effective response tools to changing market dynamics, thereby strengthening the Group's leadership in the region.

Grupo Nutresa S.A.'s consolidated financial results for the first half of 2025.

By the end of the first half of 2025, the Group's total sales reached COP 10.0 trillion, 14.5% higher than the same period last year. We reported growth across core categories and geographies.

In Colombia, revenues grew 9.6% to COP 5.8 trillion, reflecting 58.2% of the Group's total sales. We highlight the growth in the Coffee (+21.3%), Chocolate (+16.9%), Others (+13.0%), and Biscuits (+11.0%) business units.

On international platforms, we reported sales of COP 4.2 trillion, representing a 22.1% increase. In U.S. dollars, these revenues amounted to USD 1,001.0 million, 14.3% higher than in the first half of 2024. We highlight the growth in U.S. dollars in the Chocolate (+57.3%) and Coffee (+48.5%) business units, which show an increase above the Group's average.

In a global scenario defined by geopolitical uncertainty and volatility that impact the cost of raw materials, the company has demonstrated remarkable resilience in the strategic and financial management of its supplies. During this period, the Group's gross profit amounted to COP 3.8 trillion, representing a 9.0% increase compared to the same period in 2024.

The optimization of internal processes and the efficient management of the Group's expenses have resulted in a 0.5% decrease in operating expenses. Cost control has enhanced operating profit to COP 1.2 trillion, representing a 35.8% increase. It is important to note that, excluding non-recurring expenses associated with the organizational transformation project, the Group's operating profit would reach COP 1.3 trillion, representing a 41.7% increase.

In terms of profitability, the Group's EBITDA stood at COP 1.48 trillion, growing 24.4% with a margin on sales of 14.7%. EBITDA adjusted for non-recurring expenses was COP 1.53 trillion, and its margin on sales was 15.3%.

In post-operating items, we reported a COP 222,013 billion increase in the Group's financial income and a COP 197,970 billion increase in financial expenses associated with higher debt from the international bond issuance. It is important to note that the profitability of the Company's financial investments, resulting from the bond issuance, is enough to cover the incremental financial expenses generated by the bond.

Finally, the Group reported a net profit of COP 712,767 billion, growing 94.8% compared to the same period of the previous year. This is primarily due to solid operational management and the sale of minority shares during the period. Excluding non-recurring expenses and divestments in this period, net income would reach COP 680,754 billion, representing an 86% increase.

Separate Financial Statements

Grupo Nutresa S.A.'s Separate Financial Statements report net operating income of COP 549,876 billion, of which COP 549,580 billion corresponds to profit from equity method investments in food companies, and COP 296 billion to dividends from the investment portfolio. Net income is COP 712,028 billion.

This communication includes the consolidated and separate income statements, the financial position statement as of June 30, 2025, and the related financial indicators.

Contact Information

CAMILA REY

Directora de Cuentas

camila.rey@publicisgroupe.com

SOURCE: NUTRESA

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/food-and-beverage-products/during-the-first-half-of-the-year-grupo-nutresa-reported-revenues-of-cop-1054162