With major retail builds for brands like Boot Barn, Maxi Cosi and Red Bull, Tinker Tin is rewriting the rules of retail manufacturing and combining scale, storytelling, and design precision

SAN DIEGO, CA / ACCESS Newswire / July 29, 2025 / As global supply chains face renewed volatility from shifting tariffs, freight bottlenecks, and rising overseas labor costs, a new wave of manufacturers is turning onshore. Tinker Tin, a San Diego-based manufacturing and design firm, is already there. Leading the charge, Tinker Tin is proving that onshore production isn't just possible, it's profitable, scalable, and offering legacy brands new-found control over in-store customer experience.

When Tinker Tin co-founder and VP of Design Jaime Holm first entered the manufacturing space, it wasn't as an engineer or supply chain executive, it was as a creative with a vision. With no formal training in industrial design, Holm's background in brand storytelling and experiential marketing gave her the one thing the industry was missing: imagination.

This year, the zero-debt company hit the 20 million mark in revenue and has its sights set on breaking 30M before the end of the year. Their dedication to ingenuity and zero-debt growth has kept Tinker Tin nimble and flexible.

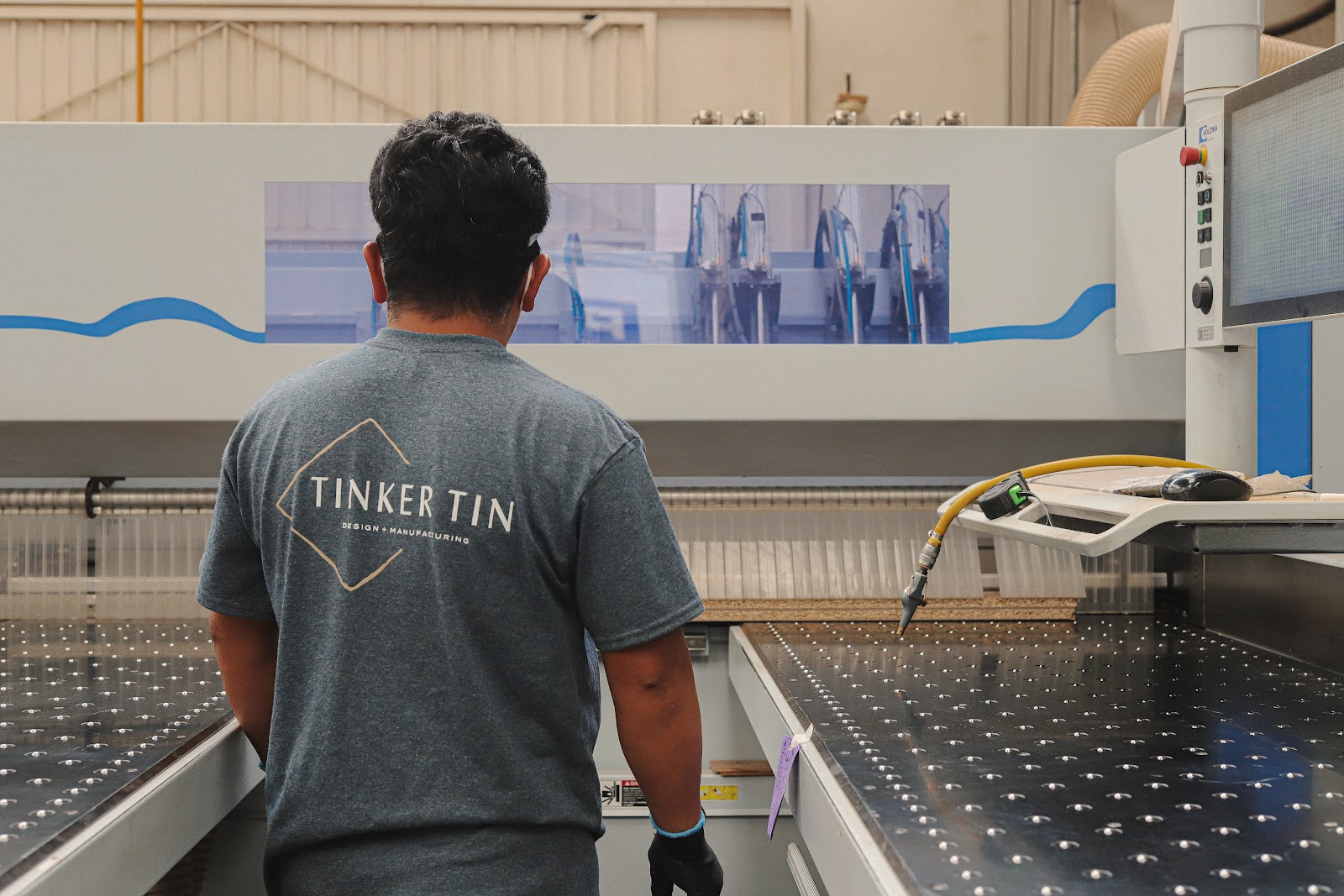

Among their strategic pivots was bringing Tinker Tin onshore in 2020. As the Pacific Ocean turned into a parking lot of stalled cargo ships, they pivoted fast, shifting their operations onshore to better manage production costs, timelines, and oversight. Today, Tinker Tin operates over 500,000 square feet of manufacturing space across San Diego and Mexico.

Bringing production onshore, Tinker Tin began to grow exponentially as they differentiated from slower, less adaptable competitors stuck in the strings of overseas trade. At this time, the company also brought in Holm's brother as CEO. Matt Hannula brings a precision mindset and a technical background, and has helped the growing manufacturer scale exponentially.

"Material costs and shipping are always moving targets," says Hannula. "But speed, quality control, and agility are things our team can now guarantee." While global brands still scramble to resolve overseas delays and tariff complications, Tinker Tin is designing, prototyping, and shipping from right next door.

Their hybrid approach merges the detail of boutique design studios with the operational capacity of major suppliers. In an industry still reliant on international freight and fragmented vendors, Tinker Tin's onshore operations offer faster timelines, real-time quality control, and dramatically fewer points of failure.

"We believe manufacturing should be just as brand-aligned as marketing," said Holm, who was recently featured in Entrepreneur Magazine for her unconventional path from retail assistant to VP of Design. "We do a lot more than just build fixtures, we translate values into physical space. And we do it at scale."

Together, the siblings lead a multidisciplinary team that spans engineering, prototyping, project management, and production. This end-to-end approach to manufacturing allows Tinker Tin to manage projects from sketch to store.

Their portfolio includes full-store buildouts, modular displays, and custom installations for legacy brands such as Boot Barn, Red Bull and more.

While the results are clean and cohesive, the process behind them is deeply technical. Tinker Tin operates under lean manufacturing principles like cutting waste, reducing excess, and ensuring that every unit aligns with the client's aesthetic, budget, and retail goals. Whether it's a flagship buildout or a high-volume product rollout, the team remains rooted in one philosophy: beauty at scale.

Even with projects across North America, Tinker Tin is deeply rooted in the community. This summer, they led the redesign and construction of The CHOC Children's Hospital Teen Room in Orange County made possible by the generosity of Jim and Gretchen Conroy. While many hospitals have a cold, sterile feel to them, the new teen room is anything but boring. Sporting a foosball table, leather couches, and arcade style basketball, the space feels like a truly teen friendly hang-out spot.

For Holm and Hannula, it's not about changing how things are built, it's about changing what's possible when design, manufacturing, and mission align onshore. As more legacy brands seek relevance in a changing economy, Tinker Tin offers something rare: a partner that can scale, innovate, and stay deeply personal all at once.

For more information please contact Katie Passarello

katie@rebeccacafiero.com

SOURCE: Tinker Tin Company

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/industrial-and-manufacturing/the-onshore-advantage-california-based-tinker-tin-is-reinventing-retai-1054391