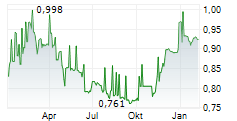

- New name. Artea is the new name of Šiauliu Bankas. The bank also has a new ticker on the Nasdaq Baltic Stock Exchange: ROE1L

- Profit. In the first half of this year, the group earned a net profit of €31.9 million

- Fee and commission income. Net fee and commission income grew by 10% over the year and exceeded €15.1 million

- Loan portfolio. The loan portfolio amounted to €3.7 billion, increasing by 15% over the year

- Share buyback. The second share buyback program was completed, with over 2.5 million own shares acquired

"I am delighted to welcome everyone to the rebranded Artea Bank. In May, as planned, we successfully changed the name of the bank to better reflect our new strategic direction, market positioning, and bold ambitions. This is another significant step towards achieving our strategy of becoming the best bank in Lithuania by 2029.

This year, the bank continues to consistently increase its financing volumes for business and retail clients. Although the ECB's monetary policy has led to lower interest income, growing fee and commission income has ensured stability. As the market conditions evolve, we will focus on effective cost management in the coming period," said Vytautas Sinius, CEO of Artea Bank.

Artea Bank Group earned €31.9 million in unaudited net profit in the first half of 2025, down 26% from the same period in 2024. Operating profit before impairment and income tax amounted to €42.9 million, down 25% compared to the same period in 2024, when operating profit amounted to €57.1 million.

Net fee and commission income in the first half of 2025 increased by 10% compared to the same period last year and exceeded €15.1 million, while net interest income decreased by 15% and amounted to €68.4 million.

The bank significantly increased its financing for business and retail clients. All key financing segments grew in the second quarter, with the total loan portfolio increasing by 5% (€159 million) to €3.7 billion. The loan portfolio has grown by 7% or €235 million since the beginning of the year. New loan agreements worth €0.9 million were signed during the first half of the year, 18% more than in the corresponding period of 2024 (€0.8 million).

The quality of the loan portfolio remains good - in the first half of 2025, provisions for loans amounted to €4.3 million, the same as in the corresponding period of 2024 (€4.3 million), and the loan portfolio Cost of risk ratio (CoR) was 0.2%. (0.3% in the corresponding period of 2024).

The customer deposit portfolio grew by 4% (€133 million) since the beginning of the year and exceeded €3.5 billion at the end of the half-year. During the half-year, demand deposits grew by 14% (€229 million) and exceeded €1.8 billion.

The group's cost/income ratio at the end of the half-year was 57.1%1 (45.4%1 in the first half of 2024), while return on equity was 11.1% (16.2% in the first half of 2024). The capital and liquidity position remains strong, and prudential ratios are being met by a wide margin.

Overview of business segments

Corporate client segment

The volume of new business financing agreements increased by 18% over the year and reached €0.5 billion in the first half of 2025 (€0.4 billion in the first half of 2024). Since the beginning of the year, the business loan portfolio grew by 7% (€120 million) and exceeded €1.9 billion. Despite rapid growth, the quality of the loan portfolio remains high - in the first half of 2025, Cost of risk ratio (CoR) of the business loan portfolio was 0.11%.

Private client segment

In the first half of 2025, the volume of new mortgages increased by 69% to €162 million compared to the same period last year. Since the beginning of the year, the housing loan portfolio has grown by 10% (€96 million) and exceeded €1 billion.

The volume of new consumer finance agreements in the first half of the year grew by 2% to €114 million. Since the beginning of the year, the consumer loan portfolio has grown by 5% (€19 million) to almost €0.4 billion.

Investment client segment

Artea Bank has strengthened its leading position in the bond issue market, with the value of bonds issued on behalf of corporate clients in the first half of 2025 exceeding €130 million. Artea continues to expand the availability of this service and actively offers its customers even more digital investment tools. At the end of the H1 2025, the value of investments under custody reached almost €2 billion.

Artea Asset Managementcontinues to demonstrate its leadership in managing second and third pillar pension and investment funds for retail investors. The company is the leader in terms of assets under management in third-pillar pension funds, with €177 million (40% of the market).

Artea's second-pillar pension funds, with nearly €1.2 billion assets of clients under management, are among the leaders in terms of performance: Six out of nine second-pillar pension funds performed best in the first half of this year compared to pension funds in the same age group managed by other asset managers, and five Artea funds rank first in the long term (five years).

| Income Statement (€'m) | 2025 6M YTD | 2024 6M | % ? |

| Net Interest Income | 68.4 | 80.6 | -15% |

| Net Fee and Commission Income | 15.1 | 13.7 | 10% |

| Other Income | 15.8 | 18.1 | -13% |

| Total Revenue | 99.3 | 112.5 | -12% |

| Salaries and Related Expenses | -27.6 | -23.2 | 19% |

| Other Operating Expenses | -28.8 | -32.2 | -11% |

| Total Operating Expenses | -56.4 | -55.4 | 2% |

| Operating Profit | 42.9 | 57.1 | -25% |

| Provisions | -3.8 | -3.9 | -3% |

| Income Tax Expense | -7.2 | -10.1 | -29% |

| Net Profit | 31.9 | 43.0 | -26% |

| Balance Sheet Metrics (€'m) | 2025.06.30 | 2024.12.31 | % ? |

| Loan Portfolio | 3 669 | 3 435 | 7% |

| Total Assets | 5 277 | 4 923 | 7% |

| Deposits | 3 530 | 3 397 | 4% |

| Equity | 575 | 585 | -2% |

| Assets under Management3 | 2 006 | 1 977 | 1% |

| Assets under Custody | 1 982 | 1 936 | 2% |

| Key indicators | 2025 6M YTD | 2024 6M | ? |

| Net Interest Margin (NIM) | 2.9% | 3.9% | -95bp |

| Cost-to-Income Ratio (C/I)1 | 57.1% | 45.4% | +1167bp |

| Return on Equity (RoE) | 11.1% | 16.2% | -508bp |

| Cost of Risk (CoR) | 0.2% | 0.3% | -4bp |

| Capital Adequacy Ratio (CAR)2 | 22.2% | 20.0% | +217bps |

1 excluding the impact of the Artea Life Insurance customer portfolio

2 preliminary data

3 includes assets managed by asset management and modernization funds

Artea Bank invites shareholders, investors, analysts and all interested parties to a webinar presentation of the financial results and highlights for the Q2 and H1 2025. The webinar will start at 08:30 am (EEST) on July 31, 2025 The webinar will be held in English. Please register here.

If you would like to receive Artea Bank news for investors directly to your inbox, please subscribe to our newsletter.

Additional information:

Tomas Varenbergas

Head of Investment Management Division

tomas.varenbergas@artea.lt, +370 610 44447