Kardex Holding AG / Key word(s): Interim Report Media Information - Half-Year Results 2025 Zurich, 31 July 2025 Release of an ad hoc announcement pursuant to Art. 53 LR Half-Year Results 2025

Bookings and net revenues increased significantly, and profitability remained at a robust level. The ongoing positive demand dynamics for Kardex intralogistics solutions, combined with Kardex' strong market position, are reflected in bookings, which totaled EUR 454.3 million, an 18.7% increase year-on-year. While Central Europe performed better than anticipated, demand in the US lagged behind expectations. Decision-making processes for larger projects have normalized. Bookings in New Business increased by 21.1% and in Life Cycle Services by 12.8%. As of 30 June 2025, the order backlog stood at EUR 512.7 million, 7.8% above the level at the beginning of the year. Net revenues amounted to EUR 415.7 million, a 12.4% increase year-on-year. Of this, EUR 307.6 million or 74.0% came from New Business, while Life Cycle Services generated EUR 108.1 million or 26.0%. The sales mix between Automated Products and Standardized Systems was the main driver of the slightly lower gross profit margin of 34.1% (34.4%). As planned, operating costs increased by 17.6% to EUR 93.0 million (EUR 79.1 million), mainly due to significantly higher R&D and IT (ERP) costs, as well as sales and marketing expenses. This resulted in a robust operating result and an EBIT margin of 11.8%. EBIT for the first half of the year totaled EUR 48.9 million, representing a 1.5% increase compared to the same period in the previous year. The net profit for the period amounted to EUR 36.1 million (EUR 38.3 million) due to a decrease in financial income. Growing demand for Automated Products Continued growth for Standardized Systems Overall bookings totaled EUR 160.4 million, representing a strong 35.6% year-over-year increase. Bookings at Kardex Mlog rose to EUR 76.5 million, 85.2% higher than H1 2024, while Kardex AS Solutions' bookings grew by 9.2% to EUR 84.1 million in the reporting period. The order backlog amounted to EUR 230.9 million, a 13.3% increase compared to the beginning of the year. Net revenues increased by 27.9% to EUR 133.0 million. Kardex Mlog achieved an increase of 4.8% to EUR 54.6 million, while Kardex AS Solutions increased by 51.6% to EUR 78.7 million. The first half of the year saw continued substantial investments in expansion to strengthen Kardex AS Solution's global setup. Due to these investments and timing effects in project progress, EBIT of EUR 5.4 million for the Segment was 10.0% below last year's period, resulting in a temporarily lower EBIT margin of 4.1% (5.8%), as already announced in the last media information in March 2025. Completion of generation change Strong ROIC Outlook

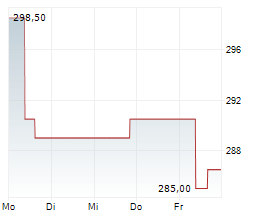

in EUR million

Interim Report

Kardex Corporate Profile Disclaimer Privacy policy Recipients of our communications have the option at any time of revoking their registration for ad hoc communications for the future or requesting information from Kardex Holding AG about their own personal data that has been processed or their deletion. Please send us an e-mail to investor-relations@kardex.com. End of Inside Information |

| Language: | English |

| Company: | Kardex Holding AG |

| Thurgauerstrasse 40 | |

| 8050 Zürich | |

| Switzerland | |

| Phone: | +41 (0)44 419 44 79 |

| E-mail: | investor-relations@kardex.com |

| Internet: | www.kardex.com |

| ISIN: | CH0100837282 |

| Valor: | 100837282 |

| Listed: | Regulated Unofficial Market in Frankfurt, Munich, Stuttgart, Tradegate Exchange; SIX Swiss Exchange |

| EQS News ID: | 2176928 |

| End of Announcement | EQS News Service |

2176928 31-Jul-2025 CET/CEST