NOT TO BE MADE PUBLIC, PUBLISHED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, BELARUS, HONG KONG, JAPAN, CANADA, NEW ZEALAND, RUSSIA, SINGAPORE, SOUTH AFRICA, THE UNITED STATES OF AMERICA, OR ANY OTHER JURISDICTION IN WHICH SUCH ACTIONS, WHOLLY OR IN PART, WOULD BE UNLAWFUL. REFER TO THE SECTION "IMPORTANT INFORMATION" AT THE END OF THIS PRESS RELEASE.

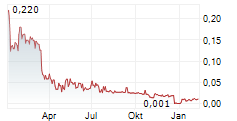

UPPSALA, SE / ACCESS Newswire / August 5, 2025 / Biovica International (STO:BIOVIC-B)(STO:BIOVIC.B)(FRA:9II) - The Board of Directors of Biovica International AB (publ) ("Biovica" or the "Company") announced on 11 June 2025, subject to subsequent approval by an extraordinary general meeting, that the Board of Directors had resolved to carry out a new issue of A-shares and B-shares of approximately SEK 80.1 million with preferential rights for the Company's shareholders (the "Rights Issue"). The Rights Issue was approved by an extraordinary general meeting held on 14 July 2025. The subscription period in the Rights Issue ended on 1 August 2025 and the outcome shows that A-shares and B-shares corresponding to approximately SEK 70 million and approximately 87.5 percent of the Rights Issue have been subscribed for with and without subscription rights. Consequently, approximately 12.5 percent of the Rights Issue is allocated to the parties that have entered into guarantee undertakings, whereby the Rights Issue is subscribed to 100 percent. In accordance with the Company's announcement of the Rights Issue on 11 June 2025, and based on the authorization from the extraordinary general meeting held on 14 July 2025, a directed issue of a total of 66,772,196 B-shares in the Company will - based on the outcome of the Rights Issue - will be carried out to the investors who have entered into guarantee undertakings as so-called top-down guarantors (the "Anchor Investors") to ensure their full allocation in the Rights Issue (the "Oversubscription Option"). The directed share issue will raise an additional approximately SEK 42.1 million, which means that the Company will receive issue proceeds amounting to approximately SEK 122.2 million before deduction of costs attributable to the Share Issue.

Outcome of the Rights Issue

The outcome of the Rights Issue shows that 6,280,755 A-shares and 66,818,479 B-shares, respectively, have been subscribed for with subscription rights. In addition, 1,871,925 A-shares and 36,231,555 B-shares were subscribed for without subscription rights. 15,919,584 B-shares have been allotted to the parties that have entered into top-down guarantee undertakings in the Rights Issue. No allocation has been made to the parties that provided bottom guarantee commitments. The Rights Issue has thus been subscribed to a total of 100 percent and Biovica will receive proceeds of approximately SEK 80.1 million before deduction of costs related to the Rights Issue.

In accordance with the Company's announcement of the Rights Issue on 11 June 2025, and based on the authorization from the extraordinary general meeting on 14 July 2025, a directed issue of a total of 66,772,196 B-shares in the Company will be made to the Anchor Investors to ensure their full allocation in the Rights Issue. The subscription price for B-shares issued under the authorization as well as the terms and conditions for the Oversubscription Option shall, where applicable, correspond to those applicable to the Rights Issue.

The Company has entered into a bridge loan agreement with the largest investor in the guarantee consortium, the Dutch investor HDF Impact BV, of up to SEK 10 million where repayment of the loan and accrued interest shall be made by offsetting the loan against payment for the subscription in accordance with the lender's guarantee undertaking in the Rights Issue.

Furthermore, in accordance with the Company's announcement of the Rights Issue on 11 June 2025 and as resolved by the extraordinary general meeting on 14 July 2025, the Anchor Investors will receive warrants of series TO 4 B through a directed issue as compensation for their top-down guarantee undertakings. The parties that have entered into bottom-up guarantee undertakings will instead receive a cash compensation of eight (8) percent of their respective guaranteed amount.

CEO Comment to the share issue

"We are pleased and proud of the strong participation in the rights issue. The proceeds will strengthen the Company's financial position and enable us to execute on the business plan we have communicated, including key partnership agreements to achieve our stated financial goals. I would like to thank all investors for their trust - both those participating in the rights issue and the anchor investors who laid the foundation for this transaction. Your support helps ensure that DiviTum® TKa reaches cancer patients where it can make a real difference, while also creating value for all our shareholders.", says Anders Rylander, CEO of Biovica.

Share capital and dilution

Through the Rights Issue, after registration of the new shares with the Swedish Companies Registration Office, the Company's share capital will increase by SEK 8,474,819.87, from SEK 6,519,092.27 to SEK 14,993,912.14 and the total number of shares will increase from 97,786,384 to 224,908,682, divided into 14,423,973 A-shares and 210,484,709 B-shares. For existing shareholders who have not participated in the Rights Issue, this means a dilution effect of approximately 58.14 percent of the share capital and approximately 56.52 percent of the number of votes in the Company.

Through the Oversubscription Option, the number of B-shares will increase by an additional 66,772,196 to 277,256,905, and the share capital will increase by an additional SEK 4,451,479.74 to a total of SEK 19,445,391.88, which together with the Rights Issue entails a dilution effect of approximately 67.94 percent of the share capital and approximately 65.58 percent of the number of votes in the Company for existing shareholders who have not participated in the Rights Issue.

Notification of allotment

Those who have subscribed for shares without subscription rights will be allocated shares in accordance with the principles set out in the information document published by the Company on 17 July 2025. Notification of any allotment of shares, subscribed for without preferential rights, will be made by sending an allotment notice in the form of a contract note by e-mail. Payment must be made no later than three (3) banking days after the issue of the contract note. No notification will be given to those who have not received an allotment. If payment is not made in due time, the shares may be transferred to another party. Should the sale price in such transfer be less than the subscription price in the Rights Issue, the person who originally received allotment of these shares may have to pay all or part of the difference. Those who subscribe for shares without preferential rights through their nominee will receive notification of subscription in accordance with their nominee's procedures.

Advisors

Zonda Partners AB acts as Sole Global Coordinator and Bookrunner in connection with the Rights Issue. Baker McKenzie acts as legal adviser to Biovica in connection with the Rights Issue.

For more information, please contact:

Anders Rylander, VD

M: +46 76 666 16 47

E: anders.rylander@biovica.com

Anders Morén, CFO

M: +46 73 125 92 46

E: anders.moren@biovica.com

About Biovica

Biovica develops and commercializes blood-based biomarker assays that help oncologists monitor cancer progression. Biovica's assay, DiviTum® TKa, measures cell proliferation by detecting the TKa biomarker in the bloodstream. The assay has demonstrated its ability to provide insight to therapy effectiveness in several clinical trials. The first application for the DiviTum® TKa test is treatment monitoring of patients with metastatic breast cancer. Biovica's vision is: "Improved care for cancer patients." Biovica collaborates with world-leading cancer institutes and pharmaceutical companies. DiviTum® TKa has received FDA 510(k) clearance in the US and is CE-marked in the EU. Biovica's shares are traded on the Nasdaq First North Premier Growth Market (BIOVIC B). FNCA Sweden AB is the company's Certified Adviser. For more information, please visit: www.biovica.com.

IMPORTANT INFORMATION

The release, announcement or distribution of this press release may, in certain jurisdictions, be subject to legal restrictions. The recipients of this press release in jurisdictions where this press release has been published or distributed shall inform themselves of and follow such legal restrictions. The recipient of this press release is responsible for using this press release, and the information contained herein, in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer, or a solicitation of any offer, to buy or subscribe for any securities in Biovica in any jurisdiction, neither from Biovica nor from someone else.

This press release is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the "Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. No prospectus will be prepared in connection with the Rights Issue. The Company has prepared a disclosure document in the form prescribed by Regulation (EU) 2024/2809 ("Listing Act") Annex IX that is available at the Company's website.

This press release does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the Company. The information contained in this announcement relating to the Rights Issue is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this press release or its accuracy or completeness. Zonda Partners AB are acting for Biovica in connection with the Rights Issue and no one else and will not be responsible to anyone other than Biovica for providing the protections afforded to its clients nor for giving advice in relation to the Rights Issue or any other matter referred to herein. Zonda Partners AB are not liable to anyone else for providing the protection provided to their customers or for providing advice in connection with the Rights Issue or anything else mentioned herein.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public Rights Issue of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the USA, Australia, Belarus, Canada, Hong Kong, Japan, New Zeeland, Russia, Singapore, South Africa, South Korea, Switzerland or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this press release and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this press release relates is available only to, and will be engaged in only with, "qualified investors" who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

Please note that an investment in the Company is subject to regulation under the Foreign Direct Investment Act (2023:560), which requires investors, under certain conditions, to notify and obtain approval from the Swedish Inspectorate for Strategic Products. Investors should make their own assessment of whether a notification obligation exists before making any investment decision regarding the Rights Issue.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, beliefs, or current expectations about and targets for the Company's and the group's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company and the group operates. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors and readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of its date and are subject to change without notice. Neither the Company nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release.

Information to distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the "MiFID II Product Governance Requirements"), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any "manufacturer" (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the offered shares have been subject to a product approval process, which has determined that such shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors should note that: the price of the shares in the Company may decline and investors could lose all or part of their investment; the shares in the Company offer no guaranteed income and no capital protection; and an investment in the shares in the Company is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Rights Issue.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares in the Company.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares in the Company and determining appropriate distribution channels.

Contact

Anders Rylander, CEO

Phone: +46 76 666 16 47

E-mail: anders.rylander@biovica.com

Anders Morén, CFO

Phone: +46 73 125 92 46

E-mail: anders.moren@biovica.com

Biovica - Treatment decisions with greater confidence

Biovica develops and commercializes blood-based biomarker assays that help oncologists monitor cancer progression. Biovica's assay, DiviTum® TKa, measures cell proliferation by detecting the TKa biomarker in the bloodstream. The assay has demonstrated its ability to provide insight to therapy effectiveness in several clinical trials. The first application for the DiviTum® TKa test is treatment monitoring of patients with metastatic breast cancer. Biovica's vision is: "Improved care for cancer patients." Biovica collaborates with world-leading cancer institutes and pharmaceutical companies. DiviTum® TKa has received FDA 510(k) clearance in the US and is CE-marked in the EU. Biovica's shares are traded on the Nasdaq First North Premier Growth Market (BIOVIC B). FNCA Sweden AB is the company's Certified Adviser. For more information, please visit: www.biovica.com

This information is information that Biovica International is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-08-05 14:00 CEST.

Attachments

Biovica announces outcome of rights issue

SOURCE: Biovica International

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/biotechnology/biovica-announces-outcome-of-rights-issue-1056607