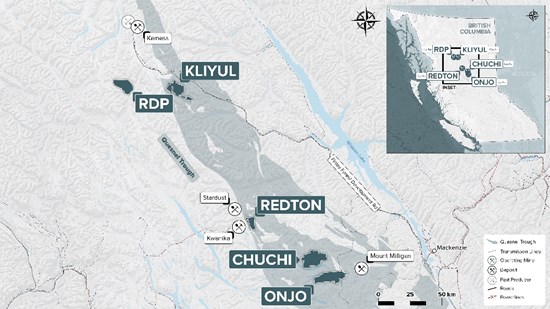

Vancouver, British Columbia--(Newsfile Corp. - August 5, 2025) - Pacific Ridge Exploration Ltd. (TSXV: PEX) (OTCQB: PEXZF) (FSE: PQW) ("Pacific Ridge" or the "Company") is pleased to announce the initial mineral resource estimate ("MRE") for the Kliyul Main Zone ("KMZ"), just one target area at its 100% owned Kliyul copper-gold project ("Kliyul"), located in the prolific Quesnel terrane in Northcentral B.C. (see Figures 1 and 2).

Highlights

The KMZ MRE compares favourably with other recently reported MREs for B.C. porphyry deposits; it was also delineated from just one mineralized zone.

KMZ hosts 334.1 million tonnes ("Mt") grading 0.33% copper equivalent ("CuEq"), 0.15% copper, 0.26 g/t gold, and 0.95 g/t silver in the Inferred Mineral Resource category (see Table 1).

2.42 billion pounds CuEq which includes 1.11 billion pounds of copper, 2.74 million ounces of gold and 10.22 million ounces of silver in the Inferred Mineral Resource category (see Table 1).

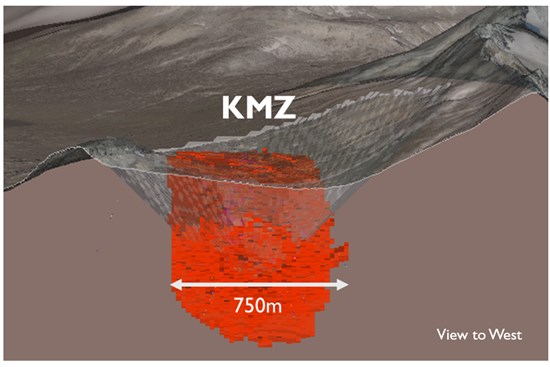

Mineralization at KMZ remains open for expansion within and beyond the resource reporting shell used to restrict the resource model (see Figure 3).

"The initial mineral resource estimate for KMZ is an important milestone for the Company and its shareholders," said Blaine Monaghan, President & CEO of Pacific Ridge. "We now belong to a select group of B.C. copper exploration and development companies that have a significant mineral resource. I am confident that once investors compare the KMZ resource to those of our peers, they will recognize the value that Pacific Ridge currently represents."

Figure 1: Location of Kliyul and Pacific Ridge's Other Porphyry Copper-Gold Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/261284_a65791729499c9d5_001full.jpg

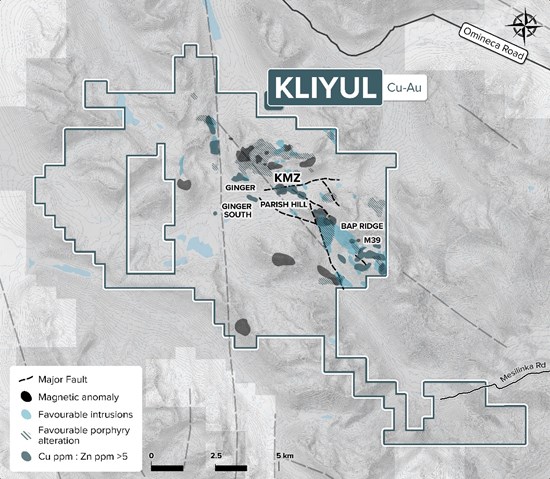

Figure 2: Kliyul Target Areas

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/261284_a65791729499c9d5_002full.jpg

Table 1

KMZ MRE (CuEq)

| Cutoff (CuEq%) | Tonnes | CuEq% | Cu% | Au g/t | Ag g/t | CuEq Mlbs | Cu Mlbs | Au Oz | Ag Oz |

| 0.15 | 383,300,000 | 0.31 | 0.14 | 0.24 | 0.91 | 2,615 | 1,212 | 2,920,000 | 11,270,000 |

| 0.20 | 334,100,000 | 0.33 | 0.15 | 0.26 | 0.95 | 2,422 | 1,110 | 2,740,000 | 10,220,000 |

| 0.25 | 239,200,000 | 0.37 | 0.16 | 0.30 | 1.04 | 1,950 | 861 | 2,280,000 | 7,980,000 |

Notes for Table 1

- The effective date of the Mineral Resource estimate is July 31, 2025.

- The Mineral Resource was estimated using the Canadian Institute of Mining, Metallurgy and Petroleum(CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

- There has been no metallurgical testing on Kliyul mineralization. The Company estimates copper recoveries (CuR) of 80%, gold recoveries (AuR) of 65%, and silver recoveries (AgR) of 65% based on the reported recoveries from Mount Milligan.

- The mineral resource is constrained within a pit shell using metal recoveries of Cu 80%, Au 65% and Ag 65%, an exchange rate of 1.30 CAD:USD, mining cost of C$3.5/t, process cost of C$7.0/t, G&A costs of C$3.0/t, pit slopes of 45 degrees and metal prices of $Cu = US$4.60/lb, $Au = US$2,600/oz., Ag = US$30.00/oz. A fixed bulk density of 2.77 t/m3 was used for the estimation of tonnes.

- CuEq = Cu% + (0.6697*Au g/t) + (0.0077*Ag g/t).

- Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne.

- The CIM definitions were followed for the classification of Inferred Mineral Resources. inferred blocks were assigned for blocks with one drill hole within 150 m.

- Mineral Resources are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

Figure 3

KMZ Pit Shell and Unconstrained Block Model at a 0.20% CuEq Cutoff

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/261284_a65791729499c9d5_003full.jpg

Next Steps

- File a NI 43-101 Technical Report for the KMZ MRE within 45 days of this press release.

- Infill drilling and resource expansion drilling at KMZ; drill testing other Kliyul target areas.

- Metallurgical test work.

Kliyul Highlights

- 100% owned by Pacific Ridge, the Company has invested more than ~$14.0 million and drilled more than 19,000 m at Kliyul since 2020.

- Kliyul is over 90 km2 in size and is located in the prolific Quesnel terrane close to existing infrastructure, ~8 km to the Omineca Resource Road and a 230 kV high-voltage power line.

- A six-kilometre long porphyry copper-gold trend, comprised of favourable geology, geochemistry, alteration, and geophysics, exists at Kliyul but KMZ has been the focus since 2021.

- Drilling by Pacific Ridge has increased the mineralized extents of KMZ tenfold. Pre-2021, the mineralized extents measured ~350 m E-W x ~150 m N-S x ~400 m vertical depth. After the last round of drilling, the known mineralized extents measure ~760 m E-W x ~600 m N-S x ~650 m vertical depth. KMZ remains open to the North, West, East, Southeast, and at depth.

- The best drilling result in 2021 was 316.7 m of 0.79% CuEq1 and 1.17 g/t AuEq2 (0.30% copper, 0.70 g/t gold and 2.17 g/t silver) within 566.7 m of 0.51% CuEq1 or 0.75 g/t AuEq2 (0.20% copper, 0.44 g/t gold and 1.39 g/t silver) from KLI-21-037 (see news release dated January 31, 2022).

- The best drilling result in 2022 was 328.0 m of 0.64% CuEq1 or 0.95 g/t AuEq2 (0.25% copper and 0.57 g/t gold) within 526 m of 0.49% CuEq1 or 0.74 g/t AuEq2 (0.25% copper, 0.57 g/t gold and 1.25 g/t silver) from KLI-22-050 (see news release January 18, 2023).

- The best drilling result in 2023 was 305.5 m of 0.59% CuEq1 or 0.87 g/t AuEq2 (0.23% copper, 0.51 g/t gold and 1.22 g/t Ag) within 540.3 m of 0.44% CuEq1 or 0.65 g/t AuEq2 (0.19% copper, 0.36 g/t gold and 0.65 g/t silver) from KLI-23-054 (see news release August 23, 2023).

- Drill hole KLI-23-069, the last hole of the 2023 drilling program, returned 45.0 m of 0.58% CuEq or 0.86 g/t AuEq (0.38% copper, 0.28 g/t gold, and 2.20 g/t silver) within 570.0 m of 0.27% CuEq or 0.40 g/t AuEq (0.14% copper, 0.18 g/t gold, and 0.99 g/t silver)(see news release dated January 9, 2024). The 45 m interval, at 584 m downhole depth, is the deepest mineralized interval ever encountered at Kliyul and provides a northward and down-plunge vector for a higher-grade porphyry centre at KMZ.

- Results of a 2024 ZTEM survey suggest that most of the KMZ porphyry system remains hidden and untested to the north.

1CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Cu x 22.0462).

2AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Commodity prices: $Cu = US$3.25/lb, $Au = US$1,800/oz., and Ag = US$20.00/oz.

There has been no metallurgical testing on Kliyul mineralization. The Company estimates copper recoveries (CuR) of 84%, gold recoveries (AuR) of 70%, and silver recoveries (AgR) of 65% based on the average recoveries from Kemess Underground, Mount Milligan, and Red Chris.

Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne.

The technical information contained within the Kliyul Highlights section has been prepared under the supervision of, and reviewed and approved by. Danette Schwab, P.Geo., Vice President Exploration of the Company, and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Estimation Methods

The mineral resource estimate was completed using HxGN MinePlanTM 3D software and includes the estimation of copper, gold and silver grades into a block model (20x20x20 m) using ordinary kriged (OK) method within a 0.1 g/t Au probability shell. Composites from a minimum of two drill holes was required for a block to be interpolated with a metal grade.

Prior to estimating block grades, potentially anomalous outlier grades were identified and their influence on the grade model was controlled during interpolation through outlier restriction method. The 2 m composites were reviewed for each metal and a restricted outlier strategy was employed to limit the influence of extreme metal grades to 60 m from a composite location. The threshold grade for gold was 4.5 g/t, 1% for copper and 10 g/t for silver.

A base case resource constraining pitshell was built using HxGN MinePlanTM 3D and inputs of metal prices (US$2600/oz Au, US$4.60/lb Cu and US$30/oz Ag), metal recoveries (80% Cu, 65% Au and 65% Ag), mining costs of C$3.50/t, processing costs of C$7.0/t, G&A costs of C$3.0/t and pit slopes of 45°. To assess the sensitivity to metal prices, additional shells were built using gold prices between US$2000/oz and US$3200/oz, and additional copper price of C$4.10/lb and silver price of C$24.00/oz.

Inferred Mineral Resources were assigned if a block was within 150 m of a drill hole.

Qualified Person

The mineral resource estimate was completed by Susan Lomas, P.Geo. of Lions Gate Geological Consulting Inc. with assistance from Bruce Davis, PhD, FAusIMM, each of whom is an Independent Qualified Person under NI43-101 standards.

The technical information related to the mineral resource estimate in this news release has been reviewed and approved by independent QP Susan Lomas, P.Geo.

LGGC completed an audit of the project drill hole database, a review of the QAQC data for the assay results and a visit to the project site and determined the drill hole data to be of sufficient quality to support the estimation of mineral resources.

About Pacific Ridge

A Fiore Group company, Pacific Ridge's goal is to become British Columbia's leading copper exploration company. The Kliyul copper-gold project, located in the prolific Quesnel terrane close to existing infrastructure, is the Company's flagship project. In addition to Kliyul, Pacific Ridge's project portfolio includes the RDP copper-gold project, the Chuchi copper-gold project, the Onjo copper-gold project, and the Redton copper-gold project, all located in B.C. The Company would like to acknowledge that its B.C. projects are in the traditional, ancestral and unceded territories of the Gitxsan Nation, McLeod Lake Indian Band, Nak'azdli Whut'en, Takla Nation, and Tsay Keh Dene Nation.

On behalf of the Board of Directors,

"Blaine Monaghan"

Blaine Monaghan

President & CEO

Pacific Ridge Exploration Ltd.

Investor Relations:

Tel: (604) 687-4951

Email: ir@pacificridgeexploration.com

Website: www.pacificridgeexploration.com

News Sign up: https://pacificridgeexploration.com/contact/subscribe/

LinkedIn: https://www.linkedin.com/company/pacific-ridge-exploration-ltd-pex-/

Twitter: https://twitter.com/PacRidge_PEX

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information: This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, which address exploration drilling and other activities and events or developments that Pacific Ridge Exploration Ltd. ("Pacific Ridge") expects to occur, are forward-looking statements. Forward-looking statements in this news release include the filing of the NI 43-101 report, infill drilling and resource expansion drilling at KMZ, drill testing other Kliyul target areas, and metallurgical test work. Although Pacific Ridge believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, that one of the options will be exercised, the ability of Pacific Ridge and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Pacific Ridge's proposed programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Pacific Ridge does not assume any obligation to update or revise its forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261284

SOURCE: Pacific Ridge Exploration Ltd.