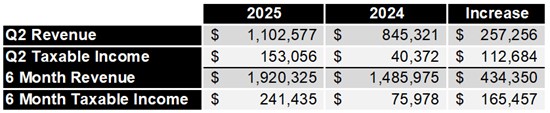

Second quarter revenue $1,102,577, up 30% year over year

Second quarter taxable income $153,056 up $112,684 year over year

Jersey City, New Jersey--(Newsfile Corp. - August 6, 2025) - EQUATOR Beverage Company (OTCQB: MOJO), reports its financial results for the quarter ended June 30, 2025. The form 10-Q was filed on August 6th with the United States Securities and Exchange Commission.

Second Quarter 2025 Financial Highlights

Revenue increased 30% year over year to $1,102,577, compared to $845,321 in Q2 2024, driven by increased shelf presence, new points of distribution, and sustained demand across retail and digital channels.

Gross Profit rose to $472,887, up from $342,483 in the prior year period.

Gross Margin improved to 43%, up from 40% in Q2 2024, reflecting operating leverage and improved product mix.

Taxable Income surged to $153,056, a near fourfold increase over $40,372 in Q2 2024.

Year-to-Date and Trailing Twelve Month Performance

Revenue for the first six months of 2025 totaled $1,920,325, up 29% from $1,485,975 in the same period last year.

Taxable Income for the first half reached $241,435, compared to $75,978 in the prior-year period.

Trailing Twelve Month Revenue was $3,681,266, representing a 38% increase from $2,670,134 year-over-year.

July 2025 Revenue was $491,391, up 27% compared to last year. Also, orders for the first week of August have been strong.

Share Repurchase Program and Capital Structure Update

During Q2 2025, EQUATOR repurchased 150,000 shares of its outstanding common stock, bringing total repurchases to date to 1,868,934 shares. The Company remains committed to its ongoing share buyback program, reflecting confidence in long-term value creation and its current valuation relative to fundamentals. We are expecting to purchase more shares during this quarter. The Company's goal is to purchase over 150,000 shares during the third quarter.

On June 24, 2025, the Board of Directors and a majority of voting shareholders approved a 1-for-2 reverse stock split of EQUATOR's common stock. The Company will also reduce its authorized shares from 20,000,000 to 10,000,000, subject to FINRA review and approval. Based on the progress with FINRA we expect the reverse split to be completed soon.

Forward-Looking Statements

This press release contains forward-looking statements within the definition of Section 27A of the Securities Act of 1933, as amended and such section 21E of the Securities Act of 1934, amended. These forward-looking statements should not be used to make an investment decision. The words 'estimate,' 'possible' and 'seeking' and similar expressions identify forward-looking statements, which speak only as to the date the statement was made. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect of government regulation, competition and other material risk.

Information: www.equatorbeverage.com

Glenn Simpson

Chairman & CEO

EQUATOR Beverage Company

glennsimpson@equatorbeverage.com

917 574 1690

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261487

SOURCE: EQUATOR Beverage Company