Readers are advised to review the "Non-GAAP and Other Financial Measures" section of this press release for information regarding the presentation of financial measures that do not have standardized meaning under IFRS® Accounting Standards. Readers are also advised to review the "Forward-Looking Information" section in this press release for information regarding certain forward-looking information and forward-looking statements contained in this press release. All amounts in this press release are stated in Canadian dollars unless otherwise specified.

The Company holds a 75% working interest in the Hangingstone Expansion Facility (the "Expansion Asset") and a 100% working interest in the Hangingstone Demonstration Facility (the "Demo Asset" and, together with the Expansion Asset, the "Hangingstone Facilities"). Unless indicated otherwise, production volumes and per unit statistics are presented throughout this press release on a "gross" basis as determined in accordance with National Instrument 51-101 - Standards for Disclosure for Oil and Gas Activities, which is the Company's gross working interest basis before deduction of royalties.

Calgary, Alberta--(Newsfile Corp. - August 6, 2025) - Greenfire Resources Ltd. (NYSE: GFR) (TSX: GFR) ("Greenfire" or the "Company"), today reported its operating and financial results thereto for the quarter ended June 30, 2025 ("Q2 2025"). The unaudited condensed interim consolidated financial statements and notes for the three and six months ended June 30, 2025 and 2024, as well as the related Management's Discussion and Analysis ("MD&A"), will be available on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov/edgar and on Greenfire's website at www.greenfireres.com.

Q2 2025 Highlights

- Bitumen production of 15,748 bbls/d

- Cash provided by operating activities of $17.7 million and Adjusted funds flow(1) of $33.8 million

- Capital expenditures(2) of $10.8 million

- Adjusted free cash flow(1) of $23.0 million

Financial & Operating Highlights

| Three Months Ended | |||||||||

| ($ thousands, unless otherwise indicated) | June 30, 2025 | June 30, 2024 | March 31, 2025 | ||||||

| WTI (US$/bbl) | 63.74 | 80.57 | 71.42 | ||||||

| WCS differential to WTI (US$/bbl) | (10.27 | ) | (13.61 | ) | (12.67 | ) | |||

| WCS Hardisty (US$/bbl) | 53.47 | 66.96 | 58.75 | ||||||

| Average FX Rate (C$/US$) | 1.3840 | 1.3684 | 1.4348 | ||||||

| Bitumen production (bbls/d) | 15,748 | 18,993 | 17,495 | ||||||

| Oil sales | 144,542 | 219,444 | 183,637 | ||||||

| Royalties | (3,932 | ) | (9,919 | ) | (6,824 | ) | |||

| Realized gains (losses) on risk management contracts | 9,823 | (13,798 | ) | (1,101 | ) | ||||

| Diluent expense | (56,290 | ) | (84,545 | ) | (73,994 | ) | |||

| Transportation and marketing | (12,415 | ) | (13,313 | ) | (14,185 | ) | |||

| Operating expenses | (31,823 | ) | (34,997 | ) | (37,929 | ) | |||

| Operating netback(1) | 49,905 | 62,872 | 49,604 | ||||||

| Operating netback(1) ($/bbl) | 35.06 | 36.68 | 31.67 | ||||||

| Net income and comprehensive income | 48,730 | 30,848 | 16,163 | ||||||

| Cash provided by operating activities | 17,732 | 85,163 | 34,673 | ||||||

| Adjusted funds flow(1) | 33,843 | 47,207 | 31,444 | ||||||

| Capital expenditures(2) | (10,840 | ) | (23,009 | ) | (26,299 | ) | |||

| Adjusted free cash flow(1) | 23,003 | 24,198 | 5,145 | ||||||

| Cash and cash equivalents | 69,980 | 159,977 | 72,238 | ||||||

| Available credit facilities(3) | 50,000 | 50,000 | 50,000 | ||||||

| Net debt(1) | (216,001 | ) | (283,025 | ) | (253,111 | ) | |||

| Common shares ('000 of shares) | 70,252 | 69,276 | 69,922 | ||||||

(1) Non-GAAP measures without a standardized meaning under IFRS. Refer to the "Non-GAAP and Other Financial Measures" section in this press release.

(2) Supplementary financial measure. Refer to the "Non-GAAP and Other Financial Measures" section of this press release.

(3) The Company had $50.0 million available under the Senior Credit Facility, with no amounts drawn as at June 30, 2025, June 30, 2024, or March 31, 2025.

Q2 2025 Review

Greenfire's average production for Q2 2025 was 15,748 bbls/d, representing a 10% decrease from Q1 2025 and below 18,993 bbls/d reported in Q2 2024.

Expansion Asset: Production in Q2 2025 was 10,105 bbls/d, reflecting a 20% decrease from the previous quarter. This reduction was primarily attributed to downtime associated with the previously disclosed failure of one of the four steam generators at the Expansion Asset.

Demo Asset: Production in Q2 2025 was 5,643 bbls/d, representing a 16% increase from the previous quarter. This growth was driven by the optimization of base well performance.

Hangingstone Facilities: Bitumen Production Results

| (bbls/d) | Q2 2025 | Q2 2024 | Q1 2025 | ||||||

| Expansion Asset | 10,105 | 15,824 | 12,613 | ||||||

| Demo Asset | 5,643 | 3,169 | 4,882 | ||||||

| Consolidated | 15,748 | 18,993 | 17,495 |

Capital expenditures for Q2 2025 totaled $10.8 million, compared to $23.0 million in the same period of the prior year. Adjusted free cash flow was $23.0 million for Q2 2025, compared to $24.2 million in Q2 2024.

Operational Update

Production and Steam Generation Updates

Greenfire's July 2025 corporate production was approximately 16,000 bbls/d. The Company's production continues to be affected by the previously disclosed failure of one of the four steam generators at the Expansion Asset, resulting in an estimated production impact of 1,500 to 2,250 bbls/d. Full steam capacity is expected to be restored by year-end 2025.

Regulatory Engagement and Installation of Sulphur Removal Facilities

Greenfire continues to engage with the Alberta Energy Regulator (the "AER") regarding previously disclosed sulphur dioxide emissions that exceed regulatory limits at the Expansion Asset. To support a timely return to compliance, Greenfire has ordered sulphur removal facilities, which are scheduled for installation and commissioning in Q4 2025. Management expects these facilities will restore emissions compliance at a total estimated cost of $11.3 million (previously $15.0 million).

Progress Update on Future Development Plans

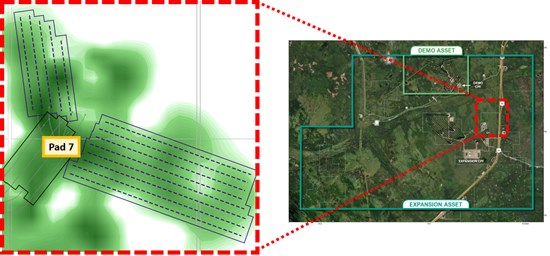

During the second quarter of 2025, Greenfire refined its proposed development plan and operational strategies at the Hangingstone Facilities. The proposed development plan includes a new SAGD well pad ("Pad 7"), consisting of 13 well-pairs, located northeast of the Expansion Asset's Central Processing Facility (the "Expansion CPF") and directly adjacent to existing production (see Exhibit 1). Greenfire has secured a drilling rig, with drilling operations expected to begin in Q4 2025 and first oil production anticipated in Q4 2026.

Exhibit 1: Expansion Asset - Pad 7 Development Plan

- Pad 7 surface facility (orange), drainage boxes and horizonal well locations (purple)

Exhibit 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8345/261602_99f7644b443f9978_001full.jpg

Greenfire continues to evaluate further development opportunities at the Hangingstone Facilities, including drilling additional well pairs southeast of the Expansion CPF and optimization opportunities at the Demo Asset to sustain current production rates.

2025 Outlook

Greenfire's board of directors has approved a 2025 capital budget of $130 million, with an anticipated 2025 annual production range of 15,000 to 16,000 bbls/d. The budget is evenly allocated between sustaining and growth initiatives. Sustaining initiatives include the restoration of the steam generator and the installation of sulphur removal facilities at the Expansion Asset. Growth initiatives are focused on the development of Pad 7, with drilling operations scheduled to commence in the fourth quarter of 2025.

Hedges

Greenfire has WTI hedges in place for 9,450 bbls/d at approximately $100.90 per barrel through 2025. For the WCS Hardisty differential, the Company has secured hedges for 12,600 bbl/d for Q3 2025 at US$10.90/bbl and 12,600 bbl/d for Q4 2025 at US$13.50/bbl. The Company will continue to assess market conditions to identify potential additional hedging opportunities.

Conference Call Details

Greenfire plans to host a conference call on Thursday, August 7, 2025 at 7:00 a.m. Mountain Time (9:00 a.m. Eastern Time), during which members of the Company's executive team will discuss its Q2 2025 results as well as host a question-and-answer session with research analysts.

- Date: Thursday, August 7, 2025

- Time: 7:00 a.m. Mountain Time (9:00 a.m. Eastern Time)

- Webcast Link: https://www.gowebcasting.com/14109

- Dial In: 1-833-752-3499 or 1-647-846-7280

- Participant instructions: Please ask the operator to join the Greenfire Resources Ltd. call.

About Greenfire

Greenfire is an oil sands producer actively developing its long-life and low-decline thermal oil assets in the Athabasca region of Alberta, Canada, with its registered offices in Calgary, Alberta. The Company plans to leverage its large resource base and significant infrastructure in place to drive meaningful, capital-efficient production growth. As part of the Company's commitment to operational excellence, safe and reliable operations remain a top priority for Greenfire. Greenfire common shares are listed on the New York Stock Exchange and Toronto Stock Exchange under the trading symbol "GFR". For more information, visit greenfireres.com or find Greenfire on LinkedIn and X.

Non-GAAP and Other Financial Measures

Certain financial measures in this press release are non-GAAP financial measures or ratios. These measures do not have a standardized meaning under IFRS Accounting Standards and therefore may not be comparable to similar measures provided by other companies. These non-GAAP measures should not be considered in isolation or as an alternative for measures of performance prepared in accordance with IFRS Accounting Standards. This press release also contains supplementary financial measures.

Non-GAAP financial measures and ratios include operating netback, adjusted funds flow, adjusted free cash flow, net debt and per barrel figures associated with such non-GAAP financial measures. Supplementary financial measures and ratios include gross profit, capital expenditures, and depletion.

Non-GAAP Financial Measures

Operating Netback (including per barrel ($/bbl)) Gross profit (loss) is the most directly comparable GAAP measure to operating netback which is a non-GAAP measure. Operating netback is further adjusted for realized gain (loss) on risk management contracts, as appropriate. Operating netback per barrel ($/bbl) is calculated by dividing operating netback by the Company's total bitumen sales volume in a specified period. When Operating netback is expressed on a per barrel basis, it is a non-GAAP ratio. Operating netback is a financial measure widely used in the oil and gas industry as a supplementary measure of a company's efficiency and ability to generate cash flow for debt repayments, capital expenditures, or other uses.

The following table is a reconciliation of gross profit (loss) to operating netback:

| Three Months Ended | |||||||||

| June 30, | June 30, | March 31, | |||||||

| ($ thousands, unless otherwise noted) | 2025 | 2024 | 2025 | ||||||

| Gross profit (loss)(1) | 55,829 | 58,581 | 34,392 | ||||||

| Depletion(1) | 19,915 | 17,130 | 21,561 | ||||||

| Gain (loss) on risk management contracts | (35,662 | ) | 959 | (5,248 | ) | ||||

| Operating netback, excluding realized gain (loss) on risk management contracts | 40,082 | 76,670 | 50,705 | ||||||

| Realized gain (loss) on risk management contracts | (9,823 | ) | (13,798 | ) | (1,101 | ) | |||

| Operating netback | 49,905 | 62,872 | 49,604 | ||||||

| Operating netback ($/bbl) | 35.06 | 36.68 | 31.67 | ||||||

(1) Supplementary financial measure.

Adjusted Funds Flow and Adjusted Free Cash Flow

Cash provided by operating activities is the most directly comparable GAAP measure for adjusted funds flow, which is a non-GAAP measure. This measure is not intended to represent cash provided by operating activities calculated in accordance with IFRS Accounting Standards.

The adjusted funds flow measure allows management and others to evaluate the Company's ability to fund its capital programs and meet its ongoing financial obligations using cash flow internally generated from ongoing operating related activities. We compute adjusted funds flow as cash provided by operating activities, excluding the impact of changes in non-cash working capital, less transaction costs and transactions considered non-recurring in nature or outside of normal business operations.

Cash provided by operating activities is the most directly comparable GAAP measure for adjusted free cash flow, which is a non-GAAP measure. Management uses adjusted free cash flow as an indicator of the efficiency and liquidity of its business, measuring its funds after capital investment that are available to manage debt levels and return capital to shareholders. By removing the impact of current period property, plant and equipment expenditures from adjusted free cash flow, management monitors its adjusted free cash flow to inform its capital allocation decisions. We compute adjusted free cash flow as cash provided by operating activities, excluding the impact of changes in non-cash working capital, less transaction costs, transactions considered non-recurring in nature or outside of normal business operations, property, plant and equipment expenditures and acquisition costs.

The following table is a reconciliation of cash provided by operating activities to adjusted funds flow and adjusted free cashflow:

| Three Months Ended | |||||||||

| June 30, | June 30, | March 31, | |||||||

| ($ thousands) | 2025 | 2024 | 2025 | ||||||

| Cash provided by operating activities | 17,732 | 85,163 | 34,673 | ||||||

| Non-recurring transactions(1) | - | - | 1,853 | ||||||

| Changes in non-cash working capital | 16,111 | (37,956 | ) | (5,082 | ) | ||||

| Adjusted funds flow | 33,843 | 47,207 | 31,444 | ||||||

| Property, plant and equipment expenditures | (10,840 | ) | (21,824 | ) | (26,299 | ) | |||

| Acquisitions | - | (1,185 | ) | - | |||||

| Adjusted free cash flow | 23,003 | 24,198 | 5,145 | ||||||

(1) Non-recurring transactions relate to a terminated shareholder rights plan and the evaluation of strategic alternatives.

Net Debt

The table below reconciles long-term debt to net debt.

| As at | June 30, | June 30, | March 31, | ||||||

| ($ thousands) | 2025 | 2024 | 2025 | ||||||

| Long-term debt | (309,641 | ) | (275,452 | ) | (317,432 | ) | |||

| Current assets | 187,689 | 204,785 | 153,150 | ||||||

| Current liabilities | (66,565 | ) | (264,365 | ) | (93,036 | ) | |||

| Current portion of risk management contracts | (31,940 | ) | 26,315 | (6,101 | ) | ||||

| Current portion of warrant liability | 4,456 | 25,692 | 10,308 | ||||||

| Net debt | (216,001 | ) | (283,025 | ) | (253,111 | ) |

Net debt is a non-GAAP measure. Long-term debt is a GAAP measure that is the most directly comparable financial statement measure to net debt. Net debt is comprised of long-term debt, adjusted for current assets and current liabilities on the Company's balance sheet, and excludes the current portions of risk management contracts and warranty liability. Management uses net debt to monitor the Company's current financial position and to evaluate existing sources of liquidity. Net debt is used to estimate future liquidity and whether additional sources of capital are required to fund planned operations.

Supplementary Financial Measures

Depletion

The term "depletion" or "depletion expense" is the portion of depletion and depreciation expense reflecting the cost of development and extraction of the Company's bitumen reserves.

Gross Profit (Loss)

Gross profit (loss) is a supplementary financial measure prepared on a consistent basis with IFRS Accounting Standards. Greenfire uses gross profit (loss) to assess its core operating performance before considering other expenses such as general and administrative costs, financing costs, and income taxes. Gross profit (loss) is calculated as oil sales, net of royalties, plus gains on risk management contracts, less losses on risk management contracts, diluent expense, operating expense, depletion expense on the Company's operating assets, transportation expenses and marketing expenses.

Management believes that gross profit (loss) provides investors, analysts, and other stakeholders with useful insight into the Company's ability to generate profitability from its core operations before non-operating expenses.

| Three Months Ended | |||||||||

| June 30, | June 30, | March 31, | |||||||

| ($ thousands) | 2025 | 2024 | 2025 | ||||||

| Oil sales, net of royalties | 140,610 | 209,525 | 176,813 | ||||||

| Gain (loss) on risk management contracts | 35,662 | (959 | ) | 5,248 | |||||

| 176,272 | 208,566 | 182,061 | |||||||

| Diluent expense | (56,290 | ) | (84,545 | ) | (73,994 | ) | |||

| Transportation and marketing | (12,415 | ) | (13,313 | ) | (14,185 | ) | |||

| Operating expenses | (31,823 | ) | (34,997 | ) | (37,929 | ) | |||

| Depletion | (19,915 | ) | (17,130 | ) | (21,561 | ) | |||

| Gross profit (loss) | 55,829 | 58,581 | 34,392 | ||||||

Capital Expenditures

Capital expenditures is a supplementary financial measure prepared on a consistent basis with IFRS Accounting Standards. Greenfire uses capital expenditures to monitor the cash flows it invests into property, plant and equipment. Capital expenditures is derived from the statement of cash flows and includes property, plant and equipment expenditures and acquisitions.

Management believes that capital expenditures provides investors, analysts and other stakeholders with a useful insight into the Company's investments into property, plant and equipment.

| Three Months Ended | |||||||||

| June 30, | June 30, | March 31, | |||||||

| ($ thousands) | 2025 | 2024 | 2025 | ||||||

| Property, plant and equipment expenditures | 10,840 | 28,124 | 26,299 | ||||||

| Acquisitions | - | 1,185 | - | ||||||

| Capital expenditures | 10,840 | 23,009 | 26,299 | ||||||

Forward-Looking Information

This press release contains forward-looking information and forward-looking statements (collectively, "forward-looking information") within the meaning of applicable securities laws. The forward-looking information in this press release is based on Greenfire's current internal expectations, estimates, projections, assumptions, and beliefs. Such forward-looking information is not a guarantee of future performance and involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. The Company believes the material factors, expectations and assumptions reflected in the forward-looking information are reasonable as of the time of such information, but no assurance can be given that these factors, expectations and assumptions will prove to be correct, and such forward-looking information included in this press release should not be unduly relied upon.

The use of any of the words "expect", "target", "anticipate", "intend", "estimate", "objective", "ongoing", "may", "will", "project", "believe", "depends", "could" and similar expressions are intended to identify forward-looking information. In particular, but without limiting the generality of the foregoing, this press release contains forward-looking information pertaining to the following: the expected timing for the restoration of full steam capacity at the Expansion Asset; Greenfire's discussions with the AER regarding previously disclosed sulphur dioxide emissions exceedance, including the expected timing of installation and commissioning of a sulphur recovery unit and that this initiative will effectively restore compliance with sulphur dioxide emissions requirements at the Expansion Asset; Greenfire's plans including development and construction around the Expansion CPF and the anticipated timing and costs thereof; the 2025 Outlook, including the Company's capital budget and the anticipated allocation thereof, and the Company's production guidance; development plans for a new SAGD pad; development plans, capital expenditures and operational strategies for the Expansion Asset and the Demo Asset; that the Company will continue to assess market conditions to identify potential additional hedging opportunities; and statements relating to the business and future activities of the Company after the date of this press release.

Management approved the capital budget and production guidance contained herein as of the date of this press release. The purpose of the capital budget and production guidance is to assist readers in understanding the Company's expected and targeted financial position and performance, and this information may not be appropriate for other purposes.

Forward-looking information in this press release relating to oil and gas exploration, development and production, and management's general expectations relating to the oil and gas industry are based on estimates prepared by management using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of the industry which management believes to be reasonable. Although generally indicative of relative market positions, market shares and performance characteristics, this data is inherently imprecise. Management is not aware of any misstatements regarding any industry data presented in press release.

All forward-looking information reflects Greenfire's beliefs and assumptions based on information available at the time the applicable forward-looking information is disclosed and in light of the Company's current expectations with respect to such matters as: the success of Greenfire's operations and growth and expansion projects; expectations regarding production growth, future well production rates and reserves volumes; expectations regarding Greenfire's capital program; the outlook for general economic trends, industry trends, prevailing and future commodity prices, foreign exchange rates and interest rates; prevailing and future royalty regimes and tax laws; expectations regarding differentials and realized prices; future well production rates and reserves volumes; fluctuations in energy prices based on worldwide demand and geopolitical events; the impact of inflation; the integrity and reliability of Greenfire's assets; decommissioning obligations; Greenfire's ability to comply with its financial covenants; Greenfire's ability to comply with applicable regulations, including those related to various emissions; Greenfire's ability to obtain all applicable regulatory approvals in connection with the operation of its business; and the governmental, regulatory and legal environment. Management believes that its assumptions and expectations reflected in the forward-looking information contained herein are reasonable based on the information available on the date such information is provided and the process used to prepare the information. However, Greenfire cannot assure readers that these expectations will prove to be correct.

The forward-looking information included in this press release is not a guarantee of future performance and involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward- looking information, including, without limitation: changes in oil and gas prices and differentials; changes in the demand for or supply of Greenfire's products; the continued impact, or further deterioration, in global economic and market conditions, including from inflation and/or certain geopolitical conflicts, such as the ongoing war in Eastern Europe and the conflict in the Middle East, and other heightened geopolitical risks, including imposition of tariffs or other trade barriers, and the ability of the Company to carry on operations as contemplated in light of the foregoing; determinations by OPEC and other countries as to production levels; unanticipated operating results or production declines; changes in tax or environmental laws, climate change regulations, royalty rates or other regulatory matters; changes in Greenfire's operating and development plans; reliability of Company owned and third party facilities, infrastructure and pipelines required for Greenfire's operations and production; competition for, among other things, capital, acquisitions of reserves and resources, undeveloped lands, access to services, third party processing capacity and skilled personnel; inability to retain drilling rigs and other services; severe weather conditions, including wildfires, impacting Greenfire's operations and third party infrastructure; availability of diluent, natural gas and power to operate Greenfire's facilities; failure to realize the anticipated benefits of the Company's acquisitions; incorrect assessment of the value of acquisitions; delays resulting from or inability to obtain required regulatory approvals; increased debt levels or debt service requirements; inflation; changes in foreign exchange rates; inaccurate estimation of Greenfire's bitumen reserves volumes; limited, unfavourable or a lack of access to capital markets or other sources of capital; increased costs; failure to comply with applicable regulations, including relating to the Company's air emissions, and potentially significant penalties and orders associated therewith and associated significant effect on the Company's business, operations, production, reserves estimates and financial condition; a lack of adequate insurance coverage; and other factors discussed under the "Risk Factors" section in Greenfire's Management's Discussion & Analysis for the interim period ended June 30, 2025 and Annual Information Form dated March 17, 2025, and from time to time in Greenfire's public disclosure documents, which are available on the Company's SEDAR+ profile at www.sedarplus.ca, and in the Company's annual report on Form 40-F filed with the SEC, which is available on the Company's EDGAR profile at www.sec.gov.

The foregoing risks should not be construed as exhaustive. The forward-looking information contained in this press release speaks only as of the date of this press release and Greenfire does not assume any obligation to publicly update or revise such forward-looking information to reflect new events or circumstances, except as may be required pursuant to applicable laws. Any forward-looking information contained herein is expressly qualified by this cautionary statement.

Contact Information

Greenfire Resources Ltd.

205 5th Avenue SW

Suite 1900

Calgary, AB T2P 2V7

investors@greenfireres.com

greenfireres.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261602

SOURCE: Greenfire Resources Ltd.