Issuer: Immunic AG

/ Key word(s): Quarter Results

Immunic, Inc. Reports Second Quarter 2025 Financial Results and Provides Corporate Update - Vidofludimus Calcium Substantially Reduced 24-Week Confirmed Disability Worsening in Phase 2 CALLIPER Trial in Overall Progressive Multiple Sclerosis Study Population and Across Subtypes, Reinforcing the Drug's Neuroprotective Potential and Ability to Slow Disease Progression - - Completed Enrollment for Both Phase 3 ENSURE Trials of Vidofludimus Calcium in Relapsing Multiple Sclerosis; Top-Line Data Expected by End of 2026 - - New Long-Term Open-Label Extension Data From Phase 2 EMPhASIS Trial in Relapsing-Remitting Multiple Sclerosis Showed High Rates of Patients Remaining Free of 12-Week and 24-Week Confirmed Disability Worsening - - Strengthened Balance Sheet with Two Financings Totaling $70.1 Million in Gross Proceeds - NEW YORK, August 7, 2025 - Immunic, Inc. (Nasdaq: IMUX), a biotechnology company developing a clinical pipeline of orally administered, small molecule therapies for chronic inflammatory and autoimmune diseases, today announced financial results for the second quarter and six months ended June 30, 2025, and provided a corporate update. "During the second quarter and more recently, we have made substantial clinical progress in advancing our potentially transformative lead asset, vidofludimus calcium (IMU-838), an orally available nuclear receptor-related 1 (Nurr1) activator," stated Daniel Vitt, Ph.D., Chief Executive Officer of Immunic. "Most notable was the on-time completion of enrollment of our twin phase 3 ENSURE trials, bringing us one step closer to delivering a novel treatment option for people living with relapsing multiple sclerosis (RMS). The unique neuroprotective effects observed to date also support the phase 3 ENSURE trials, where confirmed disability worsening will be analyzed. Top-line data from both trials, expected by the end of 2026, will allow for a synchronized readout and a pooled analysis of this clinical endpoint. The growing body of evidence we have amassed continues to strengthen our confidence that, if approved, vidofludimus calcium, with a distinct combination of neuroprotective, anti-inflammatory and anti-viral properties observed, as well as a well-established safety and tolerability profile, has the potential to emerge as a differentiated oral therapy that addresses the complex pathophysiology of multiple sclerosis (MS)." "We also reported strong results from our phase 2 CALLIPER trial in progressive multiple sclerosis (PMS), showing a 23.8% reduction in time to 24-week confirmed disability worsening (24wCDW) in the overall study population compared to placebo. In the high unmet need subgroup of primary progressive MS (PPMS), this effect was 31.3%, exceeding outcomes observed in previous PPMS trials. In another high unmet need subtype, non-active SPMS (naSPMS), the reduction was 19.2%. Moreover, patients without gadolinium-enhancing lesions at baseline, who often do not benefit from existing treatments, saw 24wCDW reductions of 33.7% for the overall PMS population, as well as 34.4% and 29.8% for the PPMS and naSPMS subgroups, respectively. Since time to 24wCDW is a recognized regulatory endpoint for assessing clinical benefit in PMS, we believe these findings strongly support advancing vidofludimus calcium into phase 3 development in progressive forms of MS. With only one approved treatment currently available for PPMS, vidofludimus calcium may be a highly promising option for this underserved $6+ billion market, where reduction of disease progression would allow patients to remain more independent, manage symptoms more easily and achieve better long-term outcomes." Management noted that, among the continued stream of positive data for vidofludimus calcium was the new readout from the long-term open-label extension (OLE) phase of the phase 2 EMPhASIS trial in relapsing-remitting multiple sclerosis (RRMS), which further reinforced the strong efficacy signals previously observed in this trial. Data showed that at week 144, 92.3% of patients remained free of 12-week confirmed disability worsening (12wCDW), and 92.7% were free of 24wCDW. This, and previously announced results across the MS program-including the top-line EMPhASIS and CALLIPER data-further support the potential of vidofludimus calcium to slow disease progression. These findings also continue to highlight its neuroprotective effects, which are believed to be mediated through activation of the Nurr1 target. Based on the strength of the data, a total of five abstracts have been selected for presentation at the 41st Congress of the European Committee for Treatment and Research in Multiple Sclerosis (ECTRIMS) in September, including one oral presentation and one late-breaking poster - a major achievement for the company. Dr. Vitt added, "Beyond vidofludimus calcium, compelling clinical and preclinical data for IMU-856, our orally available and systemically acting small molecule modulator that targets sirtuin 6 (SIRT6), indicates the drug's strong promise as a potential novel therapeutic for gastrointestinal disorders. Based on encouraging data available to date, we are preparing for further clinical testing while exploring potential financing, licensing, or partnership opportunities to advance the program. Additionally, IMU-856 has shown potential as an oral treatment option for weight management. More specifically, a post hoc analysis of our phase 1b clinical trial results showed up to a 250% increase in GLP-1 levels versus placebo in fasting celiac disease patients, mimicking natural post-meal responses and suggesting that IMU-856 may activate enteroendocrine pathways physiologically, offering a broader mechanism than current injectable incretin mimetics. If validated in future trials, this once-daily oral small molecule could become a convenient treatment alternative for weight management." Second Quarter 2025 and Subsequent Highlights

Anticipated Clinical Milestones

Financial and Operating Results Research and Development (R&D) Expenses were $21.4 million for the three months ended June 30, 2025, as compared to $18.3 million for the three months ended June 30, 2024. The $3.0 million increase reflects (i) a $2.6 million increase in external development costs related to the vidofludimus calcium programs and (ii) a $0.6 million increase in personnel expenses. The increase was offset by a $0.2 million decrease related costs across numerous categories. For the six months ended June 30, 2025, R&D expenses were $42.9 million, as compared to $37.1 million for the six months ended June 30, 2024. The $5.8 million increase reflects a $7.3 million increase in external development costs related to the vidofludimus calcium programs. The increase was offset by a $1.5 million decrease in external development costs related to IMU-856 due to the completion of the phase 1b clinical trial in celiac disease patients in 2024.

For the six months ended June 30, 2025, G&A expenses were $11.0 million, as compared to $9.6 million for the same period ended June 30, 2024. The $1.4 million increase was due to (i) a $0.7 million increase related to personnel expenses, (ii) a $0.5 million increase in legal and consultancy expenses and (iii) a $0.2 million increase related costs across numerous categories.

For the six months ended June 30, 2025, interest income was $0.4 million, as compared to $2.2 million for the same period ended June 30, 2024. The $1.8 million decrease was due to a lower average cash balance.

For the six months ended June 30, 2025, Other Income (Expense) was $1.2 million, as compared to ($1.7 million) for the same period ending June 30, 2024. The $2.8 million increase was primarily attributable to (i) a $1.7 million expense related to the portion of deal costs from the January 2024 Financing related to the tranche rights that were established at the time of the deal closing in 2024, (ii) a $1.0 million grant income of the German Federal Ministry of Finance recognized in the first quarter 2025 and (iii) a $0.1 million increase across numerous categories.

Net loss for the six months ended June 30, 2025, was approximately $52.3 million, or $0.45 per basic and diluted share, based on 116,844,985 weighted average common shares outstanding, compared to a net loss of approximately $51.0 million or $0.51 per basic and diluted share, based on 99,607,158 weighted average common shares outstanding for the same period ended June 30, 2024.

Immunic, Inc. (Nasdaq: IMUX) is a biotechnology company developing a clinical pipeline of orally administered, small molecule therapies for chronic inflammatory and autoimmune diseases. The company's lead development program, vidofludimus calcium (IMU-838), is currently in phase 3 clinical trials for the treatment of relapsing multiple sclerosis, for which top-line data is expected to be available by the end of 2026. It has already shown therapeutic activity in phase 2 clinical trials in patients suffering from relapsing-remitting multiple sclerosis and progressive multiple sclerosis. Vidofludimus calcium combines neuroprotective effects, through its mechanism as a first-in-class nuclear receptor related 1 (Nurr1) activator, with additional anti-inflammatory and anti-viral effects, by selectively inhibiting the enzyme dihydroorotate dehydrogenase (DHODH). IMU-856, which targets the protein Sirtuin 6 (SIRT6), is intended to restore intestinal barrier function and regenerate bowel epithelium, which could potentially be applicable in numerous gastrointestinal diseases, such as celiac disease as well as inflammatory bowel disease, Graft-versus-Host-Disease and weight management. IMU-381, which currently is in preclinical testing, is a next generation molecule being developed to specifically address the needs of gastrointestinal diseases. For further information, please visit: www.imux.com. Cautionary Statement Regarding Forward-Looking Statements This press release contains "forward-looking statements" that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release regarding strategy, future operations, future financial position, future revenue, projected expenses, sufficiency of cash and cash runway, expected timing, development and results of clinical trials, prospects, plans and objectives of management are forward-looking statements. Examples of such statements include, but are not limited to, statements relating to Immunic's development programs and the targeted diseases; the potential for Immunic's development programs to safely and effectively target diseases; preclinical and clinical data for Immunic's development programs; the feasibility of advancing vidofludimus calcium to a confirmatory phase 3 clinical trial in progressive multiple sclerosis; the timing of current and future clinical trials and anticipated clinical milestones; the nature, strategy and focus of the company and further updates with respect thereto; and the development and commercial potential of any product candidates of the company. Immunic may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in the forward-looking statements and you should not place undue reliance on these forward-looking statements. Such statements are based on management's current expectations and involve substantial risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, increasing inflation, tariffs and macroeconomics trends, impacts of the Ukraine - Russia conflict and the conflict in the Middle East on planned and ongoing clinical trials, risks and uncertainties associated with the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the availability of sufficient financial and other resources to meet business objectives and operational requirements, and the ability to raise sufficient capital to continue as a going concern, the fact that the results of earlier preclinical studies and clinical trials may not be predictive of future clinical trial results, any changes to the size of the target markets for the company's products or product candidates, the protection and market exclusivity provided by Immunic's intellectual property, risks related to the drug development and the regulatory approval process and the impact of competitive products and technological changes. A further list and descriptions of these risks, uncertainties and other factors can be found in the section captioned "Risk Factors," in the company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on March 31, 2025, and in the company's subsequent filings with the SEC. Copies of these filings are available online at www.sec.gov or ir.imux.com/sec-filings. Any forward-looking statement made in this release speaks only as of the date of this release. Immunic disclaims any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made. Immunic expressly disclaims all liability in respect to actions taken or not taken based on any or all of the contents of this press release.

Contact Information

US IR Contact US Media Contact Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

Aktien»Nachrichten»IMMUNIC AKTIE»EQS-News: Immunic AG: Immunic, Inc. Reports Second Quarter 2025 Financial Results and Provides Corporate Update

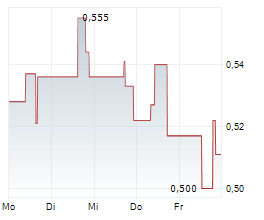

| Realtime | Geld | Brief | Zeit |

|---|---|---|---|

| 0,672 | 0,705 | 08:49 | |

| 0,672 | 0,705 | 07:43 |

EQS-News: Immunic AG: Immunic, Inc. Reports Second Quarter 2025 Financial Results and Provides Corporate Update

© 2025 EQS Group

| Zeit | Aktuelle Nachrichten | ||

|---|---|---|---|

| 04.02. | Immunic to present additional data on MS drug at ACTRIMS forum | ||

| 04.02. | EQS-News: Immunic AG: Immunic to Present Additional Phase 2 CALLIPER Trial Data for Vidofludimus Calcium at the ACTRIMS Forum 2026, Reinforcing Its Potential in Progressive Multiple Sclerosis | Issuer: Immunic AG

/ Key word(s): Conference/Study results

Immunic to Present Additional Phase 2 CALLIPER Trial Data for Vidofludimus Calcium at the ACTRIMS Forum 2026, Reinforcing... ► Artikel lesen | |

| 07.01. | EQS-News: Immunic AG: Immunic Highlights 2025 Accomplishments and Upcoming Milestones | Issuer: Immunic AG

/ Key word(s): Miscellaneous/Conference

Immunic Highlights 2025 Accomplishments and Upcoming Milestones

07.01.2026 / 12:30 CET/CEST

The issuer is... ► Artikel lesen | |

| 06.01. | Verstoß gegen Mindestkurs: Immunic wechselt an den Nasdaq Capital Market | ||

| 05.01. | IMMUNIC, INC. - 8-K, Current Report |

Sie erhalten auf FinanzNachrichten.de kostenlose Realtime-Aktienkurse von und sowie Kurse und Daten von ARIVA.DE AG.

Werbehinweise: Die Billigung des Basisprospekts durch die BaFin ist nicht als ihre Befürwortung der angebotenen Wertpapiere zu verstehen.

Wir empfehlen Interessenten und potenziellen Anlegern den Basisprospekt und die Endgültigen Bedingungen zu lesen,

bevor sie eine Anlageentscheidung treffen, um sich möglichst umfassend zu informieren, insbesondere über die potenziellen

Risiken und Chancen des Wertpapiers. Sie sind im Begriff, ein Produkt zu erwerben, das nicht einfach ist und schwer zu

verstehen sein kann.