A Groundbreaking Legal and Custody Fortress for Multi-Generational Bitcoin Wealth

DALLAS, TEXAS / ACCESS Newswire / August 7, 2025 / Onramp Bitcoin, a leading provider of institutional-grade Bitcoin custody and infrastructure solutions, has announced the launch of Onramp Bitcoin Dynasty Trust Services - a first-of-its-kind legal and custody platform designed to help high-net-worth Bitcoin holders preserve, protect, and pass on their wealth tax-efficiently across generations.

Developed in partnership with First Covenant Trust & Advisors and backed by Onramp's Multi-Institution Custody (MIC) vault model, the service blends the strongest elements of South Dakota trust law with battle-tested Bitcoin multi-institution custody architecture. The result is a turnkey solution for long-term, sovereign Bitcoin inheritance - built for serious capital.

"This is not just a product. It's an institutionally viable blueprint for legacy planning in a Bitcoin-native world," said Michael Tanguma, CEO of Onramp. "High-net-worth investors don't want to just hold Bitcoin - they want to own it like a sovereign, pass it on like a dynasty, and access liquidity without compromise. We built this for them."

A Legal Fortress in South Dakota

Leveraging South Dakota's top-tier trust statutes - long favored by billionaires and Fortune 500 families - Onramp's Dynasty Trusts provide:

Perpetual Asset Protection - Bitcoin is shielded from lawsuits, divorcing spouses, and creditors via Directed Domestic Asset Protection Trusts.

Minimize Estate Tax - Trust structures like IDGTs and SLATs ensure Bitcoin stays outside the taxable estate, avoiding the looming 40% federal estate tax (set to apply on estates over $15M from 2026).

Multi-Generational Continuity - Trusts last forever under SD law, with no forced distributions or public filings.

Client Control, Institutional Oversight - Investment decisions stay with the client (or their advisor) via Directed Trust governance.

Institutional Custody, No Single Point of Failure

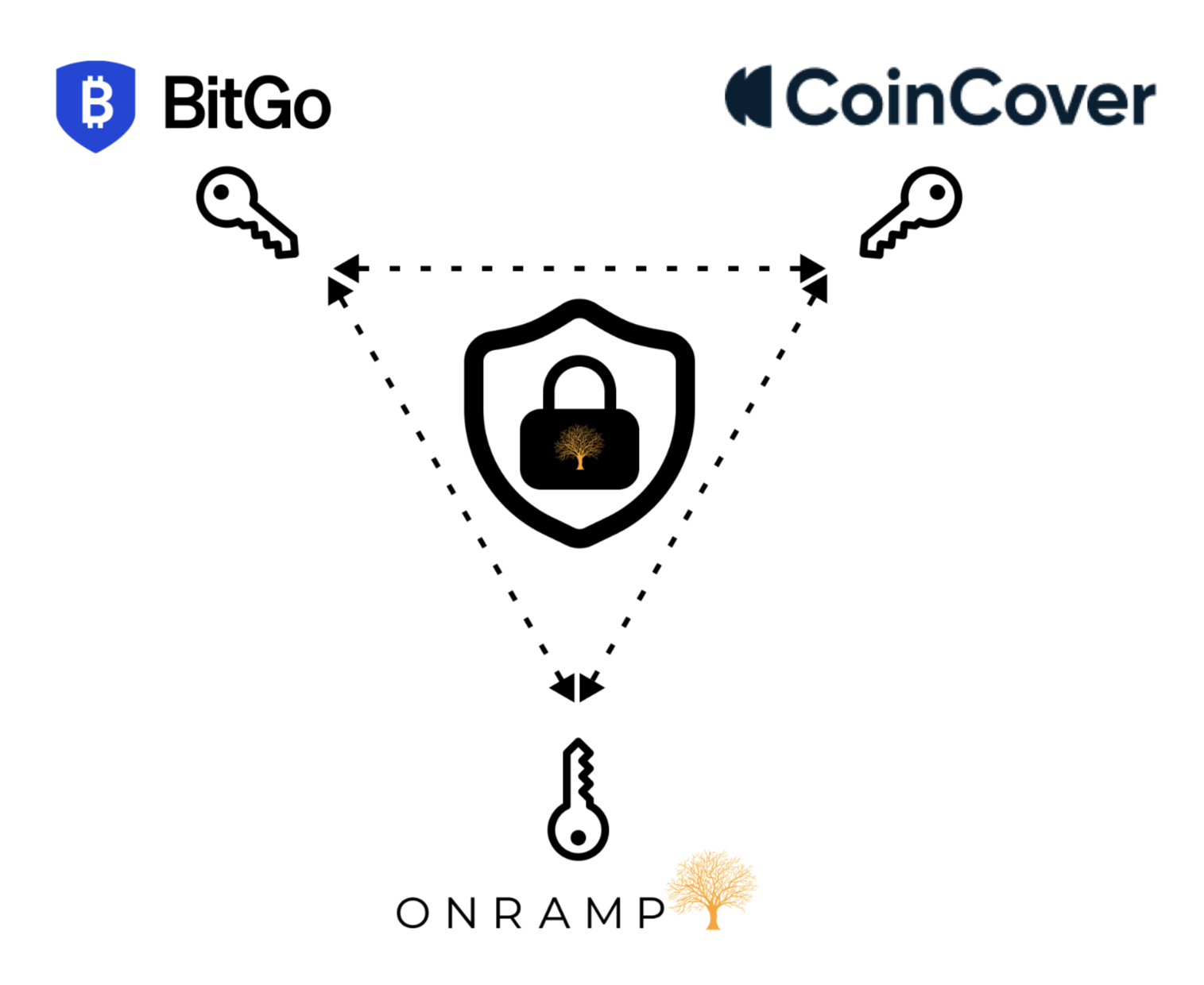

All Dynasty Trusts are powered by Onramp's Multi-Institution Custody (MIC) system - a 2-of-3 multisig vault governed by Onramp, BitGo, and CoinCover. Each institution holds a key, and no transaction can occur without dual approval. Vaults are globally distributed, independently insured, and monitored via a unified client dashboard for full transparency.

"This is institutional custody done right," said Michael Tanguma, CEO of Onramp Bitcoin. "Our clients aren't just looking for safety - they're looking for security that outlives them. MIC is how we deliver that."

Bitcoin Trusts That Borrow

What sets this launch apart is its built-in liquidity strategy. Clients can borrow against their trust-held Bitcoin - without triggering capital gains - enabling tax-free liquidity while preserving upside. Structured correctly, these trusts can distribute hundreds of thousands in annual cashflow while the Bitcoin remains compounding and untouched.

It's a Bitcoin-native take on the legendary "Buy, Borrow, Die" strategy - long used by the ultra-wealthy to extract value without liquidation or tax drag.

A New Category of Private Wealth Infrastructure

This launch marks a bold step in the maturation of the Bitcoin ecosystem - from speculative asset to core wealth building block.

"Bitcoin is now being integrated into the same planning playbooks used by America's most sophisticated family offices," said Paul Hoilman, trust banking veteran and strategic advisor to First Covenant Trust & Advisors. "By merging South Dakota's trust advantages with Onramp's ironclad multi-institution custody, we're not just protecting Bitcoin - we're institutionalizing it as the cornerstone of multi-generational family legacies, free from estate taxes, threats, and time limits."

Who It's For

Bitcoin holders with >$2M in net worth looking for ironclad estate planning

Entrepreneurs concerned about asset protection

Families with long-term Bitcoin inheritance goals

Sovereign individuals seeking tax-optimized control

Available Now

Onramp Bitcoin Dynasty Trust Services are available immediately to qualified clients.

Prospective clients can schedule a private consultation with the Onramp Bitcoin team at https://www.onrampbitcoin.com/products/dynasty-trusts.

Contact Information

Michael Tanguma

CEO

michael@onrampbitcoin.com

737-260-7979

SOURCE: Onramp

Related Images

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/blockchain-and-cryptocurrency/onramp-bitcoin-launches-dynasty-trust-services-1057099