CBMJ Outpaces All Major News Media Stocks Including Newsmax, Fox, Sinclair, Warner Bros. Discovery, Paramount, and Disney

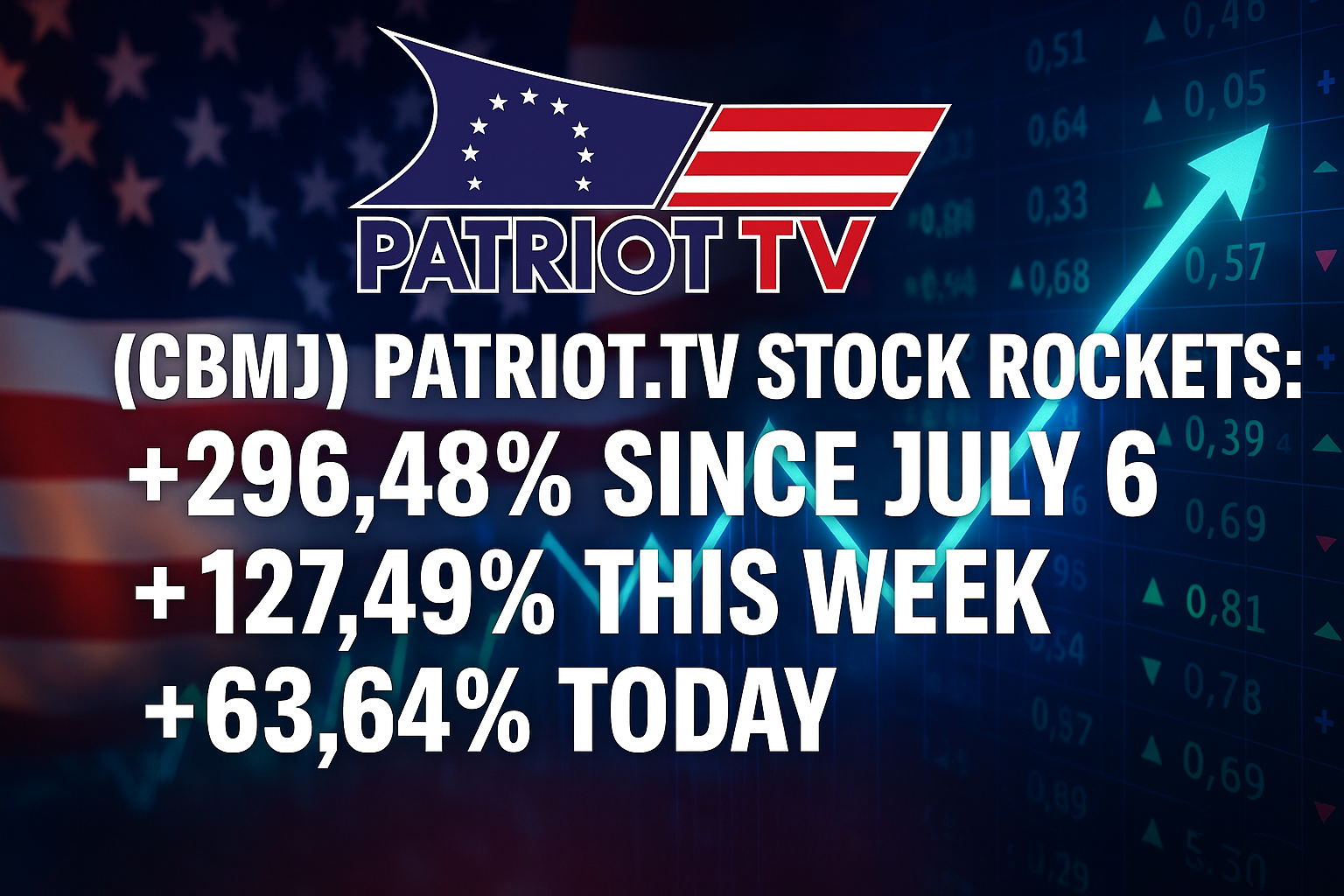

ATLANTA, GA / ACCESS Newswire / August 8, 2025 / Conservative Broadcast Media & Journalism Inc. (OTCID:CBMJ), the parent company of Patriot.TV, stock has surged an astonishing +296.48% in the past month, outpacing all major media competitors. This week alone, shares jumped +127.49%, with a single-day rally of +63.64%, marking CBMJ as the fastest-growing media stock in America.

While Patriot.TV's digital-first strategy continues to pay off, legacy media giants remain stagnant or in decline:

CBMJ (OTCID:CBMJ) - +296.48% in the past month, +127.49% this week, +63.64% today

Newsmax (NMAX) - Down 20% since mid-July

Fox Corp. (FOX) - Flat to -2% in the past month

Sinclair Broadcast Group (SBGI) - Flat performance

Warner Bros. Discovery (WBD) - -7%, following weak cable results

Paramount Global (PARA) - -2% month-to-date

The Walt Disney Company (DIS) - -3%, amid cable and ESPN subscriber losses

Two key macro trends are fueling CBMJ's meteoric rise:

1. Viewers Reject Partisan Legacy Media:

Major networks such as CNN (WBD), CBS News (PARA), and ABC (DIS) are seeing double-digit declines in viewership, especially during primetime, as trust in liberal-leaning outlets deteriorates. Patriot.TV, in contrast, is gaining loyal audiences with fact-based, pro-America content from recognizable hosts. Companies that are more right leaning Including Newsmax (NMAX), Fox (FOX), and Sinclair (SBGI) have fared significantly better but none even close to Conservative Media Broadcast and Journalism (CBMJ) have.

"There's a growing void where trust used to be in legacy media, and we're filling that void with programming people can believe in," said Mark Schaftlein, CEO of CBMJ. "Patriot.TV is succeeding because it doesn't pander, it delivers truth, accountability, and perspective. And the results are clear in both our audience numbers and our stock."

2. Streaming Dominates - Cable Collapses

While cable networks report steady subscriber loss, CBMJ's Patriot.TV is optimized for streaming, available on Rumble, and directly through web and mobile platforms. The company's alignment with the streaming revolution has positioned it for rapid scaling and monetization.

Patriot.TV's performance leap follows the appointment of JD Rucker as CEO of the platform. Since taking the helm, Rucker has spearheaded aggressive expansion efforts including:

Launching new original programs like "The JD Rucker Political Report", "Wayne Dupree Show", and "This Is My Show with Drew Berquist."

Elevating underrepresented conservative voices while reinforcing factual, principled commentary

Signing a major partnership deal with Evergreen Media Partners, significantly boosting advertising, production, and distribution capabilities

Patriot.TV's 1.6 million monthly viewers on Rumble (a new record as of July) is just the beginning. With a nationwide rollout of new streaming partnerships and the addition of high-profile conservative hosts, CBMJ is rapidly capturing market share from traditional broadcasters.

As Warner Bros. Discovery and Disney announce declines in their core TV divisions, CBMJ is charting a different path, one that aligns with shifting viewer behaviors and investor priorities.

CBMJ's momentum is more than a market anomaly, it's a referendum. Consumers are rejecting cable contracts, political bias, and media monopolies. They want authenticity, and Patriot.TV delivers it through streaming platforms that meet audiences where they are.

With streaming, trust, and content driving its business model, CBMJ is leading a new era in news and commentary, digital-first, values-aligned, and investor-validated.

About Patriot.TV: Patriot.TV is a digital-first streaming platform delivering patriotic news, commentary, and original programming. Operating as a subsidiary of Conservative Broadcast Media & Journalism (OTCID:CBMJ), Patriot.TV is committed to American values, free speech, and truthful, unfiltered content for underserved audiences. With a cutting-edge multi-platform distribution strategy, Patriot.TV reaches viewers across its website, social media, and streaming apps, and drives revenue through sponsorships, advertising, affiliate partnerships, and memberships. Since its launch, Patriot.TV has become a burgeoning home for conservative voices, featuring an array of shows hosted by military veterans, media insiders, and grassroots influencers devoted to informing and empowering the American public. Visit www.Patriot.TV for more information.

About Conservative Broadcast Media & Journalism Inc. (OTCID:CBMJ): CBMJ is a publicly traded media and digital broadcasting company focused on delivering conservative and faith-based content. Its wholly owned subsidiary, Patriot.TV, serves as a premier destination for news, commentary, and original programming that reflects traditional American values. For more information, visit www.Patriot.TV.

Media Contact:

Mark Schaftlein - CEO, Conservative Broadcast Media & Journalism

(877) 704-6773

SOURCE: Conservative Broadcast Media & Journalism, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/publishing-and-media/cbmj-patriot.tv-stock-rockets-296.48-since-july-6-127.49-this-week-and-63.64-t-1058602