Mipletamig's 85% frontline AML remission rate and favorable safety profile drive APVO's differentiated CD3 portfolio expansion with APVO455, a Nectin-4 x CD3 bispecific for multiple solid tumor types

CD3 bispecific portfolio now includes three candidates - mipletamig (AML), APVO442 (prostate cancer), and newly added APVO455 - advancing a targeted, tumor-specific strategy uniquely engineered for safety, tumor specificity and clinical impact

Mipletamig, continues to outperform benchmarks, trial enrollment continues

$15.9 million raised in 2Q25, extending cash runway into late 4Q25

SEATTLE, WASHINGTON / ACCESS Newswire / August 11, 2025 / Aptevo Therapeutics Inc. (Nasdaq:APVO), a clinical-stage biotechnology Company focused on developing novel immune-oncology therapeutics based on its proprietary ADAPTIR® and ADAPTIR-FLEX® platform technologies, today reported financial results for the quarter ended June 30, 2025, and provided a business update.

Second Quarter Highlights

Pipeline Expansion - Introduced APVO455, a Nectin-4 x CD3 bispecific for solid tumors, expanding the Company's suite of differentiated CRIS-7-derived CD3 - engaging molecules in development, including lead candidate, mipletamig

Mipletamig for acute myeloid leukemia (AML) - Achieved 85% remission* rate (11/13 patients) in frontline AML patients across two trials in combination therapy

Increased Liquidity - Completed financings that raised a total of $15.9 million, extending cash runway into late 4Q25

Secured an equity line of credit for up to an additional $25 million in capital

*Remission = complete remission (CR) and, complete remission with blood markers that have not yet recovered (CRi).

"The second quarter marked a period of decisive progress for Aptevo across both clinical and corporate fronts," said Marvin White, President and CEO of Aptevo. We are energized by the expansion of our differentiated CD3 bispecific portfolio - anchored by mipletamig in AML and APVO442 in prostate cancer - with the introduction of APVO455, a Nectin-4 x CD3 bispecific designed to address a broad range of solid tumor types. Broadening our reach into solid tumors, beyond prostate cancer, with APVO455 underscores Aptevo's commitment to advancing differentiated, next-generation immunotherapies in areas of significant unmet need."

Mr. White continued, "We're pleased to report that our lead asset, mipletamig, continues to perform as designed in the clinic. In frontline acute myeloid leukemia (AML), 85% of evaluable patients achieved remission when treated in combination with standard of care across two independent trials. These encouraging results validate mipletamig's differentiated mechanism of action and highlight its potential as a transformative therapy for AML, anchoring our CRIS-7-derived CD3 portfolio. Just as important, we strengthened our financial position with a $15.9 million raise, extending cash runway into late Q4 2025, and ensuring we are well-positioned to reach additional clinical and business milestones in the months ahead."

APVO455: A New T-Cell Engager Targeting Solid Tumors

APVO455 is a preclinical Nectin-4 x CD3 bispecific T-cell engager designed for tumors such as bladder, breast, NSCLC, and head and neck cancers, where nectin-4 is highly expressed. Unlike other approaches that restrict activity to acidic tumor environments or rely on activated T-cells, APVO455 is designed to avoid binding to or triggering T-cell activation in the periphery and do so only in the presence of nectin-4 positive tumor cells. This offers the potential for a broader therapeutic window, more consistent immune activation and the favorable safety and tolerability characteristics of Aptevo's clinical stage CD3 engager, mipletamig.

CRIS-7-Derived CD3 Portfolio

With this APVO455 addition to the pipeline, Aptevo now has a suite of three CD3-engaging molecules in development. All three molecules share the same CRIS-7-derived CD3 binding domain in the same orientation from within our ADAPTIR/ADAPTIR-FLEX platform that we believe drives the safety results, especially regarding our intention to reduce cytokine release syndrome, as is being delivered in the clinic by mipletamig. In addition, APVO455 and APVO442 contain CD3 binding domains that are optimized for localizing to solid tumors. All three molecules are designed to drive tumor-specific immune activation while limiting harmful side effects to the patient. The suite includes:

Mipletamig, a CD123 x CD3 bispecific for frontline AML, currently in a Phase 1b/2 trial

APVO442, a PSMA x CD3 bispecific targeting prostate cancer, currently in preclinical development

And now APVO455, a Nectin-4 x CD3 bispecific developed to address multiple solid tumor types

Additional Pipeline Candidates

Aptevo continues to develop clinical candidate ALG.APV-527 ( 4-1BB x 5T4) and preclinical candidates APVO711, a checkpoint inhibitor with added functionality and APVO603, a 4-1BB x OX40 molecule. All targeting multiple solid tumor types.

Mipletamig Data Highlights

Results from the RAINIER trial, reported to date demonstrate mipletamig's increasingly impressive clinical profile, and highlight its potential as a differentiated, highly targeted immunotherapy with a compelling safety profile. As evidence grows, the Company believes that mipletamig is emerging as a strong candidate to reshape frontline AML treatment for unfit patients and potentially advance the standard of care.

Efficacy Data Continues to Outperform Benchmarks

To date, 85% frontline patients across two trials have achieved remission

Of these remissions, multiple patients were considered to have poor prognosis at screening based on the genetic biomarkers of their disease and achieved CR, including one patient who was taken off study and successfully received a stem cell transplant. This is the most favorable outcome because transplant offers the best chance for a cure, although it is a rare occurrence in the unfit AML patient population

Stand Out Safety and Tolerability Outcomes Continue

No CRS has been reported in frontline patients treated to date

Q2 2025 Financial Highlights

Cash Position: Aptevo had cash and cash equivalents as of June 30, 2025, totaling $9.4 million. In Q2 2025, we raised $15.9M in gross proceeds from various equity offerings.

Research and Development Expenses: Research and development expenses decreased by $0.3 million, from $3.6 million for the three months ended June 30, 2024, to $3.3 million for the three months ended June 30, 2025. The decrease was primarily due to lower preclinical and ALG.APV-527 spending due to escalation phase ramping down and was offset by higher mipletamig trial costs from clinical trial patient enrollment.

General and Administrative Expenses: General and administrative expenses increased by $0.5 million, from $2.4 million for the three months ended June 30, 2024, to $2.9 million for the three months ended June 30, 2025. The increase is primarily due to higher consulting costs.

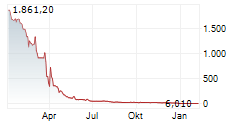

Net Loss: Aptevo had a net loss of $6.2 million or $8.40 per share for the three months ended June 30, 2025, compared to a net loss of $5.9 million or $1,236.96 per share for the corresponding period in 2024.

Aptevo Therapeutics Inc.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts, unaudited)

| June 30, 2025 |

|

| December 31, 2024 |

| |||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 9,410 |

|

| $ | 8,714 |

|

Prepaid expenses |

|

| 1,589 |

|

|

| 1,689 |

|

Other current assets |

|

| 82 |

|

|

| 256 |

|

Total current assets |

|

| 11,081 |

|

|

| 10,659 |

|

Property and equipment, net |

|

| 432 |

|

|

| 543 |

|

Operating lease right-of-use asset |

|

| 4,111 |

|

|

| 4,389 |

|

Total assets |

| $ | 15,624 |

|

| $ | 15,591 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable and other accrued liabilities |

| $ | 2,903 |

|

| $ | 3,053 |

|

Accrued compensation |

|

| 1,040 |

|

|

| 1,856 |

|

Other current liabilities |

|

| 948 |

|

|

| 1,298 |

|

Total current liabilities |

|

| 4,891 |

|

|

| 6,207 |

|

Operating lease liability |

|

| 4,209 |

|

|

| 4,629 |

|

Total liabilities |

|

| 9,100 |

|

|

| 10,836 |

|

|

|

|

|

|

|

|

| |

Stockholders' equity: |

|

|

|

|

|

|

|

|

Preferred stock: $0.001 par value; 15,000,000 shares authorized, zero shares issued or outstanding |

|

| - |

|

|

| - |

|

Common stock: $0.001 par value; 500,000,000 shares authorized; 3,224,156 and 72,922 shares issued and outstanding at June 30, 2025, and December 31, 2024, respectively |

|

| 99 |

|

|

| 84 |

|

Additional paid-in capital |

|

| 266,614 |

|

|

| 252,248 |

|

Accumulated deficit |

|

| (260,189 | ) |

|

| (247,577 | ) |

Total stockholders' equity |

|

| 6,524 |

|

|

| 4,755 |

|

Total liabilities and stockholders' equity |

| $ | 15,624 |

|

| $ | 15,591 |

|

Aptevo Therapeutics Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts, unaudited)

| For the Three Months Ended June 30, |

|

| For the Six Months Ended June 30, |

| |||||||||||

| 2025 |

|

| 2024 |

|

| 2025 |

|

| 2024 |

| |||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Research and development |

| $ | (3,328 | ) |

| $ | (3,643 | ) |

| $ | (6,961 | ) |

| $ | (7,395 | ) |

General and administrative |

|

| (2,898 | ) |

|

| (2,381 | ) |

|

| (5,745 | ) |

|

| (5,612 | ) |

Loss from operations |

|

| (6,226 | ) |

|

| (6,024 | ) |

|

| (12,706 | ) |

|

| (13,007 | ) |

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

| 22 |

|

|

| 141 |

|

|

| 94 |

|

|

| 290 |

|

Net loss |

| $ | (6,204 | ) |

| $ | (5,883 | ) |

| $ | (12,612 | ) |

| $ | (12,717 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted net loss per share: |

| $ | (8.40 | ) |

| $ | (1,236.96 | ) |

| $ | (30.84 | ) |

| $ | (4,458.98 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shares used in calculation*: |

|

| 738,149 |

|

|

| 4,756 |

|

|

| 408,985 |

|

|

| 2,852 |

|

*Adjusted retroactively to reflect reverse stock splits

About Aptevo Therapeutics

Aptevo Therapeutics Inc. (Nasdaq:APVO) is a clinical-stage biotechnology Company focused on developing novel bispecific immunotherapies for the treatment of cancer. The Company has two clinical candidates. Mipletamig is currently being evaluated in RAINIER, a two-part Phase 1b/2 trial for the treatment of frontline acute myeloid leukemia in combination with standard-of-care venetoclax + azacitidine. Mipletamig has received orphan drug designation ("orphan status") for AML according to the Orphan Drug Act. ALG.APV-527, a bispecific conditional 4-1BB agonist, only active upon simultaneous binding to 4-1BB and 5T4, is being co-developed with Alligator Bioscience and is being evaluated in a Phase 1 clinical trial for the treatment of multiple solid tumor types likely to express 5T4. The Company has four pre-clinical candidates with different mechanisms of action designed to target a range of solid tumors. All pipeline candidates were created from two proprietary platforms, ADAPTIR and ADAPTIR-FLEX. The Aptevo mission is to improve treatment outcomes and transform the lives of cancer patients. For more information, please visit www.aptevotherapeutics.com.

Safe Harbor Statement

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including, without limitation, Aptevo's expectations about the activity, efficacy, safety, tolerability and durability of its therapeutic candidates and potential use of any such candidates, including in combination with other drugs, as therapeutics for treatment of disease, its expectations regarding the effectiveness of its ADAPTIR and ADAPTIR-FLEX platforms, whether pre-clinical studies of APVO455 will show the desired anti-tumor efficacy, mechanism of action and safety profile and whether APVO455 will function with new mechanisms of action compared to our previous candidates and synergistically induce a biological response, whether APVO455 will demonstrate the ability to fight a range of solid malignancies, statements related to the progress of Aptevo's clinical programs, including statements related to anticipated clinical and regulatory milestones, whether further study of mipletamig in a Phase 1b dose optimization trial focusing on multiple doses of mipletamig in combination with venetoclax + azacitidine on a targeted patient population will continue to show remissions, whether Aptevo's final trial results will vary from its earlier assessment, whether Aptevo's strategy will translate into an improved overall survival in AML, especially among patient subgroups with poor prognosis, whether further study of ALG.APV-527 across multiple tumor types will continue to show clinical benefit, the possibility and timing of interim data readouts for ALG.APV-527, statements related to Aptevo's cash position and balance sheet, statements related to Aptevo's ability to generate stockholder value, whether Aptevo will continue to have momentum in its business in the future, and any other statements containing the words "may," "continue to," "believes," "knows," "expects," "optimism," "potential," "designed," "promising," "plans," "will" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on Aptevo's current intentions, beliefs, and expectations regarding future events. Aptevo cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from Aptevo's expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement.

There are several important factors that could cause Aptevo's actual results to differ materially from those indicated by such forward-looking statements, including a deterioration in Aptevo's business or prospects; further assessment of preliminary or interim data or different results from later clinical trials; adverse events and unanticipated problems, adverse developments in clinical development, including unexpected safety issues observed during a clinical trial; and changes in regulatory, social, macroeconomic and political conditions. For instance, actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the uncertainties inherent in the results of preliminary or interim data and preclinical studies being predictive of the results of later-stage clinical trials, initiation, enrollment and maintenance of patients, and the completion of clinical trials, the availability and timing of data from ongoing clinical trials, the trial design includes combination therapies that may make it difficult to accurately ascertain the benefits of mipletamig, expectations for the timing and steps required in the regulatory review process, expectations for regulatory approvals, the impact of competitive products, our ability to enter into agreements with strategic partners or raise funds on acceptable terms or at all and other matters that could affect the availability or commercial potential of Aptevo's product candidates, business or economic disruptions due to catastrophes or other events, including natural disasters or public health crises, geopolitical risks, including the current war between Russia and Ukraine, Israel and Hamas and Israel and Iran and any other military event that could evolve out of any of the current conflicts and macroeconomic conditions such as economic uncertainty, imposition of tariffs, rising inflation and interest rates, continued market volatility and decreased consumer confidence. These risks are not exhaustive, Aptevo faces known and unknown risks. Additional risks and factors that may affect results are set forth in Aptevo's filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and its subsequent reports on Form 10-Q and current reports on Form 8-K. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from Aptevo's expectations in any forward-looking statement. Any forward-looking statement speaks only as of the date of this press release, and, except as required by law, Aptevo does not assume any obligation to update any forward-looking statement to reflect new information, events, or circumstances.

CONTACT:

Miriam Weber Miller

Head, Investor Relations & Corporate Communications

Aptevo Therapeutics

Email: IR@apvo.com or Millerm@apvo.com

Phone: 206-859-6628

SOURCE: Aptevo Therapeutics

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/aptevo-therapeutics-reports-2q25-financial-results-and-provides-a-bus-1058831