Vancouver, British Columbia--(Newsfile Corp. - August 12, 2025) - Thor Explorations Ltd. (TSXV: THX) (AIM: THX) ("Thor Explorations", "Thor" or the "Company") is pleased to provide an operational and financial review for its Segilola Gold mine, located in Nigeria ("Segilola"), and for the Company's mineral exploration properties located in Nigeria and Senegal for the three months ("Q2 2025" or the "Period") and six months to June 30, 2025 ("H1 2025").

The Company's Unaudited Condensed Interim Consolidated Financial Statements together with the notes related thereto, as well as the Management's Discussion and Analysis for the three and six months ended June 30, 2025, are available on Thor Explorations' website at https://thorexpl.com/investors/financials/.

All figures are in US dollars ("US$") unless otherwise stated.

Financial Highlights for Q2 2025 and H1 2025

25,900 ounces ("oz") of gold ("Au") sold in Q2 2025 with an average gold price of US$3,187 per oz.

Cash operating cost of US$715 per oz sold and all-in sustaining cost ("AISC") of US$915 per oz sold.

In Q2 2025 the Company achieved quarterly records in revenue, EBITDA and net profit:

Q2 2025 revenue of US$82.7 million (Q2 2024: US$53.8 million) and H1 2025 of US$146.8 million (H1 2024: US$87.1 million).

Q2 2025 EBITDA of US$60.3 million (Q2 2024: US$37.6 million) and H1 2025 of US$103.9 million (H1 2024: US$60.9 million).

Q2 2025 net profit of US$51.6 million (Q2 2024: US$33.7 million) and H1 2025 of US$86.1 million (H1 2024: US$39.9 million).

- Net cash of US$52.8 million as at June 30, 2025.

Operational Highlights for Q2 2025 and H1 2025

Segilola Production

- Gold Poured totalled 22,784 oz for Q2 2025, and 45,574 oz for H1 2025 (Q2 2024: 21,742 oz; H1 2024: 40,285 oz).

- Mill feed grade for Q2 2025 was 3.12 g/tAu with recovery at 93.1%.

A total of 238,425 tonnes of ore were processed with no significant downtime periods.

The process plant maintained good recovery performance in Q2 2025 reducing the gold in circuit ("GIC") by 555 oz of gold.

The stockpile balance decreased by 0.74% to 41,092 tonnes of ore at an average grade of 0.84g/tAu. The significant stockpile available offers flexibility and low risk for future process plant production.

Segilola Exploration

The focus was on Segilola Underground Resource drilling and developing near mine drill targets as the Company works to extend the current Segilola mine life.

A diamond drilling program continued during Q2 2025, with 4,418 metres ("m") completed in 12 holes to test the depth extensions of the Segilola deposits.

The drilling continued subsequently to the end of the Period and will continue through to the end of the calendar year.

Following the arrival of three drilling rigs at Segilola post period end, purchased earlier this year, the Company now intends to increase its rate of exploration drilling once they have been commissioned.

- The Company is now aiming to define an updated resource for Segilola by the end of 2025.

- Regional exploration activities progressed in Q2 2025:

The Company continued with geochemical target generation, mainly south of Segilola, with a total of 5,051 geochemical samples collected in the Period.

Exploration activity included a drone aeromagnetic survey over the Company's existing and new tenure located to the south of the Segilola Mine. A total of 26 square kilometres ("km2") was covered during the Period and the data submitted to Southern Geoscience for processing and interpretations.

A follow-up drilling program designed to test surrounding geochemical signatures and potential extensions along strike commenced towards the end of the Period.

Douta Gold Project - Senegal

- During Q2 2025, the Company commenced and subsequently completed a 12,000m drilling program at the Baraka 3 Prospect in its Douta-West Licence, which lies contiguous to the west of the original Douta licence.

- It is anticipated that the assay results from the drilling program will be fully received in Q3 2025, following which a Baraka 3 resource will be incorporated into the existing Douta Resource.

The Company's strategy is to combine both the Douta and Douta-West licences and scale up the size of a combined Douta Project for the Douta Preliminary Feasibility Study ("PFS").

As part of the Company's strategy of delineating an initial 500,000 oz oxide resource at the start of the Douta mine life, metallurgical test work was carried out in Q2 2025 with encouraging initial results.

- Subject to finalising metallurgical tests on the Baraka ore, the Company anticipates that incorporating the Baraka resource into the Douta project will enable the Company to satisfy or exceed the oxide target.

Côte d'Ivoire

- At the Guitry Project, the Company completed a 3,000m drilling program at the Krakouadiokro target, with the initial set of results (announced following the end of the Period) confirming gold mineralisation at depth.

Highlights of the assay results received to date include 14m at 2.59g/tAu from surface, 4m at 6.87 g/tAu from 38m, 5m at 7.48 g/tAu from 5m and 10m at 10.36g/t Au from 57m.

Further exploration at the Krakouadiokro Prospect will include both infill and step-out drilling.

Drilling will also commence on numerous geochemical anomalies at both the Krakouadiokro and Gbaloukro Prospects, many of which remain untested or only partially tested.

- Exploration work at the Marahui Project has included further geological mapping and geological sampling, with more than 250 samples collected and encouraging initial results returned. This exploration work has has generated several prospective drill targets.

- The Company is to carry out an airborne magnetic survey, and has designed a 6,000m drilling program to commence late in Q3 2025.

Environment, Social and Governance

- Continued operational efficiencies achieved through the process plant upgrades implemented in 2024 have resulted in environmental benefits:

Use of fresh process water (ML/tonne ore processed) continued to decrease, supported by an 84% year-on-year increase in reclaimed water volumes from the Tailings Management Facility.

Energy intensity (GJ/oz gold produced) improved to 1.84 GJ/oz, compared to 1.90 GJ/oz in Q2 2024.

Emissions intensity (tCO2e/oz gold produced) decreased to 0.51, down from 0.55 in the same period of 2024.

- Notable milestones with respect to the Company's corporate ESG activities for Q2 2025 include:

Completion and commissioning of the Oba's palace, which also serves as a community meeting hall.

Delivery of nine minibuses (three per host community) to community-managed transport cooperatives under the Youth Initiative Programme.

Hosting of the inter-host community football competition in May, with eight men's and four women's teams participating for trophies and cash prizes.

- As at June, 30, 2025, total employment at the Segilola Mine stood at 2,125, 99% of which are Nigerian. Of this figure, 48% are from Osun State, and 27% of the workforce is from three host communities surrounding the mine.

- In Senegal, the ASR Douta team supported local initiatives through sponsorship of an academic award for the top-performing student at a local primary school and through food donations made during the Eid celebrations.

Outlook

- FY2025 production guidance of 85,000 to 95,000 oz maintained, while AISC guidance remains at US$800 to US$1,000 per oz.

- Advance exploration program across the portfolio:

Segilola: continuation of ongoing underground drilling program.

Nigeria: continuation of scout drilling programs on identified near-mine and regional targets.

Senegal (Douta Project): Assay results from drilling program at Baraka 3 prospect to be incorporated into the Douta PFS mine plan.

Côte d'Ivoire: Exploration being advanced on the Guitry, Marahui and Boundiali licenses, with further drilling to occur on Guitry and drilling to commence on Marahui where drill targets have been delineated.

- Continued advancement of the Douta project towards an updated resource and PFS.

Segun Lawson, President & CEO, stated:

"I am pleased with the Company's operational performance for the second quarter and first half of 2025, with record quarterly figures across revenue, EBITDA and net profit. We were unhedged and exposed to the high gold price environment, resulting in a record-breaking quarter. Revenue in Q2 2025 increased by 54% year on year, with net profit rising by 50% year on year. We ended the Period more than doubling our net cash position from the previous quarter to US$52.8 million.

"These financial achievements are not only reflective of a favourable gold price, but our continued cost discipline and operational efficiencies. During the Quarter, we produced and sold over 22,700 ounces of gold at an average price of US$3,187 per ounce, with a recovery rate of 93.1%.

"Exploration work has progressed at Segilola, with a focus on Segilola Underground Resource drilling as the company works to extend the current Segilola mine life. A drilling program is ongoing, which has been evolving to test different interpretations of the down dip mineralisation at Segilola. We will continue to drill through to the end of the calendar year when we aim to define an updated resource for Segilola.

"We are also continuing with our regional exploration in Nigeria, with geochemical target generation resulting in a follow-up drilling program which commenced towards the end of the Period.

"At the Douta Project in Senegal, the Period saw the commencement and completion of a 12,000m drilling campaign at the Baraka 3 Prospect, in the Douta-West license. We expect to receive assay results in Q3 2025, which will be fed into the existing Douta Resource. This is part of our strategy to combine both the Douta and Douta-West licences and scale up the size of a combined Douta Project for the Douta Pre-Feasibility Study.

"In Côte d'Ivoire, we completed a drilling program at the Guitry Project, with initial results confirming gold mineralisation at depth. Further drilling at Guitry, as well as initial drilling at Marahui, where targets have been delineated, is due to commence following the rainy season in late Q3 2025.

"We have been encouraged by our exploration results to date across the entire portfolio and have increased our exploration budget for the remainder of the year. In doing so, we believe we are well positioned to deliver value to our shareholders.

"Looking ahead, our operational guidance for 2025 remains unchanged at 85,000 to 95,000 ounces of gold at an AlSC of $800-$1,000 per ounce. I look forward to updating shareholders in due course on our continued progress on exploration and further developments across our project portfolio."

Investor webinar to discuss H1 2025 Financial & Operating Results

Thor is pleased to announce that Segun Lawson, President and CEO, will provide a live investor session via the Investor Meet Company platform on Thursday 14 August 2025 at 3:00pm BST.

The session will discuss in detail the announced H1 2025 Financial & Operating Results.

The presentation is open to all existing and potential investors. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 9:00 am the day before the meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add to meet Thor Explorations plc via:

https://www.investormeetcompany.com/thor-explorations-ltd/register-investor

Investors who already follow Thor Explorations on the Investor Meet Company platform will automatically be invited.

Whilst the Company may not be able to answer every individual question, the aim is to address the issues raised by investors.

Responses to the Q&A will be published at the earliest opportunity on the Investor Meet Company platform following the presentation.

Investor feedback can also be submitted directly to management after the event to ensure the Company can understand all investor views.

For further information, please email: thorexplorations@yellowjerseypr.com

About Thor Explorations

Thor Explorations Ltd. is a mineral exploration company engaged in the acquisition, exploration, development and production of mineral properties located in Nigeria, Senegal and Burkina Faso. Thor Explorations holds a 100% interest in the Segilola Gold Project located in Osun State, Nigeria and has a 70% economic interest in the Douta Gold Project located in south-eastern Senegal. Thor Explorations trades on AIM and the TSX Venture Exchange under the symbol "THX".

Qualified Person

The above information has been prepared under the supervision of Alfred Gillman (Fellow AusIMM, CP), who is designated as a "qualified person" under National Instrument 43-101 and the AIM Rules and has reviewed and approves the content of this news release. He has also reviewed QA/QC, sampling, analytical and test data underlying the information.

THOR EXPLORATIONS LTD.

Segun Lawson

President & CEO

THOR EXPLORATIONS LTD.

For further information, please contact:

Thor Explorations Ltd

Email: info@thorexpl.com

Canaccord Genuity (Nominated Adviser & Broker)

Henry Fitzgerald-O'Connor / James Asensio / Harry Rees

Tel: +44 (0) 20 7523 8000

Hannam & Partners (Broker)

Andrew Chubb / Matt Hasson / Jay Ashfield / Franck Nganou

Tel: +44 (0) 20 7907 8500

BlytheRay (Financial PR)

Tim Blythe / Megan Ray / Said Izagaren

Tel: +44 207 138 3203

Yellow Jersey PR (Financial PR)

Charles Goodwin / Shivantha Thambirajah

Tel: +44 (0) 20 3004 9512

Condensed Interim Consolidated Financial Statements

For the Three and Six Months Ended June 30, 2025, and 2024

(in thousands of United States Dollars)

NOTICE TO READER

Under National Instrument 51-102, Part 4, subsection 4.3 (3) (a), if an auditor has not performed a review of the condensed interim consolidated financial statements, they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim consolidated financial statements of the Company have been prepared by and are the responsibility of the Company's management.

The Company's independent auditor has not performed a review of these financial statements in accordance with standards established by the Canadian Institute of Chartered Accountants for a review of condensed interim consolidated financial statements by an entity's auditor.

| CONDENSED INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION In thousands of United States dollars (unaudited) | ||||||||

Note | June 30, 2025 $ | December 31, 2024 $ | ||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | 52,853 | 12,040 | ||||||

| Inventory | 4 | 37,140 | 41,104 | |||||

| Trade and Other Receivables | 5 | 6,342 | 4,561 | |||||

| Total current assets | 96,335 | 57,705 | ||||||

| Non-current assets | ||||||||

| Inventory | 63,829 | 57,124 | ||||||

| Deferred income tax assets | - | - | ||||||

| Prepaid expenses, advances and deposits | 5 | 228 | 208 | |||||

| Right-of-use assets | 6 | 4,936 | 7,302 | |||||

| Property, plant and equipment | 10 | 108,288 | 120,495 | |||||

| Intangible assets | 11 | 43,903 | 36,238 | |||||

| Total non-current assets | 221,184 | 221,367 | ||||||

| TOTAL ASSETS | 317,519 | 279,072 | ||||||

| LIABILITIES | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | 12 | 25,901 | 48,967 | |||||

| Deferred income | - | 4,463 | ||||||

| Lease liabilities | 6 | 4,833 | 4,818 | |||||

| Gold stream liability | 7 | - | 9,358 | |||||

| Loans and borrowings | 8 | - | 860 | |||||

| Other financial liabilities | 16 | - | 1,900 | |||||

| Total current liabilities | 30,734 | 70,366 | ||||||

| Non-current liabilities | ||||||||

| Lease liabilities | 6 | 232 | 2,392 | |||||

| Provisions | 9 | 5,090 | 5,061 | |||||

| Total non-current liabilities | 5,322 | 7,453 | ||||||

| SHAREHOLDERS' EQUITY | ||||||||

| Common shares | 13 | 82,393 | 81,633 | |||||

| Option reserve | 13 | - | 1,920 | |||||

| Currency translation reserve | 13 | (4,734 | (3,873 | ) | ||||

| Retained earnings | 13 | 203,804 | 121,573 | |||||

| Total shareholders' equity | 281,463 | 201,253 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | 317,519 | 279,072 | ||||||

These condensed interim consolidated financial statements were approved for issue by the

Board of Directors on August 11, 2025, and are signed on its behalf by:

| (Signed) "Adrian Coates" Director | (Signed) "Olusegun Lawson" Director |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| CONDENSED INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE THREE AND SIX MONTHS ENDED JUNE 30, In thousands of United States dollars (unaudited) | |||||||||||||

| Note | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

| 2025 $ | 2024 $ | 2025 $ | 2024 $ | ||||||||||

| Continuing operations | |||||||||||||

| Revenue | 3 | 82,794 | 53,876 | 146,857 | 87,188 | ||||||||

| Cost of sales | 3 | (27,039 | ) | (21,533 | ) | (51,829 | ) | (36,300 | ) | ||||

| Loss on forward sale of commodity contracts | - | - | - | - | |||||||||

| Gross profit from operations | 55,755 | 32,343 | 95,028 | 50,889 | |||||||||

| Amortization and depreciation - owned assets | 3 | (121 | ) | (311 | ) | (255 | ) | (783 | ) | ||||

| Amortization and depreciation - right-of-use assets | 3 | (39 | ) | (36 | ) | (75 | ) | (73 | ) | ||||

| Other administration expenses | 3 | (3,643 | ) | (2,102 | ) | (7,645 | ) | (4,822 | ) | ||||

| Impairment of exploration & evaluation assets | 11 | - | - | - | (5 | ) | |||||||

| Profit from operations | 51,952 | 29,893 | 87,053 | 45,205 | |||||||||

| Interest expense | (278 | ) | (2,388 | ) | (895 | ) | (5,276 | ) | |||||

| Net profit before income taxes | 51,674 | 27,505 | 86,158 | 39,929 | |||||||||

| Income Tax | - | - | - | - | |||||||||

| Net profit for the period | 51,674 | 27,505 | 86,158 | 39,929 | |||||||||

| Attributable to: | |||||||||||||

| Equity shareholders of the Company | 51,674 | 27,505 | 86,158 | 39,929 | |||||||||

| Net profit for the period | 51,674 | 27,505 | 86,158 | 39,929 | |||||||||

| Other comprehensive profit | |||||||||||||

| Foreign currency translation (loss)/profit attributed to equity shareholders of the company | (1,819 | ) | (670 | ) | (861 | ) | (2,289 | ) | |||||

| Total comprehensive income for the period | 49,855 | 26,835 | 85,297 | 37,640 | |||||||||

| Net earnings per share | |||||||||||||

| Basic | 14 | $ | 0.078 | $ | 0.042 | $ | 0.130 | $ | 0.061 | ||||

| Diluted | 14 | $ | 0.078 | $ | 0.042 | $ | 0.130 | $ | 0.061 | ||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| CONDENSED INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, In thousands of United States dollars (unaudited) | |||||||||||||

| Note | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| Cash flows from/(used in): | |||||||||||||

| Operating | |||||||||||||

| Net profit | $ | 51,674 | 27,505 | $ | 86,158 | 39,929 | |||||||

| Adjustments for: | |||||||||||||

| Impairment of unproven mineral interest | 11 | - | - | - | 5 | ||||||||

| Amortization and depreciation | 3 | 8,434 | 7,753 | 16,943 | 15,726 | ||||||||

| Unrealized foreign exchange (gains)/losses | 3 | (385 | ) | 549 | (244 | ) | 954 | ||||||

| Unrealized fair value movements on forward gold sale contracts | 3 | - | 907 | (1,900 | ) | 3,041 | |||||||

| Interest expense | 278 | 2,388 | 895 | 5,276 | |||||||||

| 60,001 | 39,101 | 101,852 | 64,931 | ||||||||||

| Changes in non-cash working capital accounts | |||||||||||||

| Inventories | (832 | ) | (8,777 | ) | (2,741 | ) | (22,112 | ) | |||||

| Trade and other receivables | (353 | ) | 1,614 | (1,801 | ) | 2,615 | |||||||

| Accounts payable and accrued liabilities | (8,235 | ) | (7,943 | ) | (21,237 | ) | (5,969 | ) | |||||

| Deferred income | (5,868 | ) | (2,301 | ) | (4,463 | ) | (8,461 | ) | |||||

| Net cash flows from operating activities | 44,713 | 21,694 | 71,610 | 31,003 | |||||||||

| Investing | |||||||||||||

| Purchase of intangible assets | 11 | (15 | ) | (56 | ) | (15 | ) | (78 | ) | ||||

| Assets under construction expenditures | 10 | - | (853 | ) | - | (853 | ) | ||||||

| Property, Plant & Equipment | 10 | (995 | ) | (604 | ) | (2,642 | ) | (878 | ) | ||||

| Exploration & Evaluation assets expenditures | 11 | (3,950 | ) | (2,411 | ) | (7,773 | ) | (4,572 | ) | ||||

| Net cash flows used in investing activities | (4,960 | ) | (3,924 | ) | (10,430 | ) | (6,381 | ) | |||||

| Financing | |||||||||||||

| Share subscriptions received | 13 | - | - | 760 | - | ||||||||

| Dividends paid | (5,847 | ) | - | (5,847 | ) | - | |||||||

| Repayment of loans and borrowings | 9 | (4,534 | ) | (11,179 | ) | (12,669 | ) | (21,132 | ) | ||||

| Interest paid | 9 | - | (562 | ) | (44 | ) | (1,398 | ) | |||||

| Payment of lease liabilities | 6 | (1,129 | ) | (1,257 | ) | (2,517 | ) | (2,515 | ) | ||||

| Net cash flows used in financing activities | (11,510 | ) | (12,998 | ) | (20,317 | ) | (25,045 | ) | |||||

| Effect of exchange rates on cash | (148 | ) | (8 | ) | (50 | ) | 116 | ||||||

| Net change in cash | $ | 28,095 | 4,764 | $ | 40,813 | (307 | ) | ||||||

| Cash, beginning of the period | $ | 24,758 | 2,769 | $ | 12,040 | 7,840 | |||||||

| Cash, end of the period | $ | 52,853 | 7,533 | $ | 52,853 | 7,533 | |||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY In thousands of United States dollars (unaudited) | ||||||||||||||||

| Note | Common shares | Option reserve | Currency translation reserve | Retained earnings | Total shareholders' equity | |||||||||||

| Balance on December 31, 2023 | $ | 81,491 | $ | 1,968 | $ | (1,618 | ) | $ | 30,353 | $ | 112,194 | |||||

| Net profit for the period | - | - | - | 91,172 | 91,172 | |||||||||||

| Other comprehensive loss | - | - | (2,255 | ) | - | (2,255 | ) | |||||||||

| Total comprehensive profit for the period | - | - | (2,255 | ) | 91,172 | 88,917 | ||||||||||

| Options exercised | 13 | 142 | (48 | ) | - | 48 | 142 | |||||||||

| Balance on December 31, 2024 | $ | 81,633 | $ | 1,920 | $ | (3,873 | ) | $ | 121,573 | $ | 201,253 | |||||

| Balance on December 31, 2024 | $ | 81,633 | $ | 1,920 | $ | (3,873 | ) | $ | 121,573 | $ | 201,253 | |||||

| Net profit for the period | - | - | - | 86,158 | 86,158 | |||||||||||

| Other comprehensive income | - | - | (861 | ) | - | (861 | ) | |||||||||

| Total comprehensive profit for the period | - | - | (861 | ) | 86,158 | 85,297 | ||||||||||

| Options exercised | 13 | 760 | (1,920 | ) | - | 1,920 | 760 | |||||||||

| Dividends paid | 13 | (5,847 | ) | (5,847 | ) | |||||||||||

| Balance on June 30, 2025 | $ | 82,393 | $ | - | $ | (4,734 | ) | $ | 203,804 | $ | 281,463 | |||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

THOR EXPLORATIONS LTD.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025, AND 2024

In thousands of United States dollars, except where noted (unaudited)

- CORPORATE INFORMATION

Thor Explorations Ltd. (the "Company"), together with its subsidiaries (collectively, "Thor" or the "Group") is a West African focused gold producer and explorer, dual-listed on the TSX-Venture Exchange (THX.V) and the Alternative Investment Market of the London Stock Exchange (THX.L).

The Company was formed in 1968 and is organized under the Business Corporations Act (British Columbia) (BCBCA) with its registered office at 550 Burrard St, Suite 2900 Vancouver, BC, CA, V6C 0A3.

- BASIS OF PREPARATION

a)Statement of compliance

These condensed interim consolidated financial statements ("interim financial statements") have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting, of International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS").

These interim financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2024, which have been prepared in accordance with IFRS.

These interim financial statements were authorized for issue by the Board of Directors on August 11, 2025.

b)Basis of measurement

These interim financial statements are presented in United States dollars ("US$").

These interim financial statements have been prepared on a historical cost basis, except for certain financial instruments that are measured at fair value at the end of each reporting period.

The Group's accounting policies have been applied consistently to all periods in the preparation of these interim financial statements. In preparing the Group 's interim financial statements for the three months ended June 30, 2025, the Group applied the critical judgments and estimates as disclosed in note 3 of its annual financial statements for the year ended December 31, 2024.

These interim financial statements include the accounts of the Company and its subsidiaries. Subsidiaries are entities controlled by the Company, which is defined as having the power over the entity, rights to variable returns from its involvement with the entity, and the ability to use its power to affect the amount of returns. All intercompany transactions and balances are eliminated on consolidation. The Company's subsidiaries at June 30, 2025 are consistent with the subsidiaries as at December 31, 2024 as disclosed in note 3 to the annual financial statements.

None of the new standards or amendments to standards and interpretations applicable during the period has had a material impact on the financial position or performance of the Group. The Group has not early adopted any standard, interpretation or amendment that was issued but is not yet effective.

- PROFIT FROM OPERATIONS

3a. REVENUE

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Gold revenue | 82,556 | 54,454 | 144,439 | 89,872 | |||||||||||

| Silver revenue | 238 | 329 | 518 | 357 | |||||||||||

| Unrealized fair value movements on forward gold sale contracts | - | (907 | ) | 1,900 | (3,047 | ) | |||||||||

| $ | 82,794 | $ | 53,876 | $ | 146,857 | $ | 87,188 | ||||||||

Gold revenue

The Group's revenue is generated in Nigeria. All sales are made to the Group's two customers. However, because gold can be sold through numerous gold market traders worldwide (including a large number of financial institutions), the Group is not economically dependent on a limited number of customers for the sale of its product.

Forward contracts

As at June 30, 2025, the Group had no outstanding gold forward contracts (December 31, 2024: 5,500 ounces at an average gold price of $2,277 per ounce). The contracts were entered into to manage exposure to fluctuations in the gold price.

The Group does not apply hedge accounting to these instruments. Accordingly, the forward contracts were measured at fair value through profit or loss. The fair value of forward contracts was nil at June 30, 2025 (December 31, 2024: liability of $1.9 million), with the liability previously recognized within other financial liabilities.

3b. COST OF SALES

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Mining | 7,618 | 3,474 | 14,732 | 8,143 | ||||||||

| Processing | 7,918 | 8,303 | 14,176 | 10,746 | ||||||||

| Support services and others | 1,814 | 955 | 3,463 | 1,559 | ||||||||

| Foreign exchange (gains)/losses on production costs | (119 | ) | 363 | (63 | ) | (728 | ) | |||||

| Production costs | $ | 17,231 | $ | 13,095 | $ | 32,308 | $ | 19,720 | ||||

| Transportation and refining | 810 | 568 | 1,514 | 1,026 | ||||||||

| Royalties | 724 | 466 | 1,394 | 684 | ||||||||

| Amortization and depreciation - operational assets - owned assets | 7,115 | 6,245 | 14,294 | 12,548 | ||||||||

| Amortization and depreciation - operational assets - right-of-use assets | 1,159 | 1,160 | 2,319 | 2,322 | ||||||||

| Cost of sales | $ | 27,039 | $ | 21,534 | $ | 51,829 | $ | 36,300 | ||||

3c. AMORTIZATION AND DEPRECIATION

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Amortization and depreciation - operational assets - owned assets | 7,115 | 6,245 | 14,294 | 12,548 | |||||||||||||||||||

| Amortization and depreciation - operational assets - right of use assets | 1,159 | 1,160 | 2,319 | 2,322 | |||||||||||||||||||

| Amortization and depreciation - owned assets | 121 | 311 | 255 | 783 | |||||||||||||||||||

| Amortization and depreciation - right-of-use assets | 39 | 36 | 75 | 73 | |||||||||||||||||||

| $ | 8,434 | $ | 7,752 | $ | 16,943 | $ | 15,726 | ||||||||||||||||

3d. OTHER ADMINISTRATION EXPENSES

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Employee compensation | 638 | 1,310 | 2,238 | 2,165 | ||||||||

| Professional services | 543 | 606 | 960 | 793 | ||||||||

| Other corporate expenses | 2,461 | 187 | 4,446 | 1,864 | ||||||||

| $ | 3,642 | $ | 2,103 | $ | 7,644 | $ | 4,822 | |||||

- INVENTORIES

| June 30, 2025 | December 31, 2024 | |||||

| Current: | ||||||

| Plant spares and consumables | 12,061 | 11,123 | ||||

| Gold ore in stockpile | 17,164 | 20,058 | ||||

| Gold in CIL | 3,798 | 4,260 | ||||

| Gold doré | 4,117 | 5,663 | ||||

| $ | 37,140 | $ | 41,104 |

| Non-current: | ||||||

| Gold ore in stockpile | 63,829 | 57,124 | ||||

| $ | 63,829 | $ | 57,124 |

There were no write downs to reduce the carrying value of inventories to net realizable value during the periods ended June 30, 2025 and 2024.

- AMOUNTS RECEIVABLE

| June 30, 2025 | December 31, 2024 | |||||

| Current: | ||||||

| Advance deposits to vendors | 2,959 | 1,654 | ||||

| Prepaid expenses | 1,628 | 1,991 | ||||

| Other receivables | 1,133 | 377 | ||||

| Other prepayments | 622 | 539 | ||||

| $ | 6,342 | $ | 4,561 |

The value of receivables recorded on the balance sheet is approximate to their recoverable value and there are no expected material credit losses.

- LEASES

Leases relate principally to corporate offices and the mining fleet at the Segilola mine. Corporate offices are depreciated over 5 years and mining fleet over the life of mine of Segilola.

The key impacts on the Statement of Comprehensive Income and the Statement of Financial Position for the period ended June 30, 2025, were as follows:

| Right-of-use asset | Lease liability | Income statement | |||||||

| Carrying value December 31, 2024 | $ | 7,302 | $ | (7,210 | ) | $ | |||

| New leases entered in to during the period | - | - | - | ||||||

| Depreciation | (2,394 | ) | - | (2,394 | ) | ||||

| Interest | - | (227 | ) | (227 | ) | ||||

| Lease payments | - | 2,517 | 2,517 | ||||||

| Foreign exchange movement | 28 | (145 | ) | (145 | ) | ||||

| Carrying value at June 30, 2025 | $ | 4,936 | $ | (5,065 | ) | $ | (249 | ) | |

| Current liability | (4,833 | ) | |||||||

| Non-current liability | (232 | ) | |||||||

The key impacts on the Statement of Comprehensive Income and the Statement of Financial Position for the year ended June 30, 2024, were as follows:

| Right-of-use asset | Lease liability | Income statement | |||||||

| Carrying value December 31, 2023 | $ | 12,096 | $ | (11,490 | ) | $ | |||

| New leases entered in to during the period | - | - | - | ||||||

| Depreciation | (4,788 | ) | - | (4,788 | ) | ||||

| Interest | - | (757 | ) | (757 | ) | ||||

| Lease payments | - | 5,032 | - | ||||||

| Foreign exchange movement | (6 | ) | 5 | 5 | |||||

| Carrying value at December 31, 2024 | $ | 7,302 | $ | (7,210 | ) | $ | (5,540 | ) | |

| Current liability | (4,818 | ) | |||||||

| Non-current liability | (2,392 | ) | |||||||

- GOLD STREAM LIABILITY

Gold stream liability

| June 30, 2025 | December 31, 2024 | |||||

| Balance at Beginning of period | $ | 9,358 | $ | 20,043 | ||

| Repayments | (9,981 | ) | (14,661 | ) | ||

| Fair value movements | 623 | 3,976 | ||||

| Balance at end of period | $ | - | $ | 9,358 | ||

| Current liability | - | 9,358 | ||||

| Non-current liability | - | - |

On April 29, 2020, the Group entered into a Gold Purchase and Sale Agreement ("GSA") with the Africa Finance Corporation ("AFC") in respect of the Segilola Gold Project, under which the Group received a $21.0 million prepayment for future gold production. In December 2021, the GSA was amended to allow for net cash settlement rather than physical delivery of gold.

The arrangement is accounted for as a financial liability measured at fair value through profit or loss, with changes in fair value recognized in the statement of profit or loss. As at June 30, 2025, the fair value of the GSA liability was nil.

As at June 30, 2025, a liability of $17.1 million is included in accounts payable (December 31, 2024: $9.3 million). Further details are provided in Note 3d of the audited consolidated financial statements for the year ended December 31, 2024.

- LOANS AND BORROWINGS

| June 30, 2025 | December 31, 2024 | |||||

| Current liabilities: | ||||||

| Deferred element of EPC contract | - | 860 | ||||

| $ | - | 860 |

Deferred payment facility on EPC contract for the construction of the Segilola Gold Mine

The Group has constructed its Segilola Gold Mine through an engineering, procurement, and construction contract ("EPC Contract"). The EPC Contract has been agreed on a lump sum turnkey basis which provides Thor with a fixed price of $67.5 million for the full delivery of design, engineering, procurement, construction, and commissioning of the proposed 715,000 ton per annum gold ore processing plant.

The EPC Contract included a deferred element ("the Deferred Payment Facility") of 10% of the fixed price. The 10% deferred element was repayable in instalments over a 36-month period by repaying an amount on a series of repayment dates, as set out in the Deferred Payment Facility. Repayments commenced in March 2022. Interest accrued on the deferred amount at 8% per annum from the date the Facility Taking-Over Certificate was issued.

The final instalment under the Deferred Payment Facility was paid in full during the six-month period ended June 30, 2025, and no further amounts are outstanding.

| June 30, 2025 | December 31, 2024 | |||||

| Balance at beginning of period | $ | 860 | 3,405 | |||

| Principal repayments | (858 | ) | (2,860 | ) | ||

| Interest paid | (44 | ) | (131 | ) | ||

| Unwinding of interest in the period | 42 | 446 | ||||

| Balance at end of period | $ | - | 860 | |||

| Current liability | - | 860 | ||||

| Non-current liability | - | - |

- PROVISIONS

| June 30, 2025 | Other | Fleet demobilization costs | Restoration costs | Total | ||||||||

| Balance at Beginning of period | $ | 19 | $ | 173 | $ | 4,869 | $ | 5,061 | ||||

| Initial recognition of provision | - | - | - | - | ||||||||

| Changes in estimates | - | - | ||||||||||

| Unwinding of discount | - | - | 27 | 27 | ||||||||

| Foreign exchange movements | 2 | - | - | 2 | ||||||||

| Balance at end of the period | $ | 21 | $ | 173 | $ | 4,896 | $ | 5,090 | ||||

| Current liability | - | - | - | - | ||||||||

| Non-current liability | 21 | 173 | 4,896 | 5,090 | ||||||||

| December 31, 2024 | Other | Fleet demobilization costs | Restoration costs | Total | ||||||||

| Balance at beginning of period | $ | 20 | $ | 173 | $ | 4,815 | $ | 5,008 | ||||

| Unwinding of discount | - | - | 54 | 54 | ||||||||

| Foreign exchange movements | (1 | ) | - | - | (1 | ) | ||||||

| Balance at period end | $ | 19 | $ | 173 | $ | 4,869 | $ | 5,061 | ||||

| Current liability | - | - | - | - | ||||||||

| Non-current liability | 19 | 173 | 4,869 | 5,061 | ||||||||

The restoration costs provision is for the site restoration at Segilola Gold Project in Osun State Nigeria. The value of the above provision is measured by unwinding the discount on expected future cash flows using a discount factor that reflects the credit-adjusted risk-free rate of interest.

It is expected that the restoration costs will be paid in US dollars, and as such US forecast inflation rates of 2.5% and the interest rate of 4.25% on 2-year US bonds were used to calculate the expected future cash flows, which are in line with the life of mine. The provision represents the net present value of the best estimate of the expenditure required to settle the obligation to rehabilitate environmental disturbances caused by mining operations at mine closure.

The fleet demobilization costs provision is the value of the cost to demobilize the mining fleet upon closure of the mine.

- PROPERTY, PLANT AND EQUIPMENT

| Segilola Mine | Other | Total | |||||||||

| Depletable | Non-Depletable | Assets under construction | Motor vehicles | Plant and machinery | Office furniture | ||||||

| Costs | |||||||||||

| Balance, December 31, 2023 | 194,326 | 17 | - | 723 | 290 | 311 | 195,667 | ||||

| Transfers | - | - | - | - | - | - | - | ||||

| Additions | 3,974 | - | - | - | 11 | 31 | 4,016 | ||||

| Disposals | - | - | - | (65 | ) | - | - | (65 | ) | ||

| Foreign exchange movement | - | - | - | (84 | ) | (17 | ) | (25 | ) | (126 | ) |

| Balance, December 31, 2024 | 198,300 | 17 | - | 574 | 284 | 317 | 199,492 | ||||

| Transfers | - | - | - | - | - | - | - | ||||

| Additions | 2,622 | - | - | - | 6 | 14 | 2,642 | ||||

| Disposals | - | - | - | - | - | - | - | ||||

| Foreign exchange movement | - | - | - | - | 4 | 15 | 19 | ||||

| Balance, June 30, 2025 | 200,922 | 17 | - | 574 | 294 | 346 | 202,153 | ||||

| Accumulated depreciation and impairment losses | |||||||||||

| Balance, January 1, 2024 1 | 50,553 | - | - | 408 | 206 | 137 | 51,304 | ||||

| Depreciation | 27,770 | - | - | 17 | 1 | 50 | 27,838 | ||||

| Disposals | - | - | - | (65 | ) | - | - | (65 | ) | ||

| Foreign exchange movement | - | - | - | (50 | ) | (12 | ) | (18 | ) | (80 | ) |

| Balance, December 31, 2024 1 | 78,323 | - | - | 310 | 195 | 169 | 78,997 | ||||

| Transfers | - | - | - | - | - | - | - | ||||

| Depreciation | 14,828 | - | - | 5 | 1 | 24 | 14,858 | ||||

| Disposals | - | - | - | - | - | - | - | ||||

| Foreign exchange movement | - | - | - | - | - | 10 | 10 | ||||

| Balance, June 30, 2025 | 93,151 | - | - | 315 | 196 | 203 | 93,865 | ||||

| 108,733 | |||||||||||

| Carrying amounts | |||||||||||

| Balance, December 31, 2024 1 | 119,977 | 17 | - | 264 | 89 | 148 | 120,495 | ||||

| Balance, June 30, 2025 | 107,771 | 17 | - | 259 | 98 | 143 | 108,288 | ||||

a)Segilola production stripping cost:

During the period ended June 30, 2025, the Group capitalized nil (year ended December 31, 2024: $0.7 million) of production stripping costs to the Segilola mine.

The depreciation expense related to production stripping costs deferred for the period ended June 30, 2025, was $1.1 million (year ended December 31, 2024 - $2.4 million).

Included in the Segilola mine balance at June 30, 2025, is $16.2 million (December 31, 2024 - $16.2 million) related to production stripping costs.

- INTANGIBLE ASSETS

The Group's exploration and evaluation assets costs are as follows:

| Douta Gold Project, Senegal | Lithium exploration licenses | Gold exploration licenses | Software | Total | |||||||||||

| Balance, December 31, 2023 | 22,719 | 1,981 | 4,050 | 163 | 28,913 | ||||||||||

| Acquisition costs | 120 | - | 50 | - | 170 | ||||||||||

| Exploration costs | 3,623 | 989 | 4,017 | - | 8,629 | ||||||||||

| Additions | - | - | - | 80 | 80 | ||||||||||

| Amortisation | - | - | - | (109 | ) | (109 | ) | ||||||||

| Foreign exchange movement | (1,366 | ) | - | (79 | ) | - | (1,445 | ) | |||||||

| Balance, December 31, 2024 | 25,096 | 2,970 | 8,038 | 134 | 36,238 | ||||||||||

| Acquisition costs | - | - | - | - | - | ||||||||||

| Exploration costs | 4,382 | 261 | 3,045 | - | 7,688 | ||||||||||

| Additions | - | - | - | 15 | 15 | ||||||||||

| Amortisation | - | - | - | (45 | ) | (45 | ) | ||||||||

| Foreign exchange movement | - | - | 7 | - | 7 | ||||||||||

| Balance, June 30, 2025 | 29,478 | 3,231 | 11,090 | 104 | 43,903 | ||||||||||

a)Douta Gold Project, Senegal:

The Douta Gold Project consists of two gold exploration permits, E02038 and E03709, located within the Kéniéba inlier, eastern Senegal, which it is currently advancing to preliminary feasibility stage.

The Group is party to an option agreement (the "Option Agreement") with International Mining Company ("IMC"), by which the Group has acquired a 70% interest in the Douta Gold Project.

Pursuant to the terms of the Option Agreement, IMC's 30% interest will be a "free carry" interest until such time as the Group announces probable reserves on the Douta Gold Project (the "Free Carry Period"). Following the Free Carry Period, IMC must either elect to sell its 30% interest to African Star at a purchase price determined by an independent valuer commissioned by African Star or fund its 30% share of the exploration and operating expenses.

On April 3, 2025, the Group completed the acquisition of two additional licenses in southeast Senegal to further advance the Douta Gold Project. These include an up to 85% interest in the Douta-West Licence, located contiguous to the Douta Gold Project, for $120,000, and an up to 80% interest in the Sofita Licence, approximately 20 kilometers south of Douta. These strategic acquisitions have been fully paid during the year ended December 31, 2025 and are intended to enhance and expand the Group's ongoing exploration efforts in Douta Gold Project.

b) Lithium exploration Licenses, Nigeria

As at June 30, 2025, the Group has over 600 km² of granted tenure in south-west Nigeria that covers both known lithium bearing pegmatite deposits and a large unexplored prospective pegmatite-rich belt.

c)Gold exploration Licenses

Nigeria

As at March 31, 2025, the Group's gold exploration tenure in Nigeria currently primarily comprises 16 wholly owned exploration licenses and 13 partnership exploration licenses. Together with the mining lease over the Segilola Gold Deposit, Thor's total gold exploration tenure amounts to 1,697 km².

Cote D'Ivoire

In addition, during the year ended in December 31, 2025 the Group expanded its operations into Cote d'Ivoire via the agreements detailed below, all of which remained in effect as at March 31, 2025:

Guitry

The Group signed a binding sale and purchase agreement ("SPA") with Endeavour Mining Corporation ("Endeavour") to acquire a 100% interest in the Guitry Gold Exploration Project ("Guitry").

The acquisition is still subject to the completion of certain conditions precedent including final approval of the Minister of Mines. The total consideration for the acquisition is a cash payment of US$100,000 in cash at completion and a 2% Net Smelter Royalty.

Boundiali

The Group entered into an option agreement with Goldridge Resources SARL to acquire up to 80% interest in the Boundiali Exploration Permit. This early-stage gold exploration project is located in northwest Côte d'Ivoire and comprises a 160 km² exploration permit.

Marahui

The Group entered into an option agreement with Compagnie Africaine de Recherche et d'Exploitation Minière ("CAREM") to acquire up to 80% interest in the Marahui permit. The permit covers an area of approximately 250 km² in the Bondoukou region in northeastern Côte d'Ivoire, approximately 600 km from Abidjan. The Group paid an initial consideration of US$50,000 in cash.

- ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

| June 30, 2025 | December 31, 2024 | |||||

| Trade payables | $ | 19,363 | $ | 46,273 | ||

| Accrued liabilities | 6,534 | 2,523 | ||||

| Other payables | 4 | 171 | ||||

| $ | 25,901 | $ | 48,967 |

Trade payables include a liability of $17.1 million (December 31, 2024: $9.3 million) relating to the Gold Purchase and Sale Agreement ("GSA"). Further details are provided in Note 12.

Accounts payable and accrued liabilities are classified as financial liabilities measured at amortized cost. Their carrying values approximate fair value due to their short-term nature.

- CAPITAL AND RESERVES

a)Authorized

Unlimited common shares without par value.

b)Issued

| June 30, 2025 Number | June 30, 2025 | December 31, 2024 Number | December 31, 2024 | |||||||||

| As at start of the year | 657,064,724 | $ | 81,633 | 656,064,724 | $ | 81,491 | ||||||

| Issue of new shares: | ||||||||||||

| - Share options exercised | 8,232,758 | 760 | 1,000,000 | 142 | ||||||||

| 665,297,482 | $ | 82,393 | 657,064,724 | $ | 81,633 | |||||||

i. Value of:

13,040,000 options exercised (8,232,58 received) at a price of CAD$0.20 per share on January 20, 2025;

1,000,000 options exercised at a price of CAD$0.20 per share on November 22, 2024.

c) Share-based compensation

Stock option plan

The Group had granted directors, officers and consultants share purchase options. These options were granted pursuant to the Group's stock option plan.

Under the current Share Option Plan, 44,900,000 common shares of the Group were reserved for issuance upon exercise of options.

All of the stock options were vested as at the balance sheet date. These options did not contain any market conditions and the fair value of the options were charged to the statement of comprehensive loss or capitalized as to assets under construction in the period where granted to personnel's whose cost is capitalized on the same basis.

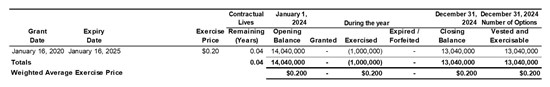

The following is a summary of changes in options from January 1, 2022, to December 31, 2024, and the outstanding and exercisable options at December 31, 2024:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7003/262089_grantdate.jpg

In Canadian Dollars

d) Nature and purpose of equity and reserves

The reserves recorded in equity on the Group's statement of financial position include 'Option reserve,' 'Currency translation reserve,' 'Retained earnings' and 'Deficit.'

'Option reserve' is used to recognize the value of stock option grants prior to exercise or forfeiture.

'Currency translation reserve' is used to recognize the exchange differences arising on translation of the assets and liabilities of foreign branches and subsidiaries with functional currencies other than US dollars.

'(Deficit)/Retained earnings' is used to record the Group's accumulated earnings.

e) Dividends

During the six months ended 30 June 2025, the Company announced and paid its quarterly dividend of $5.8 million or C$0.0125 per share. The total amount paid of $5.8 million is included in cash flows from financing activities.

- EARNINGS PER SHARE

Diluted earnings per share was calculated based on the following:

| Three months ended June 30, | Six months ended June 30, | ||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||

| Basic weighted average number of shares outstanding | 665,297,482 | 656,064,724 | 665,297,482 | 656,064,724 | |||||||

| Stock options | - | 3,824,151 | - | 3,824,151 | |||||||

| Diluted weighted average number of shares outstanding | 665,297,482 | 659,888,875 | 665,297,482 | 659,888,875 | |||||||

| Total common shares outstanding | 665,297,482 | 656,064,724 | 665,297,482 | 656,064,724 | |||||||

| Total potential diluted common shares | 665,297,482 | 670,104,724 | 665,297,482 | 670,104,724 | |||||||

- RELATED PARTY DISCLOSURES

A number of key management personnel, or their related parties, hold or held positions in other entities that result in them having control or significant influence over the financial or operating policies of the entities outlined below.

a)Trading transactions

The Africa Finance Corporation ("AFC") is deemed to be a related party given the size of its shareholding in the Company. There have been no other transactions with the AFC other than the Gold Stream liability as disclosed in Note 8, and the secured loan as disclosed in Note 9.

b)Compensation of key management personnel

The remuneration of directors and other members of key management during the three and six months ended June 30, 2025, and 2024 were as follows:

| Three months ended June 30, | Six months ended June 30, | ||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| Salaries and bonuses | |||||||||||||

| Current directors and officers | (i) (ii) (iii) | $ | 305 | $ | 677 | $ | 1,488 | 945 | |||||

| Directors' fees | |||||||||||||

| Current directors and officers | (i) (ii) | $ | 120 | 122 | $ | 262 | 241 | ||||||

| $ | 425 | $ | 799 | $ | 1,750 | 1,186 | |||||||

(i)Key management personnel were not paid post-employment benefits, termination benefits, or other long-term benefits during the three and six months ended June 30, 2025, and 2024.

(ii)The Group paid consulting and director fees to both individuals and private companies controlled by directors and officers of the Group for services. Accounts payable and accrued liabilities at June 30, 2025, include $85,163 (December 31, 2024 - $81,730) due to directors or private companies controlled by an officer and director of the Group. Amounts due to or from related parties are unsecured, non-interest bearing and due on demand.

(iii) Executive bonuses were paid during the three-month period ended in March 31, 2025.

- FINANCIAL INSTRUMENTS

The Group's financial instruments consist of cash, amounts receivable, accounts payable, accrued liabilities, gold stream liability, loans and other borrowings and lease liabilities.

Fair value of financial assets and liabilities

Fair values have been determined for measurement and/or disclosure purposes. When applicable, further information about the assumptions made in determining fair values is disclosed in the notes specific to that asset or liability.

The carrying amount for cash, amounts receivable, and accounts payable, accrued liabilities, loans and borrowings and lease liabilities on the statement of financial position approximate their fair value because of the limited term of these instruments.

Financial risk management objectives and policies

The Group has exposure to the following risks from its use of financial instruments

Interest rate risk

Credit risk

Liquidity and funding risk

Market risk

In common with all other businesses, the Group is exposed to risks that arise from its use of financial instruments. This note describes the Group's objectives, policies and processes for managing those risks and the methods used to measure them. Further quantitative information in respect of these risks is presented throughout these consolidated financial statements.

There have been no substantive changes in the Group's exposure to financial instrument risks, its objectives, policies and processes for managing those risks or the methods used to measure them from previous years unless otherwise stated in these notes.

The Board of Directors has overall responsibility for the establishment and oversight of the Group's risk management framework. The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Group's competitiveness and flexibility. Further details regarding these policies are set out below.

Financial instruments by category

The accounting policies for financial instruments have been applied to the line items below:

| June 30, 2025 | Measured at amortized cost | Measured at fair value through profit and loss | Total | |||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 52,853 | - | 52,853 | ||||

| Amounts receivable | 1,133 | - | 1,133 | |||||

| Total assets | $ | 53,986 | - | 53,986 | ||||

| Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 25,901 | - | 25,901 | ||||

| Other financial liabilities | 5,065 | - | 5,065 | |||||

| Total liabilities | $ | 30,966 | - | 30,966 | ||||

| December 31, 2024 | Measured at amortized cost | Measured at fair value through profit and loss | Total | |||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 12,040 | - | 12,040 | ||||

| Amounts receivable | 377 | - | 377 | |||||

| Total assets | $ | 12,417 | - | 12,417 | ||||

| Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 48,967 | - | 48,967 | ||||

| Loans and borrowings | 860 | - | 860 | |||||

| Gold stream liability | - | 9,358 | 9,358 | |||||

| Lease liabilities | 7,210 | - | 7,210 | |||||

| Other financial liabilities | - | 1,900 | 1,900 | |||||

| Total liabilities | $ | 57,037 | 11,258 | 68,295 | ||||

The fair value of these financial instruments approximates their carrying value.

As noted above, the Group has certain financial liabilities that are held at fair value. The fair value hierarchy establishes three levels to classify the inputs to valuation techniques to measure fair value:

Classification of financial assets and liabilities

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices); and

Level 3 - inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs).

As at June 30, 2025 and December 31, 2025, all the Group's liabilities measured at fair value through profit and loss are categorized as Level 3 and their fair value was determined using discounted cash flow valuation models, taking into account assumptions with respect to gold prices and discount rates as well as estimates with respect to production and operating results for the Segilola mine.

- CAPITAL MANAGEMENT

The Group manages, as capital, the components of shareholders' equity. The Group's objectives, when managing capital, are to safeguard its ability to continue as a going concern in order to develop and its mineral interests through the use of capital received via the issue of common shares and via debt instruments where the Board determines that the risk is acceptable and, in the shareholders' best interest to do so.

The Group manages its capital structure, and makes adjustments to it, in light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust its capital structure, the Group may attempt to issue common shares, borrow, acquire or dispose of assets or adjust the amount of cash.

- CONTRACTUAL COMMITMENTS AND CONTINGENT LIABILITIES

Contractual Commitments

The Group has no contractual obligations that are not disclosed on the Condensed Interim Consolidated Statement of Financial Position.

Contingent liabilities

The Group is involved in various legal proceedings arising in the ordinary course of business. Management has assessed these contingencies and determined that, in accordance with International Financial Reporting Standards, all cases are considered remote. As a result, no provision has been made in the financial statements for any potential liabilities that may arise from these legal proceedings.

Although the Group believes that it has valid defenses in these matters, the outcome of these proceedings is uncertain, and there can be no assurance that the Group will prevail in these matters. The Group will continue to assess the likelihood of any loss, the range of potential outcomes, and whether or not a provision is necessary in the future, as new information becomes available.

Based on the information available, the Group does not believe that the outcome of these legal proceedings will have a material adverse effect on the financial position or results of operations of the Group. However, there can be no assurance that future developments will not materially affect the Group's financial position or results of operations.

- SEGMENTED DISCLOSURES

Segment Information

The Group's operations comprise three reportable segments, the Segilola Mine Project, Exploration Projects, and Corporate.

| Six months ended June 30, 2025 | Segilola Mine Project | Exploration Projects | Corporate | Total | ||||||||

| Profit (loss) for the period | $ | 89,468 | $ | (8 | ) | $ | (3,302 | ) | $ | 86,158 | ||

| - revenue | 146,857 | - | - | 146,857 | ||||||||

| - production costs | (32,308 | ) | - | - | (32,308 | ) | ||||||

| - royalties | (1,394 | ) | - | - | (1,394 | ) | ||||||

| - amortization and depreciation | (16,848 | ) | - | (95 | ) | (16,943 | ) | |||||

| - other administration expenses | (4,430 | ) | (8 | ) | (3,207 | ) | (7,645 | ) | ||||

| - impairments | - | - | - | - | ||||||||

| - interest expense | (895 | ) | - | - | (895 | ) | ||||||

| June 30, 2025 | Segilola Mine Project | Exploration Projects | Corporate | Total | ||||||||

| Current assets | $ | 90,802 | $ | 420 | $ | 5,113 | $ | 96,335 | ||||

| Non-current assets | ||||||||||||

| Inventories | 63,829 | - | - | 63,829 | ||||||||

| Trade and other receivables | - | - | 228 | 228 | ||||||||

| Right-of-use assets | 4,633 | - | 303 | 4,936 | ||||||||

| Property, plant and equipment | 107,788 | 439 | 61 | 108,288 | ||||||||

| Intangible assets | 104 | 43,799 | - | 43,903 | ||||||||

| Total assets | $ | 267,156 | $ | 44,658 | $ | 5,705 | $ | 317,519 | ||||

| Non-current asset additions | $ | 2,637 | $ | 7,708 | $ | - | $ | 10,345 | ||||

| Liabilities | $ | (33,746 | ) | $ | (93 | ) | $ | (2,217 | ) | $ | (36,056 | ) |

Non-current assets by geographical location:

| June 30, 2025 | Senegal | Côte d'Ivoire | Nigeria | United Kingdom | Canada | Total | |||||||||||||

| Inventories | - | - | 63,829 | - | - | 63,829 | |||||||||||||

| Trade and other receivables | - | - | - | 228 | - | 228 | |||||||||||||

| Right of use assets | - | - | 4,633 | 303 | - | 4,936 | |||||||||||||

| Property, plant and equipment | 410 | - | 107,817 | 59 | 2 | 108,288 | |||||||||||||

| Intangible | 29,478 | 1,607 | 12,818 | - | - | 43,903 | |||||||||||||

| Total non-current assets | 29,888 | 1,607 | 189,097 | 590 | 2 | 221,184 | |||||||||||||

| Six months ended June 30, 2024 | Segilola Mine Project | Exploration Projects | Corporate | Total | ||||||||

| Profit (loss) for the year | $ | 40,396 | $ | (30 | ) | $ | (437 | ) | $ | 39,929 | ||

| - revenue | 87,188 | - | - | 87,188 | ||||||||

| - production costs | (19,720 | ) | - | - | (19,720 | ) | ||||||

| - royalties | (684 | ) | - | - | (684 | ) | ||||||

| - amortization and depreciation | (15,613 | ) | - | (113 | ) | (15,726 | ) | |||||

| - other administration expenses | (4,474 | ) | (24 | ) | (324 | ) | (4,822 | ) | ||||

| - impairments | - | (6 | ) | - | (6 | ) | ||||||

| - interest expense | (5,276 | ) | - | - | (5,276 | ) |

| December 31, 2024 | Segilola Mine Project | Exploration Projects | Corporate | Total | ||||||||

| Current assets | 56,349 | 325 | 1,031 | 57,705 | ||||||||

| Non-current assets | ||||||||||||

| Inventories - non current | 57,124 | - | - | 57,124 | ||||||||

| Trade and other receivables | - | - | 208 | 208 | ||||||||

| Right-of-use assets | 6,952 | - | 350 | 7,302 | ||||||||

| Property, plant and equipment | 119,992 | 427 | 76 | 120,495 | ||||||||

| Intangible assets | 134 | 36,104 | - | 36,238 | ||||||||

| Total assets | 240,551 | 36,856 | 1,665 | 279,072 | ||||||||

| Non-current asset additions | 4,054 | 8,841 | - | 12,895 | ||||||||

| Liabilities | (76,347 | ) | 178 | 1,294 | 77,819 | |||||||

Non-current assets by geographical location:

| December 31, 2024 | Senegal | Cote D'Ivoire | Nigeria | United Kingdom | Total | ||||||||||

| Inventory | - | - | 57,124 | - | 57,124 | ||||||||||

| Prepaid expenses, advances and deposits | - | - | - | 208 | 208 | ||||||||||

| Right-of-use assets | - | - | 6,952 | 350 | 7,302 | ||||||||||

| Property, plant and equipment | 401 | - | 120,018 | 76 | 120,495 | ||||||||||

| Intangible assets | 25,096 | 589 | 10,553 | - | 36,238 | ||||||||||

| Total non-current assets | 25,497 | 589 | 194,647 | 634 | 221,367 |

20. SUPPLEMENTAL CASH FLOW INFORMATION

| Three months ended June 30, | Six months ended June 30, | ||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| Non-cash items: | |||||||||||||

| Exploration & Evaluation assets expenditures | 20 | - | 85 | (116 | ) | ||||||||

| Repayment of loans and borrowings | 792 | - | (1,830 | ) | - | ||||||||

| 812 | - | (1,745 | ) | (116 | ) | ||||||||

21. SUBSEQUENT EVENTS

On July 14 2025, the Board of Directors authorized a quarterly dividend of C$0.0125 per share. These dividends are to be paid on August 15, 2025.

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR

DISTRIBUTION TO U.S. WIRE SERVICES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262089

SOURCE: Thor Explorations Ltd.