VANCOUVER, British Columbia, Aug. 12, 2025 (GLOBE NEWSWIRE) -- Cornish Metals Inc. (AIM/TSX-V: CUSN) ("Cornish Metals" or the "Company"), a mineral exploration and development company focused on advancing its wholly owned and permitted South Crofty tin project ("South Crofty") in Cornwall, United Kingdom, is pleased to announce that an independent panel of globally recognised sustainability experts from Digbee has awarded Cornish Metals an inaugural overall rating of A for both its corporate and project performance.

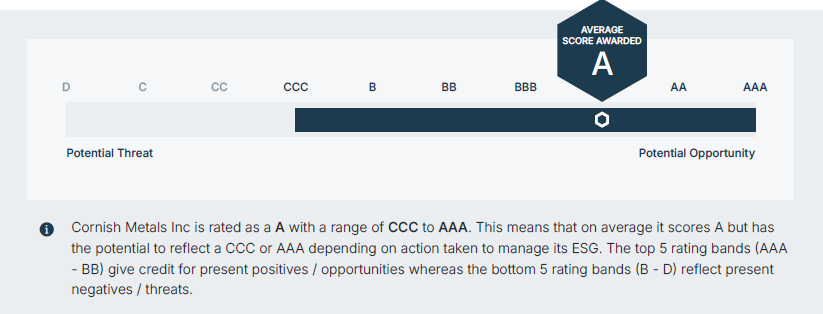

The Digbee platform offers companies a right-sized, future-looking set of globally-aligned sustainability frameworks. Digbee evaluates a comprehensive range of factors, considering both the asset's context and the effectiveness of management actions, to assign a rating from AAA to D. The A score achieved by Cornish Metals is an average of scores received between CCC to AAA.

To read the full report in full, please visit: https://cornishmetals.com/sustainability/digbee/

Extracts from the Report:

- ESG priorities are embedded in the Company's strategic planning and governance structures, as evidenced by an internal double materiality assessment, development of a formal sustainability strategy, linkage of ESG KPIs to executive remuneration, publication of the inaugural Sustainability Report, commitments to preserving the mining cultural heritage and improving biodiversity.

- The Company has attracted significant investment from Vision Blue Resources and the UK National Wealth Fund (together holding over 55%), reflecting strong market and public-sector confidence in its responsible tin production model and long-term alignment with the UK Critical Minerals Strategy.

- The South Crofty Project incorporates underground mining, reuse of existing infrastructure, backfilling of tailings, use of renewable electricity, and commissioning of a high-efficiency Water Treatment Plant, demonstrating active efforts to reduce greenhouse gas emissions, surface disturbance and water pollution.

Don Turvey, CEO and Director of Cornish Metals, stated: "We are very pleased to share our inaugural sustainability rating from Digbee, which demonstrates the Company's commitment to operating to international best practices and acting with transparency. We enjoyed working with Digbee on this and appreciate the comprehensive overview that they have compiled. We understand there is always room for improvement, and we will be taking Digbee's points of feedback onboard as we continue to develop our environmental, social and governance practices."

Jamie Strauss, founder and CEO of Digbee, commented: "The successful completion of the Digbee sustainability assessment underscores Cornish Metals' belief that responsible mining is not only the right approach, but a critical differentiator. By embedding responsibility at the heart of its strategy, the company strengthens its social licence to operate and builds trust among all stakeholders - from communities, regulators and investors.

Earning an excellent 'A' rating through the Digbee assessment demonstrates the company's significant achievements to date in transparency, environmental stewardship, and community engagement. This independent verification not only validates Cornish Metals' current performance but also reflects its clear vision for continuous improvement - proving that mining can be both a driver of economic opportunity and a trusted partner in protecting and enhancing the communities and environments in which it operates."

Figure 1: Graphic representation of Cornish Metals' overall sustainability risks and opportunities assessed by Digbee.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral exploration and development company (AIM and TSX-V: CUSN) that is advancing the South Crofty tin project towards production. South Crofty:

- is a historical, high-grade, underground tin mine located in Cornwall, United Kingdom and benefits from existing mine infrastructure including multiple shafts that can be used for future operations;

- is permitted to commence underground mining (valid to 2071), construct a new processing facility and for all necessary site infrastructure;

- would be the only primary producer of tin in Europe or North America. Tin is a Critical Mineral as defined by the UK, American, and Canadian governments as it is used in almost all electronic devices and electrical infrastructure. Approximately two-thirds of the tin mined today comes from China, Myanmar and Indonesia;

- benefits from strong local community, regional and national government support with a growing team of skilled people, local to Cornwall, and could generate over 300 direct jobs.

ON BEHALF OF THE BOARD OF DIRECTORS

"Don Turvey"

Don Turvey

CEO and Director

Engage with us directly at our investor hub. Sign up at: https://investors.cornishmetals.com/link/PKav7e

For additional information please contact:

| Cornish Metals | Fawzi Hanano Irene Dorsman | investors@cornishmetals.com info@cornishmetals.com |

| Tel: +1 (604) 200 6664 | ||

| SP Angel Corporate Finance LLP (Nominated Adviser & Joint Broker) | Richard Morrison Charlie Bouverat Grant Barker | Tel: +44 203 470 0470 |

| Hannam & Partners (Joint Broker) | Matthew Hasson Andrew Chubb Jay Ashfield | cornish@hannam.partners Tel: +44 207 907 8500 |

| BlytheRay (Financial PR) | Tim Blythe Megan Ray | cornishmetals@blytheray.com Tel: +44 207 138 3204 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward looking statements

This news release may contain certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements"). Forward-looking statements include predictions, projections, outlook, guidance, estimates and forecasts and other statements regarding future plans, the realisation, cost, timing and extent of mineral resource or mineral reserve estimates, estimation of commodity prices, currency exchange rate fluctuations, estimated future exploration expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, requirements for additional capital and the Company's ability to obtain financing when required and on terms acceptable to the Company, future or estimated mine life and other activities or achievements of Cornish Metals. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could", "would" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this news release, are forward-looking statements that involve various risks and uncertainties and there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Forward-looking statements are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the availability of financing; the timing and content of upcoming work programmes; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; projected dates to commence mining operations; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations. The list is not exhaustive of the factors that may affect Cornish's forward-looking statements.

Cornish Metals' forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward- looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements. Cornish Metals does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3fd3776c-3d24-4f5c-adf0-a0d7e92e6f60