AI-powered scoring engine helps operators catch costly lease risks, improve terms, and expand with confidence

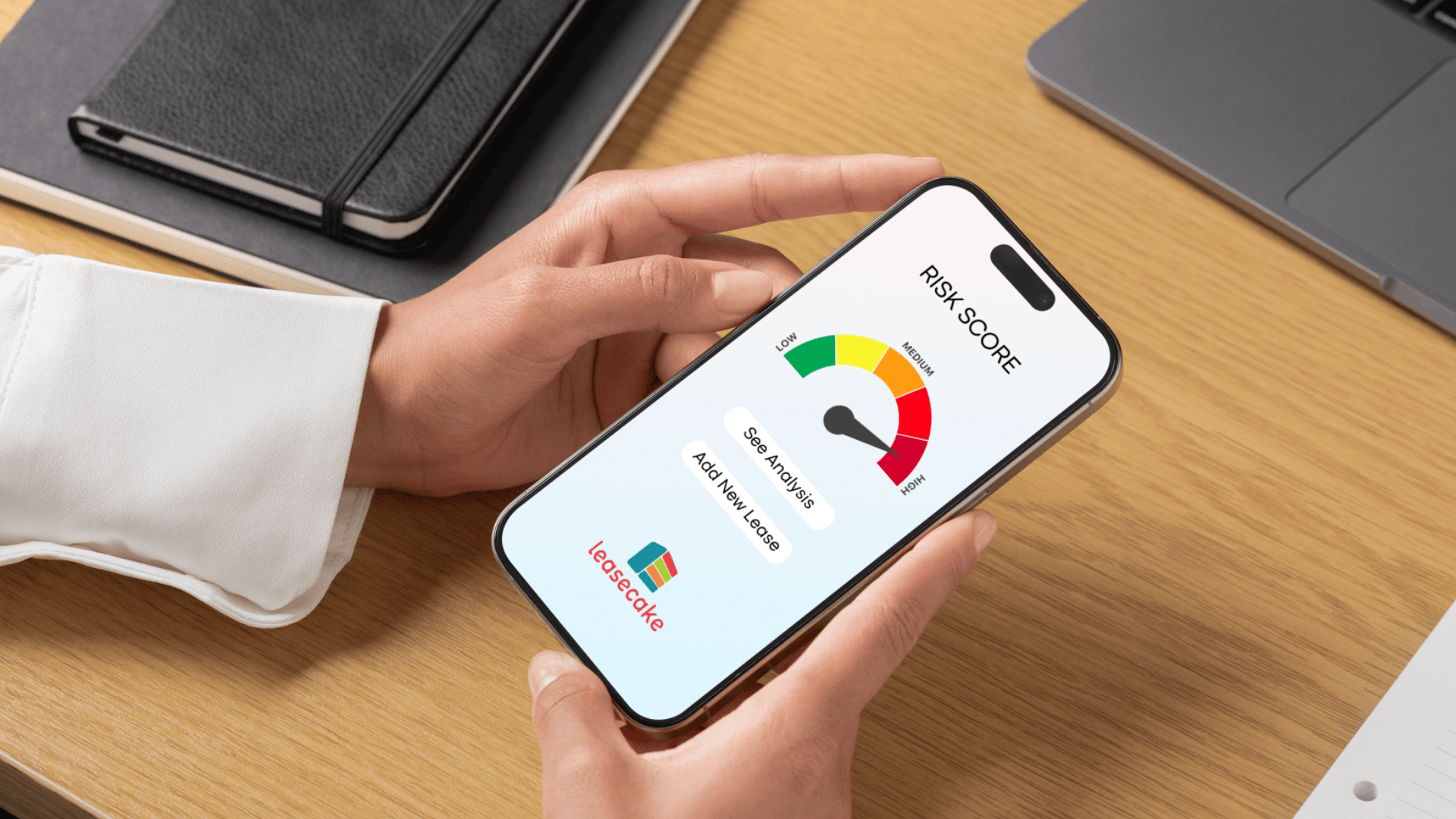

WINTER PARK, FL / ACCESS Newswire / August 12, 2025 / Leasecake, the leading lease management platform that transforms real estate risk into opportunity, today announced the launch of Leasecake LIFT: the Lease Intelligence and Favorability Tracker. This groundbreaking AI tool analyzes commercial leases, flags risk, and delivers instant, actionable insights, empowering operators to negotiate stronger terms, avoid costly oversights, and scale faster with confidence.

Lease Intelligence and Favorability Tracker spots lease risks

With this first-of-its-kind innovation, Leasecake is revolutionizing how growing brands and multi-location tenants navigate the critical but often overlooked details buried in lease language. As companies grow and take on more locations, the complexity and risk hidden in lease agreements grow with them. From ambiguous CAM clauses to missing flood protection or problematic exclusivity terms, small oversights can snowball into major financial consequences. Leasecake LIFT helps identify and eliminate that risk before it impacts the bottom line.

"We are on a mission to transform real estate risk into opportunity, and Leasecake LIFT is the next step in that journey. This is our third release of AI-infused capabilities, and like the others, it's grounded in practicality, not hype," said Scott Williamson, CEO of Leasecake. "Operators are overwhelmed with labor, supply chain, and operational execution. Real estate is a critical component of their ability to grow, but they don't have time to decode complex lease language. This new offering directly addresses the challenge so our customers can reduce overall expense and get stores online faster to drive more revenue."

Leasecake LIFT uses intelligent AI workflows and expert-calibrated scoring models to analyze every key area of risk within a lease, assigning each a "LIFT Score". This delivers unprecedented visibility across the entire portfolio, including any new leases prior to signing, empowering operators to make faster, smarter decisions aligned with their growth strategy.

"We believe Leasecake LIFT can be essential to cut through the noise and pinpoint what matters, saving days and sometimes weeks of back and forth lease negotiations," says Kristi Mailloux, Partner at Three 20 Capital Group. "As a PE fund, and for fast-growing operators like us, that speed could translate directly to hitting opening dates and driving revenue faster."

Whether entering a new market, negotiating a renewal, or evaluating leases acquired during due diligence, brands can now take a proactive approach to understanding how their lease terms impact growth. Leasecake LIFT makes it easier to assess whether existing leases support expansion strategies, identify clauses that may restrict operations, and surface risks that could affect unit-level performance. It's especially valuable during due diligence, when speed matters and critical details are often buried in inconsistent or unfamiliar lease language, enabling teams to make informed decisions and negotiate from a position of strength.

The result: teams uncover 5x more risk in half the time, saving hours per lease and reducing the cost of scaling.

"Lease language has always been a blind spot for growing brands," Williamson added. "With Leasecake LIFT, we're giving operators the power to see clearly, act confidently, and protect their business before future risk becomes today's reality."

To learn more or request a demo, visit https://get.leasecake.com/lift/.

About Leasecake

Leasecake is the premier lease management platform transforming how businesses approach real estate, by turning risk into opportunity and decisive action. Leasecake empowers organizations to protect their portfolios, reduce operational risk, and drive smarter, faster growth across their real estate footprint. Built on a foundation of intuitive design, intelligent automation, and innovation, Leasecake delivers the clarity, speed, and confidence businesses need to make better decisions and stay ahead in today's complex real estate landscape. To learn more, visit www.leasecake.com.

Contact Information

Michel Benjamin

VP Marketing

michel.benjamin@leasecake.com

SOURCE: Leasecake

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/real-estate/introducing-leasecake-lift-intelligent-risk-scoring-for-multi-location-operators-1058869