Shenzhen, Aug. 12, 2025 (GLOBE NEWSWIRE) -- Shenzhen, Aug 12, 2025 (GLOBE NEWSWIRE) - According to data released by the Macao Gaming Inspection and Coordination Bureau (official website: www.dicj.gov.mo), total gross gaming revenue for Macao's "Game of Chance" rose 8.3% YoY in Q2, reaching MOP 61.12 billion.

Notably, VIP Baccarat revenue increased by 23% YoY to MOP 16.33 billion, which is the highest level since Q4 2019.

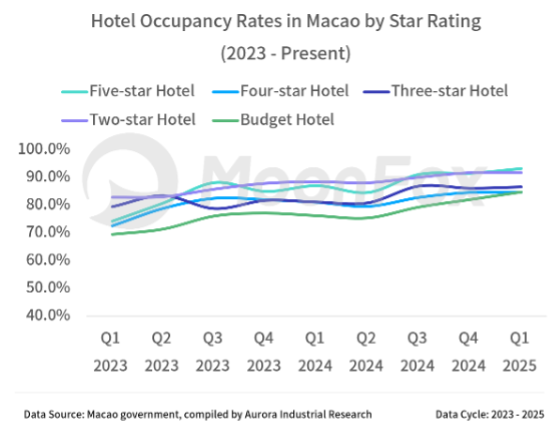

In recent years, Macao's gaming industry has been gradually recovering, supported by a rebound in tourist arrivals and hotel occupancy rates. Q2, traditionally a slower season, showed surprising vitality in 2025.

Aurora MoonFox remains optimistic about Macao's gaming market performance during the summer peak and has conducted an in-depth analysis of Wynn Macau's financial performance based on a broad range of data sources.

Macao Gaming Market Remains Upbeat; Tourist Recovery Supports Wynn Macau's Position as Sixth in the Sector

Gaming remains a cornerstone industry of the Macao SAR.

Public data show a continued increase in visitor numbers, along with strong hotel occupancy rates across the city.

Meanwhile, the Macao government is actively working to attract new international tourists. On June 16, authorities announced that nationals of Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman would be granted visa-free entry and pre-entry clearance exemptions to the Macao SAR.

According to the Public Security Police Force of Macao, over 850,000 visitors entered Macao during the Labor Day holiday period, with a daily average of 170,000, increased by 40.8% YoY. On May 2 alone, border crossings reached a record-breaking 837,000.

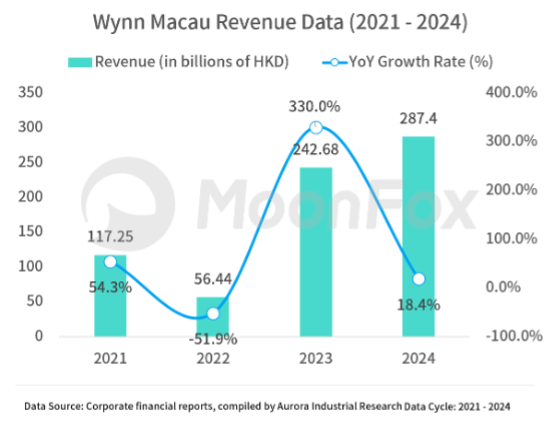

Wynn Macau's financial performance suffered a sharp decline between 2020 and 2022 due to the pandemic, with both revenue and profit severely impacted. However, from 2023 to 2024, as tourism rebounded, the company demonstrated a notable financial recovery.

From a business segment perspective, the mass gaming business has accounted for a larger proportion of the gaming business and has shown a strong recovery. VIP gaming business has also rebounded but remains below pre-pandemic levels. Slot machine operations have remained relatively stable. On the non-gaming side, sectors such as hotels, dining, and retail have gradually revived alongside the recovery of the tourism sector. These non-gaming businesses now play an increasingly important role in Wynn Macau's broader diversification strategy.

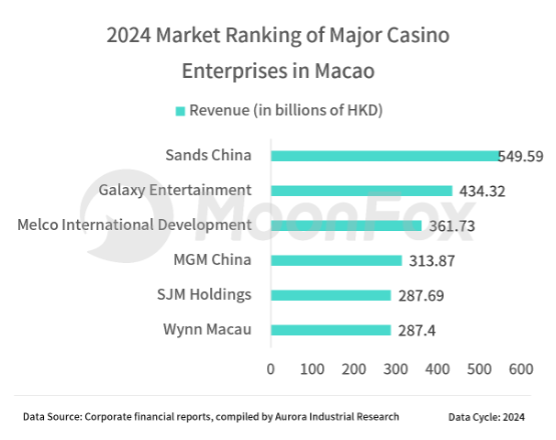

At the market competition level, Wynn Macau holds certain advantages due to its premium brand image and high-quality services. However, it also faces intense competition from other gaming operators in terms of market share and business expansion.

As of 2024, Wynn Macau ranks sixth in the industry by scale, roughly on par with SJM Holdings Limited.

The company operates two flagship properties: Wynn Palace and Wynn Macau. At its peak, Wynn Macau's total annual revenue exceeded HKD 35 billion.

In response to evolving market dynamics and changing consumer behavior, Wynn Macau continues to actively adjust both its gaming and non-gaming operations.

In the gaming segment, Wynn Macau is actively incorporating innovative technologies such as RFID smart gaming tables.

These tables are equipped with advanced electronic systems and data analytics capabilities that can track and analyze players' betting behaviors and preferences in real time.

Leveraging this data, Wynn Macau can offer personalized services and promotions, such as recommending gaming options tailored to individual betting habits and offering exclusive bonuses and gifts. At the same time, RFID smart gaming tables enhance operational efficiency, reduce human error, and lower overall operating costs.

Wynn Macau's Non-gaming Strategy Focuses on Diversified Experiences: MOP 16.5 Billion Investment on Non-gaming Business to Support World-class Entertainment

In the convention and exhibition sector, there are plans to develop a modern, multifunctional convention and exhibition center. It will host various types of large-scale international conferences, business negotiations, and specialized exhibitions, such as high-end international technology expos and fashion brand launches.

As for entertainment & live performances, Wynn Macau is set to construct a major theater and performance venue. It will host long-term residency shows by world-renowned production teams and artists. The program will feature a variety of formats, including Broadway musicals, world-class magic shows, and pop music concerts. By offering high-quality entertainment performances, the resort aims to meet the diverse cultural and entertainment needs of visitors, thereby extending their length of stay and increasing both the frequency and amount of their spending.

In the sector of Luxury Retail & Lifestyle, Wynn Macau will further upgrade and expand its retail spaces. It will introduce more global first-class brands and curated niche labels. The result will be a comprehensive shopping experience spanning fashion apparel, fine jewelry, cosmetics and skincare, and art pieces.

Wynn Macau's Q2 Revenue Expected to Grow 5.5% to USD 933 Million

Wynn Macau's financial performance remains heavily influenced by foot traffic. Even prior to the COVID-19 pandemic, Macao's gaming industry had already begun to transform to increase non-gaming revenue streams, such as live performances. However, casino operations remain the core revenue driver for both Wynn Macau and the broader Macau market.

Starting in 2023, Wynn Macau's business began a gradual recovery. By the end of 2024, revenue had rebounded to 80% of its 2019 level, reaching HKD 28.74 billion, reflecting a YoY increase of 18.4%.

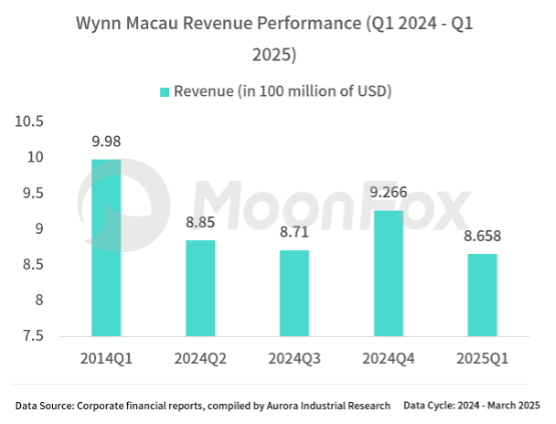

However, market sentiment was broadly cautious at the start of 2025. In Q1, Wynn Palace reported operating revenue of USD 535.9 million, down USD 51 million YoY; while Wynn Macau posted USD 330 million, decreased by USD 81.8 million YoY, largely due to softness in the VIP segment.

Despite this, occupancy rates for Wynn Palace & Wynn Macau remained exceptionally high at 98%, though average room rates saw a decline. Macao's sluggish macroeconomic environment continues to weigh on the company's profitability.

Early Q2 sentiment remained cautious, but strong Labor Day and Dragon Boat Festival traffic drove a better-than-expected recovery in Macao's gaming business.

Data shows that: Q2 Macao gross gaming revenue of Game of Chance rose 8.3% YoY, to MOP 61.12 billion.

Notably, VIP Baccarat revenue increased by 23% YoY to MOP 16.33 billion, which is the highest level since Q4 2019.

Considering the market performance in Q2, with the momentum from summer holidays and the upcoming Golden Week of National Day holidays in Q3, capital markets have become increasingly bullish. Forecasts now anticipate 6% growth in Macao's gross gaming revenue in the second half of the year, with full-year revenue expected to grow 4%, well above the 0.5% forecast by the Macao government.

Leveraging its extensive data resources, spanning online & retail stores, customer UVs, and manufacturing operations, MoonFox has built an investment model to comprehensively assess the investment value of Wynn Macau.

For Q2 2025, Wynn Macau's revenue is projected to reach USD 933 million, marking a 5.5% YoY increase.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en