By Jason Hartke, Ph.D.

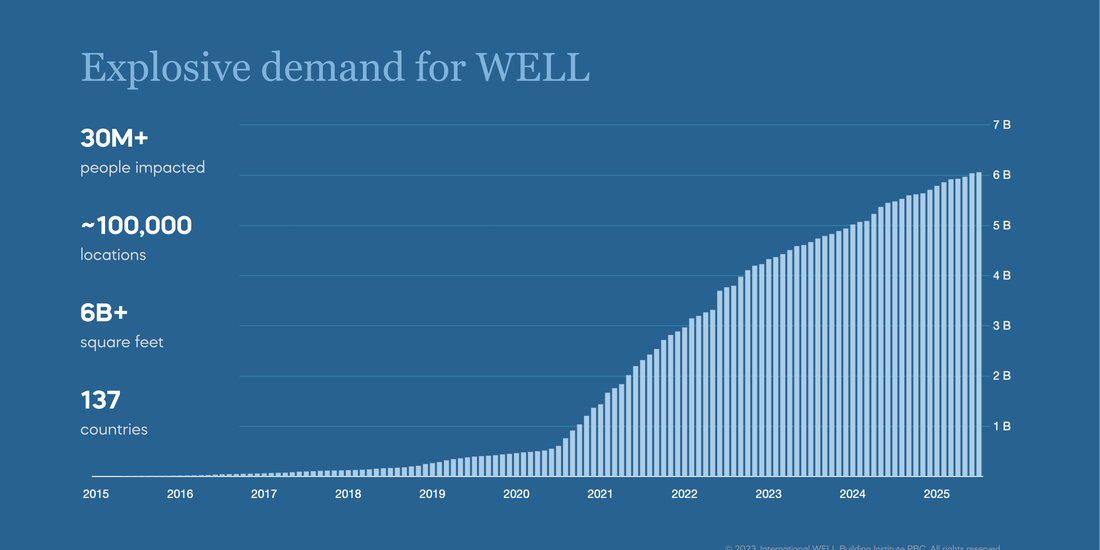

NORTHAMPTON, MA / ACCESS Newswire / August 12, 2025 / If WELL Certified spaces were a country, it would rival the entire commercial building footprint of the United Kingdom. That's where we are today - more than 6 billion square feet of real estate engaged with the WELL Building Standard, spanning nearly 100,000 locations in 138 countries

I've spent much of my career advancing people-first places, but even I'm struck by the speed and scale of what's happening. In early 2020, WELL had just eclipsed 500 million square feet. In just five years, we've seen twelve-fold growth, not only exceeding 6 billion square feet, but also reaching an estimated $2 trillion in assets and supporting the health of approximately 30 million people.

"This milestone reflects a new paradigm: prioritizing health isn't a cost, it's a catalyst. Because of WELL's relentless focus on people and their well-being, WELL projects serve as engines for better health outcomes, stronger financial returns and higher-performing people. That's why we're seeing the market embrace WELL like never before."-Rachel Hodgdon, President and CEO, IWBI

From Lendlease and Tata Realty to Cisco and Rudin, from Bloomberg and Barclays to Sunrise Senior Living and JLL, WELL is the world's leading benchmark companies around the world choose to demonstrate leadership in healthy buildings and healthy organizations. The market is telling us something: health has become a key metric of organizational success.

When you deploy WELL's evidence-based strategies-from better air quality and lighting to improved thermal comfort and water quality-something powerful happens: people thrive. And that distinctive WELL difference shows up in measurable ways, with higher productivity, stronger engagement, lower turnover and improved well-being. That's the real ROI.

"WELL's exponential global growth is unfolding alongside a deepening interest from the investment community who increasingly want to understand how organizations are investing in health and well-being-across portfolios, policies and people. These investors are asking for this information for a reason: because investments in health and well-being serve as powerful indicators of long-term financial performance and resilience. This pattern creates a positive feedback loop, where deploying WELL not only supports organizational goals but signals to investors that a company is future-ready, resilient and committed to the creativity and culture that drives lasting value."- Dr. Tauni Lanier, Director, Sustainability and Economic Growth, BDO

We're now on the other side of the tipping point, a moment where global market transformation is not just underway, but accelerating. With the momentum behind WELL growing exponentially, we're reshaping the expectations for how buildings can significantly support the people inside them.

"The market has moved quickly past the status quo, growing far more sophisticated in understanding how key building characteristics like lighting, air quality, thermal comfort and acoustics affect the health and well-being of the people inside. Now, leaders are embracing opportunities to fine-tune buildings through a people-first lens."- Brendan Owens, Principal of Black Vest Strategy, former Chief Sustainability Officer for the U.S. Department of Defense

The question for leaders is no longer if they'll embrace healthy buildings, but when. And for those who haven't yet started, the time to start is now.

View original content here.

View additional multimedia and more ESG storytelling from International WELL Building Institute (IWBI) on 3blmedia.com.

Contact Info:

Spokesperson: International WELL Building Institute (IWBI)

Website: https://www.3blmedia.com/profiles/international-well-building-institute

Email: info@3blmedia.com

SOURCE: International WELL Building Institute (IWBI)

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/six-billion-square-feet-and-counting-the-healthy-building-moveme-1059654