Recent Exploration in the Historic Rand Mining District Adds Tungsten to B&N's Gold and Silver Assets, Aligning With Global Demand for Critical Minerals

RANDSBURG, CA / ACCESS Newswire / August 12, 2025 / B&N Mining Properties, LLC (B&N) has announced the completion of a Canadian National Instrument 43-101 (NI 43-101) compliant mineral resource estimate on its wholly owned Black Hawk and Spud Patch tungsten and gold placer deposits. Both deposits are within the Rand Mining District in San Bernardino County, California.

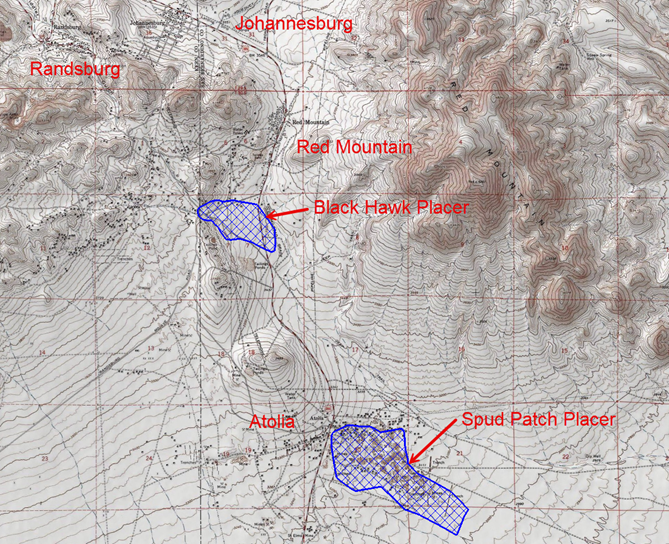

Figure 1 shows the location of the two tungsten and gold placer deposits.

The combined Inferred Mineral Resource for the two deposits totals:

33.8 million pounds of WO3 (tungsten trioxide)

104,000 troy ounces of gold

The two placer deposits are contained on the company's holdings in the Rand Mining District which totals 5,998 acres in Kern and San Bernardino Counties. In addition to the mineral lands in the Rand Mining District, B&N also holds 555 acres outside of the Rand Mining District in Kern, San Bernardino, and Inyo Counties. The two placer deposits are on company-owned land near Red Mountain and Atolia, California. Figure 1 shows the location of the two tungsten and gold placer deposits.

The Atolia area has a long history of significant tungsten production with the Rand Mining District being the third-largest primary tungsten-producing area in the United States. The addition of these two new mineral resources positions B&N as having one of the largest unmined tungsten deposits in the United States.

Mineral Resource Estimate

Mineral resource estimates for both placer deposits used a polygonal estimation method. Tungsten and gold grades per cubic yard were composited into single, per-hole composites. The grade value of each composited drill hole was then assigned to the volume of the surrounding polygon. Grade capping was applied to each tungsten and gold assay to ensure that the influence of high-grade outliers on the overall mineral resource was limited. The economics listed below were then used to determine blocks that were above a cutoff value per cubic yard. The cutoff value used is $5.00 per cubic yard or approximately 0.231 pounds of WO3 per cubic yard.

Table 1 - Economic Assumptions Used for the Black Hawk and Spud Patch Placers Mineral Resource Estimate - Source BOYD 2025

Item | Units | Placers | Source |

Operating Costs & Capital Costs | |||

Ore Mining Cost | US$/Ore Short Ton | $1.19 | Boyd, 2023 |

Waste Mining Cost | US$/Waste Short Ton | $1.26 | Boyd, 2023 |

Gold & Tungsten Processing | US$/Ore Short Ton | $0.59 | Boyd, 2025 |

G&A Cost | US$/Ore Short Ton | $1.00 | Boyd, 2023 |

Selling Cost | US$/Au Troy Oz | $5.00 | Boyd, 2025 |

Gold Recovery | % | 80.00% | Boyd, 2025 |

WO3 Recovery | % | 90.00% | Boyd, 2025 |

Metal Prices |

|

|

|

Gold Price | US$/Troy Oz | $2,373.00 | 3-Yr Trailing Average |

WO3 Price | US$/lb WO3 | $13.13 | 3-Yr Trailing Average |

Deposit Summaries

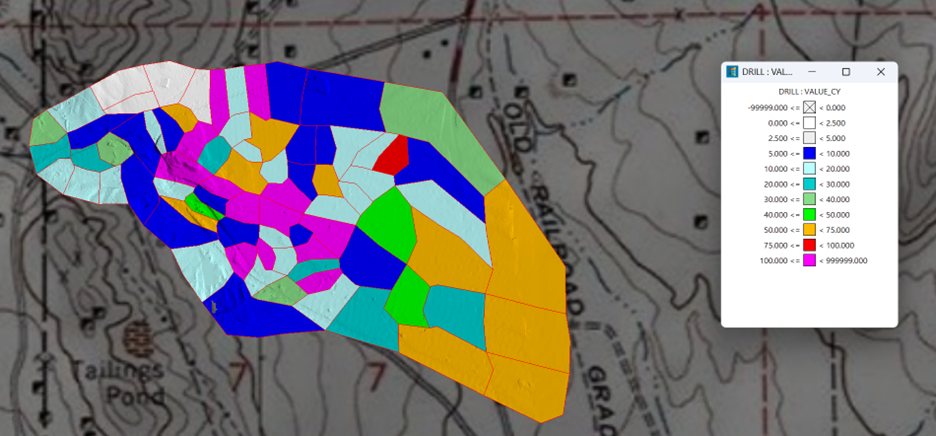

Black Hawk Placer Deposit - Located about one mile south of Red Mountain, California, the Black Hawk placer deposit was discovered in the 1950s but was never developed commercially. A total of 93 drill holes explored the deposit in the 1950s, 2022, and 2025. The deposit averages 51.1 feet in depth and contains scheelite (CaWO4, an important tungsten ore) and native gold in easily recoverable placer form. B&N completed 41 of the 93 total drill holes in 2022-2025.

The Black Hawk placer covers a total of 141.6 acres of land. All material estimated has an inferred classification. The average gross value per cubic yard for the Black Hawk placer deposit is $40.34.

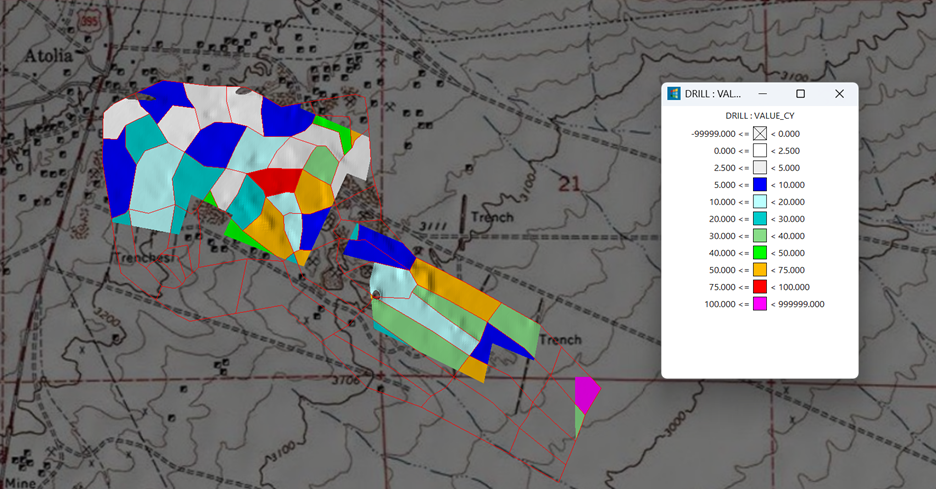

Spud Patch Placer Deposit - Located at Atolia, California, about four miles south of Red Mountain, Spud Patch was discovered in 1904 and was extensively mined between 1905 and 1950 with the greatest period of activity in 1917 and 1918. The deposit is so named because miners would find potato-sized chunks of scheelite contained in the placers. Gold is present in the placer deposit but was never historically recovered. A total of 74 drill holes explored the deposit in the 1930s, 40s, 50s, and 2022. The deposit averages 35.6 feet in depth and contains scheelite (CaWO4) and native gold in easily recoverable placer form. B&N completed 22 of the 74 total drill holes in 2022-2025.

The Spud Patch placer covers a total of 403.9 acres of land on both B&N property and non-owned B&N property. The portion of the Spud Patch Placer contained on B&N-owned property is 219.6 acres of which 151.5 acres are patented and 68.1 acres are unpatented placer mining claims. All material estimated has an inferred classification. The average gross value per cubic yard for the Spud Patch placer deposit is $32.11.

"This initial mineral resource estimate significantly adds to the value of B&N's holdings in the Rand Mining District. The tungsten contained in this mineral resource estimate will allow B&N to start the process to bring into production a significant source of tungsten trioxide within the United States. The placer material is very low cost to develop, easily processed, and environmentally clean," said Sam Shoemaker, Project Manager with the John T. Boyd Company.

Table 2 - Black Hawk and Spud Patch Placers Mineral Resource Estimate - Source BOYD 2025

Deposit | Resource Classification | WO3 Cutoff (lbs/CY) | Cubic Yards | WO3 (lbs/CY) | Au (Troy Ozs/CY) | Contained WO3 lbs | Contained Au Troy Ozs |

Black Hawk | Inferred | 0.231 | 10,530,000 | 1.563 | 0.008 | 16,454,000 | 88,000 |

Spud Patch | Inferred | 0.231 | 8,275,000 | 2.098 | 0.002 | 17,365,000 | 16,000 |

All | Inferred | 0.231 | 18,805,000 | 1.798 | 0.006 | 33,819,000 | 104,000 |

1. The effective date for this mineral resource estimate is August 7, 2025, and is reported on a 100% ownership basis.

2. Mineral Resources are calculated using a tungsten trioxide (WO3) price of US$13.13 per pound and a gold price of US$2,373.00 per troy ounce. Both metal prices are based on a trailing monthly average of the last 36 months ending in July 2025.

3. The mineral resources presented above are global and do not include a detailed pit or underground design. The pit limits were established by calculating a cutoff grade (US$5.00 per ton) representing an estimate of the operating cost and metal recoveries required to mine the placer deposit. Since the deposit is a placer deposit, internal waste blocks are not mined, and the extent of the pit limits is the extent of the known mineral resource or property boundaries.

4. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing or other relevant issues.

5. The mineral resources presented here were estimated using a simple polygonal boundary around each drillhole. Within that individual block, the tungsten trioxide and gold grades per cubic yard were applied as the metal grades for that block. The overall gross value of the block was then calculated and a total block value of $5.00 per yard or above was considered as mineral resources. Blocks have a gross value of less than $US $5.00 per yard, which are not considered as mineral resources and are assumed to remain unmined. All mineral resources are reported using an open pit equivalent tungsten trioxide grade of 0.231 pound per cubic yard. For the Black Hawk placer deposit, a tungsten trioxide capping grade of 8.0 pounds per cubic yard was used and a gold capping grade of 0.017 troy ounces per cubic yard was used. For the Spud Patch placer deposit, a tungsten trioxide capping grade of 7.0 pounds per cubic yard was used and a gold capping grade of 0.0028 troy ounces per cubic yard was used.

6. The mineral resources presented here were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council May 10, 2014.

7. Figures are rounded and totals may not add correctly.

Exploration and Development Plans

B&N continues to explore and develop the Black Hawk and Spud Patch placers including:

900+ soil samples for tungsten, gold, and rare earth element potential

Targeting untested zones along the historically rich Union South vein

Further auger drilling to improve confidence in and expand the mineral resource estimates

Metallurgical testing to maximize metal recovery rates

Environmental permitting for the initial mining operation at Black Hawk

Manager Statement

"We believe these results confirm the significant potential of the Rand Mining District," said Robert Binkele, Managing Member, B&N Mining Inc. "Tungsten is a U.S. critical mineral with strategic importance, and this estimate marks a major step toward domestic production from historically proven ground. This will increase the security of the United States, bring jobs to southeastern California, and position B&N as a leader in the domestic production of tungsten. This coupled with our expanding property position in the Rand Mining district, continued exploration of the Kelly mine, and new exploration on the recently acquired mineral properties, ensure a bright future for B&N Mining as well as the Rand Mining district."

Qualified Person Statement

Sam Shoemaker, P.G., of the John T. Boyd Company, is a Qualified Person as defined under NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

About B&N Mining Properties, LLC

B&N Mining Properties, LLC is revitalizing the historic Rand Mining District amid strong commodity prices, global supply constraints, and untapped gold, silver, and tungsten resources. We are committed to preserving the district's rich history while advancing development in a safe, environmentally responsible way that leaves a lasting legacy.

The recent addition of tungsten to our portfolio opens major opportunities in the fast-growing strategic metals sector. B&N's Kelly Southwest deposit holds an initial resource estimate of 306,000 ounces of gold, with active drilling at Kelly North to expand it.

Our holdings include the historic Kelly Mine at Red Mountain (20 million ounces silver), the King Solomon, Butte, Butte Wedge, Little Butte Extension, Minnehaha, and Napoleon mines (300,000 ounces gold combined historic production), most of the Atolia tungsten mines, and additional properties in Cerro Gordo, Skidoo, Wild Rose, Silver Mountain, and Lake Isabella. Visit www.bnmininginc.com to learn more.

Contact Information

Robert Binkele

Manager

info@bnmininginc.com

760-409-7117

SOURCE: B&N Mining, Inc.

Related Images

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/bandn-mining-properties-llc-expands-strategic-metals-portfolio-w-1059130