SAN JOSE, Calif., Aug. 12, 2025 /PRNewswire/ -- QuickLogic Corporation (NASDAQ: QUIK) ("QuickLogic" or the "Company"), a developer of embedded FPGA (eFPGA) IP, ruggedized FPGAs, and Endpoint AI solutions, today announced its financial results for the fiscal second quarter that ended June 29, 2025.

Recent Highlights

- Signed a new, revenue-generating eFPGA Hard IP License contract for a customer's Intel 18A test chip

- Awarded a feasibility contract for a very high-density eFPGA IP core

- Announced Aurora PRO FPGA User Tool that fully integrates Synopsis Synplify®, delivering 50% better resource utilization and up to 35% faster maximum frequency

- Initiated implementation of major improvements for proprietary Australis IP Generation tool with release scheduled for Q4

- Joined Intel Foundry Chiplet Alliance to expand eFPGA IP and chiplet solutions targeting Intel 18A

"With our growing success in customer designs targeting advanced fabrication nodes, which include 12nm at GlobalFoundries and TSMC, and Intel 18A, we are seeing increasing interest in high density designs," said Brian Faith, CEO of QuickLogic. "In response, we've accelerated the introduction schedule of Australis 2.0, our proprietary IP Generation tool. Australis 2.0 is scheduled for deployment in Q4 and will incorporate many new features driven by customer requirements and existing revenue-generating contracts."

Fiscal Second Quarter 2025 Financial Results

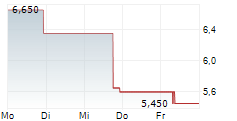

Total revenue from continuing operations for the second quarter of fiscal 2025 was $3.7 million, a decrease of 10.0% compared with the second quarter of 2024 and a decrease of 14.8% compared with the first quarter of 2025.

New product revenue from continuing operations was approximately $2.9 million in the second quarter of 2025, a decrease of $0.1 million, or 3.6%, compared with the second quarter of 2024 and a decrease of $0.8 million, or 22.1%, compared with the first quarter of 2025.

Mature product revenue from continuing operations was $0.8 million in the second quarter of 2025. This compares to $1.1 million in the second quarter of 2024 and $0.6 million in the first quarter of 2025.

Second quarter 2025 GAAP gross margin from continuing operations was 25.9% compared with 54.7% in the second quarter of 2024 and 43.4% in the first quarter of 2025.

Second quarter 2025 non-GAAP gross margin from continuing operations was 31.0% compared with 58.2% in the second quarter of 2024 and 47.1% in the first quarter of 2025.

Second quarter 2025 GAAP operating expenses from continuing operations were $3.5 million compared with $3.4 million in the second quarter of 2024 and $3.9 million in the first quarter of 2025.

Second quarter 2025 non-GAAP operating expenses from continuing operations were $2.5 million compared with $2.8 million in the second quarter of 2024 and $3.0 million in the first quarter of 2025.

Second quarter 2025 GAAP net loss was ($2.7 million), or ($0.17) per share, compared with a net loss of ($1.6 million), or ($0.11) per share, in the second quarter of 2024, and a net loss of ($2.2 million), or ($0.14) per share, in the first quarter of 2025.

Second quarter 2025 non-GAAP net loss was ($1.5 million), or ($0.09) per share, compared with a net loss of ($0.7 million), or ($0.05) per share, in the second quarter of 2024, and a net loss of ($1.1 million), or ($0.07) per share, in the first quarter of 2025.

Conference Call

QuickLogic will hold a conference call at 2:30 p.m. Pacific Time / 5:30 p.m. Eastern Time today, August 12, 2025, to discuss its current financial results. The conference call will be webcast on QuickLogic's IR Site Events Page at https://ir.quicklogic.com/ir-calendar. To join the live conference, you may dial (877) 407-0792 and international participants should dial (201) 689-8263 by 2:20 p.m. Pacific Time. No Passcode is needed to join the conference call. A recording of the call will be available approximately one hour after completion. To access the recording, please call (844) 512-2921 and reference the passcode 13755041.

The call recording, which can be accessed by phone, will be archived through August 19, 2025, and the webcast will be available for 12 months on the Company's website.

About QuickLogic

QuickLogic is a fabless semiconductor company specializing in embedded FPGA (eFPGA) Hard IP, discrete FPGAs, and endpoint AI solutions. QuickLogic's unique approach combines cutting-edge technology with open-source tools to deliver highly customizable low-power solutions for aerospace and defense, industrial, computing, and consumer markets. For more information, visit www.quicklogic.com.

QuickLogic uses its website (www.quicklogic.com/), the company blog (https://www.quicklogic.com/blog/), corporate X account (@QuickLogic_Corp), Facebook page (https://www.facebook.com/QuickLogic), and LinkedIn page (https://www.linkedin.com/company/13512/) as channels of distribution of information about its products, its planned financial and other announcements, its attendance at upcoming investor and industry conferences, and other matters. Such information may be deemed material information, and QuickLogic may use these channels to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the Company's website and its social media accounts in addition to following the Company's press releases, SEC filings, public conference calls, and webcasts.

Non-GAAP Financial Measures

QuickLogic reports financial information in accordance with United States Generally Accepted Accounting Principles, or U.S. GAAP, but believes that non-GAAP financial measures are helpful in evaluating its operating results and comparing its performance to comparable companies. Accordingly, the Company excludes certain charges related to stock-based compensation and restructuring costs, in calculating non-GAAP (i) income (loss) from operations, (ii) net income (loss), (iii) net income (loss) per share, and (iv) gross margin percentage. The Company provides this non-GAAP information to enable investors to evaluate its operating results in a manner like how the Company analyzes its operating results and to provide consistency and comparability with similar companies in the Company's industry.

Management uses the non-GAAP measures, which exclude gains, losses, and other charges that are considered by management to be outside of the Company's core operating results, internally to evaluate its operating performance against results in prior periods and its operating plans and forecasts. In addition, the non-GAAP measures are used to plan for the Company's future periods and serve as a basis for the allocation of the Company's resources, management of operations and the measurement of profit-dependent cash, and equity compensation paid to employees and executive officers.

Investors should note, however, that the non-GAAP financial measures used by QuickLogic may not be the same non-GAAP financial measures and may not be calculated in the same manner as that of other companies. QuickLogic does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures alone or as a substitute for financial information prepared in accordance with U.S. GAAP. A reconciliation of U.S. GAAP financial measures to non-GAAP financial measures is included in the financial statements portion of this press release. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of non-GAAP financial measures with their most directly comparable U.S. GAAP financial measures.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding our future profitability and cash flows, expectations regarding our future business and statements regarding the timing, milestones, and payments related to our government contracts, statements regarding the use of the Company's ATM program, and statements regarding our ability to successfully exit SensiML, and actual results may differ due to a variety of factors including: delays in the market acceptance of the Company's new products; the ability to convert design opportunities into customer revenue; our ability to replace revenue from end-of-life products; the level and timing of customer design activity; the market acceptance of our customers' products; the risk that new orders may not result in future revenue; our ability to introduce and produce new products based on advanced wafer technology on a timely basis; our ability to adequately market the low power, competitive pricing and short time-to-market of our new products; intense competition by competitors; our ability to hire and retain qualified personnel; changes in product demand or supply; general economic conditions; political events, international trade disputes, natural disasters and other business interruptions that could disrupt supply or delivery of, or demand for, the Company's products; and changes in tax rates and exposure to additional tax liabilities. These and other potential factors and uncertainties that could cause actual results to differ materially from the results contemplated or implied are described in more detail in the Company's public reports filed with the U.S. Securities and Exchange Commission (the "SEC"), including the risks discussed in the "Risk Factors" section in the Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and in the Company's prior press releases, which are available on the Company's Investor Relations website at http://ir.quicklogic.com/, and on the SEC website at www.sec.gov/. In addition, please note that the date of this press release is August 12, 2025, and any forward-looking statements contained herein are based on management's current expectations and assumptions that we believe to be reasonable as of this date. We are not obliged to update these statements due to latest information or future events.

QuickLogic and logo are registered trademarks of QuickLogic. All other trademarks are the property of their respective holders and should be treated as such.

CODE: QUIK-E

-Tables Follow -

QUICKLOGIC CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) (Unaudited) | |||||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||||

June 29, | June 30, | March 30, | June 29, | June 30, | |||||||||||||||

Revenue | $ | 3,687 | $ | 4,096 | $ | 4,325 | $ | 8,012 | $ | 9,765 | |||||||||

Cost of revenue | 2,733 | 1,854 | 2,448 | 5,181 | 3,719 | ||||||||||||||

Gross profit | 954 | 2,242 | 1,877 | 2,831 | 6,046 | ||||||||||||||

Operating expenses: | |||||||||||||||||||

Research and development | 1,193 | 1,347 | 1,268 | 2,461 | 2,668 | ||||||||||||||

Selling, general and administrative | 1,962 | 2,095 | 2,536 | 4,498 | 4,446 | ||||||||||||||

Impairment charges | 300 | - | - | 300 | - | ||||||||||||||

Restructuring costs | 21 | - | 54 | 75 | - | ||||||||||||||

Total operating expense | 3,476 | 3,442 | 3,858 | 7,334 | 7,114 | ||||||||||||||

Operating income (loss) | (2,522) | (1,200) | (1,981) | (4,503) | (1,068) | ||||||||||||||

Interest expense | (108) | (39) | (97) | (205) | (108) | ||||||||||||||

Interest and other (expense) income, net | (30) | 4 | (7) | (37) | 21 | ||||||||||||||

Income (loss) before income taxes | (2,660) | (1,235) | (2,085) | (4,745) | (1,155) | ||||||||||||||

(Benefit from) provision for income taxes | 1 | (6) | 5 | 6 | 1 | ||||||||||||||

Net income (loss) from continuing operations | (2,661) | (1,229) | (2,090) | (4,751) | (1,156) | ||||||||||||||

Net income (loss) from discontinued operations, net of taxes and inclusive of $87 in restructuring costs for the six months ended June 29, 2025 | (9) | (321) | (101) | (110) | (286) | ||||||||||||||

Net income (loss) | $ | (2,670) | $ | (1,550) | $ | (2,191) | $ | (4,861) | $ | (1,442) | |||||||||

Net income (loss) from continuing operations per share: | |||||||||||||||||||

Basic | $ | (0.17) | $ | (0.09) | $ | (0.14) | $ | (0.30) | $ | (0.08) | |||||||||

Diluted | $ | (0.17) | $ | (0.09) | $ | (0.14) | $ | (0.30) | $ | (0.08) | |||||||||

Net income (loss) per share: | |||||||||||||||||||

Basic | $ | (0.17) | $ | (0.11) | $ | (0.14) | $ | (0.31) | $ | (0.10) | |||||||||

Diluted | $ | (0.17) | $ | (0.11) | $ | (0.14) | $ | (0.31) | $ | (0.10) | |||||||||

Weighted average shares outstanding: | |||||||||||||||||||

Basic | 15,884 | 14,439 | 15,290 | 15,677 | 14,308 | ||||||||||||||

Diluted | 15,884 | 14,439 | 15,290 | 15,677 | 14,308 | ||||||||||||||

Note: Net income (loss) equals total comprehensive income (loss) for all periods presented. Additionally, the Company notes that income taxes related to discontinued operations were immaterial in nature for the periods presented and as such, only net income (loss) from discontinued operations was reported herein. |

QUICKLOGIC CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (Unaudited) | ||||||||

June 29, | December 29, | |||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash, cash equivalents and restricted cash | $ | 19,191 | $ | 21,859 | ||||

Accounts receivable, net of allowance for credit losses of $0 as of June 29, 2025 and December 29, 2024 | 974 | 2,426 | ||||||

Contract assets | 3,688 | 2,682 | ||||||

Note receivable, current | 1,355 | - | ||||||

Inventories | 867 | 940 | ||||||

Prepaid expenses and other current assets | 1,300 | 1,666 | ||||||

Assets of business held for sale, net | 14 | 31 | ||||||

Total current assets | 27,389 | 29,604 | ||||||

Property and equipment, net | 17,767 | 15,699 | ||||||

Capitalized internal-use software, net | 967 | 711 | ||||||

Right of use assets, net | 614 | 758 | ||||||

Intangible assets, net | 359 | 378 | ||||||

Non-marketable equity investment | - | 300 | ||||||

Inventories, non-current | 648 | 718 | ||||||

Note receivable, non-current | - | 1,292 | ||||||

Other assets | 114 | 117 | ||||||

Assets of business held for sale, net | 2,356 | 2,356 | ||||||

TOTAL ASSETS | $ | 50,214 | $ | 51,933 | ||||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

Current liabilities: | ||||||||

Revolving line of credit | $ | 15,000 | $ | 18,000 | ||||

Trade payables | 3,383 | 3,097 | ||||||

Accrued liabilities | 1,042 | 1,587 | ||||||

Deferred revenue | 369 | 444 | ||||||

Notes payable, current | 1,424 | 1,928 | ||||||

Lease liabilities, current | 302 | 284 | ||||||

Liabilities of business held for sale | 5 | 57 | ||||||

Total current liabilities | 21,525 | 25,397 | ||||||

Long-term liabilities: | ||||||||

Lease liabilities, non-current | 308 | 447 | ||||||

Notes payable, non-current | 724 | 1,202 | ||||||

Total liabilities | 22,557 | 27,046 | ||||||

Commitments and contingencies | ||||||||

Stockholders' equity: | ||||||||

Preferred stock, $0.001 par value; 10,000 shares authorized; no shares issued and outstanding | - | - | ||||||

Common stock, $0.001 par value; 200,000 authorized; 16,378 and 15,336 shares issued and outstanding as of June 29, 2025 and December 29, 2024, respectively | 16 | 15 | ||||||

Additional paid-in capital | 341,898 | 334,268 | ||||||

Accumulated deficit | (314,257) | (309,396) | ||||||

Total stockholders' equity | 27,657 | 24,887 | ||||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 50,214 | $ | 51,933 | ||||

QUICKLOGIC CORPORATION SUPPLEMENTAL RECONCILIATIONS OF US GAAP AND NON-GAAP FINANCIAL MEASURES (in thousands, except per share amounts and percentages) (Unaudited) | ||||||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||||||

June 29, | June 30, | March 30, | June 29, | June 30, | ||||||||||||||||

US GAAP operating income (loss) | $ | (2,522) | $ | (1,200) | $ | (1,981) | $ | (4,503) | $ | (1,068) | ||||||||||

Adjustment for stock-based compensation within: | ||||||||||||||||||||

Cost of revenue | 189 | 140 | 158 | 347 | 438 | |||||||||||||||

Research and development | 205 | 102 | 142 | 347 | 301 | |||||||||||||||

Selling, general and administrative | 449 | 517 | 636 | 1,085 | 1,486 | |||||||||||||||

Adjustment for impairment charges | 300 | - | - | 300 | - | |||||||||||||||

Adjustment for restructuring costs | 21 | - | 54 | 75 | - | |||||||||||||||

Non-GAAP operating income (loss) | $ | (1,358) | $ | (441) | $ | (991) | $ | (2,349) | $ | 1,157 | ||||||||||

US GAAP net income (loss) from continuing operations | $ | (2,661) | $ | (1,229) | $ | (2,090) | $ | (4,751) | $ | (1,156) | ||||||||||

Adjustment for stock-based compensation within: | ||||||||||||||||||||

Cost of revenue | 189 | 140 | 158 | 347 | 438 | |||||||||||||||

Research and development | 205 | 102 | 142 | 347 | 301 | |||||||||||||||

Selling, general and administrative | 449 | 517 | 636 | 1,085 | 1,486 | |||||||||||||||

Adjustment for impairment charges | 300 | - | - | 300 | - | |||||||||||||||

Adjustment for restructuring costs | 21 | - | 54 | 75 | - | |||||||||||||||

Non-GAAP net income (loss) from continuing operations | $ | (1,497) | $ | (470) | $ | (1,100) | $ | (2,597) | $ | 1,069 | ||||||||||

US GAAP net income (loss) from discontinued operations | $ | (9) | $ | (321) | $ | (101) | $ | (110) | $ | (286) | ||||||||||

Adjustment for stock-based compensation within: | ||||||||||||||||||||

Research and development | - | 94 | (32) | (32) | 252 | |||||||||||||||

Adjustment for restructuring costs | - | - | 87 | 87 | - | |||||||||||||||

Non-GAAP net income (loss) from discontinued operations | $ | (9) | $ | (227) | $ | (46) | $ | (55) | $ | (34) | ||||||||||

Non-GAAP net income (loss) | $ | (1,506) | $ | (697) | $ | (1,146) | $ | (2,652) | $ | 1,035 | ||||||||||

US GAAP net income (loss) from continuing operations per share, basic | $ | (0.17) | $ | (0.09) | $ | (0.14) | $ | (0.30) | $ | (0.08) | ||||||||||

Adjustment for stock-based compensation | 0.06 | 0.06 | 0.06 | 0.11 | 0.15 | |||||||||||||||

Adjustment for impairment charges | 0.02 | - | - | 0.02 | - | |||||||||||||||

Adjustment for restructuring costs | - | - | 0.01 | - | - | |||||||||||||||

Non-GAAP net income (loss) from continuing operations per share, basic | $ | (0.09) | $ | (0.03) | $ | (0.07) | $ | (0.17) | $ | 0.07 | ||||||||||

US GAAP net income (loss) from discontinued operations per share, basic | $ | - | $ | (0.02) | $ | (0.01) | $ | (0.01) | $ | (0.02) | ||||||||||

Adjustment for stock-based compensation | - | - | - | - | 0.02 | |||||||||||||||

Adjustment for restructuring costs | - | - | 0.01 | 0.01 | - | |||||||||||||||

Non-GAAP net income (loss) from discontinued operations per share, basic | $ | - | $ | (0.02) | $ | - | $ | - | $ | - | ||||||||||

Non-GAAP net income (loss) per share, basic | $ | (0.09) | $ | (0.05) | $ | (0.07) | $ | (0.17) | $ | 0.07 | ||||||||||

US GAAP net income (loss) from continuing operations per share, diluted | $ | (0.17) | $ | (0.09) | $ | (0.14) | $ | (0.30) | $ | (0.08) | ||||||||||

Adjustment for stock-based compensation | 0.06 | 0.06 | 0.06 | 0.11 | 0.15 | |||||||||||||||

Adjustment for impairment charges | 0.02 | - | - | 0.02 | - | |||||||||||||||

Adjustment for restructuring costs | - | - | 0.01 | - | - | |||||||||||||||

Non-GAAP net income (loss) from continuing operations per share, diluted | $ | (0.09) | $ | (0.03) | $ | (0.07) | $ | (0.17) | $ | 0.07 | ||||||||||

US GAAP net income (loss) from discontinued operations per share, diluted | $ | - | $ | (0.02) | $ | (0.01) | $ | (0.01) | $ | (0.02) | ||||||||||

Adjustment for stock-based compensation | - | - | - | - | 0.02 | |||||||||||||||

Adjustment for restructuring costs | - | - | 0.01 | 0.01 | - | |||||||||||||||

Non-GAAP net income (loss) from discontinued operations per share, diluted | $ | - | $ | (0.02) | $ | - | $ | - | $ | - | ||||||||||

Non-GAAP net income (loss) per share, diluted | $ | (0.09) | $ | (0.05) | $ | (0.07) | $ | (0.17) | $ | 0.07 | ||||||||||

US GAAP gross margin percentage from continuing operations | 25.9 | % | 54.7 | % | 43.4 | % | 35.3 | % | 61.9 | % | ||||||||||

Adjustment for stock-based compensation included in cost of revenue | 5.1 | % | 3.5 | % | 3.7 | % | 4.4 | % | 4.5 | % | ||||||||||

Non-GAAP gross margin percentage from continuing operations | 31.0 | % | 58.2 | % | 47.1 | % | 39.7 | % | 66.4 | % | ||||||||||

QUICKLOGIC CORPORATION SUPPLEMENTAL DATA (Unaudited) | ||||||||||||||||||||

Percentage of Revenue | Change in Revenue | |||||||||||||||||||

Q2 2025 | Q2 2024 | Q1 2025 | Q2 2025 to | Q2 2025 to | ||||||||||||||||

COMPOSITION OF REVENUE | ||||||||||||||||||||

Revenue by product: (1) | ||||||||||||||||||||

New products | 79 | % | 73 | % | 87 | % | (4) | % | (22) | % | ||||||||||

Mature products | 21 | % | 26 | % | 13 | % | (28) | % | 33 | % | ||||||||||

Discontinued Operations: | ||||||||||||||||||||

New products | - | % | 1 | % | - | % | (100) | % | (100) | % | ||||||||||

Revenue by geography: | ||||||||||||||||||||

Asia Pacific | 17 | % | 10 | % | 8 | % | 57 | % | 79 | % | ||||||||||

North America | 80 | % | 87 | % | 90 | % | (18) | % | (24) | % | ||||||||||

Europe | 3 | % | 2 | % | 2 | % | (6) | % | 27 | % | ||||||||||

Discontinued Operations: | ||||||||||||||||||||

Asia Pacific | - | % | - | % | - | % | (100) | % | (100) | % | ||||||||||

North America | - | % | 1 | % | - | % | (100) | % | (100) | % | ||||||||||

Europe | - | % | - | % | - | % | - | % | (100) | % | ||||||||||

_____________________ | |

(1) | New products include all products manufactured on 180 nanometer or smaller semiconductor processes, eFPGA IP intellectual property, professional services, and QuickAI and SensiML AI software as a service (SaaS) revenue. Mature products include all products produced on semiconductor processes larger than 180 nanometer and includes related royalty revenue. |

SOURCE QuickLogic Corporation