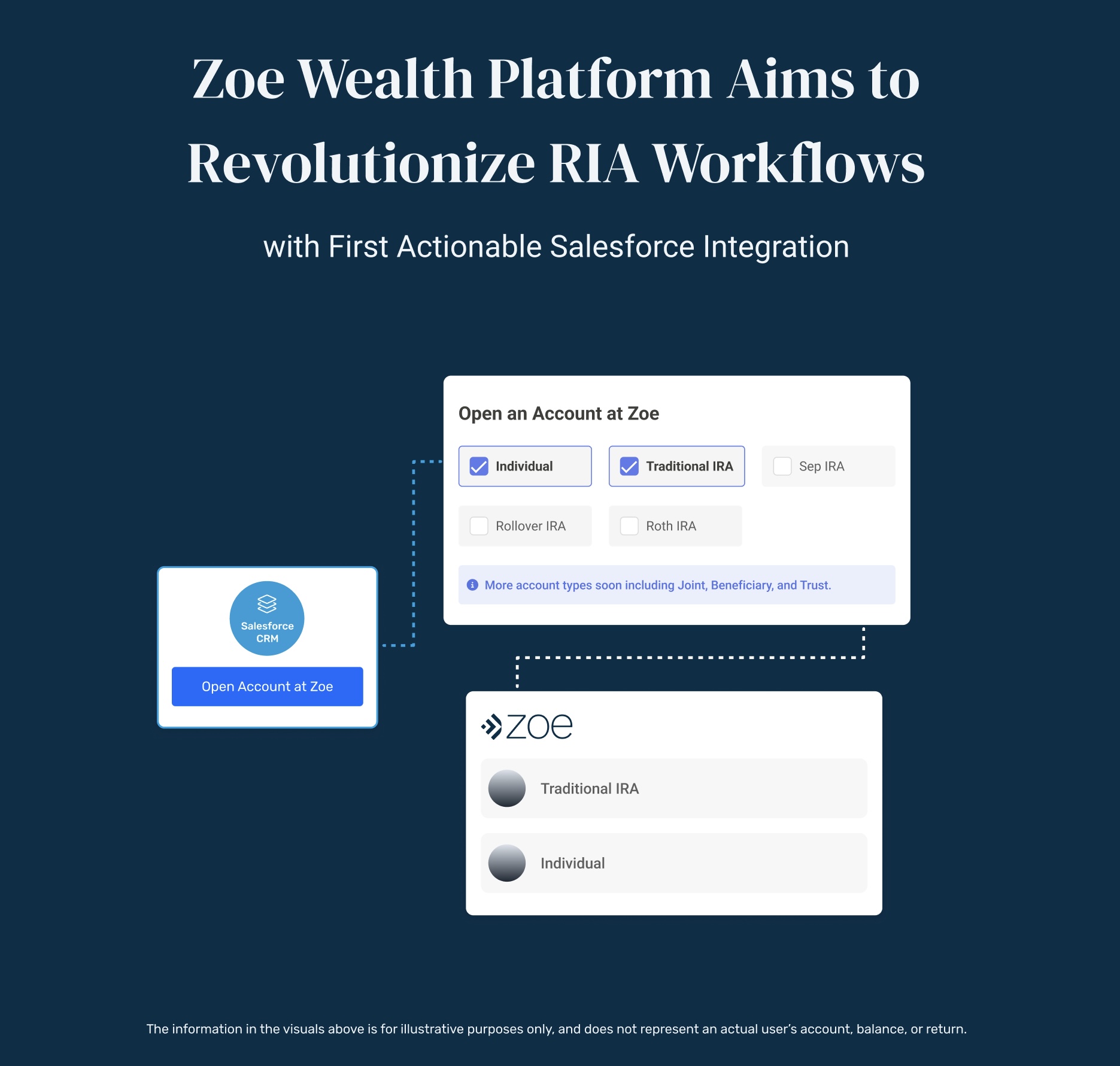

NEW YORK CITY, NEW YORK / ACCESS Newswire / August 13, 2025 / Zoe Financial, a digital end-to-end wealth platform that aims to transform the wealth management experience, announced a new integration with Salesforce, the biggest CRM platform in the world. This update brings advisor workflows and real-time account data from the Zoe Wealth Platform directly into the Salesforce CRM. The integration enables advisors on the platform to open accounts, request cash movements, and collaborate with operations, all from within the tools they already use every day.

"This integration reflects our commitment to helping advisors spend more time with clients and less time on manual processes," said Andres Garcia-Amaya, CFA, Zoe's founder and CEO. "It helps advisors focus on what matters most: growing and protecting their clients' wealth. By streamlining operations inside Salesforce, we're enabling faster, more personalized service without added complexity."

About The Integration

With Zoe's new embedded widgets and real-time data sync, advisors can now manage key client workflows entirely inside Salesforce, increasing efficiency and reducing errors.

Two core features of the Zoe Wealth Platform are now embedded directly in the Salesforce interface:

Open an Investment Account Widget for advisors to initiate multiple investment account requests directly from a Contact record in Salesforce, streamlining the onboarding process.

Request Cash Movement Widget for advisors to request dollar-based cash transfers from Zoe accounts, with real-time notifications to their operations team for faster execution.

"We're proud to share that this is now a reality. Zoe Accounts, Contacts, and Deals are fully synchronized between our robust platform and Salesforce in real time," said Dillon Ferguson, CFP, VP of Product at Zoe. "This ensures advisors, operations, and compliance teams are working from the same accurate data across systems. We're making it easier for advisors to be productive and compliant, without ever leaving their CRM."

RIAs interested in leveraging Zoe for growth can request a demo to experience the platform in action.

Business and Operational Impact For RIAs

Faster onboarding: Initiate client account creation in seconds from within Salesforce.

Real-time collaboration: Cash and account requests trigger notifications to the operations team.

Reduced errors: Embedded workflows eliminate copy-paste steps and manual entry.

Increased advisor productivity: Key actions now occur within advisors' existing work systems.

Greater auditability: Centralized data ensures visibility of the whole advisor-client lifecycle for compliance and operations teams.

"The best part is that we structured the integration to require no code to install or update using a verified Salesforce Application," said Cristian Pardo, Director of Product at Zoe. "We're simplifying operations and unlocking new efficiencies for RIAs without any kind of added effort."

Learn more about the integration and its full capabilities.

About Zoe Financial

Zoe is a wealth platform with the mission to help grow and protect clients' wealth. Zoe's platform brings account opening, funding, automated rebalancing, tax-loss harvesting, direct indexing, and commission-free fractional trading into one cohesive advisory experience. Learn more at https://zoefinancial.com/.

Disclosure: Zoe Financial does not provide tax or legal advice. Consult with an attorney for legal advice and a qualified tax professional for tax advice.

Contact Information

Carolina Padilla

Director of Marketing

carolina@zoefin.com

(213) 325-6697

SOURCE: Zoe Financial

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/zoe-wealth-platform-aims-to-revolutionize-ria-workflows-with-first-a-1060210