- Cash of $6.1 million as of June 30, 2025, with cash provided by operations of $0.7 million in Q2 2025, compared to $0.4 million in Q2 2024

- Quarterly revenue of $4.5 million in Q2 2025, compared to $5.4 million in Q2 2024(1)

- Quarterly gross profit of $1.6 million or 35% in Q2 2025, compared to $2.1 million or 39% in Q2 2024

- Net loss of ($0.29) million in Q2 2025, compared to ($0.34) million in Q2 2024(1)

- Adjusted EBITDA(2) of $0.3 million in Q2 2025, compared to $0.2 million in Q2 2024(1)

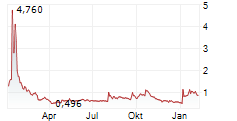

LAKE MARY, Fla., Aug. 13, 2025 /PRNewswire/ -- VerifyMe, Inc. (NASDAQ: VRME) ("VerifyMe," "we," "our," or the "Company") provides brand owners time and temperature sensitive logistics, and brand protection and enhancement solutions, announced today the Company's financial results for its second quarter ended June 30, 2025 ("Q2 2025").

Adam Stedham, VerifyMe's CEO and President stated, "We are pleased with our year-to-date adjusted EBITDA growth over 2024, our positive cash generation in Q2 2025, and our new partnership with the other major parcel carrier in the US. We continue to look for strategic acquisitions to complement our services. In the meantime, we are setting the stage for organic revenue growth in 2026, accompanied by a higher margin profile and continued cash generation."

__________ |

(1) Including $0.6 million from loss of previously disclosed Premium services customer |

(2) Adjusted EBITDA is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" below for information about this non- |

Key Financial Highlights for Q2 2025:

- Quarterly consolidated revenue of $4.5 million in Q2 2025, compared to $5.4 million for the three months ended June 30, 2024 ("Q2 2024"), approximately 70% of reduction is attributable to a $0.6 million decrease from a discontinued contract with one customer in our Premium services.

- Gross profit of $1.6 million or 35% in Q2 2025, compared to $2.1 million or 39% in Q2 2024

- Net loss of ($0.29) million or ($0.02) per basic and diluted share in Q2 2025, compared to a net loss of ($0.34) million or ($0.03) per basic and diluted share in Q2 2024(1)

- Adjusted EBITDA(2) of $0.3 million in Q2 2025, compared to Adjusted EBITDA of $0.2 million in Q2 2024(1)

- Cash of $6.1 million as of June 30, 2025, with $0.7 million provided by operations during Q2 2025 compared to $0.4 million in Q2 2024.

Financial Results for the Three Months Ended June 30, 2025 :

Revenue in Q2 2025 was $4.5 million, compared to $5.4 million in Q2 2024. Revenue for the quarter decreased by $0.9 million. The decrease is primarily due to a $0.6 million decrease from a discontinued contract with one customer in our Premium services, a $0.5 million decrease related to discontinued services to two customers in our Proactive services, partially offset by increased revenues from new and existing customers in the Precision Logistics segment. The decrease in revenue in our Authentication segment is primarily due to the divestiture of our Trust Codes Global business in December 2024.

Gross profit in Q2 2025 was $1.6 million, compared to $2.1 million in Q2 2024. The resulting gross margin percentage was 35% for the three months ended June 30, 2025, compared to 39% for the three months ended June 30, 2024. The decrease in gross margin was principally due to the discontinued contract in Premium services in the Precision Logistics segment which has higher margins. The Proactive services gross margin percentage improved in Q2 2025 compared to Q2 2024.

Operating loss was ($0.3) million in Q2 2025, compared to ($0.5) million in Q2 2024. The decrease in gross profit was more than offset by the decrease in operating expenses in the quarter. In addition to the reduction in operating costs with the divestiture of Trust Codes, the Company also implemented cost cutting measures in Precision Logistics.

Our net loss was ($0.29) million in Q2 2025and ($0.34) million in Q2 2024(1). The resulting loss per basic and diluted share was ($0.02) in Q2 2025, compared to loss per basic and diluted share of ($0.03) in Q2 2024.

Adjusted EBITDA(2) in Q2 2025 was $0.3 million, compared to $0.2 million in Q2 2024. Adjusted EBITDA is a non-GAAP financial measure. Please see "Use of Non-GAAP Financial Measures" for a discussion of this non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, net loss is included as a schedule to this release.

At June 30, 2025, we had a $6.1 million cash balance and $6.0 million in working capital.

__________ |

(1) Including $0.6 million from loss of previously disclosed Premium services customer |

(2) Adjusted EBITDA is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" below for information about this non- |

Earnings Call

The Company has scheduled an earnings conference call and webcast for 11:00 a.m. ET on Wednesday, August 13, 2025. Prepared remarks regarding the company's financial and operational results will be followed by a question and answer period with VerifyMe's executive team. The conference call may be accessed via webcast at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=YmPT1jph or by calling +1 (844) 763-8274 within the US, or +1 (412) 717-9224 internationally, and requesting the "VerifyMe Call." The presentation slides broadcast via the webcast will also be available on the Investors section of the VerifyMe website the morning of the call. Participants must be logged in via telephone to submit a question to management during the call. Participants may optionally pre-register for the conference call and webcast at: https://dpregister.com/sreg/10201806/ffaa27b28a.

The webcast and presentation will be archived on the Investors section of VerifyMe's website and will remain available for 90 days.

About VerifyMe, Inc.

VerifyMe, Inc. (NASDAQ: VRME), provides specialized logistics for time and temperature sensitive products, as well as brand protection and enhancement solutions. To learn more, visit www.verifyme.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words "believe," "continue," "may," "should," "will," and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include our engagement in future acquisitions or strategic partnerships that increase our capital requirements or cause us to incur debt or assume contingent liabilities, our reliance on one key strategic partner for shipping services in our Precision Logistics segment, competition including by our key strategic partner, seasonal trends in our business, severe climate conditions, the highly competitive nature of the industry in which we operate, our brand image and corporate reputation, impairments related to our goodwill and other intangible assets, economic and other factors such as recessions, downturns in the economy, inflation, global uncertainty and instability, the effects of pandemics, changes in United States social, political, and regulatory conditions and/or a disruption of financial markets, reduced freight volumes due to economic conditions, reduced discretionary spending in a recessionary environment, global supply-chain delays or shortages, fluctuations in labor costs, raw materials, and changes in the availability of key suppliers, our history of losses, our ability to use our net operating losses to offset future taxable income, the confusion of our name brand with other brands, the ability of our technology to work as anticipated and to successfully provide analytics logistics management, our ability to continue to invest in the development and commercialization of our Authentication segment, the ability of our strategic partners to integrate our solutions into their product offerings, our ability to manage our growth effectively, our ability to successfully develop and expand our sales and marketing capabilities, risks related to doing business outside of the U.S., intellectual property litigation, our ability to successfully develop, implement, maintain, upgrade, enhance, and protect our information technology systems, our reliance on third-party information technology service providers, our ability to respond to evolving laws related to information technology such as privacy laws, our ability to attract, retain and develop successors for management, our ability to work with partners in selling our technologies to businesses, production difficulties, our inability to enter into contracts and arrangements with future partners, our ability to acquire new customers, issues which may affect the reluctance of large companies to change their purchasing of products, acceptance of our technologies and the efficiency of our authenticators in the field, our ability to comply with the continued listing standards of the Nasdaq Capital Market, and our ability to timely pay amounts due and comply with the covenants under our debt facilities. These risk factors and uncertainties include those more fully described in VerifyMe's Annual Report and Quarterly Reports filed with the Securities and Exchange Commission, including under the heading entitled "Risk Factors." Should one or more of these risks or uncertainties materialize, or should any of our underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Use of Non-GAAP Financial Measures

This press release includes both financial measures in accordance with U.S. generally accepted accounting principles ("GAAP"), as well as non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures should be viewed as supplemental to and should not be considered as alternatives to any other GAAP financial measures. They may not be indicative of the historical operating results of VerifyMe nor are they intended to be predictive of potential future results. Investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP.

VerifyMe's management uses and relies on EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The Company believes that both management and shareholders benefit from referring to EBITDA and Adjusted EBITDA in planning, forecasting and analyzing future periods. Additionally, the Company believes Adjusted EBITDA is useful to investors to evaluate its results because it excludes certain items that are not directly related to the Company's core operating performance. In particular, with regard to our comparison of Adjusted EBITDA for the three and six months ended June 30, 2025, to the three and six months ended June 30, 2024, we believe is useful to investors in understanding the results of operations. The Company's management uses these non-GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparison. The Company's management recognizes that EBITDA and Adjusted EBITDA, as non-GAAP financial measures, have inherent limitations because of the described excluded items.

The Company defines EBITDA as net loss before interest (income) expense, income tax expense (benefit), and depreciation and amortization. Adjusted EBITDA represents EBITDA plus non-cash stock compensation expense, severance expense, gain on derecognized liability, impairments, change in fair value of contingent consideration, and one-time professional expenses for acquisitions and divestiture. VerifyMe believes EBITDA and Adjusted EBITDA are important measures of VerifyMe's operating performance because they allow management, investors and analysts to evaluate and assess VerifyMe's core operating results from period-to-period after removing the impact of items of a non-operational nature that affect comparability.

A reconciliation of EBITDA and Adjusted EBITDA to the most comparable financial measure, net loss, calculated in accordance with GAAP is included in a schedule to this press release. The Company believes that providing the non-GAAP financial measure, together with the reconciliation to GAAP, helps investors make comparisons between VerifyMe and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules as the presentation here may not be comparable to other similarly titled measures of other companies.

VerifyMe, Inc. Consolidated Balance Sheets (In thousands, except share data) | |||||||

June 30, 2025 | December 31, 2024 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

CURRENT ASSETS | |||||||

Cash and cash equivalents | $ | 6,067 | $ | 2,823 | |||

Accounts receivable, net of allowance for credit loss reserve, $8 and $71 as of June 30, | 1,100 | 2,636 | |||||

Unbilled revenue | 324 | 733 | |||||

Prepaid expenses and other current assets | 335 | 131 | |||||

Inventory | 41 | 39 | |||||

TOTAL CURRENT ASSETS | 7,867 | 6,362 | |||||

PROPERTY AND EQUIPMENT, NET | $ | 80 | $ | 116 | |||

RIGHT OF USE ASSET | 89 | 236 | |||||

INTANGIBLE ASSETS, NET | 5,142 | 5,365 | |||||

GOODWILL | 3,988 | 3,988 | |||||

TOTAL ASSETS | $ | 17,166 | $ | 16,067 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

CURRENT LIABILITIES | |||||||

Term note, current | $ | - | $ | 500 | |||

Accounts payable | 1,559 | 2,971 | |||||

Other accrued expense | 327 | 660 | |||||

Lease liability- current | 51 | 108 | |||||

TOTAL CURRENT LIABILITIES | 1,937 | 4,239 | |||||

LONG-TERM LIABILITIES | |||||||

Long-term lease liability | 43 | 139 | |||||

Term note | - | 375 | |||||

Convertible note - related party | 450 | 450 | |||||

Convertible note | 300 | 650 | |||||

TOTAL LIABILITIES | $ | 2,730 | $ | 5,853 | |||

STOCKHOLDERS' EQUITY | |||||||

Series A Convertible Preferred Stock, $0.001 par value, 37,564,767 shares authorized; 0 | - | - | |||||

Series B Convertible Preferred Stock, $0.001 par value; 85 shares authorized; 0.85 shares | - | - | |||||

Common stock, $0.001 par value; 675,000,000 shares authorized;12,734,425 and | 13 | 11 | |||||

Additional paid in capital | 101,392 | 96,344 | |||||

Treasury stock as cost; 410,757 and 290,467 shares at June 30, 2025 and December 31, | (434) | (480) | |||||

Accumulated deficit | (86,535) | (85,673) | |||||

Accumulated other comprehensive loss | - | 12 | |||||

STOCKHOLDERS' EQUITY | 14,436 | 10,214 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 17,166 | $ | 16,067 | |||

VerifyMe, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share data) | ||||||||||||||||||||||||||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||||||||

June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||||||||||||||||||||||||

NET REVENUE | $ | 4,520 | $ | 5,352 | $ | 8,975 | $ | 11,111 | ||||||||||||||||||||||||||||||||

COST OF REVENUE | 2,929 | 3,262 | 5,894 | 6,761 | ||||||||||||||||||||||||||||||||||||

GROSS PROFIT | 1,591 | 2,090 | 3,081 | 4,350 | ||||||||||||||||||||||||||||||||||||

OPERATING EXPENSES | ||||||||||||||||||||||||||||||||||||||||

Segment management and | 920 | 1,517 | 1,846 | 2,860 | ||||||||||||||||||||||||||||||||||||

General and administrative (a) | 716 | 894 | 1,572 | 2,015 | ||||||||||||||||||||||||||||||||||||

Research and development | 5 | 5 | 10 | 60 | ||||||||||||||||||||||||||||||||||||

Sales and marketing (a) | 272 | 210 | 568 | 598 | ||||||||||||||||||||||||||||||||||||

Total Operating expenses | 1,913 | 2,626 | 3,996 | 5,533 | ||||||||||||||||||||||||||||||||||||

LOSS BEFORE OTHER INCOME | (322) | (536) | (915) | (1,183) | ||||||||||||||||||||||||||||||||||||

OTHER (EXPENSE) INCOME | ||||||||||||||||||||||||||||||||||||||||

Interest income (expenses), net | 32 | (42) | 54 | (80) | ||||||||||||||||||||||||||||||||||||

Other (expense) income, net | (1) | (1) | ||||||||||||||||||||||||||||||||||||||

Change in fair value of | - | 232 | 364 | |||||||||||||||||||||||||||||||||||||

TOTAL OTHER INCOME | 31 | 190 | 53 | 284 | ||||||||||||||||||||||||||||||||||||

NET LOSS | ||||||||||||||||||||||||||||||||||||||||

$ | (291) | $ | (346) | $ | (862) | $ | (899) | |||||||||||||||||||||||||||||||||

LOSS PER SHARE | ||||||||||||||||||||||||||||||||||||||||

BASIC | (0.02) | (0.03) | (0.07) | (0.09) | ||||||||||||||||||||||||||||||||||||

DILUTED | (0.02) | (0.03) | (0.07) | (0.09) | ||||||||||||||||||||||||||||||||||||

WEIGHTED AVERAGE | ||||||||||||||||||||||||||||||||||||||||

BASIC | 12,643,791 | 10,238,717 | 12,469,118 | 10,156,081 | ||||||||||||||||||||||||||||||||||||

DILUTED | 12,643,791 | 10,238,717 | 12,469,118 | 10,156,081 | ||||||||||||||||||||||||||||||||||||

(a) Includes share-based compensation of $259 thousand and $592 thousand for the three and six months ended June 30, 2025, |

VerifyMe, Inc. Consolidated EBITDA and Adjusted EBITDA Reconciliation Table (Unaudited) | |||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||||||

Net Loss (GAAP) | $ | (291) | $ | (346) | $ | (862) | $ | (899) | |||||||

Interest (income) expense, net | (32) | 42 | (54) | 80 | |||||||||||

Amortization and depreciation | 286 | 300 | 572 | 599 | |||||||||||

Total EBITDA (Non-GAAP) | (37) | (4) | (344) | (220) | |||||||||||

Adjustments: | |||||||||||||||

Stock based compensation | 45 | 43 | 86 | 89 | |||||||||||

Fair value of restricted stock and restricted stock units issued in exchange | 214 | 196 | 506 | 608 | |||||||||||

Severance | 18 | 141 | 75 | 141 | |||||||||||

Change in fair value of contingent consideration | - | (232) | - | (364) | |||||||||||

Gain on derecognized liability | - | - | (100) | - | |||||||||||

Impairments | - | 9 | - | 13 | |||||||||||

One-time professional expenses for acquisitions/divestiture | 30 | - | 47 | - | |||||||||||

Total Adjusted EBITDA (Non-GAAP) | $ | 270 | $ | 153 | $ | 270 | $ | 267 | |||||||

SOURCE VerifyMe, Inc.