VANCOUVER, British Columbia, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Zacatecas Silver Corp. (TSXV: ZAC; OTC: ZCTSF; 7TV: Frankfurt) (the "Company") is pleased to announce the launch of a 4,000-metre diamond drill program at its wholly owned Zacatecas Silver Project in Mexico. The campaign will focus on advancing the high-priority El Cristo and Panuco North vein systems. Designed to build on recent structural reinterpretations and the Company's foundational NI 43-101 resource at Panuco, the program aims to unlock what could be a significantly larger silver system within one of Mexico's most prolific mining districts.

- 4,000-metre drill program underway at high-priority El Cristo and Panuco targets in Zacatecas, Mexico.

- El Cristo to test large, underexplored vein system linked to historic Veta Grande.

- Strong high-grade results and updated 20.5 Moz AgEq resource at Panuco support further exploration (see news release dated May 30, 2023 and additional information below).

- $2.5M private placement to fund drilling, community work, and strategic growth.

- Actively reviewing new acquisition opportunities to strengthen the project portfolio.

El Cristo: A Major Push into an Untested, High-Potential System

The Company has finalized the design of a 2,500-metre diamond drill program at its wholly owned El Cristo Silver Project and is in the final stages of preparation for drill mobilization, targeted for December 2025. Major Drilling (Mexico) (TSX: MDI), which previously drilled successfully at El Cristo, is the world's leading provider of specialized drilling services in the metals and mining industry and has been engaged for the program. The Company is currently finalizing the terms of the drill contract for targeted commencement in Q4.

To support ongoing environmental and community initiatives, the Company has re-engaged Señor Emilio Torres through his consultancy, Mesoamerican Explore S.A.S. de C.V. ("MES"), to provide environmental and social services and liaise with landowners. Señor Torres has successfully negotiated access for all previous exploration campaigns at Zacatecas Silver's projects and is highly respected among local communities.

The El Cristo vein system is interpreted as the northwestern extension of the prolific Veta Grande vein, which has reported - though unverified - historical production of over 200 million ounces of silver. The El Cristo system exhibits similar structural characteristics, vein orientation, and geological setting as Veta Grande, featuring a sigmoidal zone of dilation extending over 3 kilometres along strike and up to 600 metres in width. Multiple steeply dipping, northwest-southeast trending veins have been historically mined via at least 20 near-surface shafts and numerous surface workings.

El Cristo hosts an intermediate sulphidation, silver-dominant lead-zinc base metal system, characterized by steeply dipping quartz-carbonate-sulphide veins. Globally and within the Zacatecas region, such deposits can host economic mineralization over vertical extents exceeding 600 metres - making them particularly attractive exploration targets.

Previously, the Company completed 28 diamond drill holes totaling 2,815 metres at El Cristo, primarily targeting near-surface extensions of veins proximal to historical workings and areas of anomalous surface geochemistry. Notably, 22 of the 28 holes intersected silver and base metal mineralization. Key intercepts include:

- 9.00 m @ 158 g/t AgEq (149 g/t Ag, 0.05 g/t Au, 0.08% Zn, 0.05% Pb) from 17.87 m (CRI-2022-018)

- 0.82 m @ 592 g/t AgEq (84 g/t Ag, 0.14 g/t Au, 3.7% Zn, 11.8% Pb) from 69.10 m (CRI-2022-020)

- 3.00 m @ 262 g/t AgEq (250 g/t Ag, 0.07 g/t Au, 0.1% Zn, 0.04% Pb) from 21.00 m (CRI-2022-026)

- 2.10 m @ 204 g/t AgEq (200 g/t Ag, 0.03 g/t Au, 0.03% Zn, 0.01% Pb) from 47.14 m (CRI-2022-017)

- 1.60 m @ 181 g/t AgEq (175 g/t Ag, 0.02 g/t Au, 0.06% Zn, 0.05% Pb) from 4.40 m (CRI-2022-027)

*See news release dated August 29, 2022 for additional information. Assumptions used in USD for the silver equivalent calculation were metal prices of $24/oz silver, $1,800/oz gold, $1.81/lb zinc, $ 0.90/lb lead. Metallurgical recoveries have been estimated to be 85% silver and 90% gold.

Most of these intercepts were within 50 metres of surface, in highly oxidized and leached material. The deeper sulphidic mineralization underlying these intercepts remains untested-representing high-reward targets for the upcoming campaign. In addition, undrilled sections of veins with a cumulative strike of over 3 kilometres offer robust, drill-ready targets beneath surficial workings and geochemical anomalies. Several of these will be tested with shallow, angled holes.

"El Cristo has the scale, structure, and signature of a significant system - and we're going after it," said Eric Vanderleeuw, CEO. "El Cristo is a western extension of the prolific Veta Grande vein system and so far has carried very good grade, and we believe the deeper, untested sulphide zones could be game-changing."

Panuco: Advancing a Proven High-Grade System

Concurrent with El Cristo drilling, the Company will revisit Panuco for up to 1,500 metres of drilling, where extensive prior work has returned high-grade intercepts, including:

- 1.25 metres at 1,440 g/t silver equivalent (1,423 g/t silver and 0.23 g/t gold)

- 1.23 metres at 750 g/t silver equivalent (723 g/t silver and 0.36 g/t gold)

*See news release dated April 7, 2022 for additional information. Assumptions used in USD for the silver equivalent calculation were metal prices of $24/oz silver, $1,800/oz gold. Metallurgical recoveries have been estimated to be 85% silver and 90% gold.

On May 30, 2023, Zacatecas Silver published an updated resource estimate at Panuco:

- Panuco South Deposit Inferred Mineral Resource of 3.04 million tonnes at 179 g/t AgEq for 17.5 million ounces AgEq.

- Panuco North Deposit Inferred Mineral Resource of 0.37 million tonnes at 255 g/t AgEq for 3.0 million ounces AgEq

The Panuco South and North underground Mineral Resource Estimate now consists of 3.41 million tonnes at 187 g/t AgEq (173 g/t Ag and 0.18 g/t Au) for 20.5 million ounces AgEq (19.0 million ounces silver and 19.2 thousand ounces gold).

New 3D modeling and structural reinterpretation have opened up new exploration opportunities along strike and at depth.

"Our updated structural models show compelling opportunities to extend known mineralization," said Dr. Chris Wilson, Chief Geologist. "This next round of drilling is designed to expand on that base-but El Cristo offers a scale and upside near surface that we're especially excited about."

Community Engagement and Drill Readiness

Surface access and community engagement agreements are being supported by the engagement of MES and are nearing completion. Roadwork and drill pad construction are complete, and final contractor mobilization is scheduled for early Q4 2025.

Aggressive Growth Strategy and Upcoming Catalysts

This 4,000-metre program represents Phase I of a broader multi-stage exploration initiative planned through 2025. The Company is also actively evaluating strategic acquisition opportunities in the region with a focus on advanced, but under-explored, high-grade gold, silver and copper projects.

"With silver prices strengthening and regional activity heating up, we're entering a new phase of the Company's growth," added Eric Vanderleeuw. "We're fully committed to advancing our existing assets while aggressively and strategically expanding our portfolio. We hope to update our investors on this direction in the near future."

Key Milestones

| Timeline | Milestone |

| Q4 2025 | Finalization of surface access & mobilization |

| Q4 2025 | Drilling at Panuco and El Cristo |

| Q4 2025 | Initial assay results and follow-up modeling |

| Q4 2025 | Target refinement and Phase II planning |

| Q3/Q4 2025 | Acquisition updates and growth initiatives |

| Early 2026 | Potential resource expansion |

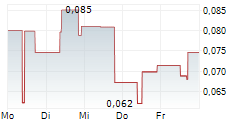

Concurrent Private Placement

To fund this drill campaign and strategic initiatives, Zacatecas Silver announces a non-brokered private placement of units for up to $2.5 million. Units will be priced at $0.06, each comprising one common share and one common share purchase warrant exercisable at $0.10 for two years. Securities will be subject to a four-month hold period, and finders' fees may be paid. Zacatecas Silver retains the right to accelerate the warrant exercise period if the 20-day volume-weighted average price of its shares exceeds $0.20 cents. The private placement is subject to the acceptance of the TSX Venture Exchange.

About Zacatecas Silver Corp.

The Company has two key projects. The Esperanza Gold Project in Morelos State, Mexico and the Zacatecas Silver Project in Zacatecas State, Mexico.

Esperanza is an advanced stage, attractive low-cost, low-capital-intensity and low-technical-risk growth project located in Morelos state, Mexico. Alamos has progressed the project through advanced engineering, including metallurgical work, while also focusing on stakeholder engagement, including building community relations. The Company announced a Mineral Resource Estimate at Esperanza consisting of a Measured and Indicated Mineral Resource Estimate of 30.5 million tonnes at 0.97 g/t AuEq for 956 thousand ounces AuEq and an Inferred Mineral Resource estimate of 8.7 million tonnes at 0.98 g/t AuEq for 277 thousand ounces AuEq (see news release dated November 16, 2022).

The Zacatecas Silver Project is located in Zacatecas state, Mexico, within the highly prospective Fresnillo silver belt, which has produced over 6.2 billion ounces of silver. The Company holds 7,826 hectares (19,338 acres) of ground that is highly prospective for low-sulphidation and intermediate-sulphidation silver base metal mineralization and potentially low-sulphidation gold-dominant mineralization. The Company announced a Mineral Resource Estimate at the Panuco Deposit consisting of 2.7 million tonnes at 187 grams per tonne (g/t) silver equivalent (AgEq) (171 g/t silver (Ag) and 0.17 g/t gold (Au)) for 16.4 million ounces AgEq (15 million ounces silver and 15,000 ounces gold) (see news release dated December 14, 2021).

The property is 25 kilometres (km) southeast of MAG Silver Corp.'s Juanicipio Mine and Fresnillo PLC's Fresnillo Mine. The Property shares common boundaries with Pan American Silver Corp. claims and El Orito, which is owned by Endeavour Silver.

On behalf of the Company

Eric Vanderleeuw

Chief Executive Officer and Director

Email: Info@ZacatecasSilver.com

Qualified Person

The contents of this news release have been reviewed and approved by Chris Wilson, B.Sc. (Hons), PhD, FAusIMM (CP), FSEG, FGS, Chief Operating Officer of Zacatecas Silver. Dr. Wilson is Qualified Persons as defined by NI 43-101.

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Zacatecas Silver cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Zacatecas Silver's limited operating history, its proposed exploration and development activities on is Zacatecas Properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Zacatecas Silver does not undertake to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.