Loan Interest Revenue up 54% and Recurring Free Cash Flow up 212% year over year

TORONTO, ON, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Flow Capital Corp. (TSXV:FW), a leading provider of flexible growth capital and alternative debt solutions, announces its unaudited financial and operating results for the three- and six-month periods ended June 30, 2025.

Performance Highlights

Three Months Ended June 30, 2025, Compared to Three Months Ended June 30, 2024:

- 54% increase in Loan Interest Revenue to $3.2 million from $2.1 million

- 212% increase in recurring free cash flow to $884,129 from $283,036

- 216% increase in recurring free cash flow per share to $0.0290 from $0.0092

- 39% increase in total investments value to $72.2 million from $52.0 million

- $16.3 million in new investments compared to $9.3 million

Six Months Ended June 30, 2025, Compared to Six Months Ended June 30, 2024

- 49% increase in Loan Interest Revenue to $6.1 million from $4.1 million

- 148% increase in recurring free cash flow to $1.7 million from $698,887

- 152% increase in recurring free cash flow per share to $0.0567 from $0.0224

- 39% increase in total investments value to $72.2 million from $52.0 million

- $19.5 million in new investments compared to $16.0 million

"Q2 2025 represented the 8th consecutive quarter of loan interest revenue growth. More importantly, we are growing our revenue while consistently generating positive free cash flow, with a total of $884,129 for the quarter compared to only $283,036 a year ago. We believe our continued strong growth indicates the strength of our business model and management's ability to execute on it." said Alex Baluta, CEO of Flow Capital.

Detailed Financial Results are available on our website at http://www.flowcap.com/investor-relations/2025 or on www.sedar.com.

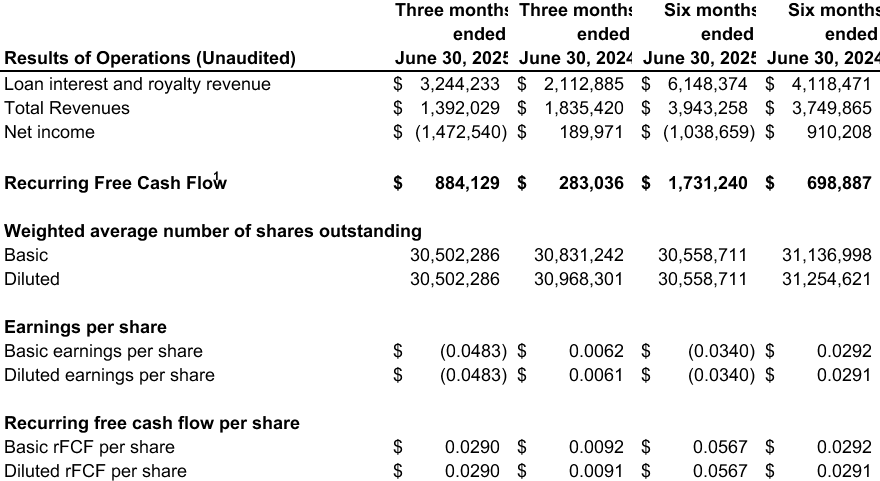

Results of Operations

Click here to view image

(1) Recurring Free Cash Flow is an internally defined, non-IFRS measure calculated as loan interest revenue less loan amortization income, one-time payments, salaries, professional fees, office and general administrative expenses, and financing expenses. See the section "Use of Non-IFRS Financial Measures".

Conference Call Details

Flow Capital will host a conference call to discuss these results at 9:30 a.m. Eastern Time, on Thursday August 14, 2025. Participants should call +1 800-717-1738 or +1 289-514-5100 and ask an operator for the Flow Capital Earnings Call, Conference ID 29927. Please dial in 10 minutes prior to the call to secure a line. A replay will be available shortly after the call. To access the replay, please dial +1 888-660-6264 or +1 289-819-1325 and enter passcode 29927#. The replay recording will be available until 11:59 p.m. ET, August 28, 2025.

An audio recording of the conference call will be also available on the investors' page of Flow Capital's website at http://www.flowcap.com/investor-relations/2025

About Flow Capital

Flow Capital Corp. is a publicly listed provider of flexible growth and alternative capital solutions dedicated to supporting market-leading high-growth companies. Since its inception in 2018, the company has provided financing to businesses in the US, the UK, and Canada, helping them achieve accelerated growth while minimizing dilution and retaining founder control. Flow Capital focuses on revenue-generating, VC-backed, and founder-owned companies seeking growth capital to drive their continued expansion.

Learn more at www.flowcap.com

For further information, please contact:

Flow Capital Corp.

Alex Baluta

Chief Executive Officer

alex@flowcap.com

47 Colborne St, Suite 303,

Toronto, Ontario M5E 1P8

Non-IFRS Financial Measures

This press release includes references to the non-IFRS financial measure "Recurring Free Cash Flow." This financial measure is employed by the Company to measure its operating and economic performance, to assist in business decision-making, and to provide key performance information to senior management. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors and analysts use this information to evaluate the company's operating and financial performance. This financial measure is not defined under IFRS, nor does it replace or supersede any standardized measure under IFRS. Other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Reconciliations of non-IFRS measures to the nearest IFRS measure can be found in this press release under "Reconciliation of Non-IFRS Measures."

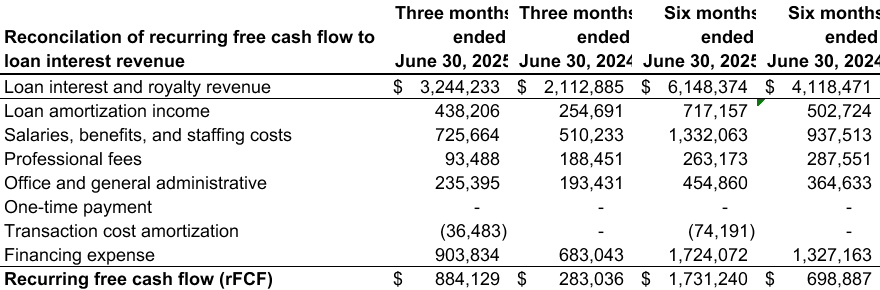

Reconciliation of Non-IFRS Measures

The table below reconciles Recurring Free Cash Flow for the periods indicated.

Recurring Free Cash Flow is an internally defined, non-IFRS measure calculated as loan interest and royalty income less loan amortization income, one-time payments, salaries, professional fees, office and general administrative expenses, and financing expenses.

Please click here to view image

Forward-Looking Information and Statements

Certain statements herein may be "forward-looking" statements that involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Flow or the industry to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. A number of factors could cause actual results to vary significantly from the results discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events and operating performance and are made as of the date hereof and Flow assumes no obligation, except as required by law, to update any forward-looking statements to reflect new events or circumstances.