New acquisition taps into EU's regulatory push for sustainable apparel

Company investing in market capture as EU legislation reshapes apparel industry

AIRPORT CITY, Israel, Aug. 15, 2025 /PRNewswire/ -- With the acquisition and launch of Percentil, MySize has strengthened its position in Europe's rapidly evolving circular fashion economy - a market transformation driven by new EU legislation mandating durability, repairability, recyclability, and traceability in apparel.

"We are focused on building long-term value while delivering operational progress each quarter," said Ronen Luzon, Founder and CEO of MySize. "The EU is rewriting fashion's rulebook. Percentil is designed to help brands comply with these new standards and unlock new opportunities for growth."

Q2 and H1 2025 Highlights

- Revenue: $2.0 million in the three months ended June 30, 2025, up 2% year-over-year (YoY), primarily due to the addition of Percentil; $3.5 million in the six months ended June 30, 2025, down 30% YoY, attributable to a decrease in Orgad sales due to market changes.

- Gross Profit: $1.1 million in the three months ended June 30, 2025, up 14% YoY; $1.5 million in the six months ended June 30, 2025, down 30% YoY

- Operating Loss: $586,000 in the three months ended June 30, 2025, a 49% improvement from the corresponding period in 2024; $1.6 million in the six months ended June 30, 2025, a 25% improvement from the corresponding period in 2024

- Cash Position: $4.28 million as of June 30, 2025, with $2.90 million in inventory.

- Percentil Contribution: $180,000 in revenue since May acquisition, with integration milestones ahead of schedule.

- Orgad Optimization: Transition to Fulfillment by Amazon (FBA) lowered logistics costs and improved delivery efficiency.

Why Percentil Changes the Game

Percentil operates in Spain and across Europe, directly in the path of the EU's Circular Economy Action Plan and Extended Producer Responsibility (EPR) for textiles. As legislation forces brands to manage the entire lifecycle of their products - including take-back, recycling, and repair - Percentil provides a ready-made platform for compliance and growth.

This is not an optional trend. It is a structural shift in the fashion industry, backed by regulation and consumer demand for sustainability. Percentil's capabilities in AI-powered product matching, garment grading, and logistics integration position it as the go-to solution for brands navigating this change.

CEO Commentary

"Some companies see regulation as a hurdle. We see it as the competitive advantage," Luzon added. "In five years, we believe European fashion resale will not be a niche - it will be the infrastructure of the industry. We intend Percentil to be at the center of that infrastructure, enabling brands to comply, delight customers, and operate profitably in a circular economy."

Strategic Highlights

- Three Complementary Segments - SaaS sizing solutions (MySizeID, Naiz Fit), fashion & equipment e-commerce (Orgad), and apparel resale (Percentil).

- Regulatory Tailwind Alignment - Designed to meet EPR, eco-design, and Digital Product Passport requirements as they roll out across Europe.

- Technology Differentiation - FirstLook Smart Mirror and Smart Catalog enhance both resale and retail experiences.

Looking Ahead

MySize is investing in long-term market capture in the European resale space, leveraging its triple-revenue model to create operational synergies and recurring cash flow. The company expects Percentil's contribution to accelerate in the second half of 2025, driven by brand partnerships and regulatory compliance demand.

About MySize, Inc.

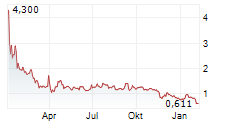

MySize, Inc. (Nasdaq: MYSZ), an AI-powered fashion technology company operating across sizing solutions, e-commerce, and circular fashion platforms. Its portfolio includes Orgad, a fashion and equipment e-commerce business, and Percentil, a European resale platform operating at the forefront of the continent's circular fashion legislation. MySize's solutions empower retailers to increase conversion rates, boost average order value, and reduce returns, contributing to more sustainable commerce. The company's innovations include the FirstLook Smart Mirror and Smart Catalog for in-store and online personalization. Learn more at www.mysizeid.com.

We routinely post information that may be important to investors in the Investor Relations section of our website. Follow us on Facebook, LinkedIn, Instagram, and X (formerly known as Twitter).

For more information, visit www.mysizeid.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements related to strategic and business plans, technology, relationships, objectives and expectations for its business, growth. These statements are identified by the use of the words "could," "believe," "anticipate," "intend," "estimate," "expect," "may," "continue," "predict," "potential," "project" and similar expressions that are intended to identify forward-looking statements. All forward-looking statements speak only as of the date of this press release. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward-looking statements are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will be achieved. Forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results may differ materially from those in the forward-looking statements and the trading price for our common stock may fluctuate significantly. Forward-looking statements also are affected by the risk factors described in the Company's filings with the U.S. Securities and Exchange Commission. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Investor Contact

Oren Elmaliah, CFO

[email protected]

Logo - https://mma.prnewswire.com/media/689689/3320229/MySize_Logo.jpg

SOURCE My Size Inc.