Gross Profit Rises 462% to $6.7 Million

Net Income from Continuing Operations Improved by $26.6 Million to $23.7 Million

Revenue for First Half of 2025 Increased 382% to $22.9 Million, a $18.1 Million Increase from Prior Year

Generated $973,606 in Positive Cash Flow from Continuing Operations in First Half of 2025, Marking a Significant Milestone

Reaffirms 2025 Guidance for Net Income of ~$1.3 Million on Revenue of Over $45 Million; Projects 2026 Net Income of ~$5.0 Million on Revenue of More than $60 Million

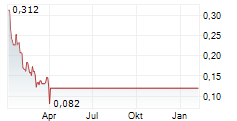

NEW YORK, NY, Aug. 15, 2025 (GLOBE NEWSWIRE) -- 1847 Holdings LLC ("1847" or the "Company") (Ticker: EFSH), a holding company specializing in identifying overlooked, deep-value investment opportunities in middle market businesses, today announced financial results for the three months ended June 30, 2025, and provided a business update.

Second quarter 2025 financial highlights:

| Q2 2025 | Q2 2024 | Change | |

| Revenue | $12.8 million | $2.7 million | +380.4% |

| Gross Profit | $6.7 million | $1.2 million | +461.8% |

| Gross Margin | 52.2% | 44.6% | +756 bps |

| Operating Income (Loss) | $2.5 million | $(1.7 million) | +$4.1 million |

| Net Income (Loss) from Continuing Operations | $23.7 million | $(2.9 million) | +$26.6 million |

Mr. Ellery W. Roberts, CEO of 1847, commented, "In the second quarter of 2025, we delivered record results with revenue up 380% year-over-year to $12.8 million and gross profit increasing 462% to $6.7 million, driving gross margin growth of 756 basis points to 52.2%. Operating income improved by $4.1 million to $2.5 million, and net income from continuing operations achieved a $26.6 million improvement, reaching $23.7 million compared to a loss in the prior-year period. For the first half of 2025, revenue increased 382% to $22.9 million, an $18.1 million increase from the prior year, underscoring the strength and momentum of our business. Notably, the Company generated $973,606 in positive cash flow from continuing operations during the first half of 2025, marking a significant milestone for 1847."

"We believe these results underscore our disciplined approach to value creation and our strategy of acquiring, enhancing, and monetizing undervalued businesses. We are reaffirming our 2025 guidance of revenue expected to exceed $45 million and net income of approximately $1.3 million. For 2026, we anticipate revenue to surpass $60 million with net income rising to approximately $5.0 million. Additionally, we have also initiated the process to transition our shares to the OTCID Basic Market and will announce the commencement date upon approval. At the right time, we plan to reapply for a national exchange listing as we continue executing our growth strategy and building long-term shareholder value"

The Company has initiated the process of transitioning the trading of its common shares to the OTCID® Basic Market, operated by OTC Markets Group Inc. The Company has submitted an application for quotation, which is currently under review. The Company's application follows a determination by NYSE American to delist its common shares. As previously disclosed, the Company appealed the initial staff determination; however, on July 1, 2025, a Listing Qualifications Panel affirmed the decision to proceed with delisting. Trading on NYSE American has been suspended since April 3, 2025, and NYSE American filed a Form 25 is with the U.S. Securities and Exchange Commission on July 9, 2025 to formally complete the delisting process.

Q2 2025 Financial Summary

Revenues increased by $10,140,652, or 380.4%, to $12,806,457 for the three months ended June 30, 2025 from $2,665,805 for the three months ended June 30, 2024. The increase in revenues was primarily attributed to the acquisition of CMD, which contributed $11,223,360 to revenues for the three months ended June 30, 2025

Cost of revenues increased by $4,648,808, or 314.8%, to $6,125,355 for the three months ended June 30, 2025 from $1,476,547 for the three months ended June 30, 2024.

Personnel costs increased by $906,281, or 83.2%, to $1,995,320 for the three months ended June 30, 2025 from $1,089,039 for the three months ended June 30, 2024.

Total operating expenses were $10,333,149 compared to $4,329,841 in Q2 2024. This resulted in income from operations of $2,473,308, compared to a loss of $1,664,036 a year ago.

Total other income, net, was $22,046,876 compared to an expense, net, of $1,590,795 in Q2 2024, mainly due to a gain on change in fair value of warrant liabilities of $24,053,885, partially offset by interest expense of $1,052,848, amortization of debt discounts of $472,680, and a loss on extinguishment of debt of $708,218.

The foregoing factors resulted in net income from continuing operations of $23,680,184 for Q2 2025, versus a net loss of $2,946,831 in Q2 2024. As noted above, such net income was largely driven by the gain on change in fair value of warrant liabilities, as well as the operating income resulting from the significant revenues generated by CMD.

About 1847 Holdings LLC

1847 Holdings LLC, a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit www.1847holdings.com.

For the latest insights, follow 1847 on Twitter.

Forward-Looking Statements

This press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com